Leeham News and Analysis

There's more to real news than a news release.

The Airbus and Boeing market outlooks, Part 2

Subscription Required

By Vincent Valery

Introduction

Sept. 19, 2022, © Leeham News: In the first article last week, we focused on the differences in market outlook assumptions between Airbus and Boeing. Despite similar levels of passenger single-aisle and twin-aisle deliveries envisioned over the next two decades, there were significant differences in the underlying assumptions.

We now focus on whether there is enough production capacity to meet the envisioned aircraft demand over the next two decades.

Summary

- Outlining the delivery forecast assumptions;

- Converting deliveries into production rates;

- Estimating production capacity;

- Is Boeing implying something?

Pontifications: No engines, billions shy, devastating enviro analysis, Boom’s CEO still exudes optimism

Sept. 20, 2022, © Leeham News: Blake Scholl, the founder and CEO of Boom, the start-up company, continued to paint an optimistic picture about the Overture Supersonic Transport.

He told the US Chamber of Commerce Aerospace Summit last week that the Overture, a Mach 1.7 88-passenger aircraft concept, will revolutionize international air travel.

But Boom has big challenges ahead—not the least of which is that there is no engine manufacturer so far that has stepped up to provide an engine. The Big Three—GE Aviation, Pratt & Whitney, and Rolls-Royce—have either outright rejected participation or other priorities exist.

Plethora of Challenges

- Rolls says publicly it won’t pursue an engine for Boom. GE told LNA it’s not interested in developing an engine for Boom. P&W is focused on advances for its GTF, developing sustainable technology and military engines.

- The International Civil Aviation Organization (ICAO) in July issued a report on the environment that eviscerated SSTs and the SAF concept outlined for Boom. The report included analysis from the International Council on Clean Transportation (ICCT).

- Scholl claims a market demand for thousands of SSTs but Boom’s 2013 study by Boyd International forecast a market demand over the life of the program of 1,318 Overtures. Some thought this figure was generous.

- Boyd’s report also concludes Boom needs a Mach 2.2 airplane to be commercially viable. Scholl reduced the speed to 1.7. This means that in some cases, airline crews can’t do a round trip from the US to Europe without a relief crew, which upsets some of the economics.

- If Boom were a publicly traded company, all the orders would fall under the ASC 606 accounting rule that questions the viability of those orders.

- Scholl told AIN Online Boom needs $6bn to $8bn to come to market and so far, it has raised $600m.

- And we don’t get into the certification and regulatory hurdles. Among them: In his presentation to the Chamber, Scholl said there are 600 potential SST markets. He included some inland in the US, where there is a ban on SSTs flying over land.

HOTR: MAX 7 and 10 certification; ecoAviation and the missing life cycles

By the Leeham News Team

Sept. 18, 2022, © Leeham News: LNA last week attended the US Chamber of Commerce’s Aerospace Summit in Washington (DC). We’ll have a  series of full reports in the coming weeks. Here are things picked up on the sidelines.

series of full reports in the coming weeks. Here are things picked up on the sidelines.

Boeing

- The Federal Aviation Administration remains “pissed” at Boeing.

- Boeing CEO David Calhoun said certification of the 737 MAX 10 could come this year, but it might not. He expects certification of the MAX 7 to come this year.

- Separately, LNA is told that the MAX 10 probably won’t be certified until next summer, and certification of the MAX 7 could come as early as next month.

- Calhoun said that Boeing is now pausing the 737 production line when parts don’t come in from suppliers. Doing so prevents traveled work. “We’re going to stay here until these lines move. Steadily, steadily, steadily when we’re not getting defects and we’re not getting shortages.”

- Calhoun said the stored airplanes aren’t facing shortages. But getting them delivered is a matter of going through the “conformance” steps. “They sat for a couple of years. There were a lot of deferred actions that were incorporated into the new certification. Every one of those actions must be taken on these return-to-service airplanes. It requires almost as many hours to do that as it did to build one in the first place.”

- Boeing is probably going to be frozen out of China for one-two years, principally in retaliation for the visits by House Speaker Nancy Pelosi and a Congressional committee as well as defense product sales to Taiwan.

Bjorn’s Corner: Sustainable Air Transport. Part 37. VTOL Flight Control.

September 16, 2022, ©. Leeham News: We discussed one of the critical systems for an eVTOL over the last weeks, the battery system, its cells, and its management system.

Another critical system for a VTOL is its Flight Control System (the FCS).

Boeing remarketing stored 737s ordered by China

By Scott Hamilton

David Calhoun

Sept. 15, 2022, © Leeham News: The indefinite delay in China authorizing Boeing to deliver 737 MAXes to airlines led Boeing to slowly remarket more than that are 100 stored.

CEO David Calhoun said today that Boeing can no longer wait for China’s OK with the large inventory of aircraft that went into storage when the MAX was grounded in March 2019. Boeing continued building the MAX on the assumption that the grounding would be a short one. When by the end of 2019, there was no end in sight for recertification, production was halted with 450 MAXes built but stored. About 140 of these were destined for Chinese airlines and lessors. Lessors have been allowed to accept some deliveries as long as the airplanes were delivered to customers outside China, LNA previously reported.

Engine Development. Part 5. The Turbofans go High Bypass

Subscription Required

By Bjorn Fehrm

Introduction

September 15, 2022, © Leeham News: Last week, we looked at how Pratt & Whitney’s JT8D turbofan came to dominate short-haul airliners while the JT3D had the long-range market.

The introduction of the widebody jets in the 1970s with Boeing 747, Douglas DC-10, and Lockheed Tristar brought GE and Rolls-Royce into the market. It was the start of the high bypass turbofans.

Summary

- The military TF39 for Lockheed C-5 Galaxy military transport set the benchmark for the new generation of high bypass turbofans with its 8-to-1 bypass ratio.

- Pratt & Whitney, GE, and Rolls-Royce developed civil engines along the lines of the TF39 for the new generation widebodies.

The Airbus and Boeing market outlooks, Part 1

Subscription Required

By Vincent Valery

Introduction

Sept. 12, 2022, © Leeham News: Airbus and Boeing published their updated 2022-2041 commercial aircraft outlooks ahead of the July Farnborough Air Show. Unsurprisingly, both OEMs saw robust demand for the next two decades despite recent economic headwinds that lowered long-term fleet growth forecasts.

Airbus and Boeing see a market for delivering 38,600 and 38,110 single-aisle and twin-aisle passenger aircraft over the period. A 1.3% difference over 20 years is well below the margin of error of such long-term forecasts.

However, despite such minor overall differences in long-term delivery forecasts, both OEMs use different assumptions to come up with those numbers.

Also, the recent challenges with increasing production rates on single-aisle aircraft raise the question of whether there is enough capacity to meet the optimistic demand outlook.

The first part of this two-article series highlights the main assumption differences between the Airbus and Boeing market outlooks. The second will translate those assumptions into production rates and assess whether OEMs can meet that demand, notably over the next 10 years.

We will focus on the single-aisle (100 passengers and above) and twin-aisle passenger markets.

Summary

- One OEM is more optimistic about fleet growth;

- Another on replacement rates;

- A (maybe not) surprising up-gauging assumption for one OEM;

- Higher growth rates than meet the eye.

Pontifications: BOC Aviation sees widebody recovery next year

Sept. 12, 2022, © Leeham News: Widebody aircraft demand cratered during the COVID-19 pandemic. It’s still depressed.

But the chief executive officer of lessor BOC Aviation sees recovery in the works.

“We’re beginning to see quite a big pickup in demand for widebody aircraft,” Robert Martin told LNA in an interview late last month. “Not now but starting next year. What’s prompting that is people are beginning to realize that China will probably open in the fourth quarter this year for international traffic. Just to give you some statistics, if you go back to 2019, China outbound was more than 70 million passengers. Last year was 1.5 million, and so the amount of uplift is quite full.”

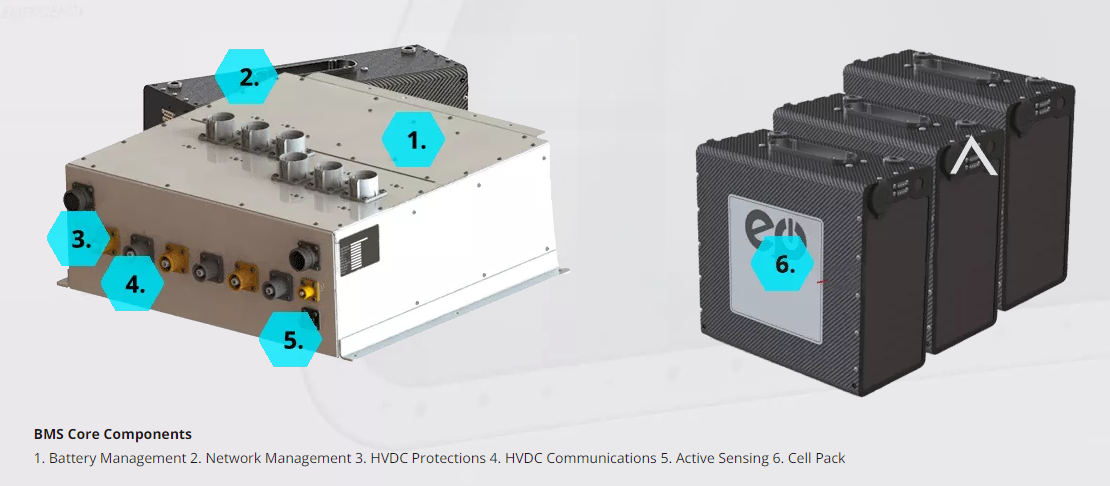

Bjorn’s Corner: Sustainable Air Transport. Part 36. Battery Management.

September 9, 2022, ©. Leeham News: Over the last weeks, we have discussed the cells that make up the battery system for an eVTOL.

The battery system has 10,000 cells or more. All these must, on an individual level, be managed to ensure they operate inside their allowed values. The Battery Management System, BMS, has this responsibility. It’s one of the most critical safety systems in an eVTOL.

Engine Development. Part 4. Turbofans go mainstream.

Subscription Required

By Bjorn Fehrm

Introduction

September 8, 2022, © Leeham News: Last week, we analyzed the change from turbojets to turbofans for civil air transport. The jet engine was developed for high-speed military fighters and was not ideal for subsonic airliner use.

We also dwelled on why the three major engine OEMs came to different solutions for the first-generation turbofans. Now we look at the engine that made turbofans mainstream, the Pratt & Whitney JT8.

Summary

- The JT8 competed with the more developed Rolls-Royce Spey to engine the first US domestic jet airliner, the Boeing 727.

- After it captured the Boeing 727, it went on to engine all US short and median haul jets of the 1960s.