Leeham News and Analysis

There's more to real news than a news release.

Enhancing the Dreamliner, Part 5: 787-10

Subscription Required

By Vincent Valery

Introduction

Nov. 5, 2020, © Leeham News: After analyzing the 787-9, we now turn our attention to the last Dreamliner variant that entered into service, the -10.

The 787-10 was developed as a minimum change stretch of the 787-9. Keeping it at the same gross weight as the 787-9 meant it could share the same wing and landing gear, yet offer a higher capacity. The longer fuselage meant higher empty weight and drag so the range of the -10 was cut compared with the other Dreamliners.

Summary

- Maximizing commonality by trading range for volume;

- Limited near-term replacement market;

- A case for further enhancements;

- Payload limitations on a long-haul route.

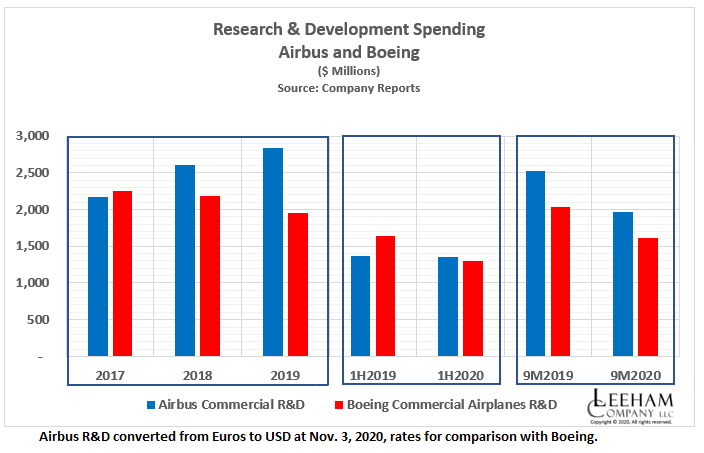

HOTR: Airbus, Boeing R&D spending continues decline

By the Leeham News Team

Nov. 5, 2020, © Leeham News: Research and Development spending by the Airbus and Boeing commercial units declined year-over-year.

The movement is in keeping with cost-cutting by the Big Two OEMs. For Airbus, the reduction is due to the coronavirus pandemic. For Boeing, it’s due  to the 737 MAX grounding and the pandemic.

to the 737 MAX grounding and the pandemic.

Boeing’s spending typically lags Airbus. Richard Aboulafia, a consultant with Teal Group, for years criticized Boeing over its smaller spending, favoring instead shareholder value. Airbus overtook Boeing is innovative single-aisle airplane development years ago. Boeing’s choice of creating a 777 derivative instead of a new design to compete with the A350-1000 proved to be a weak move. There are only a handful of customers and the skyline is weak.

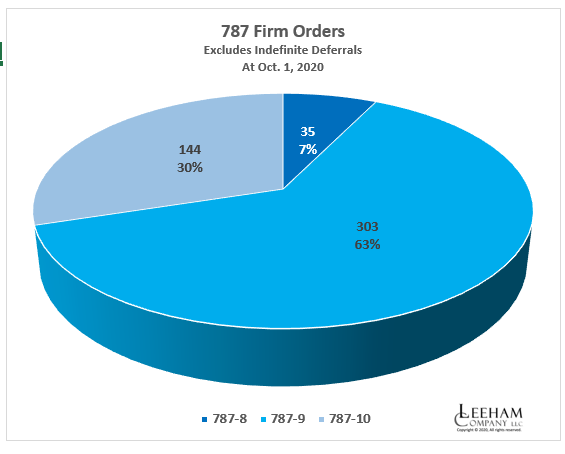

Boeing 787 SC plant has room to increase production in current building: Exclusive Leeham News Analysis

Subscription Required

By the Leeham News Team

Introduction

Nov. 2, 2020, © Leeham News: When Boeing announced consolidation of the 787 Program in Charleston, Washington State and local officials—as well as thousands of employees—hoped that if production rates recovered, the final assembly line in Everett would reopen.

However, for Everett and Washington State, the message is clear. The 787 is leaving for good.

Boeing made it clear that consolidation wouldn’t happen if Charleston couldn’t grow the production beyond the current maximum of 7/mo.

LNA’s analysis makes it clear the South Carolina facility can do so.

The Charleston FAL is positioned to build all future 787s, at rates higher than the recent 7/mo maximum.

Summary

- The Charleston FAL can go higher than the historical maximum of 7/mo without capital expenditures.

- Production rates can increase under the current process more than 40%.

- Rates can increase more than 70% with some process changes.

- The current FAL can accommodate these higher rates.

Pontifications: Certification timing may push EIS for 777X

Nov. 2, 2020, © Leeham News: Throughout the 737 MAX investigations and recertification process, former Boeing CEO Dennis Muilenburg said there would be no delay on 777X certification.

On Boeing’s earnings call last week, Muilenburg’s successor, David Calhoun, said there could be.

“On the 777X, we continue to work with the regulators on certification work scope, including reflecting the learnings from the 737 cert process,” Calhoun said. “As with any development program, there are inherent risks that can affect schedule. And while we continue to drive toward entry into service in 2022, this timing will ultimately be influenced by certification requirements defined by the regulators.”

Boeing is certifying the 777X under the Changed Product Rule, the same process used for the MAX. Certification is being pursued as a derivative of the 777, a point of scrutiny on the MAX.

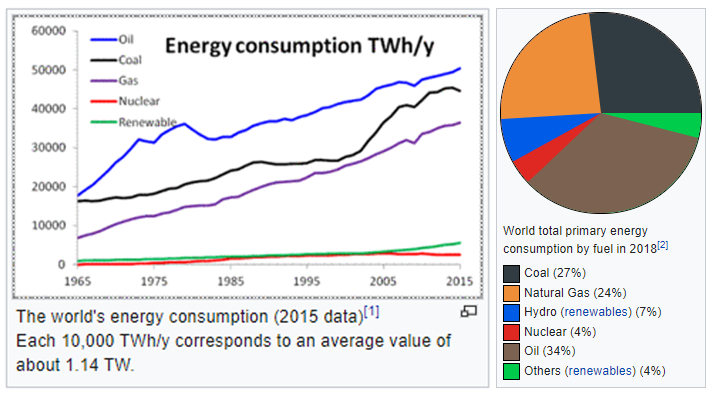

Bjorn’s Corner: The challenges of Hydrogen. Part 13. The supply of Hydrogen

October 30, 2020, ©. Leeham News: In our series on Hydrogen as an energy store for airliners we now address the problem of liquid hydrogen supply for air transport.

Before we go into the ecosystem and its costs, let’s start with a more principle discussion. Is continuing today’s consumption pattern a valid alternative?

Airbus stopped consuming cash in 3Q2020

October 29, 2020, © Leeham News: Airbus announced its third-quarter 2020 financial results today. It has achieved convergence of production and deliveries by delivering 145 aircraft in the quarter and 341 since the start of the year. It will keep its present production rates until next summer when A320neo rates are expected to increase.

The convergence of production and delivery rates combined with other measures has stopped the outflow of cash and Free Cash Flow from operations was positive in the quarter and is expected to stay positive until the end of 2020.

Enhancing the Dreamliner, Part 4: the 787-9 analyzed.

Subscription Required

By Bjorn Fehrm

Introduction

October 29, 2020, © Leeham News: We look deeper at the 787-9, the most successful member of the Dreamliner family. It’s 50 seats larger than the 787-8 but shares the same wing dimensions and engines.

The 787-9 quickly overtook the smaller 787-8 in sales and deliveries once its performance was clear to the airlines.

By following on the 787-8 it could benefit from many enhancements in design and production, becoming a very efficient aircraft in the process. To check its efficiency we run the 787-9 against its predecessor, the Boeing 777-200ER, on the San Francisco to Sydney route and look at the data.

Summary

- The 787-9 enjoyed all the improvements that came to light when developing the 787-8. The result is one of the most efficient twin-aisle aircraft on the market.

- Why it’s popular with the airlines becomes evident when we compare with the aircraft it replaces, the 777-200ER.

Update 2: (adds earnings call information): Update 1: (adds Calhoun on CNBC): Boeing cites grounding, COVID, 787 quality issues in 3Q/9 month loss

Oct. 28, 2020, © Leeham News: Boeing released its 3Q2020 and nine months financial report this morning and, as expected, it wasn’t pretty.

- Boeing burned through more than $4.8bn in cash during the quarter from losses. Another $262m in cash was used on building additions.

- For nine months, Boeing reported an operating loss of nearly $6.2bn.

- Debt remains at $61bn.

- “Commercial Airplanes third-quarter revenue decreased to $3.6bn, reflecting lower delivery volume primarily due to COVID-19 impacts as well as 787 quality issues and associated rework. [Emphasis added.] Third-quarter operating margin decreased to (38.1) percent, primarily driven by lower delivery volume, as well as $590m of abnormal production costs related to the 737 program,” Boeing reported.

- Boeing Global Services revenue declined by nearly $1bn and earnings fell by slightly more than $400m, impacted by the decline in commercial aviation because of COVID.

- The value of the commercial airplanes backlog at Sept. 30 was $312.68bn vs $376.59bn. Boeing delivered 98 airliners in the nine months compared with 301 in 2019. The MAX was grounded March 13, 2019, with deliveries halted then.

Key Airbus, Boeing supplier sees recovery in 2022

By Scott Hamilton

Oct. 28, 2020, © Leeham News: A key supplier to Airbus and Boeing believes there will be a “significant upturn” in passenger traffic and aircraft demand in 2022, well before consensus.

Hexcel provides composites and other materials for the Airbus A320 and A350 and Boeing 737 MAX.

Hexcel provides composites and other materials for the Airbus A320 and A350 and Boeing 737 MAX.

And Raytheon Technologies sees passenger traffic returning to pre-COVID levels in 2023, depending on widespread use of vaccines.

Consensus is a return to pre-COVID levels in 2024.

In its 3Q2020 earnings press release Oct. 20, Hexcel’s CEO, Nick Stanage said, “The overall long-term demand for aircraft and our advanced composites technology remains robust, and the potential for a significant upturn in 2022 and beyond looks positive.”

The actions we are taking will ensure that Hexcel emerges from the effects of this pandemic stronger than ever. As we do, our liquidity will have been strengthened, our cost structure will be reset, and we will be well positioned to deliver strong shareholder returns.”

Quizzed on the earnings call, Stanage elaborated:

HOTR: With MAX nearing recertification, Boeing has bigger problem

By the Leeham News team

Oct. 27, 2020, © Leeham News: Boeing’s 737 MAX may be nearing recertification and airlines worry about passenger acceptance.

But Boeing’s larger MAX problem is its general product line-up.

But Boeing’s larger MAX problem is its general product line-up.

LNA pointed out the poor sales of the 7 MAX in the past. We’ve also compared the lagging sales of the 9 MAX and 10 MAX compared with the A321neo.

As a result of the MAX grounding and now COVID-19’s disastrous financial impact on airlines around the world, more than 1,000 orders have been canceled or reclassified as iffy under the ASC 606 accounting rule.

Airbus doesn’t publicly reclassify the European equivalent of ASC 606. But LNA in July estimated how many A320s would be similarly classified. At that time, about 425 appeared to be similarly subject to ASC 606 if this accounting rule was applied to Airbus.