Leeham News and Analysis

There's more to real news than a news release.

Boeing, unions need reset: analysis

Subscription Required

By the Leeham News Team

Analysis

Introduction

Nov. 16, 2020, © Leeham News: Boeing is at a defining moment, says John Holden, the president of IAM 751. This is the labor union that assembles Boeing’s airplanes in Washington State.

The Seattle Times wrote that “Boeing must realign for better days“.

Neither said anything that hasn’t been said before, some of them repeatedly.

There is a new twist to it this time. Boeing is seriously bleeding money. It is making changes for survival and paying a horrible price as it loses talent that takes years to develop. There are many losers here: Boeing, Washington State, Snohomish, King and Pierce counties, Everett, Renton and all the communities in the Washington Aerospace heartland. There are no winners.

But for all the points identified, few offer solutions. What should a realignment include? What could it look like?

Over a series of articles, LNA will examine some possible solutions.

The first is Labor, starting with the IAM 751.

Summary

- Long, tortured relationship.

- Strong union state.

- “Expensive labor.”

- Is there a “value” premium?

Pontifications: EU tariffs on Boeing airplanes in effect; ~60 at risk

Nov. 16, 2020, © Leeham News: The European Union implemented tariffs Nov. 9 on Boeing and other US products in retaliation for the Trump Administration tariffs on Airbus and EU products.

This is the latest in the 16-year trade battle between the US and Europe over subsidies and tax breaks found to be illegal under World Trade Organization rules.

The US was authorized last year to impose tariffs on Airbus and other EU products. The Trump Administration initially imposed a 10% tariff on imported Airbus aircraft. A320/321s assembled at Airbus’ Mobile (AL) plant were exempt, even though major components were imported.

Trump increased the tariffs to 15% in March, just as the COVID-19 pandemic erupted worldwide. As a result, few Airbus airplanes were delivered into the US since then.

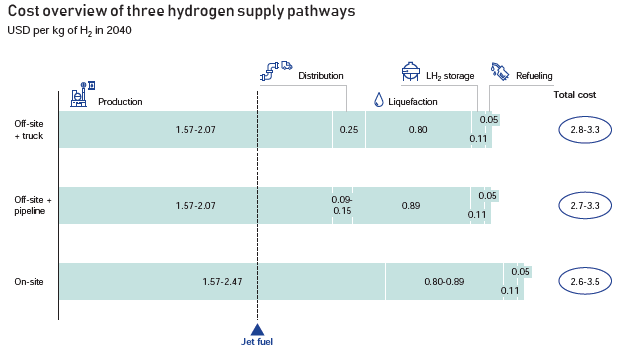

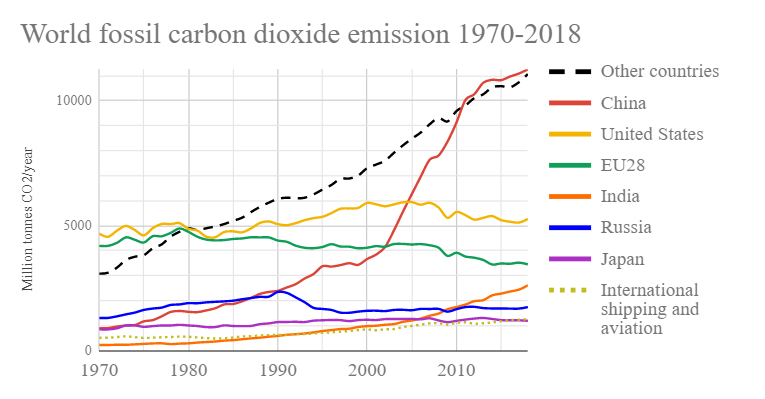

Bjorn’s Corner: The challenges of Hydrogen. Part 15. Hydrogen cost

November 13, 2020, ©. Leeham News: In our series on hydrogen as an energy store for airliners, we now look at the cost of hydrogen.

The current cost-efficient production is predominantly by reforming natural gas, meaning it’s a process that involves carbons. Hydrogen as an energy transporter then makes no sense as the point is to de-carbonize our energy supply.

HOTR: New workforce newsletter; the return of Airchives

By the Leeham News Team

Nov. 12, 2020, © Leeham News: A new on-line newsletter, Future Aviation/Aerospace Workforce News, was launched last week  focusing on industry regulatory, corporate, training, recruitment and retention challenges.

focusing on industry regulatory, corporate, training, recruitment and retention challenges.

Created by Kathryn Creedy, a decades-long aviation writer and a contributor to LNA, the newsletter tackles workforce issues that long have received superficial coverage.

Boeing, for as long as can be remembered, issued annual forecasts about the need for pilots and mechanics over the next decade. As the workforce aged, the numbers grew in each category to hundreds of thousands.

Boeing, for as long as can be remembered, issued annual forecasts about the need for pilots and mechanics over the next decade. As the workforce aged, the numbers grew in each category to hundreds of thousands.

The regional airline industry has long had challenges finding pilots.

Now, with COVID-19, cutbacks and bankruptcies upend the workforce.

Creedy’s new publication tackles these issues and more.

Enhancing the Dreamliner, Part 6: The 787-10 analyzed

Subscription Required

By Bjorn Fehrm

Introduction

November 12, 2020, © Leeham News: We look deeper at the 787-10, the stretched Dreamliner. The 787-10 was conceived as a “cut and stretch” of the 787-9, leaving as many parts untouched as possible. It carries 40 more passengers, but over a shorter distance.

It’s a high capacity complement to the other Dreamliners for airlines that needed more seats and could sacrifice about 1,500nm in payload-range performance. To check how well this works, we run the 787-10 against 787-9 on the San Francisco to Sydney route from last week and look at the data.

Summary

- The 787-10, as a “cut and stretch” development from the 787-9 comes with compromises on long routes.

- Our San Francisco to Sydney example shows these limitations in practice, even with the rumored Gross Weight stretch of the latest sales to Air New Zealand.

- The 787-10 comes into its own on shorter routes. We look at this next week.

Embraer’s 3Q2020: Embraer announces net loss of $148m

By Bjorn Fehrm

November 10, 2020, ©. Leeham News: Embraer presented its 3Q2020 results today. The revenue was down 35% compared to 3Q2019 at $759m ($1,176m 3Q2019) at deliveries of seven E-Jets (17 3Q2019).

Net loss was -$148m (-$48m 3Q2019), which does not include special charges. Liquidity remains adequate at $2.2bn after issuing new credit facilities during the quarter.

HOTR: Don’t get over-optimistic on COVID-19 vaccine news

By the Leeham News team

Nov. 10, 2020, © Leeham News: Pfizer yesterday announced it’s on track to produce a COVID-19 vaccine that appears to be 90% effective in trials. The company is one of the world’s leading drug makers.

This is good news.

But before jumping to the old cliché about a light at the end of the tunnel, LNA’s Judson Rollins cautions, do the math.

But before jumping to the old cliché about a light at the end of the tunnel, LNA’s Judson Rollins cautions, do the math.

“Read the fine print at the end of the press release,” Rollins says.

“Based on current projections, we expect to produce globally up to 50m vaccine doses in 2020 and up to 1.3b doses in 2021,” the press release says.

“It’s a two-dose vaccine, so divide by two to figure the number of people who could be immunized,” Rollins says. “Even if a second candidate is approved and can be produced in the same quantity next year, that means just 17% of the world’s population will be vaccinated. And that assumes everything goes according to plan.”

Rollins did an extensive analysis of how quickly global air traffic would return to normal. In his July 13 post, Rollins projected that traffic won’t fully recover until 2024 at the earliest or 2028 at the latest. It all depends on how quickly a vaccine was developed, how quickly it could be distributed globally and how quickly people had confidence in it.

“We’re in only the second or maybe third inning of a very long ball game,” Rollins says. “Vaccines kill off a virus by denying it bodies in which to reproduce. If you don’t innoculate enough of the population while immunity lasts, you’re back to square one.”

Boeing needs 737 replacement launch by 2026 if not sooner

Subscription Required

By Scott Hamilton

Introduction

Nov. 9, 2020, © Leeham News: Boeing needs hundreds of new orders for the 737 MAX and/or a new replacement program launch by 2026, if not sooner.

An analysis shows that 737 deliveries tank by 2028.

This isn’t just about the 737-10 and 737-9, which don’t fare well against the Airbus A321neo. The shrinking backlog is the problem.

Ryanair’s CEO, Michael O’Leary, said last week Boeing will delay delivery/entry into service of the 737-10 MAX by up to two years.

This largely stated the obvious.

The first 10 MAX rolled out of the factory Nov. 22 last year. It could not enter flight testing because the MAX family was grounded March 13. The MAX remains grounded. Recertification may come this month, but it appears more likely next month.

This delays the start of flight testing until probably January. This is a 14-month delay.

Flight testing will take a year to 15 months, or to January to March 2022—about two years after the planned EIS. Boeing’s production ramp up will further impact delivery of the 10 MAX.

Although some recent new focus was on the 10 MAX, the larger issue is the entire 737 family.

Summary

- Production ramp up will be slow.

- Inventory will take two years to clear.

- Airline demand is poor the next 2-3 years.

- Boeing’s breadwinner sees major delivery drop from 2026.

- A further drop by 2028 demonstrates need for a 737 replacement—not just an A321 competitor.

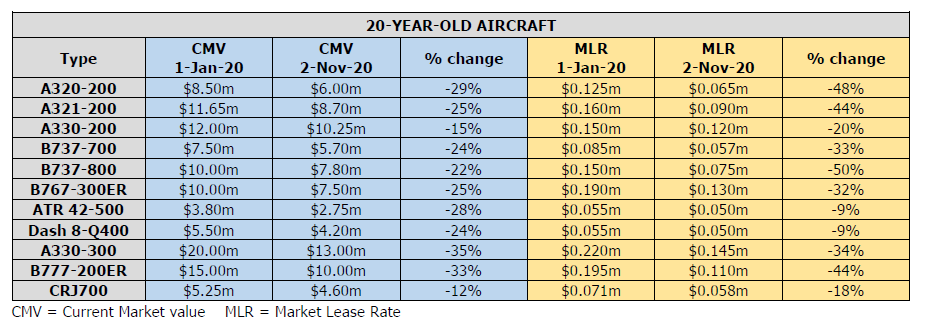

Pontifications: Aircraft prices, rents plunge

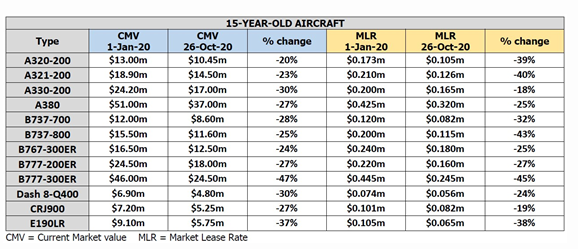

Nov. 9, 2020, © Leeham News: Aircraft prices and lease rates are plunging as the COVID-19 pandemic continues to devastate the airline and manufacturing industries.

The Australian newspaper reports that Rex Airlines will pay A$60k/mo for its ex-Virgin Australia Boeing 737-800s, rising to A$100k after 12 months. This is US$43,600 to US$72,700.

Rex is a small regional airline that is leaping to a jet operator. It committed to take 10 737s.

The article says the airplanes are more than 10 years old.

Compare the rates to the rents listed Nov. 2 by Ishka, the UK-based appraisal and consultancy firm: US$115k/mo for a 15-year-old model.

Virgin’s airplanes date from 2003 to 2018. The oldest leased airplanes date to 2004.

Virgin’s airplanes date from 2003 to 2018. The oldest leased airplanes date to 2004.

It’s not especially surprising that swamped with excess airplanes that lessors will place airplanes for whatever they can get. Lessors are under great pressure to service their own debt.

Even Ishka’s estimates for 20-year old airplanes are higher than the Rex rates.

But the real story is what new airplanes are going for. And the prices are eye-popping low.

Bjorn’s Corner: The challenges of Hydrogen. Part 14. Supply of Hydrogen

November 6, 2020, ©. Leeham News: In our series on Hydrogen as an energy store for airliners we now look at how to create a supply industry for hydrogen.

The problem of a sizable and competitive hydrogen supply industry is a chicken or egg problem. To achieve a competitive and functioning hydrogen transport system we need an adequate hydrogen infrastructure and to get an adequate hydrogen industry we need large-scale consumers.