Leeham News and Analysis

There's more to real news than a news release.

NBA Single or Dual Aisle Airline preferences

Subscription Required

By Vincent Valery

Introduction

May 10, 2021, © Leeham News: Boeing has been studying the launch of a clean-sheet design aircraft for at least a decade. Studies included a single-aisle design but favored a twin-aisle concept before the 737 MAX launch in 2011. As time went on, the twin-aisle concept morphed into a focus on 767-sized dual-aisle with the New Midmarket Airplane (NMA).

The combination of the 737 MAX crisis, Calhoun’s arrival as CEO, and the COVID-19 pandemic led Boeing to shelve plans to launch the NMA in early 2020. However, the American OEM hasn’t stood idle despite sizable layoffs and R&D budget cuts.

LNA reported Boeing’s renewed focus on dual-aisle design and production systems and studied the tradeoffs between a single- and dual-aisle. The NMA has morphed into the concept of a New Boeing Airplane (NBA).

A critical mass of airlines needs to be willing and able to buy a new aircraft to justify a launch. Most observers agree that Boeing needs to launch a new plane to address the weakening market share in the large single-aisle market. However, there isn’t a consensus whether a single- or dual-aisle is the way to go.

LNA analyses in this article the design preferences of the airlines that could be interested in the NBA.

Summary

- Dual-aisle preferences;

- Different opinions about the required range;

- Low-cost carrier preferences;

- Lessor preferences.

Pontifications: A330-300 could be great deal ahead

May 10, 2021, © Leeham News: The COVID-19 pandemic prompted airlines to ground more than 8,000 aircraft at the peak.

Among widebodies, no aircraft was hit harder than the Airbus A330ceo.

Traffic within China, the US and Asia recovers with narrowbody airplanes. European short- and medium-haul traffic is not recovering as quickly due to continued boarder closings. International traffic, for the same reason, remains awful.

But in chaos some see opportunities.

Jep Thornton, managing partner of the boutique lessor Aerolease, last week said the A330-300 could be a great trading opportunity.

At April 1, there were 267 -300s and 286 A330-200s (of all types) in storage, according to data reviewed by LNA.

Bjorn’s Corner: The challenges of airliner development. Part 2. Why Certification?

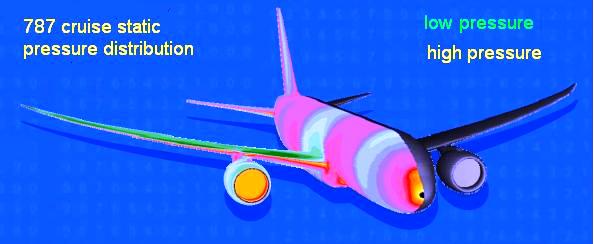

May 7, 2021, ©. Leeham News: The major challenge with developing commercial aircraft is the certification process. You can’t just develop the aircraft based on your unique knowledge and ideas, you must do it according to a detailed rulebook written with the knowledge from thousands of accidents and incidents.

From the beginning of the design process when you’re thinking about how big your engines would need to be or whether you can carry enough passengers to have a competitive advantage the certification rules influence (and sometimes govern) your design decisions.

Beyond just scrutiny of the design of the vehicle and its components, the process by which it is designed, the production site & methods used, and the organization doing the work all go through certification processes.

China’s air travel “recovery:” volume improving, but revenue still elusive

Subscription Required

By Judson Rollins

Introduction

May 6, 2021, © Leeham News: In a media briefing this week, the International Air Transport Association (IATA) showed a deep contrast between the airline landscapes in the US and China versus the rest of the world.

The two countries together delivered 55% of the world’s domestic passenger traffic in March, with Chinese domestic capacity approaching 100% of pre-pandemic levels. China’s three largest carriers – Air China, China Eastern Airlines, and China Southern Airlines – are matching their US peers by deploying A350s and 787s on domestic routes, as most international routes to/from China remain closed.

However, first-quarter data continued to paint an ugly picture as unit revenue, or revenue per available seat-kilometer (RASK), was down at every publicly-traded carrier. Some of this was due to reduced load factors in January and February, but a key driver is the ongoing sale of “all you can fly” passes on most Chinese airlines.

Summary

- Domestic load factors have picked up, but international traffic near non-existent.

- First quarter financial reports show unit revenue fell below even last year’s abysmal levels.

- “Airpass” promotions continue, but it’s unclear how long they will go on.

- Fleet utilization during COVID: widebodies down but not out.

HOTR: Annual Reports give hint to MAX return in China

By the Leeham News Team

May 4, 2021, © Leeham News: Annual reports from some Chinese airlines give an indication when Boeing can expect to resume deliveries of the 737 MAX there.

China Southern’s report issued this week indicates 48 MAXes will be delivered next year. Another 44 are shown to be delivered the following year. This compares with five A320 series this year and none next year. Only 15 A320s were delivered in 2020.

Five 787s and one 777s are scheduled for delivery to China Southern this year. Four A350s are scheduled for delivery this year and next.

Uneven financial challenges among OEMs

Subscription Required

By Vincent Valery

Introduction

May 3, 2021, © Leeham News: The three largest commercial aircraft OEMs and their largest suppliers continue to report impacts from the COVID-19 pandemic in their 2020 financial results.

The pandemic and its impact on airlines’ bottom line is rippling through Airbus, Boeing, Embraer, and their suppliers.

LNA collected financial information on the big three aircraft manufacturers and seven major commercial aircraft suppliers. The impact on each company varied significantly on their earnings, cashflows, and balance sheet.

Summary

- Cashflow and charge challenges at aircraft OEMs;

- Engine OEMs feeling the pressure;

- A more benign picture for other large suppliers;

- Goodwill monitoring.

Pontifications: Long road ahead, but Boeing will recover

May 3, 2021, © Leeham News: Cowen Co. called the Boeing 1Q21 financial results “messy” with questions unanswered.

Credit Suisse characterized a “challenging 1Q, though recovery should begin to accelerate.”

My take falls in line with Credit Suisse. It was a challenging first quarter and lots of variables overhang Boeing going forward. But I was struck by the confidence displayed by CEO David Calhoun and CFO Greg Smith going forward. And I’m not one to drink the Kool-Aid by any stretch.

To be sure, many challenges lie ahead for Boeing. Returning the 737 MAX to service has been anything but smooth. New issues popped up that resulted in Boeing (not the regulators) grounding the airplane again. Deliveries were suspended once more.

After 10 years of production, Boeing suspended deliveries of the 787. The KC-46 tanker still isn’t performing as required after nearly two years of delivery delay and limited operations with the US Air Force.

This is not The Boeing Co. of decades past.

Bjorn’s Corner: The Challenges of Airliner Development. Part 1. Introduction

April 30, 2021, ©. Leeham News: After our hydrogen series, we now start a series around the Challenges of Airliner Development.

We have more aeronautical projects in development than ever, fueled by the transformation to new, more sustainable technology and new forms of flight, like Urban Air Mobility and Drones based on electrical propulsion.

Many of these projects underestimate what it takes to ready a certified air vehicle. We describe what’s involved in a series of Corners.

Embraer shows some improvement YOY

April 29, 2021, © Leeham News: Embraer posted improvement in some of its year-over-year financial results today.

Revenue for the first quarter was up 27.3%, from $633.9m to $807.3m. The 1Q20 period was largely unaffected by the global COVID-19 pandemic, which didn’t hit until March 10. But Embraer Commercial was at a standstill, awaiting approval from the European Union on the proposed joint venture with Boeing. (Boeing terminated the JV late in April.)

Embraer reported an EBIT loss last year of $46.9m. It still reported a loss this year, of $33.1m. Adjusted net losses for the two quarters weren’t much different: $104m in 1Q20 vs $95.9m this year. But Net income attributable to shareholders improved from a loss of $292m to a loss of $89.7m.

Adjusted Free Cash Flow remained negative YOY but improved from $676.5m to $226.6m.

Embraer delivered nine E-Jets, including five E195-E2s, and 13 executive jets during the quarter. Post quarter, EMB signed a firm order for 30 E-195 E2s with an unidentified customer. Deliveries begin in 2022.

Initial analyst reaction is below.