Leeham News and Analysis

There's more to real news than a news release.

Boeing, IAM reach tentative agreement on new contract

By Scott Hamilton

- IAM 751 and Boeing reach a four year contract agreement. The IAM summary is here.

- Additional contract news from the IAM is here.

- The Boeing fact sheet is here: Boeing fact sheet IAM 751 W24 TA highlights-090824a

Boeing CEO Kelly Ortberg. Photo source: Boeing. The new contract agreement between Boeing and the IAM 751 avoids a strike and potentially marks a new era of labor relations between the two.

Sept. 8, 2024, © Leeham News: In a development that is contrary to all expectations, The Boeing Co. and the IAM 751 labor union reached a tentative agreement this morning on a new four-year contract.

IAM members, who assemble Boeing’s airplanes in the great Seattle area, get a 25% raise over the life of the contract; the union asked for 40%. The value goes up to 33% in “wage growth” when the wage increases, and “progression” are calculated. Certain pay grades did get a 42.3% increase, the IAM said.

There is a lump sum payment of $3,000 and Boeing’s 401(k) contribution increases up to $4,160 per employee per year. The union asked for a return to a defined benefit plan, which was probably a non-starter. Lower costs for medical care were agreed.

Boeing committed to build the next new airplane in the Seattle area. A Boeing spokesperson did not have details whether this would be in Renton, where 737s are built, or Everett, where widebody aircraft are currently assembled. Boeing also committed to keep the current 737, 767 and 777X production in Puget Sound.

The union also wanted a seat on the Boeing Board of Directors. Neither side referred to the seat in their information released today, so it appears this may not have been agreed. The Boeing spokesperson had no information on this and the IAM wasn’t immediately available to comment.

The IAM leadership unanimously recommends approval of the contract. The vote is set for this Thursday.

Bjorn’s Corner: New engine development. Part 23. Development risks.

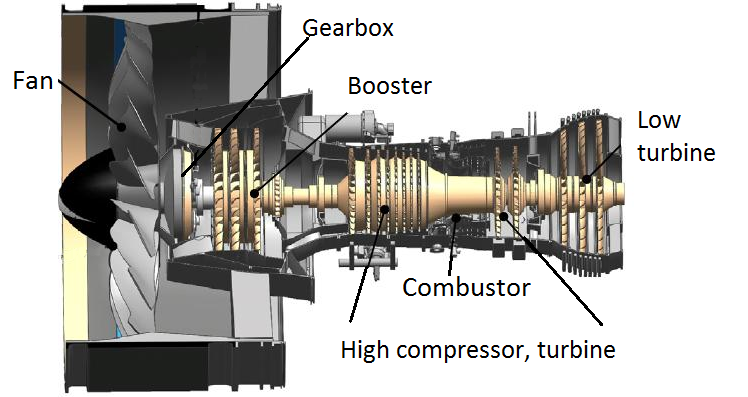

September 30, 2024, ©. Leeham News: We do an article series about engine development and why it has longer timelines than airframe development. It also carries larger risks of product maturity problems when it enters service than the airframe of an airliner.

We have covered the parts of an engine that involve challenging technology and which decide its reliability (dispatch consistency) and durability (time on wing). Now, we discuss why modern engine design is more challenging regarding these parameters than airframe design.

If a strike occurs, here’s what Boeing can do

Subscription Required

- Contingency plan for 4-12 week strike.

By the Leeham News Team

Analysis

Sept. 5, 2024, © Leeham News: There seems to be quite an expectation that there will be a strike by Boeing’s touch labor union, the IAM walkout at Boeing this contract cycle. The costs associated with a strike are well understood. Crippled cash flow, upset customers, and stock price losses not counting the damage to the companies in Puget Sound that built much of their business models on Boeing worker’s paychecks. It’s never a good thing to sustain a strike of any duration because the disruptive effects can last for years.

Sept. 5, 2024, © Leeham News: There seems to be quite an expectation that there will be a strike by Boeing’s touch labor union, the IAM walkout at Boeing this contract cycle. The costs associated with a strike are well understood. Crippled cash flow, upset customers, and stock price losses not counting the damage to the companies in Puget Sound that built much of their business models on Boeing worker’s paychecks. It’s never a good thing to sustain a strike of any duration because the disruptive effects can last for years.

The last time the IAM struck was in 2008, for 57 days. The strike cost Boeing billions of dollars in lost revenue, much of which was made up in the following years. The ill-will generated by the strike affected customers. Management-labor relations remain strained to this day. Union leadership is determined to recover previous givebacks in wages and benefits. They want a seat on the Board of Directors, a role in improving Boeing’s safety culture, and a guarantee that the next airplane will be assembled in Puget Sound.

Talks remain far apart, according to the union. Boeing says progress is being made. A strike seems likely at this stage.

Boeing is clear about a strike potential. In a message last week to employees, Boeing said:

Does Boeing want a strike so it can stabilize production or allow time for the supply chain to recover?

Absolutely not. Any work stoppage, whether days, weeks or months, would disrupt our production system, supply chain and most importantly, our customers. When Boeing cannot deliver airplanes as scheduled, customers question our reliability. A strike would only help the competition and hurt our suppliers.

What is Boeing supposed to do if the IAM walks out? The usual answer is sweeping and cleaning and trying to deliver whatever you can sneak out the door to keep the money coming in. It is never a very effective way to operate.

Here are some points to ponder if the strike occurs and Boeing production shuts down.

China banks on C919, but numbers say it still needs Boeing

Subscription Required

By Scott Hamilton

Sept. 2, 2024, © Leeham News: Airbus and Boeing see China doubling its airliner fleet over the next 20 years. The numbers vary between the two companies. But the underlying data points to how challenging it will be for China to meet this demand without letting Boeing back into the mix.

Sept. 2, 2024, © Leeham News: Airbus and Boeing see China doubling its airliner fleet over the next 20 years. The numbers vary between the two companies. But the underlying data points to how challenging it will be for China to meet this demand without letting Boeing back into the mix.

Boeing has largely been frozen out of China since 2017 when then-President Donald Trump initiated a trade war with one of the world’s largest economies. Then, Boeing’s self-inflicted wounds came in the form of the 21-month grounding of the 737 MAX, a 20-month suspension of deliveries of the 787, and major, slow rework required for each model.

On top of this, after Russia invaded Ukraine, the Biden Administration—which kept Trump’s tariffs upon taking office in 2021—ramped up the pressure on China, which initially covertly supported Russia’s war on Ukraine. This support became more open as the war dragged on.

Few Boeing airplanes have been delivered to China since 2017 and fewer orders have been placed.

Boeing predicts that China will need 6,720 single-aisle aircraft through 2043. Airbus sees a need for 7,950 single aisles for the same period. On the widebody side, Boeing forecasts a requirement for 1,575 aircraft; Airbus forecasts a need for 1,380. Widebody freighter forecasts for China are 170 and 190 by Boeing and Airbus, respectively.

Let’s compare these numbers with production rates. China still needs Boeing.

Bjorn’s Corner: New engine development. Part 22. High Turbine technologies.

August 30, 2024, ©. Leeham News: We do an article series about engine development and why it has longer timelines than airframe development. It also carries larger risks of product maturity problems when it enters service than the airframe of an airliner.

We reached the turbine part on our way through the engine, where we last looked at high-pressure turbine temperatures. It’s the most stressed part of the engine and, in most cases, decides its durability. To understand why, we look closer at turbine technologies.

The A330 for medium haul or twice the frequency with A321XLR? Part 1

Subscription required

By Bjorn Fehrm

August 29, 2024, © Leeham News: We have compared the Airbus A321XLR to the Boeing 757 to see if it can replace the long-range single aisle on its trans-Atlantic routes. The result was convincing: The A321XLR is, in many respects, what the Boeing NMA should have been: a replacement for the 757 with additional range.

Now, we look at the short- to medium-range market and check whether a route that was previously only possible with the Airbus A330 can be flown with a fleet of A321XLRs. The advantage, at an equal per-passenger cost, is the doubling of the frequency to drive market growth, revenue, and margin.

Summary:

- The A321XLR is close to 50% of the passenger capacity of the A330-300/900 in a long-range configuration.

- It has most of the range of the A330-300 and can fly the bulk of the routes of an A330-900.

- Can an airline operate a dual daily A321XLR to a daily A330 at the same per-passenger cost?

Using stock could be one option for IAM salary demands

Subscription Required

By The Leeham News Team

Aug. 26, 2024, © Leeham News: Boeing’s in contract negotiations with its touch labor union, the International Association of Machinists District 751 (IAM 751). The powerful union wants a 40% raise over the life of a four-year contract. Leadership wants to recover medical co-pays and reinstate a defined pension plan, given up in previous contracts.

Aug. 26, 2024, © Leeham News: Boeing’s in contract negotiations with its touch labor union, the International Association of Machinists District 751 (IAM 751). The powerful union wants a 40% raise over the life of a four-year contract. Leadership wants to recover medical co-pays and reinstate a defined pension plan, given up in previous contracts.

The union also wants a guarantee that the Next Boeing Airplane (NBA) will be built in the Seattle area. Boeing’s executives used the threats of relocating 737 MAX and 777X assembly elsewhere to wring economic concessions out of 751 members in previous contract talks.

The contract expires on September 12. The union membership already has voted to authorize a strike on September 12 if the contract offer is voted down.

This time, the membership believes it is in a stronger bargaining position. Boeing’s weak financial position is viewed as playing right into labor’s strength. Jon Holden, president of the union, echoed those sentiments. “We understand our power. We are ready to use it,” Holden told The Seattle Times. Holden was also not going to let management off the hook, due to the poor financial position Boeing finds itself in, he told the newspaper. “It’s not about whether they can afford to pay us. That’s not even a question,” he added. “They can.”

But the ultimate question is, How can Boeing afford to pay what the union wants?

Here’s how.

Bjorn’s Corner: New engine development. Part 21. The High Turbine.

August 23, 2024, ©. Leeham News: We do an article series about engine development and why it has longer timelines than airframe development. It also carries larger risks of product maturity problems when it enters service than the airframe. We discuss why.

In our journey through an engine, we have reached the turbine part, where we will dig deeper into the high-pressure turbine. This is the most stressed part of the engine and has a major influence on engine performance and durability.

Figure 1. Our example engine, the LEAP-1A cross-section with the high-pressure turbine marked. Source: CFM.

The Military Gravy Train. Not for everyone.

Subscription Required

By the Leeham News Team

Aug. 22, 2024, © Leeham News: Lockheed Martin (LM). RTX. Northrop Grumman (NG), General Dynamics (GD). BAE Systems (BAE). These are the world’s largest defense contractors, by revenue.

Aug. 22, 2024, © Leeham News: Lockheed Martin (LM). RTX. Northrop Grumman (NG), General Dynamics (GD). BAE Systems (BAE). These are the world’s largest defense contractors, by revenue.

| 2023 | 2022 | 2021 | |||||

| Sales | Earnings | Sales | Earnings | Sales | Earnings | ||

| Lockheed Martin | $67,571 | 6,920 | 65,984 | 5,732 | 67,044 | 6,315 | |

| RTX | $68,920 | 3,195 | 67,074 | 5,5216 | 64,388 | 3,897 | |

| Northrop Grumman | $39,290 | 2,056 | 36,602 | 4,896 | 35,667 | 7,005 | |

| General Dynamics | $42,272 | 3,315 | 39,407 | 3,390 | 38,469 | 3,257 | |

| BAE Systems (in £) | £25,284 | 2,682 | 23,256 | 2,479 | 21,310 | 2,205 | |

| (in millions) |

Source: 2023 Financial reports. BAE reporting in EBIT.

Five corporations. Three years. Fifteen sets of data points. Not a drop of red ink to be seen. Airbus and Boeing can’t say the same thing.

Aviation’s recruiting problem shifting from pilots to technicians, cabin crew

Subscription Required

By Judson Rollins

Introduction

August 19, 2024, © Leeham News: Boeing issued the latest edition of its annual Pilot and Technician Outlook (PTO) last month, forecasting demand for 2.3 million new aviation personnel by 2043.

Of these, 649,000 are new pilots, 690,000 are new technicians, and 938,000 are new cabin crew.

“Driven by aviation traffic trending above pre-pandemic levels, personnel attrition, and commercial fleet growth, the demand for aviation personnel continues to rise,” said Chris Broom, vice president of Commercial Training Solutions at Boeing Global Services.

The Seattle-based OEM says demand for new personnel will be driven primarily by single-aisle airplanes, except in Africa and the Middle East, where widebody airplane demand will be the key factor.

According to the forecast, greater Europe — what Boeing now calls “Eurasia” — China and North America will account for more than half of new industry personnel.

The company believes South Asia, Southeast Asia, and Africa will be the fastest-growing regions for personnel, with demand expected to more than triple within 20 years.

Two-thirds of new personnel will address replacement due to retiring staff and other attrition, while one-third will support growth in the commercial fleet.

Summary

- The global pilot shortage may peak sooner than expected.

- Technician recruiting is increasingly hampered by competition from other industries and obsolete educational programs.

- Increasing cabin crew attrition could drive higher costs for airlines.