Leeham News and Analysis

There's more to real news than a news release.

Leeham News and Analysis

Leeham News and Analysis

- The Boeing 767 Cross Section, Part 1 November 24, 2022

- Movie Review: Devotion November 21, 2022

- China will accelerate development of its commercial aerospace sector November 21, 2022

- Bjorn’s Corner: Sustainable Air Transport. Part 46. eVTOL comparison with helicopter November 18, 2022

- The economics of a 787-9 and A330-900 at eight or nine abreast November 16, 2022

Pontifications: Embraer’s China ambitions

March 22, 2021, © Leeham News: Embraer wants to become a big player in China.

“We see a huge market potential there,” said Arjan Meijer, CEO of Embraer Commercial Aviation, in an interview with Nikkei Asia. The news outlet continued, “The company expects worldwide demand for 5,500 jets with up to 150 seats over the next 10 years. A third of that will come from Asia, with a large part of it from China, Meijer added.”

However, China presents risks and few rewards to companies wishing to gain a significant foothold. This is especially true for commercial aviation companies. China has high ambitions for the commercial aviation industry. Partnering with China in this sector produced more heartbreak than success.

Posted on March 22, 2021 by Scott Hamilton

Embraer 2020 results

By Bjorn Fehrm

March 19, 2021, ©. Leeham News: Embraer presented its full-year 2020 results today. Revenue for 2020 was down 31% at $3,771m versus $5,463m in 2019. The resulting loss was $323m, compared with $77m 2019.

The company managed to stay cash neutral with $2.8bn at exit 2020, the same as when exiting 2019. Due to the uncertainty of how COVID-19 develops during 2021, there was no 2021 guidance.

Posted on March 19, 2021 by Bjorn Fehrm

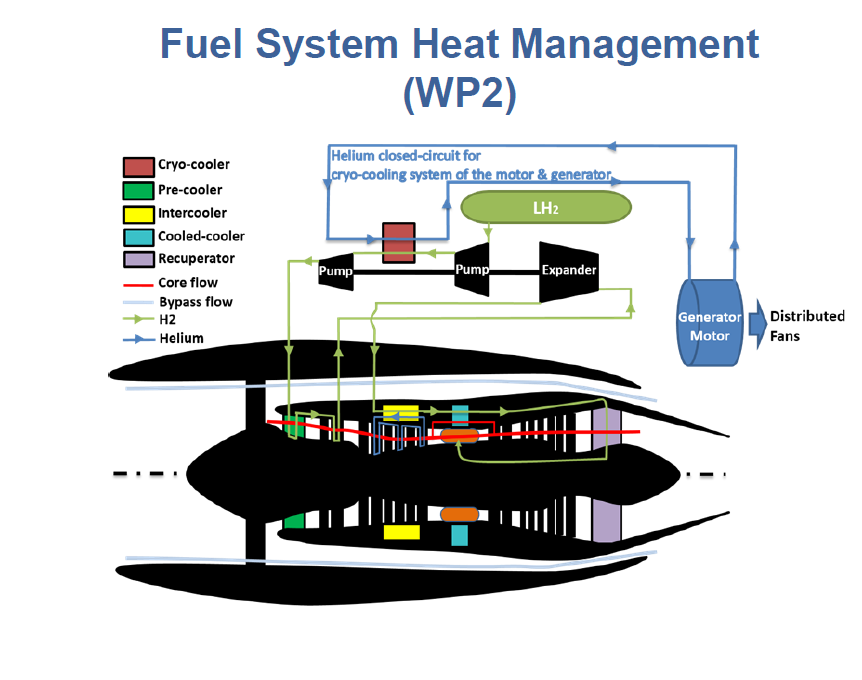

Bjorn’s Corner: The challenges of hydrogen. Part 29. Gas turbine heat management.

March 19, 2021, ©. Leeham News: This week we look deeper into the gains we can have for a hydrogen gas turbine-propelled airliner.

The ideas stem from the work of Chalmers Professor T. Grönstedt’s team in different EU research projects.

Posted on March 19, 2021 by Bjorn Fehrm

The A350, Part 10 Project Sunrise Intro

Subscription Required

By Vincent Valery

Introduction

Mar. 18, 2021, © Leeham News: After assessing the performance of the A350-1000 against the 777-300ER on a trans-Pacific route, we turn our attention to a dedicated A350 variant developed for Qantas’ Project Sunrise.

Summary

- The holy grail of ultra-long-haul routes;

- A limited market;

- A350-1000 “ULR” against 777-8;

- Reasons for Qantas’ choice.

Posted on March 18, 2021 by Vincent Valery

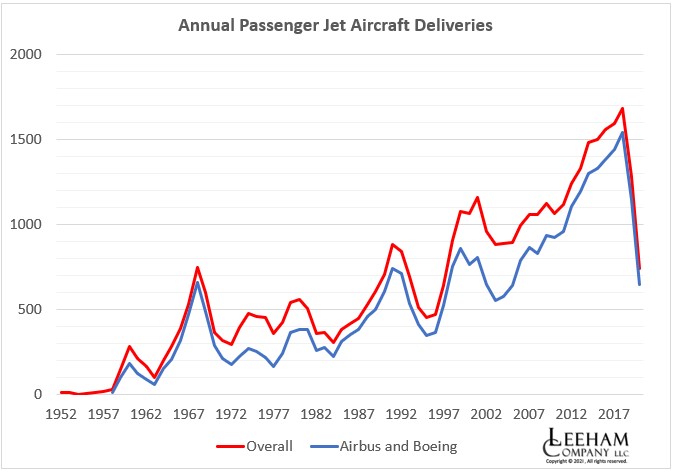

HOTR: Putting the 2020 Delivery Slump into historical perspective

By the Leeham News Team

March 16, 2021, © Leeham News: OEMs delivered 743 jet-powered passenger aircraft to airlines last year, compared with 1,684 at this cycle’s peak in 2018. The below chart shows the total for all OEMs as well as Airbus and Boeing (including McDonnell-Douglas).

Posted on March 16, 2021 by Vincent Valery

Pontifications: AerCap and GECAS to combine — assessing the impact

March 15, 2021, © Leeham News: GE Corp.’s decision to sell its mega-leasing unit, GECAS, to AerCap represents a huge shift in commercial aviation.

For decades, GECAS was the largest lessor in the world. One of GE’s best profit centers, GECAS was a major source of financing to airlines. The lessor purchases and leases back airliners, as do most lessors, as well as initiating leases with orders received directly from the OEMs. GECAS’ scale was a magnitude or two larger than most competitors.

The closest competitor was International Lease Finance Corp., a unit of insurance giant AIG. ILFC’s leadership liked to boast the asset value of ILFC’s smaller fleet was greater than GECAS, which while larger had more older airplanes in its portfolio.

Posted on March 15, 2021 by Scott Hamilton

China’s hollow airline “recovery”: capacity without revenue

Subscription Required

By Judson Rollins

Introduction

March 15, 2021, © Leeham News: A flood of media coverage has centered on Chinese airlines’ supposed recovery from COVID-19.

The Chinese “big three,” Air China, China Eastern, and China Southern, made headlines with their rapid restoration of flights and even the announcement of new routes. Industry commentators and industry group IATA trumpeted the “recovery to pre-crisis levels” in China.

New routes garner headlines in normal times, but even more so now. And there is other good news: the US Transportation Security Administration last week processed the highest number of passengers since the pandemic all but shut down traffic a year ago.

But yield quality of such traffic in most markets is problematic. Cheap fares draw leisure travelers, yet business traffic remains a fraction of pre-pandemic levels and there are few signs of near-term recovery. Executives at Lufthansa Group, where business travelers deliver nearly 60% of revenue, said earlier this month they believe such travel will ultimately only return to 80-90% of pre-pandemic levels – and not until mid-decade.

If market analysts want to examine China’s recovery, they have to look at the whole picture. China may be leading the way in capacity restoration, but it’s not the “good” news touted.

The positive trends in China are in mainland domestic flights and seats, not passenger traffic or revenue — and not at all for regional (Hong Kong, Macau) or international routes. Scant attention has been paid to operational data from the country’s airlines – and even its national aviation regulator – showing passenger traffic even on domestic routes is still well below pre-COVID levels.

The “big three’s” third-quarter 2020 financial reports – when the domestic market was supposedly beginning to hit its stride – showed revenue losses far greater than the airlines’ pre-crisis share of revenue from international service. Even those disastrous results included a strong tailwind from increased cargo revenue, as the airlines don’t break out their revenue by business segment outside of annual reports.

LNA dug into the reports of China’s three state-owned airlines, privately held Hainan Airlines, low-cost carrier Spring Airlines, and monthly data releases from the Civil Aviation Administration of China (CAAC). Much of this data is only published in Mandarin, or in English only after long delays, so we enlisted translation help to build a more complete picture.

Summary

- Capacity is (mostly) back, but passenger volumes haven’t followed.

- Desperate sales promotions are widespread among Chinese carriers.

- Third quarter 2020 financial reports show grave revenue losses.

- Fourth quarter traffic isn’t materially better – and early 2021 is worse.

- Continued excess capacity appears to be driven by politics, not demand.

Posted on March 15, 2021 by Judson Rollins

Bjorn’s Corner: The challenges of hydrogen. Part 28. Airbus priorities

March 12, 2021, ©. Leeham News: I had the chance to talk about Sustainable Air Transport with Airbus VP Zero Emission Aircraft, Glenn Llewellyn, in the week.

The discussion centered around Airbus’ overall direction and the targets with their ZEROe project.

Posted on March 12, 2021 by Bjorn Fehrm

The A350, Part 9: The A350-1000 versus 777-300ER

Subscription Required

By Bjorn Fehrm

Introduction

March 11, 2021, © Leeham News: Last week, we started analyzing the Airbus A350-1000 and compared it with the Boeing 777-300ER.

We now fly the airplanes on a demanding route, close to their maximum range, the LAX to Hong Kong sector. How much better is the 14 years younger A350-1000?

Summary

- The A350-1000 is the logical replacement for a 777-300ER if a same capacity replacement is sought.

- The carbon-fiber structure, a more advanced wing, and newer engines give the A350-1000 convincing arguments for the change.

Posted on March 11, 2021 by Bjorn Fehrm

HOTR: Investors optimistic for Boeing. Are they too optimistic?

By the Leeham News Team

March 10, 2021, © Leeham News: Boeing’s recovery will be long, slow and painful.

But Boeing has been through long, slow and painful periods before.

Investors appear optimistic. The stock price has been rising since lows hit immediately after and throughout the pandemic.

The stock price is far off its high of $440 on March 1, 2019. March 1 was after the October 2018 Lion Air 737 MAX accident but nine days before the March 10, 2019, Ethiopian Airlines MAX crash. The price closed yesterday at $231, abut equal to where it was a year ago today.

Posted on March 10, 2021 by Scott Hamilton

Email Subscription

Twitter Updates

My TweetsAssociations

Aviation News-Commercial

Commentaries

Companies-Defense

Resources

YouTube

Archives

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008