Leeham News and Analysis

There's more to real news than a news release.

Airbus’ strategy for the A330-800

By Scott Hamilton

Dec. 6, 2017, © Leeham Co.: The A330-800 entered the final assembly line last week at the Airbus production plant in Toulouse, France, amid doubts in the industry that the airplane will be produced beyond the prototype.

There is only one order for the sub-type, six from Hawaiian Airlines—and Hawaiian is expected to cancel the order. The airline is running a competition between the Airbus A350-900 and the Boeing 787-8/9, according to market intelligence.

Boeing moves EIS target for NMA to 2027: sources

Subscription Required

Introduction

Dec. 4, 2017, © Leeham Co.: Officially, Boeing says the New Midmarket Aircraft (NMA, or 797) entry-into-service will be around 2024-25 if the program is launched.

LNC has learned the target date now being discussed is 2027.

This means the 737 replacement likewise slips, with EIS after 2030 instead of late next decade or in 2030.

The new NMA target date, which we’ve heard from the supply chain and customer base, gives further impetus to the prospect of restarting the 767-300ER passenger production, a decision that is supposed to be made by the end of this year.

Summary

- Technology is at the heart of the new target EIS for the NMA.

- The 737 replacement was always intended to follow the NMA.

- Supply chain asked for 767 production rate ramp-up feasibility.

Leahy reflects on 33 years at Airbus

John Leahy will retire in January and stay for a short transition to help his successor, Eric Schulz, who was named EVP, Chief of Sales, Marketing and Contracts. Leahy is Chief Operating Officer-Customers. During his three-decade long tenure at Airbus, the company moved from a single-digit market share to surpassing Boeing for more than a decade in sales. Leahy spoke with LNC about his retirement.

John Leahy, right, with William Franke, CEO of Indigo Partners at a history-making deal for 430 A320neos, announced at the Dubai Air Show. Photo via Google images.

Nov. 28, 2017, © Leeham Co.: John Leahy was a salesman at Piper Aircraft, a small general aviation aircraft producer when he received a call from a headhunter to join Airbus North America as its top salesman.

Leahy was head of marketing at Piper. With a pilot’s license, he would take various Piper aircraft to conventions or air shows and on sales calls for demonstration.

“It was great fun,” he said. “It was really an enjoyable job.” Leahy said Piper was consolidating everything in Vero Beach (FL) and he wasn’t sure he wanted to move there. He wanted a more direct sales role and accepted a position with Piper in Geneva, Switzerland, as Director of the Eastern Hemisphere. “I felt that was pretty cool.”

Before moving, the headhunter called.

Boeing’s good year for wide-body orders

Subscription Required

Introduction

Nov. 27, 2017, © Leeham Co.: Officials from Airbus and Boeing each said this year that wide-body orders, languishing for the past couple of years, should pick up by the turn of the decade as the in-service fleet reaches 20-25 years old.

Aerolineas Argentinas plans a wide-body competition for deliveries around 2020-2021. Photo via Google images.

But Boeing has had an exemplary year through Nov. 21, the most recent update of its Orders and Deliveries website. The company reported 160 net orders for the 767, 777 and 787, with 88 for the latter. Commitments for 40 more at the Dubai Air Show are not included, as these have not yet been firmed up.

Airbus hasn’t done nearly as well: just 56 net orders for the A330 and A350 families through October, its most recently reported data.

Have Boeing’s results indicated a sooner-than-expected uptick in orders?

Summary

- Not enough data to draw definitive conclusions, but uptick may be arriving early.

- Aerolineas Argentinas and Thai Airways are looking at wide-body aircraft orders. See the stories here and here.

- Early this year, 5-year slump was seen. By August, strong market seen.

Challenges facing Boeing in 767-300ER passenger restart

Subscription Required

Now open to all readers.

Introduction

Nov. 13, 2017, © Leeham Co.: The clock is ticking toward the end of the year for Boeing to decide whether to restart the 767-300ER passenger line.

Officials want to decide by year-end.

Restarting the line isn’t as easy as one might think. Boeing is building the 767-300ER freighter and it has the tooling for the passenger model. Boeing has several challenges to resolve before any green light for the restart.

Summary

- There is a space problem at Everett, where the 767 is assembled.

- Restarting the passenger supply chain is an issue.

- And, as ever, so is cost.

- Does Boeing simply restart the line without upgrades, or are upgrades included, which will increase the cost to produce the airplane?

- Closing the business case on the NMA.

Boeing’s Bold Ambition, Part 2

Subscription Required

Introduction

Oct. 9, 2017, © Leeham Co.: When Boeing launched the 787 program in 2003, an after-market maintenance program called Gold Care followed.

It wasn’t successful. Few customers signed up for it.

Stan Deal, CEO of Boeing Global Services.

But the lessons learned are important for Boeing’s drive to vastly expand its presence in the global commercial airplane after-market business.

Boeing Commercial Airplanes and Boeing Defense, Space & Security (and the latter’s predecessor, Integrated Defense Systems) provided services to the airlines, lessors and government customers, but now there is a dedicated business unit.

Boeing Global Services was announced nearly one year ago, on Nov. 21. When Boeing reports its third quarter earnings at the end of this month, for the first time revenues and profits for BGS and its predecessors will be a line-item in the earnings statements.

Stan Deal, the CEO of BGS, acknowledged the poor start of Gold Care in an interview with LNC. But from this unhappy experience, Boeing learned what officials hope lays the foundation of a new, robust business.

Summary

- 787 Gold Care didn’t start out well.

- Gold Care is rejigged and rebranded.

- BGS services Airbus aircraft, too.

Pontifications: 49 years ago, the first 747 rolled out

Sept. 30, 2017, © Leeham Co.: Today is the 49th anniversary of the roll-out of the Boeing 747-100.

On Nov. 7, United Airlines operates its last 747 flight. Delta Air Lines ends it 747 service this year. Afterward, there won’t be a single US operator of the passenger model.

The 747 remains in service with US cargo carriers Atlas Air, Kalitta Air, UPS and a few others. Globally, British Airways, Lufthansa and Korean Air Lines are among those flying the passenger model.

Ted Reed, one of the writers of TheStreet.com, asked me earlier this month to give some thoughts about the 747. Below is what I gave him; he excerpted some for his column in Forbes. The focus was on US operators.

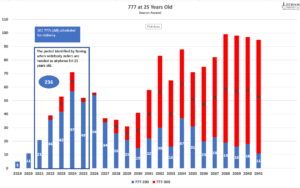

Assessing the 25 YOA aircraft factor

Subscription Required

Introduction

Sept. 21, 2017 © Leeham Co.: Airbus and Boeing look ahead to 2021 and the next several years when wide-body aircraft begin turning 25 years old to spur orders for this sector.

Boeing specifically points to this period as one reason for the announcement last week that it will boost production of the 787 to 14/mo beginning in 2019.

Summary

- There already are 1.4 times more wide-body airplanes scheduled for delivery in 2021-2025 than there are aircraft turning 25 years old.

- The next surge in aging aircraft comes ~2030.

- Middle of the Market aircraft isn’t factored in.