Leeham News and Analysis

There's more to real news than a news release.

Leeham News and Analysis

Leeham News and Analysis

- The Boeing 767 Cross Section, Part 1 November 24, 2022

- Movie Review: Devotion November 21, 2022

- China will accelerate development of its commercial aerospace sector November 21, 2022

- Bjorn’s Corner: Sustainable Air Transport. Part 46. eVTOL comparison with helicopter November 18, 2022

- The economics of a 787-9 and A330-900 at eight or nine abreast November 16, 2022

Pontifications: Boeing 777 production rates

Feb. 27, 2017, © Leeham Co.: When Boeing announced it will reduce 777 production to 5/mo, with actual deliveries of the 777 Classic to 3.5/mo beginning in 2018, the aerospace analyst at Goldman Sachs immediately concluded Boeing will have to reduce the rate to 2-2.5/mo.

Since then, and other analysts (whether publicly or privately) reached a similar conclusion.

On the 4Q/YE2016 earnings call in January and again last week at a Barclays conference, company executives said 90% of the positions in 2018 and 2019 are sold.

Shortly after the Barclays conference ended, one analyst called me to challenge the assertion by Greg Smith, Boeing’s CFO, about 2019. By his assessment, the analyst could only get to 60% in 2019. Did I see anything differently?

59% or 74%, but not 90%

At that point, I hadn’t looked. When I did later, I got to 59% based on firm orders. I could get to 74%, giving Boeing every benefit. But I couldn’t get to 90%.

Posted on February 27, 2017 by Scott Hamilton

Airbus, Airlines, American Airlines, Boeing, Pontifications, Svalbard, United Airlines

767, 777 Classic, 777-300ER, 777F, 777X, 787, A330, A330-200, A330-800, A330neo, A350, Airbus, American Airlines, Barclays, Boeing, Emirates Airline, Etihad Airlines, Goldman Sachs, Greg Smith, Hong Kong Airlines, National Geographic, Pakistan International Airlines, Singapore Airlines, Svalbard, United Airlines

United: the road back

By Bjorn Fehrm

Introduction

February 1, 2017, ©. Leeham Co: A headline from one year ago read: “UNITED’S QUEST TO BE LESS AWFUL: A bungled merger. A corruption scandal. Three CEOs in a year. But hey, at least the snacks are free again.” (Bloomberg 14 January 2016).

“Things have changed, but not everything is fixed yet,” said Gary Laderman, United’s SVP Finance, Procurement and Treasurer, at the Airline Economics Growth Frontiers conference in Dublin last week.

Laderman then candidly went through the history, the fixes and why there is more to come. Read more

Posted on February 1, 2017 by Bjorn Fehrm

A380, from flagship to LCC mass transport

By Bjorn Fehrm

January 23, 2017, ©. Leeham Co: The Airbus A380 was introduced as the flagship aircraft for an airline’s fleet. Legacy carriers with a large long-haul network introduced the aircraft on the routes with the most traffic in the network. After an initial rush of inductions, only Emirates continued to buy the aircraft in larger numbers. The aircraft had become too large for the airlines which sought frequency over capacity at their hub airports.

Airbus and its leasing partner, Amedeo, are convinced the aircraft will have a second spring when airport congestion has grown in the next decade. Until then, both are seeking the market niches that will keep production at minimum one aircraft per month.

We sat with Amedeo’s CEO, Mark Lapidus, at the Air Finance Journal conference in Dublin to find out what market will require a new or used A380. Lapidus has spent the last two years in meetings with the world’s major airlines, discussing all aspects of operating an A380. He presented some surprises.

Posted on January 24, 2017 by Bjorn Fehrm

Pontifications: Airbus, Boeing single-aisle production rates solid

Jan. 23, 2017, © Leeham Co.: The global economy is softening and airlines are deferring airplanes, but we don’t see Airbus or Boeing trimming aircraft production for their single-aisle airplanes.

Over-sales and rising fuel prices support today’s A320 and 737 production rates and the increased rates previously announced by Airbus and Boeing.

While oil prices are low compared with the pre-Great Recession levels, Embraer’s John Slattery noted that fuel costs went up more than 48% last year alone. Fuel now costs more than $50/bbl. West Texas Intermediate Crude was selling at $51.08 Thursday, off $1.40. There will be ups and downs, but the trend is up.

Slattery, the president of Embraer Commercial airplanes, believes “fuel efficient fleets will become more critical in the coming years,” he wrote in a Tweet Jan. 7.

Posted on January 23, 2017 by Scott Hamilton

Resurgence for ERJ-145

Note: Nov. 24 and 25 are Thanksgiving Holidays in the US. Our next post will be Monday.

Subscription Required

Introduction

Nov. 23, 2016, © Leeham Co.: The 50-seat regional jet market is dead.

That’s the conventional wisdom.

Well, not quite.

Embraer ERJ-145 is finding new life with regional airlines.

Piedmont Airlines, a unit of American Airlines, is adding the 50-seat Embraer ERJ-145 to its fleet. Eleven joined so far and next year the company plans to add 24 more.

CommutAir, an operator for United Airlines, is adding the same aircraft type to its fleet. Forty of them.

Why the mini-resurgence?

Low fuel prices and cheap airplanes.

Summary

- 50-seat regional jets were considered economically obsolete with high fuel prices.

- Sustain low prices provided a boost to the Embraer ERJ-145.

- Bombardier’s CRJ-200 hasn’t seen a similar resurgence.

Posted on November 23, 2016 by Scott Hamilton

Airbus, Boeing deferrals may indicate slowing global economy

Subscription Required

Introduction

Boeing 737 flightline at Boeing Field: 737s awaiting delivery. Seattle Times photo via Google images.

Nov. 17, 2016, © Leeham Co.: The deferral by United Airlines of 65 Boeing 737-700s announced Tuesday caused some observers to conclude this has a negative impact on the manufacturer, but this may well overlook a larger issue.

UAL is the latest “quality” airline to announce deferrals to reschedule capital expenditures or because of not needing the aircraft now.

Softening yields, particularly among US airlines, indicate over-capacity despite load factors of 85% or more, say industry observers.

While the backlogs of Boeing and Airbus remain solid today, do the actions of several major airlines indicate the leading edge of a global economy that’s beginning to soften?

Summary

Posted on November 17, 2016 by Scott Hamilton

Boeing stock sell-off on United news appears misplaced

Nov. 16, 2016, © Leeham Co.: The market sell off yesterday of Boeing stock appeared on the surface to be a reaction to the news that United Airlines is deferring 61 737-700s and switching these to four larger 737-800s and the balance to either the 737-8 or 737-9.

Figure 1. Boeing stock traded down on news that United Airlines is deferring 65 737s. The price stayed flat through early today. But stock for Spirit Aerosystems, which makes the 737 fuselages, recovered after a short dip (Figure 2). This suggests the Boeing sell-off was for other reasons. Click on image to enlarge.

Boeing’s stock today remains flat-to-down slightly.

An odd thing happened concurrent to Boeing’s stock decline.

After a short dip, stock of Spirit Aerosystems recovered to the level before the UAL news and remained there through the time of this writing. Spirit makes the 737 fuselages. If Boeing’s stock was hit by the United decision, then logic suggests Spirit’s stock should have been, too.

This suggests the Boeing’s sell off has other reasons.

Posted on November 16, 2016 by Scott Hamilton

Airline assets and lessor assets: Bombardier and Embraer

Subscription Required

Part 2. Part 1 may be found here.

Introduction

Bombardier invented the regional jet. Despite some sales these days, the CRJ was eclipsed by the Embraer J-Jet. Bombardier photo.

Oct. 10, 2016, © Leeham Co.: Regional aircraft are much riskier assets for lessors than mainline aircraft.

Until recently, Bombardier and Embraer were the only two regional jet Original Equipment Manufacturers (OEMs).

Today, the Sukhoi SSJ100 and the Mitsubishi MRJ90 join BBD and EMB in this arena.

Summary

- Bombardier’s regional jets CRJ series enjoyed a good life with airlines and lessors, but fell into disfavor as fuel prices spiked.

- BBD’s CSeries was ordered by four lessors, but two of them have question marks.

- Embraer’s E-Jet found good homes with lessors, but some worry about supply-and-demand in the secondary market.

Posted on October 10, 2016 by Scott Hamilton

Airlines, American Airlines, Bombardier, CSeries, Delta Air Lines, Embraer, Mitsubishi, Pratt & Whitney, Premium, Sukhoi, United Airlines, US Airways

American Airlines, Bombardier, C-110, C-130, Continental Airlines, CRJ, CSeries, Delta Air Lines, E-Jet, Embraer, ERJ, GTF, Mitsubishi, MRJ90, Pratt & Whitney, SSJ100, Sukhoi, United Airlines, US Airways

Boeing positioned to narrow market share gap

Subscription Required

Now open to all readers.

Introduction

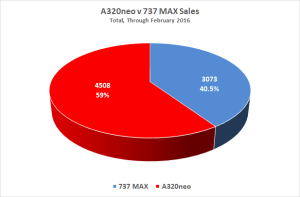

Market sahre data from February–little has changed since–for sales of the A320neo vs 737 MAX families.

Sept. 22, 2016, © Leeham Co.: Early this year Boeing officials began a new message in pushing back against market data that show Airbus captured about 60% of the single aisle market in the A320neo vs 737 MAX sector.

There’s plenty of time, Boeing said, for the MAX to catch up to the neo. Just look, officials said. Southwest Airlines and Ryanair ordered only a fraction of the MAXes they need to replace the 737s they currently operate.

Airbus, on the other hand, has hundreds more neos ordered by the likes of new airlines such as AirAsia and Indigo.

The implication is that the AirAsia and Indigo orders are not as solid as the potential for Southwest and Ryanair.

It’s a fair point.

But it’s not the whole story.

Summary

- An analysis of airlines that have not ordered the A320neo or 737 MAX families shows Boeing has more upside potential.

- Boeing companies still have thousands of orders yet to be placed.

- Forecasting ahead, Boeing has a solid prospect of narrowing the market share gap with Airbus—but probably not closing it entirely.

Posted on September 22, 2016 by Scott Hamilton

Email Subscription

Twitter Updates

My TweetsAssociations

Aviation News-Commercial

Commentaries

Companies-Defense

Resources

YouTube

Archives

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

Norwegian, others have vision; US airlines don’t

Subscription Required

Introduction

Dec. 5, 2016, © Leeham Co. Last weeks’ approval by the US Department of Transportation of a license for Norwegian Air Shuttle to operate long-haul, low-cost service to and from the US drew immediate fire from labor unions over anticipated US job losses.

Iceland’s Loftleider Airlines, one of the first trans-Atlantic low-cost carriers. Photo via Google images.

But their view is too narrow.

It means more jobs for Boeing and its supply chain, which are also heavily unionized. It means benefits to US exports.

But overlooked is the next evolution in long haul travel that starts next year.

Summary

Read more

Leave a Comment

Posted on December 5, 2016 by Scott Hamilton

Airbus, Airlines, American Airlines, Boeing, Delta Air Lines, Emirates Airlines, Leeham News and Comment, Premium, United Airlines

737-8, 737-800, 737-9, 737-900ER, 767, 787, A321LR, A321NEO, A330, Airbus, American Airlines, Boeing, Delta Air Lines, Icelandair, Laker Airways, Loftleider, SkyTrain, United Airlines