Leeham News and Analysis

There's more to real news than a news release.

P&W, Collins Aerospace launch hybrid-electric demonstrator

By Scott Hamilton

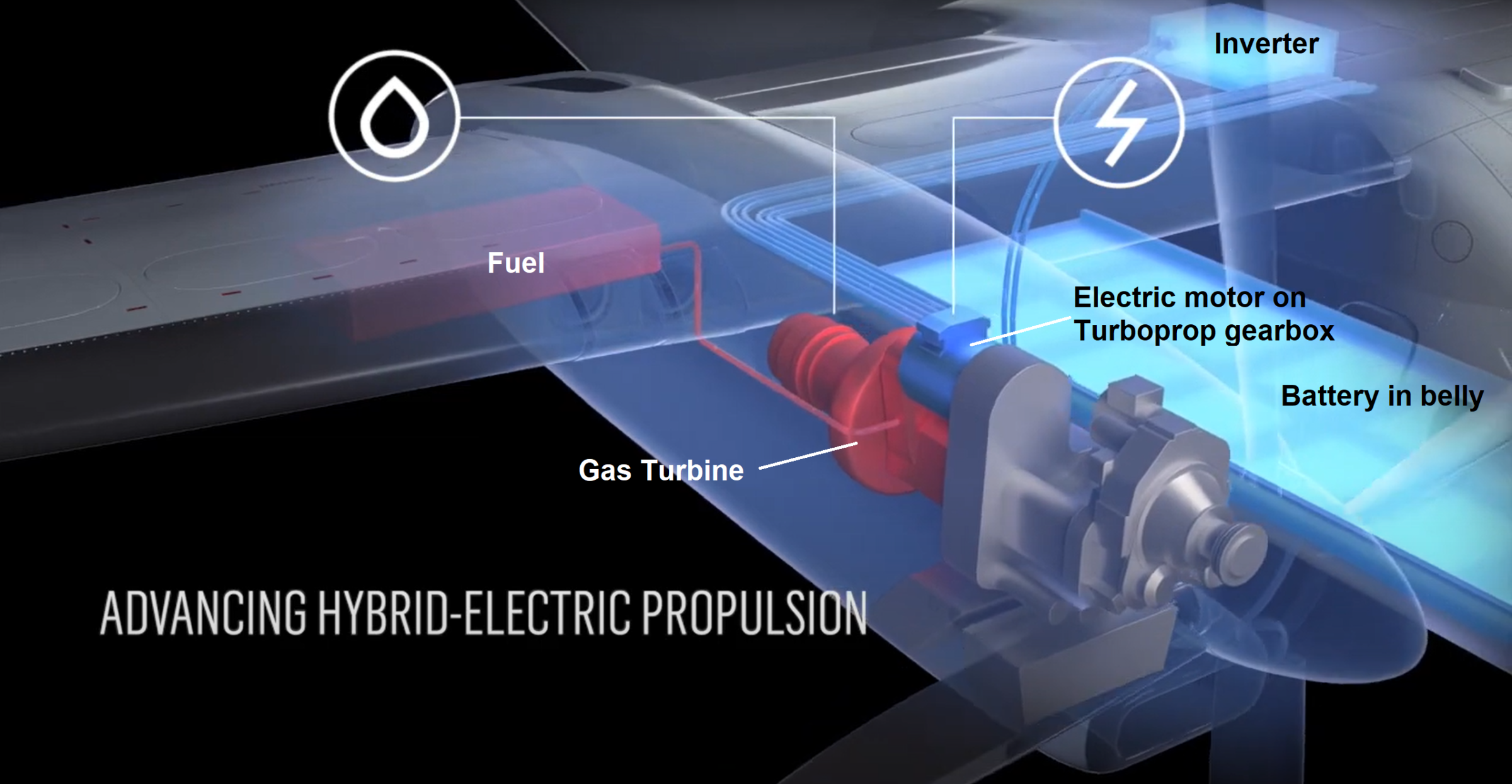

July 18, 2022 (BST), © Leeham News: Pratt & Whitney and sister company Collins Aerospace announced the launch of a hybrid-electric technology demonstrator, it was announced today at the Farnborough Air Show. This program is for future advanced air mobility vehicles.

Collins and Pratt & Whitney Canada, the turboprop engine unit, also announced the completion of the preliminary design of a 1MW motor for the demonstrator. A De Havilland Canada Dash 8-100 will be the platform for the commercial hybrid-electric application.

Bjorn’s Corner: Sustainable Air Transport. Part 23P. Fuel Cell-based 70-seat airliner. The deeper discussion.

Subscription required

June 10, 2022, ©. Leeham News: This is a complementary article to Part 23, Fuel Cell-based 70-seat airliner. It analyses the masses and efficiencies of a 70-seat airliner equipped with the fuel cell-based propulsion systems we analyzed last week.

Bjorn’s Corner: Sustainable Air Transport. Part 12. Hydrogen storage.

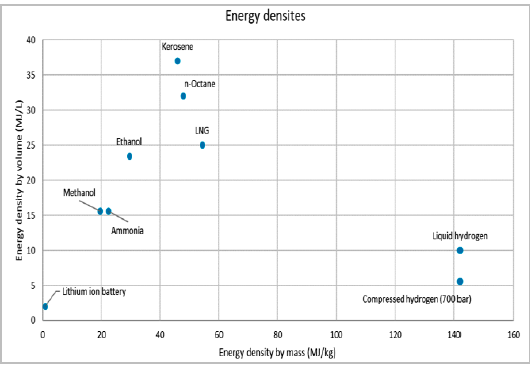

March 25, 2022, ©. Leeham News: Last week, we looked at the energy density by mass and volume for hydrogen and regular Jet fuel (Kerosene), Figure 1.

With this information, we now look at how these fuels can be stored in an aircraft.

Read more

Bjorn’s Corner: Sustainable Air Transport. Part 9. Parallel Hybrids.

March 4, 2022, ©. Leeham News: This is a summary of the article Part 9P. Parallel Hybrid, the Deeper Discussion.

We look into the Pratt & Whitney, Collins Aerospace, and De Havilland project to create a Parallel Hybrid propulsion alternative for the Dash 8 turboprops.

The project “targets a 30% reduction in fuel burn and CO2 emissions, compared to a modern regional turboprop airliner” according to the Pratt & Whitney press release.

Bjorn’s Corner: Sustainable Air Transport. Part 9P. Parallel Hybrid. The deeper discussion.

Subscription required

March 4, 2022, ©. Leeham News: This is a complementary article to Part 9. Parallel Hybrid. It uses Leeham Company’s Aircraft Performance Model from our consultancy practice to analyze the design of a Parallel Hybrid aircraft for regional operations.

Our design brief is to make turboprop upgrade packages for De Havilland DH8-200,-300, and-400 aircraft. By using a Parallel Hybrid we could “target a 30% reduction in fuel burn and CO2 emissions, compared to a modern regional turboprop airliner” according to Pratt & Whitney Canada. Time to check if we can reach these levels.

Carbon footprint: Regional jet versus turboprop, how large is the difference?

Subscription Required

By Bjorn Fehrm

Introduction

January 27, 2022, © Leeham News: Last week, we kicked off a series of articles where we will measure what difference our choice of flying makes to the primary Greenhouse gas emission, CO2.

We have upgraded our airliner performance model for the series to give a direct output of the CO2 emissions for the flights in different phases.

We start this week by comparing a typical domestic feeder flight of 300 nm, with an example route of Cleveland to Chicago O’Hare. What will be the time differences? And the fuel burn and CO2 emission difference?

To make it a fair comparison, we’ll use present generation aircraft flying on the US market, the Embraer E175 and De Havilland’s DH 8-400. We will fly the DH 8 at a high-speed cruise to keep the flight time differences within 10 minutes.

Summary

- As expected, the turboprop is the more efficient mode of transportation on the route. It consequently emits less CO2 per transported passenger.

- With new, more comfortable turboprops in the works, the drive for sustainability could see a return of the turboprop to the US market.

2022 Outlook depends largely on pandemic, Boeing recovery

Subscription Required

By the Leeham News Team

Dec. 13, 2021, © Leeham News: Attempting a forecast for the new year historically has been reasonably easy. One just started with the stability of the current years, and maybe the previous one or two years, and looked forward to next year.

Until the Boeing 737 MAX grounding, COVID-19 pandemic, and the Boeing 787 suspension of deliveries.

These events upended everything. Boeing’s outlook for 2020 depended on what happened to return the MAX to service. The grounding, initially expected by many to be measured in months, ultimately was measured in years.

The 2020 outlook for the rest of the aircraft manufacturers blew up that March with the global pandemic.

Then, in October 2020, Boeing suspended deliveries of the 787, exacerbating its cash flow crunch.

Commercial aviation began to recover some in late 2020. Airbus, which reduced but didn’t suspend deliveries throughout 2020, saw signs of hope for the narrowbody market—less so for widebody airplanes.

There is a lot of uncertainty, however, that makes looking even one year ahead challenging.

Pontifications: Recovery plans from the pandemic at ATR, De Havilland

March 29, 2021, © Leeham News: Aviation stakeholders’ attention understandably focuses on Airbus and Boeing as the industry works its way through the COVID-19 pandemic. Embraer gets less attention than the Big Two.

But two other OEMs must be considered as well: ATR and De Havilland Canada.

Outside of China and Russia, whose home-grown industries sell only to these markets, ATR and DHC are the only manufacturers of turboprops in the 50-90 seat sectors.

LNA revealed on Jan. 12 that DHC would suspend Dash 8-400 production after the small backlog rolled off the assembly line. The privately held company delivered 11 airplanes last year due to the pandemic.

About 900 aging regional turboprop aircraft need to be replaced in the coming years.