Leeham News and Analysis

There's more to real news than a news release.

Forecast 2022: IRKUT

Subscription Required

By Bjorn Fehrm

Introduction

January 24, 2022, © Leeham News: IRKUT became the Airliner company in Russia’s United Aircraft Corporation when the Superjet project was transferred from Sukhoi in February 2020.

The rationale was to focus the new single-aisle MC-21 and the regional Superjet in one entity where the needed investment in after-sales support, a chronic weakness of Russian aircraft, could be concentrated.

The MC-21 is the most advanced of the world’s single-aisle designs, with a roomy fuselage and a composite wing. But this, the market’s best design, has the worst chances for success. We go through why.

Summary

- The MC-21 has a fuselage design that makes it roomier without causing extra drag or weight.

- It also has the most advanced wing, an out-of-autoclave resin infusion design, the type which Airbus is aiming for in the “Wing of Tomorrow” project.

- But despite the best technology, it has the slimmest market chances. It has little to do with the aircraft itself.

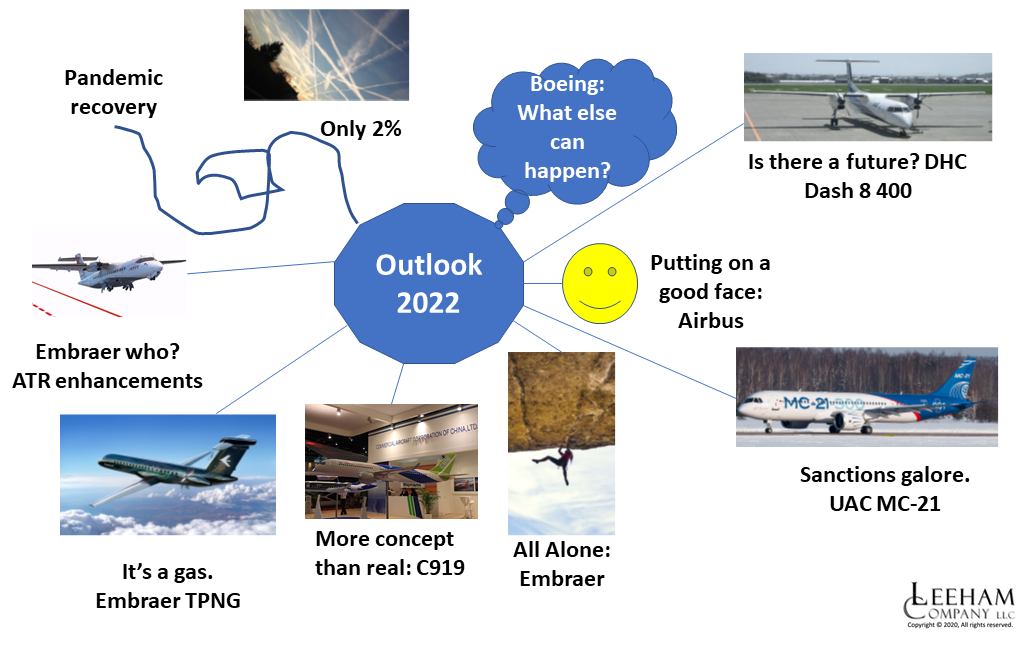

2022 Outlook depends largely on pandemic, Boeing recovery

Subscription Required

By the Leeham News Team

Dec. 13, 2021, © Leeham News: Attempting a forecast for the new year historically has been reasonably easy. One just started with the stability of the current years, and maybe the previous one or two years, and looked forward to next year.

Until the Boeing 737 MAX grounding, COVID-19 pandemic, and the Boeing 787 suspension of deliveries.

These events upended everything. Boeing’s outlook for 2020 depended on what happened to return the MAX to service. The grounding, initially expected by many to be measured in months, ultimately was measured in years.

The 2020 outlook for the rest of the aircraft manufacturers blew up that March with the global pandemic.

Then, in October 2020, Boeing suspended deliveries of the 787, exacerbating its cash flow crunch.

Commercial aviation began to recover some in late 2020. Airbus, which reduced but didn’t suspend deliveries throughout 2020, saw signs of hope for the narrowbody market—less so for widebody airplanes.

There is a lot of uncertainty, however, that makes looking even one year ahead challenging.

Pontifications: The WTO Airbus/Boeing standstill and pursuing China

June 28, 2021, © Leeham News: The US and European Union agreed on June 15 to a standstill in the 17-year old trade dispute over illegal subsidies to Airbus and Boeing.

The World Trade Organization (WTO) found each violated international rules. By the time all was said and done, the US was authorized to levy tariffs on $7.5bn worth of European goods. The EU received authorization to levy tariffs on $4bn of US goods.

Tariffs on goods went beyond Airbus and Boeing products. But it was 15% tariffs on Airbus planes imported into the US and Boeing planes imported into the EU that were the highest-profile and most costly.

Despite initial reports in some uninformed media that the long-running dispute was “resolved,” in fact, only a standstill was agreed. The US and EU now have five years to negotiate a permanent settlement to Airbus’ “reimbursable launch aid” and Boeing’s benefits from tax breaks and NASA.

The two sides also agreed to put China’s commercial aerospace industry in the crosshairs.

Outlook 2021: Russia and China

Subscription Required

By Bjorn Fehrm

Introduction

Jan. 14, 2021, © Leeham News: China and Russia are both developing a single-aisle domestic airliner in the A320/737 MAX class, a regional turboprop in the ATR 72 class, and is jointly working on an A330neo/787 widebody competing airliner.

While these are similar development programs, the countries are in very different positions in their markets and industries. China is a five times larger market for airliners than Russia, and its airlines are on the way back from COVID riddled passenger numbers. It has the fastest recovery from COVID-19 of any country and its civil airliner industry is on the rise.

Russia on the other hand has a stagnant market, still hit by COVID-19, and its market and industry have become introverted after a decade of flirting with Western markets and technology.

Summary

Summary

- China and Russia drive almost identical civil airliner projects to replace Soviet-era and Western airliners.

- While similar in their projects, they are different in their markets and state of industries.

- China is on the way up (albeit from a low state) to eventually compete on the world market, whereas Russia is falling back to a Soviet-style all Russian state-controlled model.

Pontifications: Outlook 2021 Series begins today

Jan. 4, 2021, © Leeham News: Beginning today through next week, Leeham News presents its annual Outlook series for the coming year.

We’ve been doing this for years. In recent years, the Outlook reflected continued growth in commercial aviation. The industry had the longest upward tick in the more than three decades I’ve been involved in the sector.

Not this year. As I wrote before the Christmas-New Year’s holiday period, 2020 was the worst year for commercial aviation I’ve ever seen in 41 years.

This year is the beginning of the end of the COVID crisis. Yes, the vaccines began distribution in December, but large spikes in COVID cases began simultaneously and are predicted to climb higher through the first quarter.

Over the coming days, as LNA provides its Outlook for 2021, readers will see what we believe will happen.

HOTR: With MAX nearing recertification, Boeing has bigger problem

By the Leeham News team

Oct. 27, 2020, © Leeham News: Boeing’s 737 MAX may be nearing recertification and airlines worry about passenger acceptance.

But Boeing’s larger MAX problem is its general product line-up.

But Boeing’s larger MAX problem is its general product line-up.

LNA pointed out the poor sales of the 7 MAX in the past. We’ve also compared the lagging sales of the 9 MAX and 10 MAX compared with the A321neo.

As a result of the MAX grounding and now COVID-19’s disastrous financial impact on airlines around the world, more than 1,000 orders have been canceled or reclassified as iffy under the ASC 606 accounting rule.

Airbus doesn’t publicly reclassify the European equivalent of ASC 606. But LNA in July estimated how many A320s would be similarly classified. At that time, about 425 appeared to be similarly subject to ASC 606 if this accounting rule was applied to Airbus.

Pontifications: Boeing’s latest forecast raises more doubt than hope

Oct. 12, 2020, © Leeham News: Every year, like clockwork, when Boeing publishes its 20-year Current Market Outlook, there is always another upward revision in forecast demand for new aircraft.

So, when the Chicago-based OEM admits that demand has taken a long-term hit, you know the situation must be dire.

Last week, Boeing belatedly published its annual CMO forecast for global commercial jet production and services. The forecast was quite a comedown as it marked a 2% fall from Boeing’s previous expectations for aircraft demand, with a whopping 10% drop for widebodies and freighters.

Airbus has withheld its 2020 Global Market Forecast while it continues to assess the impact of COVID-19. Read more

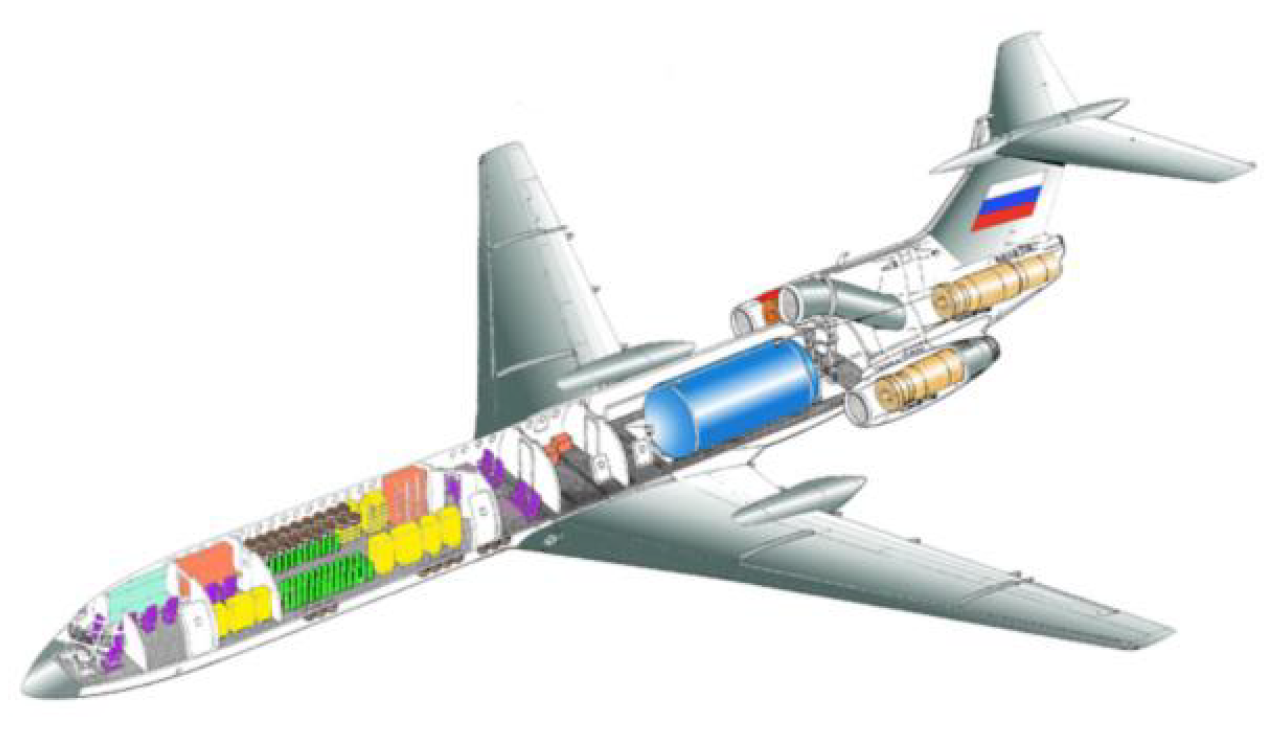

Bjorn’s Corner: The challenges of Hydrogen. Part 6. Tank placement.

August 28, 2020, ©. Leeham News: In our series on Hydrogen as an energy store for airliners we look at the challenge of placing the hydrogen tanks efficiently.

Different from carbon fuels, liquid hydrogen needs specially shaped and bulky tanks. It can’t be stored in the wingbox as today’s Jet-A1.

Bjorn’s Corner: The challenges of Hydrogen. Part 5. The Hydrogen tank.

August 21, 2020, ©. Leeham News: In our series on hydrogen as an energy store for airliners we start the design discussion of a hydrogen-fueled airliner by understanding the onboard storage of hydrogen better.

While there is present knowledge from for instance the space launcher industry, the storage demands for launchers are hours rather than days. Several implementations of longer storage aeronautical tanks have been done, among others by NASA/Boeing for high flying UAVs.

Airbus and the Russian aircraft industry were also active with research during the 1990s and Tupolev built a test aircraft that included a complete hydrogen fuel system (Figure 1).

Looking ahead for 2020 and 2030 decades: UAC

Subscription Required

Fifth in a series.

By Bjorn Fehrm

Introduction

July 15, 2020, © Leeham News: UAC stands for United Aircraft Corporation, and is the name of the group owning the Russian aircraft industry.

After the fall of the Soviet Union, the multitude of individual companies and design bureaus could no longer survive on their own. The Russian state, therefore, gathered them all in UAC to introduce necessary consolidation and reform.

While UAC has done much with the support of the Ministries of Industry and Defense, the changing political situation for Russia has made it harder for the Civilian aircraft side to achieve sales outside captive Russian markets for its jets.

Summary

- UAC is the holding company of the Russian aircraft industry since 2006. The UAC management has stopped pointless infighting and consolidated the industry, latest to a civilian and military side.

- But it’s ambitions on the civil side outside Russia is at mercy to state politics and the Kremlin has shown that world politics is more important than the development of its industries.

- This, and the rise of arch-rival and cooperation partner China, clouds the future for UAC civil aircraft.