Leeham News and Analysis

There's more to real news than a news release.

Leeham News and Analysis

Leeham News and Analysis

- The Boeing 767 Cross Section, Part 1 November 24, 2022

- Movie Review: Devotion November 21, 2022

- China will accelerate development of its commercial aerospace sector November 21, 2022

- Bjorn’s Corner: Sustainable Air Transport. Part 46. eVTOL comparison with helicopter November 18, 2022

- The economics of a 787-9 and A330-900 at eight or nine abreast November 16, 2022

Pontifications: Returning MAX to pre-grounding rate one key to Boeing’s launch of new airplane

April 4, 2022, © Leeham News: Returning the 737 MAX production rate to pre-grounding levels, and beyond, is a key element to positioning Boeing to launch a new airplane program.

So far, Boeing hasn’t provided any guidance to Wall Street aerospace analysts beyond reaching a rate of 31/month this year.

A month ago, LNA reported that hints of new rates came from Boeing suppliers ATI and Spirit Aerosystems during their investor day presentations. The two days were a week apart. ATI is a parts supplier. Spirit builds entire fuselages for the 737. The investor days suggested that Boeing will return to rate 52, the pre-ground MAX rate, by 2024.

LNA has learned more specific information from its sourcing in the supply chain. Boeing notifies the chain when to expect rate breaks to higher or lower rates for planning purposes.

According to LNA’s latest information, Boeing is planning to achieve a rate of 38 by January 2023 and boost it to a rate of 47 by the summer of 2023. Another rate break would boost production to 52 a month early in 1Q24. When regulators grounded the MAX in March 2019, Boeing was geared up to boost production to 57 a month by year-end.

So far, Boeing apparently hasn’t given guidance to its supply chain beyond rate 52. But if the pattern holds up, rate 57 could be in the cards by the end of 2024. Orders for the MAX, especially for the MAX 10, have picked up nicely.

Posted on April 4, 2022 by Scott Hamilton

Bjorn’s Corner: Sustainable Air Transport. Part 12. Hydrogen storage.

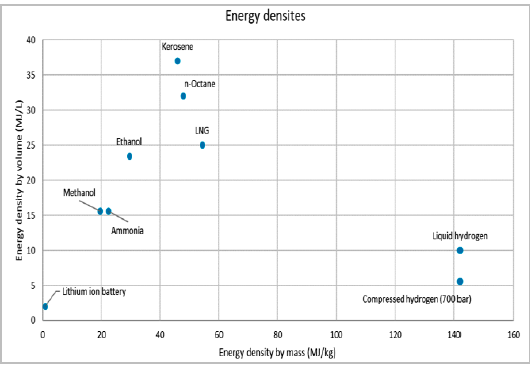

March 25, 2022, ©. Leeham News: Last week, we looked at the energy density by mass and volume for hydrogen and regular Jet fuel (Kerosene), Figure 1.

With this information, we now look at how these fuels can be stored in an aircraft.

Read more

Posted on March 25, 2022 by Bjorn Fehrm

A Boeing 787 freighter, which model and how good? Part 2

Subscription Required

By Bjorn Fehrm

Introduction

March 24, 2022, © Leeham News: Last week, we discussed the creation of a Boeing 787 freighter. It shall replace the Boeing 767-300F, which is running into emission rule problems in 2027.

After looking at what 787 variant makes for the best freighter, we now compare the economics of the 787, 767-300F, and A330-200F freighters.

Figure 1. The 767-300F freighter (top) and its possible replacements: 787-8F (middle) and 787-9F (bottom). Source: Leeham Co.

Summary

- When a Boeing 787 freighter arrives at the decade’s end, its economics will change the freighter market’s dynamics.

Posted on March 24, 2022 by Bjorn Fehrm

Boeing sees incumbency as advantage in coming air force tanker procurement

Subscription Required

Now open to all Readers

- The interview with Lockheed Martin appeared Jan. 30.

By Scott Hamilton

March 21, 2022, © Leeham News: Lockheed Martin Co. (LMCO) plans to submit a proposal for the US Air Force’s KC-Y aerial refueling tanker procurement. So does Boeing. LMCO joined with Airbus and will offer a tanker based on the existing Airbus A330 MRTT (Multi-Role Tanker Transport). Boeing will offer a follow-on purchase of the incumbent KC-46A, based on the 767-200ER.

These two aircraft faced off in the KC-X competition. Airbus initially teamed with Northrop Grumman and was awarded the contract. Boeing protested the award on procurement procedural grounds and prevailed. Northrop dropped out of the recompete, which Boeing won in 2011.

The two aircraft will be offered again, but this time, one party doesn’t view the aircraft as competitive. LMCO sees the Airbus airplane, which it brands the LMXT, as complementary to rather than competitive to the KC-46A. Lockheed explains why here.

Boeing, on the other hand, isn’t convinced the USAF will even seek a competitive bid—or that LMCO’s belief that the service wants a larger airplane than the KC-46A to fill a “gap” is correct.

Mike Hafer, senior manager of KC-46A Business Development, explains why.

Posted on March 21, 2022 by Scott Hamilton

Pontifications: From the aviation perspective, there’s something in China to watch

March 21, 2022, © Leeham News: Eyes are focused on Ukraine and the Russian War. In our corner of the world, commercial aviation, the stakeholders follow the fallout from the war: sanctions placed on Russia which affect overflights, supply chains, oil to Europe (fuel), and Russia’s confiscation of about $10bn worth of airliners from Western lessors and lenders.

But there is another drama playing out on the other side of the world, too. This one involves China and one of its commercial aviation companies, AVIC.

AVIC is a major aerospace company in China. It also has a variety of none-aerospace companies. It’s one of these that caught our eye last week.

The Wall Street Journal on March 14 reported that AVIC subsidiaries involved in solar energy filed for bankruptcy to avoid an $85m judgment after allegedly absconding with intellectual property from two US companies. The firm had to settle for 30 cents on the dollar.

It’s another example of China companies simply ignoring international IP laws.

Posted on March 21, 2022 by Scott Hamilton

A Boeing 787 freighter, which variant and how good?

Subscription Required

By Bjorn Fehrm

Introduction

March 17, 2022, © Leeham News: Monday, we started a series of articles discussing a possible Boeing 787 freighter. It shall replace the Boeing 767 freighter, one of Boeing’s most-produced models, with over 200 factory freighters delivered.

We use our Airliner Performance Model to understand which 787 variant would be most suitable as a base for a freighter and what performance it would have.

Figure 1. Would a 767-300F replacement (top) be a 787-8F (middle) or 787-9F (bottom)? Source: Leeham Co.

Summary

- Boeing can build a very competitive freighter on the 787 base.

- We analyze which of the different 787 models is the most suitable and predict payload, range, and economics.

Posted on March 17, 2022 by Bjorn Fehrm

Pontifications: The soup du jour

March 14, 2022, © Leeham News: You might call it the soup du jour.

EcoAviation is all over the place at aviation conferences these days. It was a key topic at last October’s Annual General Meeting of the International Air Transport Association (IATA). Likewise at last month’s annual conference of the Pacific Northwest Aerospace Alliance (PNAA). EcoAviation also was an element of the Speed News conference in Los Angeles early this month and at another event the following week. Investor Day events now routinely include ecoAviation discussion.

This is all well and good, but at last, some key members of the industry are putting caution and realism to the pie-in-the-sky stuff that is sucking up investment like the Dot Com era a few decades ago. Only a few ideas and technologies will be successful.

Posted on March 14, 2022 by Scott Hamilton

The large Twin-Aisle replacements

Subscription Required

By Bjorn Fehrm

Introduction

March 10, 2022, © Leeham News: We looked into the replacement market for the large twin-aisles and freighters in our February 28th article.

The obvious replacements for the market’s large Twin-Ailes are Airbus’ A350-1000, and Boeing’s 777-9, replacing 747s and A380s but more often 777-300ERs.

We compare the 777-300ER to the A350-1000 and 777-9 to understand the driving forces behind such replacements.

Summary

- The choice between Airbus’ A350-1000 and Boeing’s 777-9 as the replacement for the market’s large aircraft will be decided by route passenger volumes and commonality more than any difference in the operating economics of the aircraft.

Posted on March 10, 2022 by Bjorn Fehrm

Pontifications: Embraer launches E1 Jet P2F program

March 7, 2022, © Leeham News: Embraer announced today that it launched a conversion program for its E190-E1 and E195-E1 jets.

“The full freighter conversion is available for all pre-owned E190 and E195 aircraft, with entry into service expected in early 2024. Embraer sees a market for this size of airplane of approximately 700 aircraft over 20 years,” Embraer said in a statement.

Embraer notes that there are a number of E1 jets aged 10-15 years old that are potential feedstock. The replacement cycle for these continues for the next decade, it said. The company sees a life extension of 10-15 years post-conversion.

Embraer aims to replace turboprop freighters. The E1 Freighters have 50% more volume, three times the range, and up to 30% lower operating costs than narrowbody freighters. (It avoids mentioning that turboprops have lower operating costs than the E-Jets.)

Posted on March 7, 2022 by Scott Hamilton

Replacement opportunities for older-generation single-aisle operators

Subscription Required

By Vincent Valery

Introduction

March 7, 2022, © Leeham News: Several airlines announced orders for new-generation single-aisle aircraft in recent months. Air France – KLM and jet2.com announced Airbus A320neo family orders, while Allegiant and Qatar announced Boeing 737 MAX deals. SmartLynx, a Latvian ACMI carrier, will operate 737 MAXes on operating leases from SMBC Aviation Capital.

Despite the lingering effects of the COVID-19 pandemic, airlines are eager to order newer-generation single-aisle aircraft to improve their environmental footprint and secure delivery slots, notably on the A320 production line. The low level of interest rates by historical standards also facilitates those transactions.

(This analysis does not include the Russia-Ukraine crisis, the full impacts of which to commercial aviation are still in the future.)

Such orders represent once-in-a-generation opportunities for OEMs to “flip” an airline away from the other one.

Many airlines operate A320ceos or 737 NGs but have not yet ordered new-generation single-aisle aircraft. LNA analyses this population.

Summary

- Breaking down the population into four categories;

- Airlines unlikely to place orders in the near term;

- Two types of potential customers.

Posted on March 7, 2022 by Vincent Valery

Email Subscription

Twitter Updates

My TweetsAssociations

Aviation News-Commercial

Commentaries

Companies-Defense

Resources

YouTube

Archives

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008