Leeham News and Analysis

There's more to real news than a news release.

Leeham News and Analysis

Leeham News and Analysis

- The Boeing 767 Cross Section, Part 1 November 24, 2022

- Movie Review: Devotion November 21, 2022

- China will accelerate development of its commercial aerospace sector November 21, 2022

- Bjorn’s Corner: Sustainable Air Transport. Part 46. eVTOL comparison with helicopter November 18, 2022

- The economics of a 787-9 and A330-900 at eight or nine abreast November 16, 2022

“Air Wars” tops Puget Sound Business Journal Christmas List of Books

Air Wars is available here.

Dec. 24, 2021, (c) Leeham News: The those late shoppers looking for last-minute gifts, the Puget Sound Business Journal (Seattle area) on Tuesday listed 11 aerospace books for the aviation geeks. Air Wars, The Global Combat Between Airbus and Boeing was at the top of the list. Air Wars is by LNA’s Scott Hamilton. It was published in August.

Christmas may be almost over, but the PSBJ gives plenty of options for post-holiday reading nevertheless.

Posted on December 24, 2021 by Scott Hamilton

“Air Wars” makes Top 10 book list of Royal Aeronautical Society

Dec. 22, 2021, © Leeham News: Air Wars, The Global Combat Between Airbus and Boeing, by LNA’s Scott Hamilton, yesterday was placed on the Top 10 Aerospace book choices for Christmas 2021 by the Royal Aeronautical Society. The Society is one of the world’s most prestigious aerospace organizations.

Dec. 22, 2021, © Leeham News: Air Wars, The Global Combat Between Airbus and Boeing, by LNA’s Scott Hamilton, yesterday was placed on the Top 10 Aerospace book choices for Christmas 2021 by the Royal Aeronautical Society. The Society is one of the world’s most prestigious aerospace organizations.

While second in the listing, the Society doesn’t rank the books.

Air Wars is currently rated No. 1 of the 15 Best New Aerospace eBooks To Read In 2022 by Book Authority.

The book is available here.

Posted on December 22, 2021 by Scott Hamilton

P&W, Embraer pause E175-E2 engine; MTU writes off investment, sees no revenue in future for SpaceJet engine

By Scott Hamilton

Exclusive: Dec. 21, 2021, © Leeham News: Pratt & Whitney and Embraer agreed to suspend further development and production of the PW1700G for three years, LNA learned.

PW and Embraer did not respond to inquiries. Separately, the aerospace company MTU reported earlier this year that it wrote off its entire investment in the PW1200G and expects no revenue from the program in the future.

Update: P&W provided this statement Dec. 22: “As already informed to the market, Embraer and P&W are evaluating E175-E2 program timing given market conditions and scope clause.“

The engine was developed for the Mitsubishi MRJ. Development of the MRJ90 and follow-on MRJ70 were refined to the M100 SpaceJet when analysis concluded the MRJ90 wasn’t economically competitive with the E190-E2. A myriad of technical flaws also was discovered in the flight test vehicles that rendered the original design uncertifiable.

Mitsubishi Heavy Industries indefinitely suspended the SpaceJet program in 2020. Embraer rescheduled the entry-into-service of the E175-E2 from 2021 twice, now targeting EIS for 2025. This depends on US pilot unions relaxing an airplane weight restriction in the labor contracts. The E175-E2 weight exceeds that allowed in the contracts.

Posted on December 21, 2021 by Scott Hamilton

HOTR: Restarting M100 SpaceJet program is a very, very long runway

By the Leeham News Team

Dec. 21, 2021, © Leeham News: Speculation that Mitsubishi Heavy Industries (MHI) may restart the M100 SpaceJet program seems unrealistic.

unrealistic.

The consulting firm Avascent on Dec. 8 reported that MHI and the Japanese government may complete the M90 SpaceJet (formerly the MRJ90) airplanes. This could lead to restarting the M100 SpaceJet.

LNA believes the former might happen. It doubts the latter will. Here’s why.

Posted on December 21, 2021 by Scott Hamilton

Forecast 2022: Boeing hopes for the best on pandemic, 787, MAX

Subscription Required

By Scott Hamilton

Introduction

Dec. 20, 2021, © Leeham News: To say that last two years have been challenging for Boeing is an understatement.

But for the first time in a long time, officials appear optimistic that the worst is behind them. This is not to say that 2022 will be a cakewalk.

- Boeing is slowly clearing the inventory of 450 737 MAXes produced during the grounding. New airplane production rates are slowing ramping up.

- China’s recertification of the MAX appears around the corner.

- Deliveries of the 787 to restart in a few months.

- Widebody recovery still a challenge.

Posted on December 20, 2021 by Scott Hamilton

Pontifications: EADS went ahead with tanker bid despite long odds against winning

Third in a Series

Dec. 20, 2021, © Leeham News: When EADS, then the name of the parent of Airbus, decided to go it alone and bid for the US Air Force contract for the KC-X aerial refueling tanker, officials knew it was an uphill battle.

Despite winning the contract in Round Two, with Northrop Grumman as the lead, the parameters of the competition changed. No longer would the A330-200-based tanker get credit for its greater capabilities that won it the contract in Round Two. Now, the ancient Boeing KC-135 was the baseline to meet. Any bidders—Boeing and EADS—would receive only a pass-fail rating for meeting the baseline.

If the bid price was within 1% of each other, then EADS would receive credit for the extra capacity afforded the A330 tanker over Boeing’s KC-767 offer.

The pass-fail approach caused Northrop to take one look at decide to withdraw from the competition. EADS officials made the decision to proceed anyway, knowing now that winning was unlikely.

Posted on December 20, 2021 by Scott Hamilton

Bjorn’s Corner: The challenges of airliner development. Part 34. Wrap-up.

December 17, 2021, ©. Leeham News: As we wrap up the series where we look at the monumental work you have to do to get a new aircraft type certified, we will discuss how we need several aircraft variants, addressing different markets, if we shall survive as an aircraft manufacturer.

All successful aircraft manufacturers produce and market a family of aircraft. If you stay with only one variant, you will find it hard to keep good people as the development work ends.

Posted on December 17, 2021 by Bjorn Fehrm

HOTR: Dropping Embraer comes back to bite Boeing

By the Leeham News Staff

Updated with details of Air France – KLM order

Dec. 16, 2021, © Leeham News: When Boeing decided to drop its joint venture plan with Embraer, there were good business reasons to do so.

The grounding of the 737 MAX was dragging on much longer than anyone ever expected, and there was no end in sight. The coronavirus infections exploded into a global pandemic the month before. Air transportation plunged as much as 95%. Airlines were grounding fleets and some, at that  point, looked certain to go bankrupt or go out of business. Boeing was bleeding cash and debt exploded by more than $20bn. The company was in survival mode.

point, looked certain to go bankrupt or go out of business. Boeing was bleeding cash and debt exploded by more than $20bn. The company was in survival mode.

Embraer faced the same industrial and customer challenges Boeing did. And while none of its airplanes were grounded, the E175-E2 turned out to be an airplane with no customers because the US market for which it was designed disappeared. Restrictions in pilot contracts limiting the weight of airlines in regional operations killed the airplane.

Finally, Embraer’s market value at the time the joint venture was agreed was set at $4.5bn. By April 2020, it had fallen to $1.25bn. Given the business environment and the drop in value, why pay the higher price?

With Qantas Airways abandoning Boeing, we now know why going through with the deal may have been smart.

Posted on December 16, 2021 by Scott Hamilton

One A380 departure of two 777-200ER alternatively 787-9? Part 3.

Subscription Required

By Bjorn Fehrm

Introduction

December 16, 2021, © Leeham News: Last week, we discussed the economics for an airline that dispatches one A380 instead of two smaller widebodies on a trunk route with heavy traffic.

Our example modeled British Airways, which uses the A380 on its highest volume Heathrow departures. Now we finish the series by going deeper into the analysis, examining all cost and revenue aspects, including looking at slot values on congested airports.

Summary

- The ultimate decision to fly one departure or two per departure wave on slot-constrained airports is the value of using one slot or two to transport x passengers on an airport like London Heathrow.

- We develop the revenue and costs factors and discuss the airline’s intangible values around this dilemma.

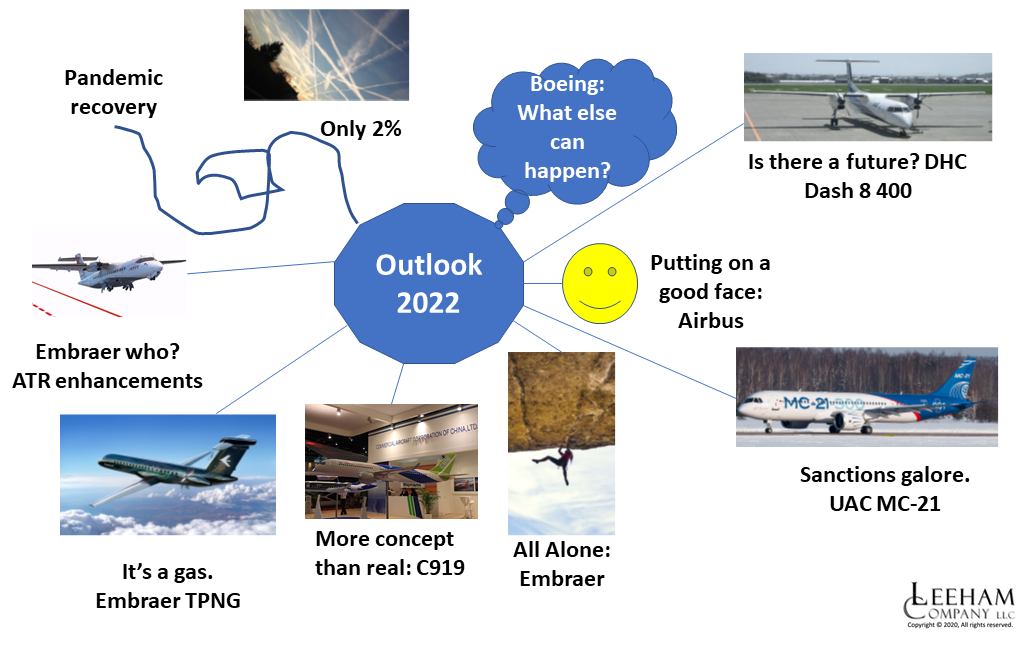

2022 Outlook depends largely on pandemic, Boeing recovery

Subscription Required

By the Leeham News Team

Dec. 13, 2021, © Leeham News: Attempting a forecast for the new year historically has been reasonably easy. One just started with the stability of the current years, and maybe the previous one or two years, and looked forward to next year.

Until the Boeing 737 MAX grounding, COVID-19 pandemic, and the Boeing 787 suspension of deliveries.

These events upended everything. Boeing’s outlook for 2020 depended on what happened to return the MAX to service. The grounding, initially expected by many to be measured in months, ultimately was measured in years.

The 2020 outlook for the rest of the aircraft manufacturers blew up that March with the global pandemic.

Then, in October 2020, Boeing suspended deliveries of the 787, exacerbating its cash flow crunch.

Commercial aviation began to recover some in late 2020. Airbus, which reduced but didn’t suspend deliveries throughout 2020, saw signs of hope for the narrowbody market—less so for widebody airplanes.

There is a lot of uncertainty, however, that makes looking even one year ahead challenging.

Posted on December 13, 2021 by Scott Hamilton

Email Subscription

Twitter Updates

My TweetsAssociations

Aviation News-Commercial

Commentaries

Companies-Defense

Resources

YouTube

Archives

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008