Leeham News and Analysis

There's more to real news than a news release.

Air Asia asks Airbus for A321F; chief commercial officer says not yet

Subscription Required

By Scott Hamilton

Nov. 8, 2021, © Leeham News: Air Asia is in talks with Airbus to develop a factory-built A321F, according to a report last week from Reuters. LNA first reported in August that Airbus is pondering a new-build A321F.

“AirAsia would seek to convert a “meaningful chunk” of its 362 orders for the passenger version of the A321neo narrowbody to a dedicated freighter, said Pete Chareonwongsak, CEO of AirAsia logistics division Teleport,” Reuters wrote.

But although Airbus has had talks with a few customers, an A321F is not a priority, the firm’s chief commercial officer told LNA last month.

Pontifications: As customers wait for 787s, some rethink 777-300ERs

Nov. 8, 2021, © Leeham News: Boeing now has passed one year since deliveries were suspended for the 787. There were 105 787s in inventory at Sept. 30. The current build rate is 2/mo.

LNA identified 93 787s that were ordered in 2020 and 2021 that are believed to be parked, leaving 12 unaccounted for.

Among the aircraft in inventory are:

- 11 787-8s destined for American Airlines, which are owned by Boeing Capital Corp.

- 3 for BOC Aviation, which do not have identified customers.

- 9 for Chinese airlines.

- 8 for the always cranky Qatar Airways.

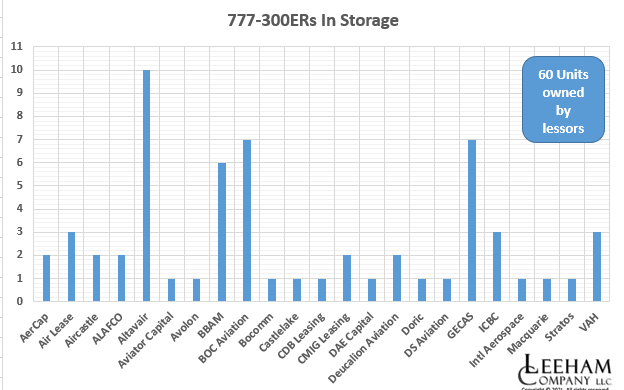

LNA understands that several customers are now looking for substitutions in the Boeing 777-300ER fleet owned by lessors. Of the 116 -300ERs in storage, 60 are owned by lessors. Nearly all are leased to airlines that put the aircraft in storage. But there are some off-lease. The latter includes seven owned by GECAS (now AerCap), which are destined for conversion to freighters via IAI Bedek.

Embraer 3rd Quarter 2021 results

By Bjorn Fehrm

November 5, 2021, ©. Leeham News: Embraer presented its 3Q2021 results today. The results were better than expected as the company has tight control over its spending and managed to deliver nine E-jets and 21 Business jets in the quarter, giving a revenue increase over 3Q last year of 26%.

Sales were also positive and the backlog has grown from $15.9bn last quarter to $16.8bn. Profits before tax were $30m from a loss of $37m a year ago. The strong results had the company upgrade its guidance for 2021.

Bjorn’s Corner: The challenges of airliner development. Part 28. Crew training

November 5, 2021, ©. Leeham News: Last week, we looked at our role in creating a competent maintenance activity so our aircraft can be kept airworthy throughout its operational life. The other important part of operational safety is crew training.

We learned that these two parts, keeping the aircraft airworthy with its maintenance and providing adequate training and information to the crews operating the airplane, have a major influence on flight safety. In fact, FAA has found that these parts have a larger influence on flight safety than the aircraft certification regulations.

We, as the OEM, must therefore develop the documentation, curriculum, and training tools so that crews working in the aircraft can fly it safely. This encompasses not only initial training but a continued refresh and check training throughout the crew’s life with the aircraft.

Jean Pierson, key figure in early Airbus, dies at 80

Nov. 4, 2021: Reuters reports that Jean Pierson, a key figure in the early decades of Airbus, died overnight in France.

Single aisle or Widebody over the Atlantic on thin routes? Part 2

Subscription Required

By Bjorn Fehrm

Introduction

November 4, 2021, © Leeham News: Last week, we compared the economics of an Airbus A321LR and A330-200 on a thin route over the Atlantic. We found the Widebody could compensate for its higher operating costs as long as the route has a sizable cargo stream and that this is paid at today’s elevated air freight prices. The A321LR has extra center tanks that take away all cargo space and thus has negligible cargo revenue.

Now we repeat the analysis with the more capable A321XLR. It stores four ACTs worth of extra fuel in the space of two. This leaves room for cargo. Will it be enough to restore the supremacy in margin generation over the twin-aisle?

Summary

- The check last week surprised with how close a mid-age A330-200 can come in margin generation to an A321LR on a thin route, thanks to its higher cargo revenue.

- The A321XLR, with its more efficient tank setup, rebalances the fight in favor of the single-aisle.

HOTR: Boeing sees travel recovery end of 2024

By the Leeham News Team

Nov. 2, 2021, © Leeham News: Although US domestic passenger traffic seems to be booming, globally air trave l remains well below 2019 levels preceding the 2020 COVID-19 pandemic.

l remains well below 2019 levels preceding the 2020 COVID-19 pandemic.

Boeing sees domestic travel recovering in 2022. But international, widebody traffic won’t recover until the end of 2024, Boeing predicts.

In an appearance last week before the Aerospace Futures Alliance in Seattle, Janene Collins, VP of Contracts & Sourcing Supply Chain, also said Boeing expects a supply chain squeeze is likely to impact plans to increase airplane production rates.

Vaccinations, improving economies drive recovery

Collins said vaccinations and improving economies are accelerating air travel recovery. As vaccinations become more widespread and economies recover, pent-up demand is spurring traffic. However, international border restrictions and proof of vaccinations continue to inhibit travel recovery, however.

Supply chain squeeze

Collins also told the AFA conference that competition for raw materials and labor, especially in the US, is a rising concern. Shipping at US ports is backing up, with hundreds of cargo vessels anchored awaiting labor and truck drivers to unload and ship their freight.

On Boeing’s 3Q2021 earnings call the next day, CEO David Calhoun said, “We’re actively working to ensure the production system, including the supply chain, is stable prior to making decisions to further increase

the production rate. Raw materials, logistics and labor availability will also be key watch items for future rate increases.

“With economic activity picking up, labor availability within our supply chain will be the critical watch item,” Calhoun said.

Snippets from the Boeing earnings call

Other quick facts from the earnings call:

- About one-third (122) of the current 737 MAX inventory of 370 airplanes is destined for China.

- “We have to get better at delivering [737s] out of the completion center our inventoried airplanes,” Calhoun said. (Delivery of MAXes from inventory is taking about twice as long as previously expected, a knowledgeable source tells )

- Boeing will increase the production capacity of the 777F, which currently is about 1.5/mo, due to the demand for freighters. Boeing did not specify the new rate.

Boeing faces cancellations for 787s

Boeing has about 110 787s in inventory, representing the suspension of deliveries since October 2020. LNA understands that one major customer sees as many as half of these aircraft as subject to cancellation before deliveries resume. No date has been set for resumption. But, based on information LNA has obtained as affected airlines look for substitute lift, it may be well into the first quarter of 2022 before Boeing begins clearing this inventory.

Boeing, and airlines, are shopping for available 777-300ERs to provide substitute lift for the grounded 787s. Some airlines seek long-term leases, suggesting cancellations are possible. As the delivery delays pass 9-12 months, customers are able to cancel the aircraft–even if built.

Fortress, Wichita State U ensnared in Mammoth-Sequoia trade secret theft lawsuit

By Scott Hamilton

Nov. 1, 2021, © Leeham News: A nasty trade secret theft lawsuit between two companies vying to compete in aftermarket freighter conversions expanded this month to include Fortress Investments and the National Institute for Aviation Research at Wichita State University (NIAR).

Last July, Mammoth Freighters LLC, Wagner Aeronautical and their principals filed a lawsuit in the US Southern District of California against Sequoia Aircraft Conversions and its principals. Mammoth alleged Sequoia and its founders stole trade secrets from Mammoth to start their company in competition to Mammoth.

Engine OEMs pushing ahead for next airplane, even as Boeing pauses

Subscription Required

By Scott Hamilton

Nov. 1, 2021, © Leeham News: David Calhoun may not be anywhere near ready to launch the Next Boeing Airplane (NBA), but the engine makers are actively researching and developing engines to hang of whatever that NBA will be.

Calhoun, the CEO of Boeing, repeatedly said the NBA will be more about reducing production costs through advanced design and production methods. For some time, Calhoun said the next engines available on the assumed timeline—to about 2030—will have only 10% better economics than today’s engines.

And 10% isn’t enough for the airlines or the commensurate reduction in emissions.

CFM/GE Aviation/Safran are developing an “open fan” engine that will reduce fuel burn and emissions by 20%. A target date for entry into service is in the 2030 decade. The open fan builds on R&D of open rotors that have been underway since the era of the Boeing 727 and McDonnell Douglas MD-80.

Pratt & Whitney sees an evolution of its Geared Turbofan engine. The GTF was under development for 20 years before an operating engine made it onto the Bombardier C Series (now the Airbus 220), the Airbus A320, and United Aircraft MC-21. The GTF also was selected for the Mitsubishi MRJ90, which launched the GTF program. However, Mitsubishi pulled the plug on the MRJ/SpaceJet program last year. PW remains committed to the GTF for future engines.

Rolls-Royce is developing the Ultra Fan and Advanced engines. GE’s Open Fan and RR’s engines adopt geared turbofan technology pioneered by PW but add new technology.

LNA takes a look at the new engines for the NBA or any other competing airplane in a series of articles.