Leeham News and Analysis

There's more to real news than a news release.

Assessing passenger airline fuel efficiency

Subscription Required

By Vincent Valery

Introduction

April 4, 2022, © Leeham News: Fuel prices abruptly increased just as travel restrictions started easing after the Covid-19 Omicron wave. The oil price increase accelerated after the Russian invasion of Ukraine. What would have seemed unthinkable 20 months ago has arrived: fuel prices are back to their 2010-14 levels.

Most airlines are still healings their wounds from the Covid-19 pandemic. Higher fuel prices are an unwelcome feature that will delay their return to profitability if not significantly complicate it.

Considering the above, LNA thought it relevant to assess the fuel efficiency of the major passenger airlines’ fleets.

Summary

- The paradox and challenges of fuel hedging;

- Explaining the fuel efficiency score methodology;

- Twin-aisle, single-aisle, and regional airline rankings.

Bjorn’s Corner: Sustainable Air Transport. Part 13. Hydrogen fuel system and APU.

April 1, 2022, ©. Leeham News: Last week, we looked at how to store hydrogen in an aircraft. We could see the gaseous storage of hydrogen is too heavy other than for demo systems and extreme short-haul. For practical airliners, liquid hydrogen is the solution.

Now we look at what this means for the aircraft fuel system and how to configure a suitable Auxiliary Power Unit, APU.

A Boeing 787 Freighter, Airbus response

Subscription Required

By Vincent Valery

Introduction

March. 31, 2021, © Leeham News: Last week’s article showed that a Boeing 787 freighter based on the -9 variant would be a suitable replacement for the aging 767-300F.

Should Boeing proceed with the aircraft, expect Airbus to launch a competing airplane, it not launch it before the American OEM.

The A330-200F recorded 38 sales as a factory freighter, a disappointing tally. Which aircraft variant could Airbus use as a baseline to develop a more successful 787F competitor?

Summary

- A nuanced view on 767-300F and A330-200F factory sales;

- Need for suitable older-generation aircraft replacement;

- Limitations of A330 P2Fs;

- A potential candidate.

An uneven financial recovery among OEMs

Subscription Required

By Vincent Valery

Introduction

March 28, 2022, © Leeham News: In an article last year, LNA highlighted the significant impact the COVID-19 pandemic had on the financials of commercial aviation OEMs. Most recorded sizable losses and charges.

The OEMs entered into a recovery mode in 2021. Airbus intends to aggressively increase its A320neo family production rates to satisfy a strong demand, while Boeing must clear large 737 MAX and 787 backlogs.

The impact of changing production rates takes time to ripple through the supply chain. LNA collected financial information on the big three aircraft manufacturers and seven major commercial aircraft suppliers to assess how quickly they are recovering from the most significant shock since World War II.

Summary

- Significant differences among the three major aircraft OEMs;

- Twin-aisle engine OEMs lagging;

- Varying levels of profitability among OEM suppliers;

- Supply chain challenges to monitor and the war factor.

Pontifications: Horizon’s plan to focus on single fleet type appears a blow to TPNG hopes

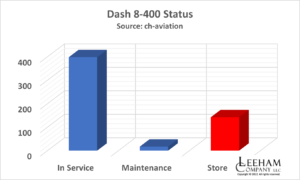

March 29, 2022, © Leeham News: Alaska Air Group announced last week that its subsidiary, Horizon Air, will retire 32 De Havilland Canada (DHC) Dash-8-400s by the end of 2023. The regional airline will go to a single fleet type, the Embraer E175-E1. AAG owns some of the 175s. Regional partner SkyWest owns and operates others.

The plan adds to the struggles of DHC to return to service -400s stored at the start of the COVID pandemic. At the end of 2021, there were more than 150 stored. As of last week, this number was down to 142, according to the ch-aviation data base. Another 17 were in maintenance. There were 398 in service. The number stored represents 25% of the -400 fleet.

Consolidating to a single fleet type doesn’t bode well for Embraer’s efforts to win Alaska/Horizon as a launch customer for its new TPNG. This advanced turboprop, proposed in 70- and 90-seat versions, has engines mounted on pods at the rear in the latest concept shown to the industry. A new engine will replace the aging but reliable Pratt & Whitney PW-series used on the Dash 8 and ATR-42/72. P&W, GE and Rolls-Royce are developing a new generation engine.

Embraer wants to launch the program this year with a proposed entry into service of 2027.

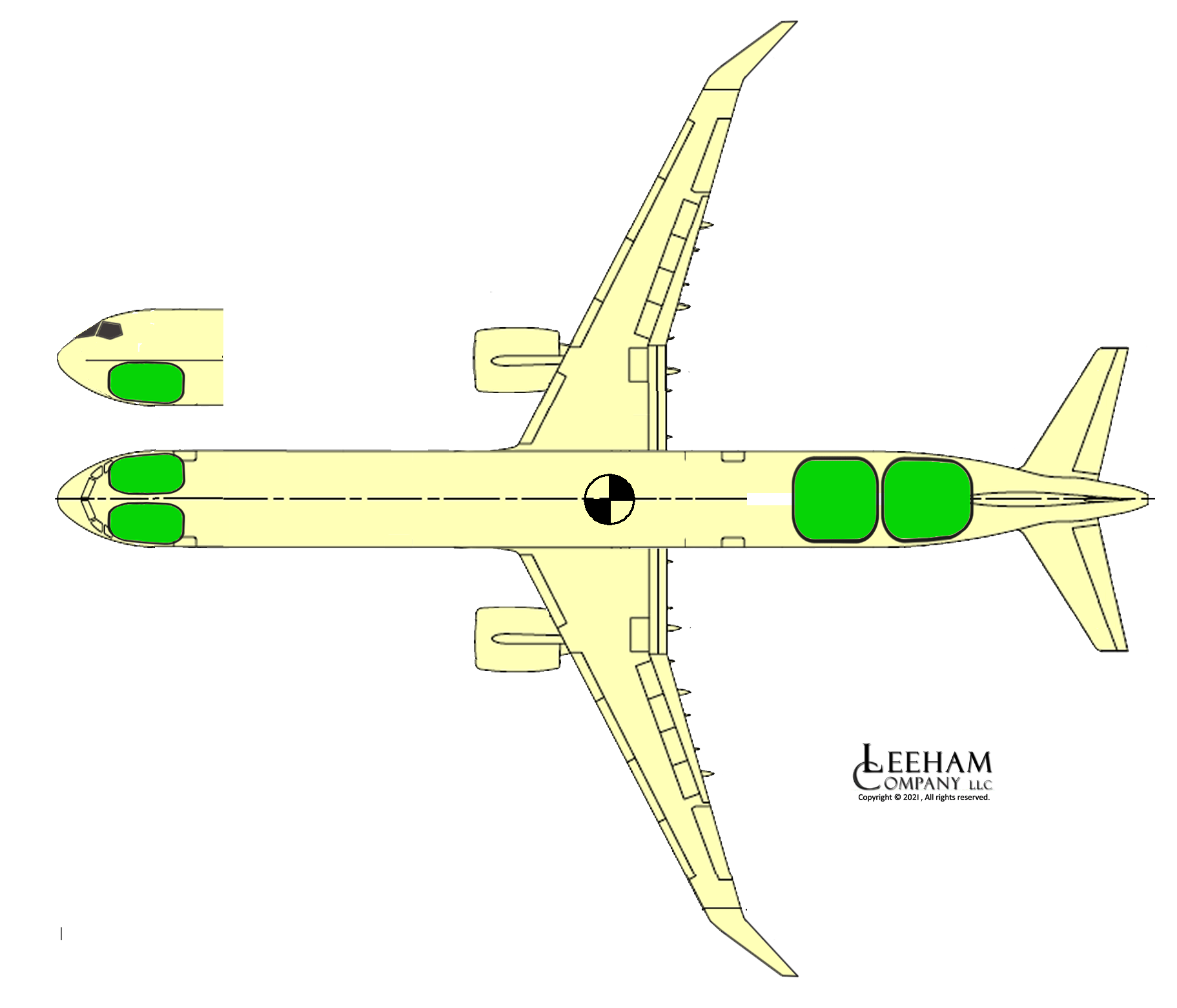

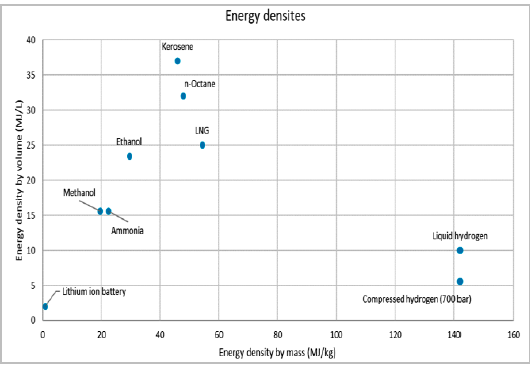

Bjorn’s Corner: Sustainable Air Transport. Part 12. Hydrogen storage.

March 25, 2022, ©. Leeham News: Last week, we looked at the energy density by mass and volume for hydrogen and regular Jet fuel (Kerosene), Figure 1.

With this information, we now look at how these fuels can be stored in an aircraft.

Read more

A Boeing 787 freighter, which model and how good? Part 2

Subscription Required

By Bjorn Fehrm

Introduction

March 24, 2022, © Leeham News: Last week, we discussed the creation of a Boeing 787 freighter. It shall replace the Boeing 767-300F, which is running into emission rule problems in 2027.

After looking at what 787 variant makes for the best freighter, we now compare the economics of the 787, 767-300F, and A330-200F freighters.

Figure 1. The 767-300F freighter (top) and its possible replacements: 787-8F (middle) and 787-9F (bottom). Source: Leeham Co.

Summary

- When a Boeing 787 freighter arrives at the decade’s end, its economics will change the freighter market’s dynamics.

China Eastern 737 crashes-it is not a MAX

By Scott Hamilton

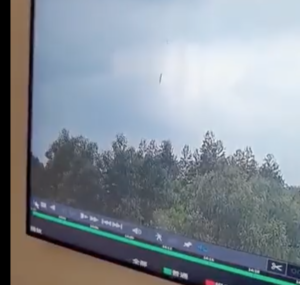

March 21, 2022, © Leeham News: A China Eastern Airlines Boeing 737-800 (Flight number MYU5735) crashed today while enroute to Guangzhou. All 132 people on board were killed.

For those likely to jump the gun, it is important to note that this 737 was a Next Generation model, not the MAX. The accident airplane was delivered new to the airline in 2015.

A screenshot of a Chinese CCTV video believed to show China Eastern MU5735 moments before crashing near Guangzhou.

According to flight tracking radar images, the flight was at cruising altitude when it nosed over into a vertical dive. A photo circulating on Twitter shows the airplane in a vertical position moments before the crash.

No conclusions may be drawn about the cause of the crash based on the sketchy information available. As a matter of routine investigative procedures, the following will be areas of inquiry, in no particular order:

Boeing sees incumbency as advantage in coming air force tanker procurement

Subscription Required

Now open to all Readers

- The interview with Lockheed Martin appeared Jan. 30.

By Scott Hamilton

March 21, 2022, © Leeham News: Lockheed Martin Co. (LMCO) plans to submit a proposal for the US Air Force’s KC-Y aerial refueling tanker procurement. So does Boeing. LMCO joined with Airbus and will offer a tanker based on the existing Airbus A330 MRTT (Multi-Role Tanker Transport). Boeing will offer a follow-on purchase of the incumbent KC-46A, based on the 767-200ER.

These two aircraft faced off in the KC-X competition. Airbus initially teamed with Northrop Grumman and was awarded the contract. Boeing protested the award on procurement procedural grounds and prevailed. Northrop dropped out of the recompete, which Boeing won in 2011.

The two aircraft will be offered again, but this time, one party doesn’t view the aircraft as competitive. LMCO sees the Airbus airplane, which it brands the LMXT, as complementary to rather than competitive to the KC-46A. Lockheed explains why here.

Boeing, on the other hand, isn’t convinced the USAF will even seek a competitive bid—or that LMCO’s belief that the service wants a larger airplane than the KC-46A to fill a “gap” is correct.

Mike Hafer, senior manager of KC-46A Business Development, explains why.