Leeham News and Analysis

There's more to real news than a news release.

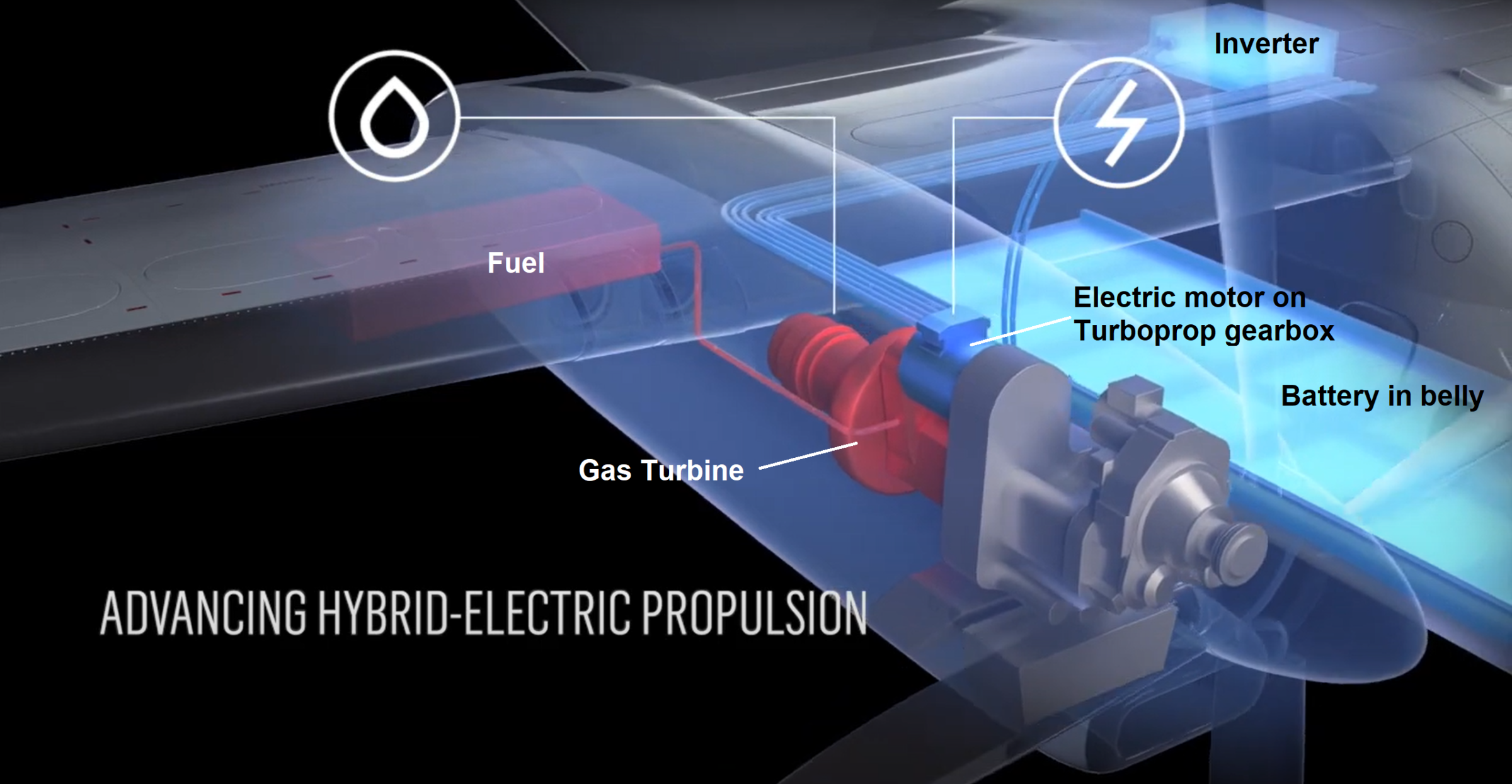

P&W, Collins Aerospace launch hybrid-electric demonstrator

By Scott Hamilton

July 18, 2022 (BST), © Leeham News: Pratt & Whitney and sister company Collins Aerospace announced the launch of a hybrid-electric technology demonstrator, it was announced today at the Farnborough Air Show. This program is for future advanced air mobility vehicles.

Collins and Pratt & Whitney Canada, the turboprop engine unit, also announced the completion of the preliminary design of a 1MW motor for the demonstrator. A De Havilland Canada Dash 8-100 will be the platform for the commercial hybrid-electric application.

Bjorn’s Corner: Sustainable Air Transport. Part 9. Parallel Hybrids.

March 4, 2022, ©. Leeham News: This is a summary of the article Part 9P. Parallel Hybrid, the Deeper Discussion.

We look into the Pratt & Whitney, Collins Aerospace, and De Havilland project to create a Parallel Hybrid propulsion alternative for the Dash 8 turboprops.

The project “targets a 30% reduction in fuel burn and CO2 emissions, compared to a modern regional turboprop airliner” according to the Pratt & Whitney press release.

Bjorn’s Corner: Sustainable Air Transport. Part 9P. Parallel Hybrid. The deeper discussion.

Subscription required

March 4, 2022, ©. Leeham News: This is a complementary article to Part 9. Parallel Hybrid. It uses Leeham Company’s Aircraft Performance Model from our consultancy practice to analyze the design of a Parallel Hybrid aircraft for regional operations.

Our design brief is to make turboprop upgrade packages for De Havilland DH8-200,-300, and-400 aircraft. By using a Parallel Hybrid we could “target a 30% reduction in fuel burn and CO2 emissions, compared to a modern regional turboprop airliner” according to Pratt & Whitney Canada. Time to check if we can reach these levels.

HOTR: Collins Aerospace sustainability

Feb. 22, 2022, © Leeham News: The headlines and debate over ecoAviation focus on the airframe and engine manufacturers, for good reason. But the aerospace supply chain is mindful of its ESG (Environmental, Social, and Governance) issues as well.

Pratt & Whitney makes the engines that emit emissions and burn fuel. It works to reduce fuel burn and emissions. PW also is exploring electric, hybrid and hydrogen alternatives. Sister company Collins Aerospace works to find solutions to reduce emissions in other areas.

Pratt & Whitney makes the engines that emit emissions and burn fuel. It works to reduce fuel burn and emissions. PW also is exploring electric, hybrid and hydrogen alternatives. Sister company Collins Aerospace works to find solutions to reduce emissions in other areas.

“We play a big role in sustainability,” says LeAnn Ridgeway, Vice President, Sustainability. Collins purchased FlightAware, which is perhaps best know for flight tracking in competition with FlightRadar24. But FlightAware provides route planning and ADS-B services, among others.

Why was the 737-8 losing market to the A320neo before the MAX crisis?

By Bjorn Fehrm

Subscription Required

Introduction

February 27, 2020, © Leeham News: While we wait on the Boeing 737-8 to get back in the air, we take a look at how this best seller in the 737 series compares with its direct rival, the Airbus A320neo.

The 737-800 and its follow on, the 737-8, have been the most popular single-aisles in Boeing’s lineup for decades. The 737-800 sold more units than the A320. But when both got re-engined, this changed. The A320neo is now outselling the 737-8.

We look into why.

Summary:

- The trend where the A320neo is outselling the 737-8 started well before the MAX crisis. Is the root cause better airframe performance?

- We find the cause to be another. The difference is not about a change in relative airframe performance between the two.

Embraer’s E195-E2 or Airbus’ A220-300 for the 120 to 150 seat segment?

By Bjorn Fehrm

Subscription required

Introduction

September 19, 2019, ©. Leeham News: What aircraft to choose for the segment 120 to 150 seats, Embraer’s E195-E2 or Airbus A220-300? After discussions with Airbus’ Rob Dewar at the Paris Airshow, Head of A220 Engineering and Product Support, and a visit to Embraer last week for the E195-E2’s first customer delivery, we have collected some unique insights.

We also had the opportunity to talk to David Neeleman of Azul, Moxy and TAP Portugal when at Embraer, the only owner/operator which has bought both aircraft; E195-E2 for Azul and A220-300 for his Moxy project.

Summary:

- We start with a detailed comparison of the aircraft in this first article.

- While serving the same passenger capacity segment, they are surprisingly different in their design approach and, therefore, in their characteristics.

Collins Aerospace faces new merger before previous one is fully integrated

July 16, 2019, © Leeham News: Ajay Agrawal, the president of Collins Aerospace’s aftermarket services, wasn’t done integrating the  merger between United Technologies and Rockwell Collins.

merger between United Technologies and Rockwell Collins.

He now faces a new integration with the planned merger between United Technologies (Collins’ parent) and Raytheon. The new company will be called Raytheon Technologies. There’s little he can do until the merger is approved by regulators, except plan internally how to integrate and expand the aftermarket business.

Collins contract vote keeps 737 landing gear on track

By Bryan Corliss

By Bryan Corliss

March 11, 2019 (c) Leeham News: Workers at the Collins Aerospace landing gear plant in Everett, WA, have approved their first union contract with the company.

Both sides can come away feeling OK with how they did at the bargaining table. But the biggest winner in these talks actually was Boeing, which now doesn’t have to worry about a break in the flow of 737 landing gear for the next 40 months.