Leeham News and Analysis

There's more to real news than a news release.

Pontifications: From the aviation perspective, there’s something in China to watch

March 21, 2022, © Leeham News: Eyes are focused on Ukraine and the Russian War. In our corner of the world, commercial aviation, the stakeholders follow the fallout from the war: sanctions placed on Russia which affect overflights, supply chains, oil to Europe (fuel), and Russia’s confiscation of about $10bn worth of airliners from Western lessors and lenders.

But there is another drama playing out on the other side of the world, too. This one involves China and one of its commercial aviation companies, AVIC.

AVIC is a major aerospace company in China. It also has a variety of none-aerospace companies. It’s one of these that caught our eye last week.

The Wall Street Journal on March 14 reported that AVIC subsidiaries involved in solar energy filed for bankruptcy to avoid an $85m judgment after allegedly absconding with intellectual property from two US companies. The firm had to settle for 30 cents on the dollar.

It’s another example of China companies simply ignoring international IP laws.

Bjorn’s Corner: Sustainable Air Transport. Part 11. Hydrogen and SAF.

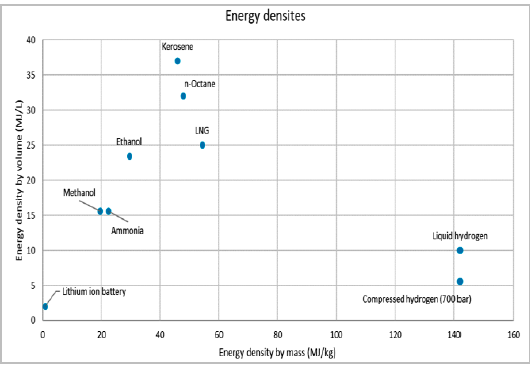

March 18, 2022, ©. Leeham News: In our series, we have now seen the major limitations batteries as an energy source impose on an airliner and that hybrids work but don’t bring any advantages for an airliner.

The alternatives are to use an energy source with a higher energy density and combine it with an efficient propulsion system. Sustainable Aviation Fuel, SAF, has the same high energy density as today’s Jet fuel and hydrogen’s density is three times higher than Jet fuel.

A Boeing 787 freighter, which variant and how good?

Subscription Required

By Bjorn Fehrm

Introduction

March 17, 2022, © Leeham News: Monday, we started a series of articles discussing a possible Boeing 787 freighter. It shall replace the Boeing 767 freighter, one of Boeing’s most-produced models, with over 200 factory freighters delivered.

We use our Airliner Performance Model to understand which 787 variant would be most suitable as a base for a freighter and what performance it would have.

Figure 1. Would a 767-300F replacement (top) be a 787-8F (middle) or 787-9F (bottom)? Source: Leeham Co.

Summary

- Boeing can build a very competitive freighter on the 787 base.

- We analyze which of the different 787 models is the most suitable and predict payload, range, and economics.

Is the 787-8 a freighter of the future?

Subscription Required

By the Leeham News Team

March 15, 2022, © Leeham News: Is the 787-8 a freighter of the future?

There will be a glaring hole in Boeing’s freighter offerings by the end of 2027. The cause will be the inability for Boeing to sell aircraft that do not meet emission standards adopted in 2017 by ICAO, the International Civil Aviation Organization, effective in 2027. This will put an end to the current Boeing 767 and 777 freighters. Boeing launched the 777-8F last month, solving the latter problem. But unless some magic occurs, and extensions are granted, Boeing will need to fill the 767 gap with something.

767F faces production extinction; Boeing ponders 787F, market says

Subscription Required

March 14, 2022, © Leeham News: Boeing’s launch of the 777-8F program, with an entry-into-service of 2027, solves part of its freighter challenges.

But it still faces the question of what to do with its aging 767-300ERF.

Both airplanes face a 2027 deadline by the International Civil Aviation Organization (ICAO) that limits emissions and noise for today’s in-production aircraft. The 777-200LRF and 767-300ERF fail the new standards.

ICAO crafted the new standards in 2017. Aircraft that fail to meet them must go out of production from 2028 unless an exemption is granted. It’s left to the member governments to formally adopt and enforce the standards—or grant an exemption to them.

Boeing 767-300ERF (top). Concepts of Boeing 787-8F and Boeing 787-9F (middle and bottom). Source: Leeham Co.

The 777-8F solves the upper end of the problem for Boeing. The airframer is seeking an exemption for the smaller 767-300ERF. Industry officials think it unlikely Boeing would receive an indefinite exemption. But a short-term exemption to bridge to another airplane is viewed as possible.

LNA learned in January Boeing is considering developing a freighter out of the 787. Stan Deal, the CEO of Boeing Commercial Airplanes, confirmed at the Singapore Air Show last month that this study is underway.

With Airbus for the first time in its history offering a new-build freighter that is seen as not only competitive to Boeing airplanes but in some quarters viewed as superior, Boeing’s decades-long dominance for cargo aircraft is under serious threat for the first time.

LNA has undertaken an analysis of the 787-8, 787-9, and 767-300ERF to look at which model makes the most sense for Boeing to pursue. LNA’s Bjorn Fehrm will detail our analysis later this week. Today, we’ll look at the background and strategic issues for a second production Boeing freighter.

Bjorn’s Corner: Sustainable Air Transport. Part 10. Where Hybrids work.

March 11, 2022, ©. Leeham News: After our articles about Serial Hybrids and Parallel Hybrids showed they were unsuitable for airliners, where do these make sense?

The obvious answer is for our stop-and-go cars (as we then can recover the brake waste energy). Still, there are aeronautical special cases where hybrids can bring advantages. Let’s look into these.

Embraer 2021 results helped by Executive jets

By Bjorn Fehrm

March 10, 2022, ©. Leeham News: Embraer presented its 2021 results today. The results follow a recovery trend from Pandemic effects, with strong order intake for Executive and Commercial jets and a revenue increase due to more Executive jet deliveries. Free Cash Flow, FCF, improved $1.3bn over 2020, from -$990m to $292m.

Guiudance for 2022 is 60-70 Commercial deliveries (2021: 45-50), Executive jets 100-110 (90-95), revenue $4.5bn-$5bn ($4.0-$4.5), EBIT margin 3.5%-4.5% (3.0%-4.0%) and Free Cash Flow over $50m (over $100m).

Read more

The large Twin-Aisle replacements

Subscription Required

By Bjorn Fehrm

Introduction

March 10, 2022, © Leeham News: We looked into the replacement market for the large twin-aisles and freighters in our February 28th article.

The obvious replacements for the market’s large Twin-Ailes are Airbus’ A350-1000, and Boeing’s 777-9, replacing 747s and A380s but more often 777-300ERs.

We compare the 777-300ER to the A350-1000 and 777-9 to understand the driving forces behind such replacements.

Summary

- The choice between Airbus’ A350-1000 and Boeing’s 777-9 as the replacement for the market’s large aircraft will be decided by route passenger volumes and commonality more than any difference in the operating economics of the aircraft.

Pontifications: Embraer launches E1 Jet P2F program

March 7, 2022, © Leeham News: Embraer announced today that it launched a conversion program for its E190-E1 and E195-E1 jets.

“The full freighter conversion is available for all pre-owned E190 and E195 aircraft, with entry into service expected in early 2024. Embraer sees a market for this size of airplane of approximately 700 aircraft over 20 years,” Embraer said in a statement.

Embraer notes that there are a number of E1 jets aged 10-15 years old that are potential feedstock. The replacement cycle for these continues for the next decade, it said. The company sees a life extension of 10-15 years post-conversion.

Embraer aims to replace turboprop freighters. The E1 Freighters have 50% more volume, three times the range, and up to 30% lower operating costs than narrowbody freighters. (It avoids mentioning that turboprops have lower operating costs than the E-Jets.)