Leeham News and Analysis

There's more to real news than a news release.

Leeham News and Analysis

Leeham News and Analysis

- The Boeing 767 Cross Section, Part 1 November 24, 2022

- Movie Review: Devotion November 21, 2022

- China will accelerate development of its commercial aerospace sector November 21, 2022

- Bjorn’s Corner: Sustainable Air Transport. Part 46. eVTOL comparison with helicopter November 18, 2022

- The economics of a 787-9 and A330-900 at eight or nine abreast November 16, 2022

Airbus integrates the last pieces of the CSeries from Bombardier

September 3, 2020, © Leeham News: Airbus and its subsidiary Satair announced today it has integrated one of the last pieces of Bombardier’s engagement with the A220, the spare parts distribution.

Airbus acquired Bombardier’s part of the A220 aircraft program in January, but Bombardier continued to purchase, stock, sell and distribute the A220 spare parts. From the 1st of July, this is handled by Satair, part of the Airbus group, to give airlines with Airbus aircraft a single point of contact for spares part services.

Posted on September 3, 2020 by Bjorn Fehrm

Sunset of the Quads, Part 5

Subscription Required

By Vincent Valery

Introduction

Sep. 3rd, 2020, © Leeham News: Last week, we compared the economics of the A340-300 and the 777-200ER on the Paris to San Francisco route. We now turn our attention to Airbus’ larger long-range aircraft, the A340-600.

The 30% larger A340-600 was developed in the last year of the 1990s to compete with Boeing’s 777-300ER, then in development.

Summary

- Offering airlines a full product suite;

- A340-600 launch and development;

- Quad vs. twin-engine long-range operations;

- Disappointing commercial performance;

- A long-haul trunk route.

Posted on September 3, 2020 by Vincent Valery

Boeing seeks to cut production costs of 787-8 to boost sales

By Scott Hamilton

Sept. 2, 2020, © Leeham News: Boeing is considering production changes to the slow-selling 787-8 to lower costs and boost sales.

The effort comes at a time when global passenger traffic is at record lows and recovery of international traffic is forecast to take four or five years.

As airline traffic recovers, carriers appear to be favoring smaller aircraft in restarting suspended routes.

In recent years, Boeing discouraged sales of the 787-8 because it is a low margin airplane with high production costs. This is a legacy of the program and development difficulties from 2004-2011, when it finally entered service.

The 787-9 and 787-10 are high margin aircraft Boeing counted on to reduce the billions of dollars in deferred production and tooling costs. At one time, this exceeded $32bn.

The early program difficulties resulted in the production and parts of the -8 to be substantially different than the -9/10, which have 95% commonality. The -8 was only 30% common.

Posted on September 1, 2020 by Scott Hamilton

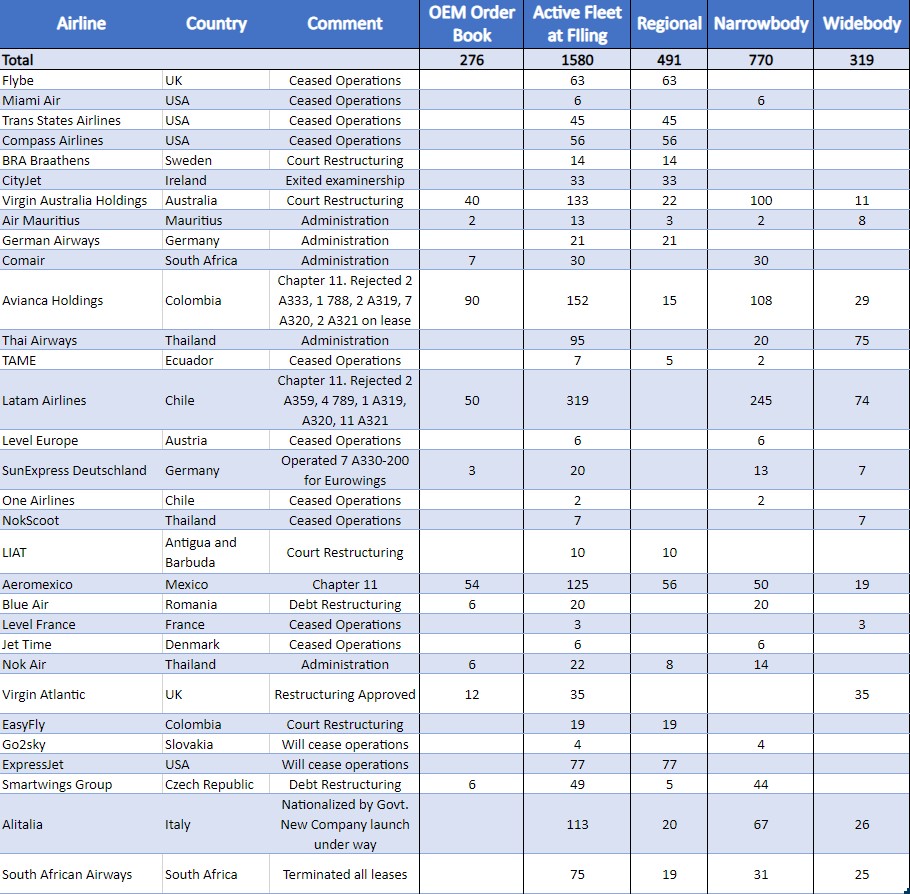

HOTR: Five more airlines under court restructuring or ceasing operations

By the Leeham News Staff

Aug. 31, 2020, © Leeham News: The Smartwings Group is the latest airline to file for a court restructuring.

LNA’s monthly tracking of failed carriers adds Virgin Atlantic, EasyFly, Go2Sky, ExpressJet, and the Smartwings Group to the list of carriers in bankruptcy or court-supervised restructuring since COVID collapsed the global airline industry beginning in mid-March.

Among those five, Go2Sky and ExpressJet announced that they would cease operations. Virgin Atlantic won the support of its creditor for a court-supervised restructuring.

Posted on August 31, 2020 by Vincent Valery

European Regionals Face Hostile Operating Environment

Subscription Required

By Kathryn B. Creedy

Third in a Series. Previous articles:

- The future of regional jets is limited by choices, Scope Clause

- US Regional Consolidation Began Before Covid

Introduction

Aug. 31, 2020, (c) Leeham News: European regionals face far greater challenges than Covid and, sadly, much of what is happening to the industry is beyond its control. The result is similar to failures seen in the U.S. Flybe’s recent loss resulted from pre-Covid problems which also led to the pre-Covid failures of such airlines as Flybmi and Cobalt.

The failures illustrate, however, the three reasons why European regionals are so fragile – low-cost competition, geography, and challenging government policy.

Summary

- Government Policies Hardest on Regionals

- LCC Competition Challenging

- Consumer Protections Crushing

- Turboprops Have Large Role

Posted on August 31, 2020 by Kathryn Creedy

Airbus, Airlines, ATR, Boeing, Bombardier, Coronavirus, COVID-19, CSeries, E-Jet, Electric Aircraft, Embraer, European Regions Airline Association, European Regions Airlines Association, Mitsubishi, Pratt & Whitney Canada, Premium, Regional Airlines, SpaceJet

aircraft, airlines, aviation, flight, full-service carriers, low cost carriers, regional airlines

Pontifications: WA State frets about Boeing brain drain, but it’s already happening

Aug. 31, 2020, © Leeham News: Elected officials and others in Washington State worry about the “brain drain” as Boeing considers whether to consolidate 787 production from Everett to Charleston.

These people are asleep at the switch and have been for some time. The brain drain is already just around the corner.

Nearly half of the membership of SPEEA, the engineers and technicians union at Boeing, are 50 years or older right now.

Almost two thirds of these are within 55-64 years old. In other words, ready for retirement right now or soon to be.

Posted on August 31, 2020 by Scott Hamilton

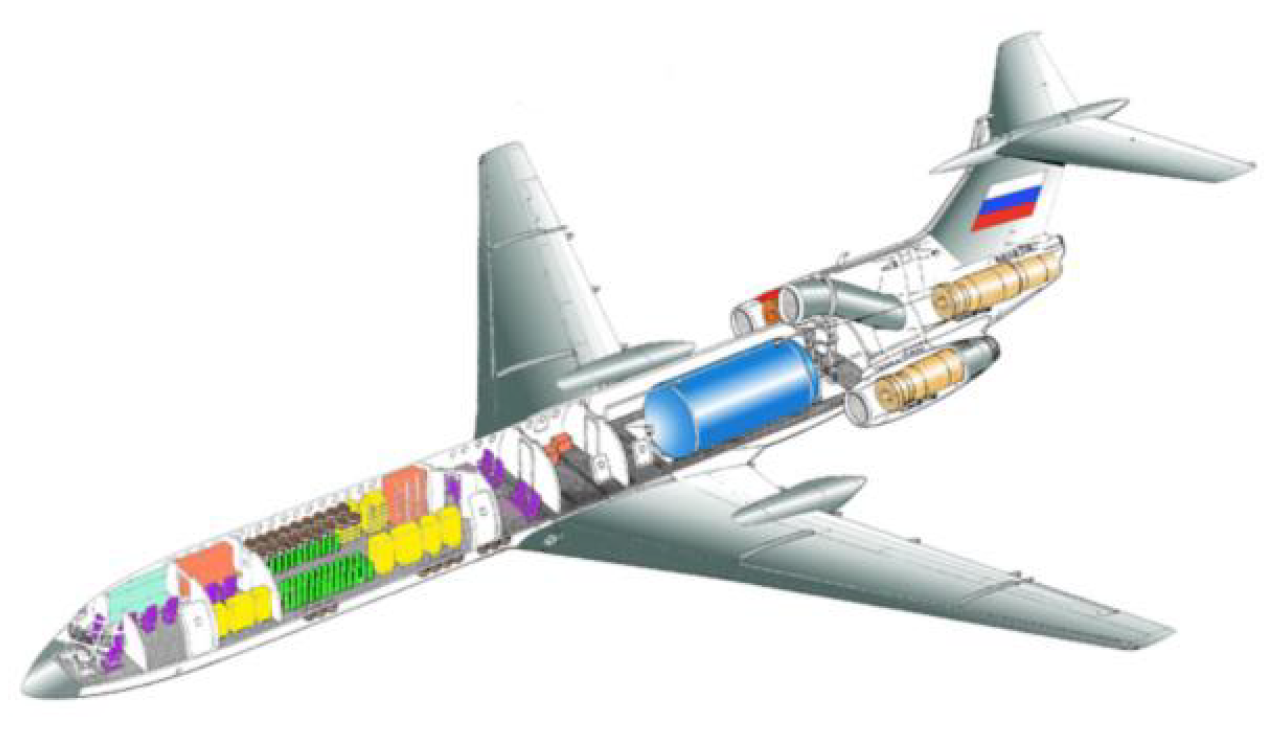

Bjorn’s Corner: The challenges of Hydrogen. Part 6. Tank placement.

August 28, 2020, ©. Leeham News: In our series on Hydrogen as an energy store for airliners we look at the challenge of placing the hydrogen tanks efficiently.

Different from carbon fuels, liquid hydrogen needs specially shaped and bulky tanks. It can’t be stored in the wingbox as today’s Jet-A1.

Posted on August 28, 2020 by Bjorn Fehrm

Sunset of the Quads, Part 4.

Subscription Required

By Bjorn Fehrm

Introduction

August 27, 2020, © Leeham News: After presenting Boeing’s and Airbus’ first 300 seater long-range widebodies, the 777-200ER and A340-300 in Part 3, we now fly them both on the route Paris to San Fransisco to understand their economics.

The A340-300 was first on the market, but when the 777-200ER arrived amid changed ETOPS rules, the four holer found the twin a difficult competitor. We use our airliner performance model to understand why.

Summary

- The A340-300 has about the same payload-range performance as the later introduced 777-200ER.

- Its economics is competitive with the 777-200ER, yet sales dried up when the 777-200ER became available. We explain why.

Posted on August 27, 2020 by Bjorn Fehrm

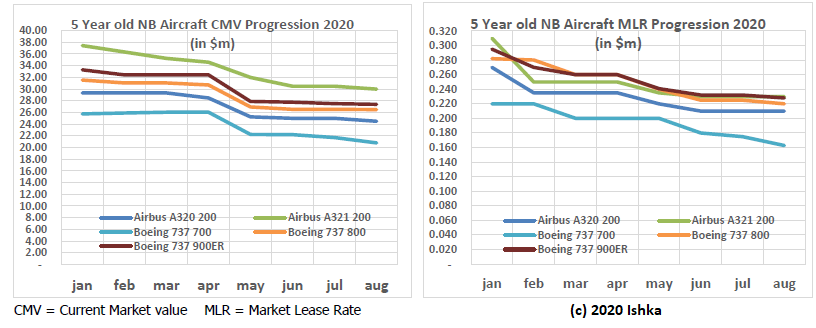

HOTR: Values, rents leveling off for 5-year old aircraft

By the Leeham News staff

Aug. 25, 2020, © Leeham News: Lease rates and aircraft values on narrowbody, mainline jets appear to be leveling off, except for the Boeing  737-700.

737-700.

Ishka, the UK-based appraisal company, revised its tracking presentation in last week’s update. Moving from text to a graphic, it’s visually apparent that values for the A320, 737-700, Boeing 737-800 and -900ER began to level off in May. Values for the Airbus A321 began to level off in June.

Lease rates for all airplanes except the 737-700 began to level off in June. Rates for the -700 continue to decline.

These are for off-lease, half-life aircraft that are five years old.

Half-life means an airplane half-way through its maintenance cycle.

Half-life means an airplane half-way through its maintenance cycle.

Posted on August 25, 2020 by Scott Hamilton

R&D spending at Boeing plunges; Airbus yet to kick in

Subscription Required

By Scott Hamilton

Introduction

Aug. 24, 2020, © Leeham News: Research and development spending at Boeing Commercial Airplanes declined 21% in the first half this year compared with 2019.

From 2017 through 2019, BCA’s R&D spending declined 13%.

During the first half this year, Airbus Commercial airplanes R&D spending declined 1%. From 2017-2019, R&D spending increased 31%.

Boeing’s decline in 2019 vs 2018 and the first half of 2020 vs 2019 clearly reflects the grounding of the 737 MAX.

The flat spending in 2017-2018 reflects Boeing’s corporate approach of keeping R&D spending level while returning 100% of free cash flow to shareholders.

Airbus, on the other hand, was aggressively pursuing green aviation R&D, driven by a European Union that is more dedicated to green aviation than the USA is.

Summary

- COVID-19 related R&D spending cuts may not be fully seen until the third quarter.

- Boeing suspended R&D spending on the New Midmarket Airplane in January. Coupled with MAX grounding pressure, Boeing’s spending was already depressed.

- Airbus said it was suspending all R&D except for the A321XLR after the global COVID devastation on air passenger demand.

- Airbus historically outspends Boeing in R&D.

Email Subscription

Twitter Updates

My TweetsAssociations

Aviation News-Commercial

Commentaries

Companies-Defense

Resources

YouTube

Archives

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008