Leeham News and Analysis

There's more to real news than a news release.

Bjorn’s Corner: The challenges of airliner development. Part 25. Safety monitoring and reporting

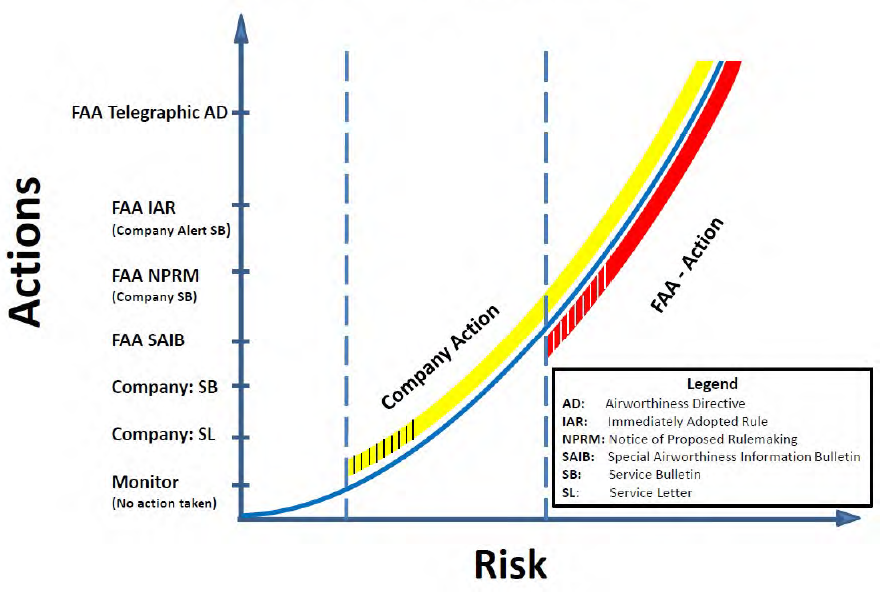

October 15, 2021, ©. Leeham News: Last week, we introduced the activities around Continued Airworthiness that we have to do during development and flight testing of our aircraft.

As described, the majority of accidents for aircraft are attributed to failings in Continued Airworthiness and Operations rather than design. We listed Continued Operational Safety, Operational Preparedness, and Service Readiness as the three important areas for Continued Airworthiness.

We dive into Continued Operational Safety first, specifically Safety Monitoring and Reporting.

With high cargo prices, will airlines fly larger aircraft in their widebody fleets?

Subscription Required

By Bjorn Fehrm

Introduction

October 14, 2021, © Leeham News: Over the last weeks, we’ve seen that the present cargo crunch and high yields will influence what aircraft variants airlines purchase. Models that are too large passenger-wise for years to come will be paid for by a longer belly that can take more cargo.

This trend will remain as long as cargo prices are high. Will the high cargo yields also affect what aircraft to keep stored and which to fly of an existing fleet? We apply the analysis to an airline with a fleet of Boeing 777s.

Summary

- The increased yields for air cargo changes the fleet planning for the widebody fleet. The most suitable passenger models stay in the desert, and the longer siblings fly despite lower load factors.

Pontifications: Upping the game in eco Aviation

Oct. 4, 2021, © Leeham News: The pressure to reduce greenhouse gas emissions by the commercial aviation industry continues to increase.

Two weeks ago, Airbus hosted a day-and-a-half media event promoting its vision of moving toward decarbonizing aviation.

Boeing and Alaska Airlines last week hosted media for a touchy-feely event following up on the announcement in June by Boeing and Alaska of its joint ecoD (as Boeing calls it) program.

Boeing in October outlined progress of its ecoDemonstrator program, at the time with Etihad Airways as the partner. A 787-10 was used at that stage.

Mike Sinnett, Boeing VP of Product Development, said last week that the Alaska 737-9 MAX that is the focus of the current ecoD effort includes several ideas that would not make it into test on a stand-alone basis. But as part of a larger effort, little things that cumulatively can reduce drag and therefore fuel burn can be tested.

IATA AGM: Airplanes, engines SAF capable coming; feedstock lags by years

Subscription Required

By Scott Hamilton

Introduction

Oct. 4, 2021, © Leeham News: Engine and airframe makers are well on their way to becoming fully capable of using Sustainable Aviation Fuel (SAF). But the industries providing SAF are way behind in meeting the potential demand.

Rick Deurloo. Sr. VP & Chief Commercial Officer at Pratt & Whitney said one major US airline would use all currently available SAF in one day.

“The challenge will be the feedstock. How do we grow that technology or grow that ability to provide the feedstock so when we do have 100% SAF-capable aircraft and engines, we have the energy to go with it?” Deurloo said in an interview with LNA at the IATA AGM this week in Boston.

Airlines around the world are partnering with different companies to develop this technology, he said.

PW is already 50% capable and has a “clear path” to getting 100% capable within two years. But there is not enough feedstock in the world today do fill the 50% capability.

Airbus begins “stuffing” A220 to speed assembly, cut costs

By Scott Hamilton

Sept. 28, 2021, © Leeham News: Airbus is streamlining some of its production of the A220 to reduce costs and the time to assemble the airplanes at its Montreal and Mobile plants.

Florent Massou, the SVP and Head of the A220 program, told LNA the company wants to shave 50% of the final assembly time for the A220. There will be an unrevealed cost reduction, which Massou declined to reveal. But he said it isn’t a one-for-one cost reduction.

Final assembly typically runs 5% to 8% of the total cost of the airplane, according to Boeing’s touch labor union, the IAM 751. Whether this equates to the A220, which began life as a Bombardier aircraft, is unknown.

777 freighter conversion methods and their differences

Subscription Required

By the Leeham News Team

Sept. 27, 2021, © Leeham News: The race for the Boeing 777 P2F Freighter conversion is on.

IAI Bedek Big Twin Boeing 777-300ERF passenger-to-freighter conversion. Lessor GECAS, now part of AerCap, was the launch customer of this, the first 777 P2F program. Source: IAI Bedek.

There are three companies in various stages of development. The first, IAI Bedek, announced its conversion process in 2019 with an order from the giant lessor, GECAS (now a part of AerCap). The second is a program driven by Nair Werx of Wichita (KS) and marketed by Sequoia Aircraft Conversions. The third is the recently announced Mammoth Freighter Conversions of California and Florida.

IAI has cut metal. Mammoth is test-flying a 777-200LR for stress and technical analysis. NAIR is in the pre-production Engineering Phase.

Let’s take a moment to understand the process of a P2F Conversion.

Is cargo capacity deciding the airliner variant?

Subscription Required

By Bjorn Fehrm

Introduction

September 23, 2021, © Leeham News: In last week’s article, we put the question: Has the increased cargo pricing started to affect the choice of airliner variant?

We listed recent decisions between the Boeing 787-8 and -9 or Airbus A330-900 and A350-900 where the traffic levels post-pandemic would motivate the smaller variant, but the larger was retained or selected.

It makes you wonder whether the higher cargo capacity of the larger variant compensates for flying a larger cabin at a lower load factor? We make a cost and revenue analysis to find out.

Summary

- Cargo was an additional revenue stream on top of the main source, the passenger traffic.

- The lower traffic levels for international long-haul traffic and the increase in cargo pricing have changed this. Cargo is now as important in the decision of which aircraft to choose as the passenger capacity.

HOTR: Lockheed reveals tanker info: it’s all about America

Sept. 21, 2021, © Leeham News: Lockheed Martin (LMT) last week revealed its dedicated product launch web site page of  the LMXT aerial refuel tanker. The LMXT uses the Airbus A330 MRTT as the platform for the US Air Force’s KC-Y competition for which initial information requests have been issued.

the LMXT aerial refuel tanker. The LMXT uses the Airbus A330 MRTT as the platform for the US Air Force’s KC-Y competition for which initial information requests have been issued.

LMT and Airbus partnered in 2018 in anticipation of the KC-Y program, originally intended to replace the aging Boeing (nee McDonnell Douglas) KC-10. KC-Z was to follow, an entirely new concept in aerial refueling tankers.

KC-Y is now recast as a replacement for 140-160 Boeing KC-135s. It will be a follow-on to the original KC-X program, which was won by Boeing after three tries. Boeing has 179 orders for the 767-200ER-based KC-46.

Behind the latest Boeing CMO

Subscription Required

By Vincent Valery

Introduction

Sept. 20, 2021, © Leeham News: Boeing Commercial Airplanes (BCA) released its latest Commercial Market Outlook (CMO) last week. While the latest total 20-year outlook for commercial aircraft remains below 2019 (43,610 vs. 44,040), it increased by 500 units compared to the previous year.

BCA highlights the headline number of aircraft deliveries to point out the bright long-term growth prospects for the commercial aviation market. The report states that the COVID-19 pandemic erased two years’ worth of growth but did not materially affect long-term prospects.

The delivery figures rely on a large number of assumptions, including market segment and region. LNA takes a deeper look at those assumptions, notably regarding delivery and production rates.

Summary

- Converting to more understandable metrics;

- Assessing the impact of slower 2021 deliveries;

- Plausibility of twin-aisle prospects for the 2020s;

- Can production follow?