Leeham News and Analysis

There's more to real news than a news release.

Pontifications: Airbus delays for A220 tied to supply chain issues

May 23, 2022, © Leeham News: The delivery delays for the Airbus A320neo and Boeing 737 MAX get all the headlines. But Airbus also has delivery delays for the Airbus Canada A220.

There are at least three A220s missing cockpit installations on the ramp at the Mirabel Airport final assembly line with more coming off the FAL, LNA is told. The number of A220s with this traveled work at the Mobile (AL) FAL is not known. Some quality control issues at the Mobile plant, which is still in its learning curve phase, have been reported.

Bjorn’s Corner: Sustainable Air Transport. Part 20. Dimensioning the Fuel Cell system

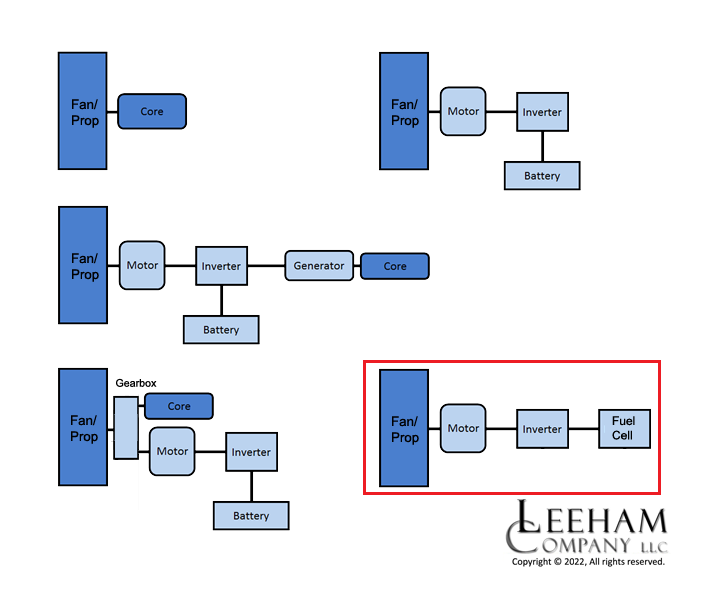

May 20, 2022, ©. Leeham News: Last week, we looked at the principal parts of a Fuel Cell-based propulsion system. We need a fuel cell that converts hydrogen to electric power and then an inverter and electric motor that drives the fan, Figure 1.

The fuel cell system is the complicated and heavy part of this setup. Let’s look at how we size such a system.

Impact of Russian Airspace Closure on the World’s longest flight

Subscription Required

By Bjorn Fehrm

Introduction

May 19, 2022, © Leeham News: Last week, we looked at what the closure of Russian airspace would mean for a mid-European cargo airline. A cargo plane has a shorter range, and the difference in flight distance meant that the cost of transporting cargo from Far-East to West Europe increased considerably as cargo payload was reduced.

We now check what the Russian airspace closure means for the World’s longest flight, Singapore Airlines flight SQ23/SQ24 between New York and Singapore.

Summary

- The flight from New York to Singapore has changed the routing after the 24th of February. It now avoids Russian and Ukrainian airspace.

- It results in a longer flight but the cost increase shall not pose a profitability problem on this premium route.

Boeing B-29 “Doc” visits Seattle May 17-22

By Scott Hamilton

May 17, 2022, (c) Leeham News: A Boeing B-29 bomber, made famous in World War II, is here in Seattle May 17-22. Ground tours will be May 19-22. Rides will be the mornings of May 21-22. Times may be found here. The plane is at the Museum of Flight at Boeing Field.

Start-up nears airport Aircraft Towing System tests

Subscription Required

By Scott Hamilton

May 16, 2022, © Leeham News: A start-up company is 60-90 days away from landing a contract with a US airport to install a prototype system that will pull airplanes around the field, eliminating taxiing with engines or tugs.

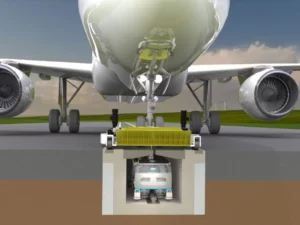

ATS Worldwide (for Aircraft Towing System) proposes a network of trench-like guides equipped with a flexible tow mechanism that captures the nose gear to tow airplanes from the regional jet to the Airbus A380. It’s all done with automation. No new equipment, other than a nose camera, is added to the airplane. This eliminates added weight and complexity, or the need for a Supplemental Type Certificate, proposed by Wheel Tug. No external tug, like Taxibot, takes the airplane to the end of the runway. This eliminates airfield conflicts, ATS said during the Aviation Week MRO Americas conference last month in Dallas.

But constructing a network of towing trenches from the gate, across the ramp, to the taxiways and the runways, presents its own challenges. Constructing the network won’t be inexpensive. Funding sources must be identified. The Federal Aviation Administration and other regulators must be convinced that the system will be safe. Regulatory standards must be prepared.

And the elephant in the room will be the reaction from unions whose ground handlers, wing walkers, etc., face losing jobs or fewer jobs.

The big advantages: eliminating the need for hundreds of tugs at an airport. Reduction in fuel required to taxi airplanes, major cost savings for the airlines. A reduction in emissions, a growing goal, especially in Europe and the USA. Finally, there can be lower headcounts by the airlines and airports, another cost savings.

Implementation, if all goes well, is years away. But a prototype system for proof-of-concept is expected to be activated at the Ardmore (OK) airport in 60-90 days. At least three major hub airports are reviewing proposals for initial demonstration projects as well, ATS says.

Pontifications: Boeing spending millions to retain engineers

May 16, 2022, © Leeham News: Boeing is spending millions of dollars to retain engineers represented by the union, SPEEA.

It’s a reversal of efforts to trim SPEEA ranks through early buyouts and outsourcing and to address an aging workforce.

The proposed 2017 joint venture between Boeing and Embraer was meant to address the retirement crunch. But delays in clearing the JV by the European Union and then the Boeing 737 MAX crisis and the global COVID pandemic killed the deal. Boeing walked in April 2020, shortly after the pandemic began. Officials claimed that Embraer failed to meet all the terms and conditions outlined in the documentation. Embraer denied this, claiming Boeing’s self-inflicted MAX crisis was the reason Boeing walked. The companies are in arbitration over a $100m break-up fee. With the collapse of the JV, Boeing lost access to Embraer’s young (and less expensive) engineering workforce, the No. 1 reason to do the joint venture.

“There is a big push to keep people,” SPEEA tells LNA. “Boeing is using raises, restricted stock, and incentive bonuses to keep engineers. Our contracts called for $7m in out-of-sequence raises last year and the company spent $22m.”

Boeing is more than a year away from clearing its inventory of 737s and 787s. Until then, or until the end is definitively in sight, it’s highly unlikely that Boeing will launch a new airplane program. But there are five 7-Series airplane programs that engineers and others are working on: the certification of the 737-7 and 737-10 this year and next; the development of the 777-8F; and increasing the gross weight of the 787-9 and -10. Certification of the 777-9 is also outstanding. Nothing official has been said in detail, but changes to the airplane demanded by regulators may require engineering work.

Bjorn’s Corner: Sustainable Air Transport. Part 19. Fuel Cell propulsion systems

May 13, 2022, ©. Leeham News: Last week, we looked at advanced developments for hydrogen-burning gas turbines.

Now we look at the alternative hydrogen-based propulsion system, which uses a Fuel Cell to convert the energy in hydrogen to electric power that drives motors to spin propellers or fans, Figure 1.

Impact of Russian Airspace Closure for mid-European freight airlines

Subscription Required

By Bjorn Fehrm

Introduction

May 12, 2022, © Leeham News: Last week, we looked at what the closure of Russian airspace would mean for a mid-European airline that flies to Asia destinations like Japan, Korea, or Mainland China.

Air France now flies the routes from East Asia south of Russian airspace instead of over Siberia. The route is longer which increases the operating costs, but with the examples Boeing 777-300ER, there are no restrictions on passenger load factors, and most times, the cargo space can be loaded to the volume limit.

For a freight airline flying similar routes, the added distance impacts payload, as freighters have about 2,000nm less range than their passenger siblings. We check the operating cost and payload impact for mid-European freighter airlines flying from Far-East freighter hubs to West Europe.

Summary

- A freighter airline takes a heavier hit from Russian airspace closure.

- As the extra distance eats into the possible payload, the operating cost per tonne for hubs like Shanghai, Seoul, and Taipei increases more than for the airline’s passenger service.

HOTR: Embraer gets launch customer for E-Freighter, Boeing adds Lufthansa for 777-8F

By the Leeham News Team

May 10, 2022, © Leeham News: Embraer yesterday received its launch order for the E-Jet E1 P2F conversions from lessor Nordic Aviation Capital (NAC).

NAC reach “an agreement in principle” to convert 10 E190/195-E1s into freighters. The first deliveries are in 2024. The aircraft are in NAC’s current fleet.

NAC reach “an agreement in principle” to convert 10 E190/195-E1s into freighters. The first deliveries are in 2024. The aircraft are in NAC’s current fleet.

The E-Freighters have 50% more volume capacity and three times the range of turboprop freighters (read: ATR) and up to 30% lower operating costs than narrowbodies (read: Boeing 737s), Embraer says. The aircraft will be converted by Embraer at its Brazilian operations. The conversion “includes the main deck front cargo door; cargo handling system; floor reinforcement; Rigid Cargo Barrier (RCB) – 9G Barrier with access door; cargo smoke detection system, including class “E” extinguishers in upper cargo compartment; Air Management System changes (cooling, pressurization, etc.); interior removal and provisions for hazardous material transportation,” Embraer says. “The E190F can handle a payload of 23,600lb (10,700kg) while the E195F a payload of 27,100 lb (12,300 kg).”

Mind the gap between announced and actual production rates

Subscription Required

By Vincent Valery

Introduction

May 9, 2022, © Leeham News: As passenger traffic is recovering from the COVID-19 pandemic, especially in the Americas and Western Europe, many airlines are eager to take delivery of more fuel-efficient aircraft. Higher oil prices and ambitious plans to reduce carbon emissions are driving new-generation aircraft demand, notably for the Airbus A320neo and Boeing 737 MAX families.

A combination of supply chain disruptions and challenges associated with increased production means that Airbus and Boeing aren’t ramping-up A320neo and 737 MAX production as much as they would like. Boeing fell short last year on its 737 MAX production targets. The American company is also dealing with multiple delays in the resumption of Dreamliner deliveries.

In recent years there have been significant gaps between announced and actual production rates. The gaps have a material impact on projected OEM revenues, cashflows, and incomes.

LNA analyzes aircraft production rates on all the Airbus and Boeing programs since 2010 to assess whether the gaps were as significant in the past. LNA also evaluates the programs that were the closest and furthest away from announced production plans.

Summary

- A metric to measure production line consistency;

- Relatively consistent Single-Aisle rates;

- More volatile twin-aisle rates;

- A more consistent OEM.