Leeham News and Analysis

There's more to real news than a news release.

Leveraged Go Air plans major expansion

April 13, 2018, © Leeham News: Go Air of India is the fourth-ranked low-cost carrier by market share, with big ambitions.

The airline had only 32 airplanes at the end of last year but had more than 140 on order as of last month, presaging expansion domestically and internationally.

This compares with rival Indigo Airlines, the leading LCC, with a current fleet of 153 aircraft and orders for 380; Jet Airways (115 and 75) and SpiceJet (57 and 155). Subsequent to the end of last year, Jet place an order for 75 more 737 MAXes.

Narrowbody and Widebody engine developments

By Bjorn Fehrm

Subscription Required

Introduction

April 12, 2018, © Leeham News: In an article yesterday about Long-Haul LCC costs we observed how the new Narrowbody engines are catching up to the fuel efficiencies of the Widebody engines.

Traditionally the Widebody engines were the efficiency leaders. The Narrowbody companions were designed to be durable rather than efficient.

We use the engine modelling software GasTurb to understand why this catching up of the Narrowbody engines has happened.

Summary:

- The new Narrowbody engines for Airbus’ A320 series and Boeing’s 737 MAX are close in specific fuel consumption to the new Widebody engines.

- We use the GasTurb engine modelling software to find the root cause of this change.

Is Long-Haul LCC viable? Part 3

By Bjorn Fehrm

April 11, 2018, © Leeham News: In the second article if Long-Haul LCC is a viable business, we described the cost items which have to be part of a Revenue versus Cost analysis.

In a subsequent article, we used our performance model to develop the typical costs for the aircraft types we study. We now look at these typical costs, discuss their background and relative importance. Read more

Read more

Boeing’s NMA decision entering final stretch, Part 2

By Bjorn Fehrm

Subscription Required

Introduction

March 26, 2018, © Leeham News: Boeing’s NMA or 797 is taking final form ahead of a decision to essentially launch the program with an Authority to Offer (ATO), widely believed to be later this year.

In the first article, we looked at the key characteristics of the design. We also looked at the engine situation in a couple of articles.

Now we round up the series with analyzing the potential economics of the aircraft.

Figure 1. The first sketch of the smaller 797-6X with 224 seats. Source: JonOstrower.com

Summary:

- The projected 797 would have competitive Cash Operating Costs compared with a modern Single Aisle aircraft like the Airbus A321LR.

- The challenge is the capital costs. The A320/A321 and Boeing’s 737 MAX models are produced in numbers passing 10,000. An NMA would be successful if produced in 1,000 units. This leads to higher production costs for the numerically smaller series.

- The focus from Boeing is therefore on lowering Production costs and on finding Services revenue which can help the 797 business case.

Focus on NMA engines: all OEMs vying for Boeing’s approval

Subscription Required

Now open to all readers.

Introduction

March 22, 2018, © Leeham Co.: As Boeing enters the final stretch whether to launch the New Midrange Aircraft (NMA, aka 797) market focus should shift to the  engines more than the airframe and even the market demand.

engines more than the airframe and even the market demand.

It all comes down to this: no engines, no plane.

Monday’s post outlined some of the issues to consider.

But there are larger implications as well.

Summary

- Market sources are tossing about various scenarios about the future GE Aviation and CFM.

- Rolls-Royce won’t have its Trent 1000 problems fixed until 2021 or 2022, at great cost.

- Pratt & Whitney won’t have its Geared Turbo Fan final PIP packages for its problems sorted out until around 2021.

- Resources—both financial and with engineering—are stretched now.

- Sequencing current engine problems, and in the case, GE’s GE9X, are a factor, in the eyes of some.

GE/CFM in “lockstep” with Boeing on NMA

March 22, 2018, © Leeham News: GE Aviation/CFM International are in “lockstep” with Boeing for development of an engine for the New Midrange Aircraft (NMA, or 797), the CEO of GE Aviation told a JP Morgan Aviation conference last week.

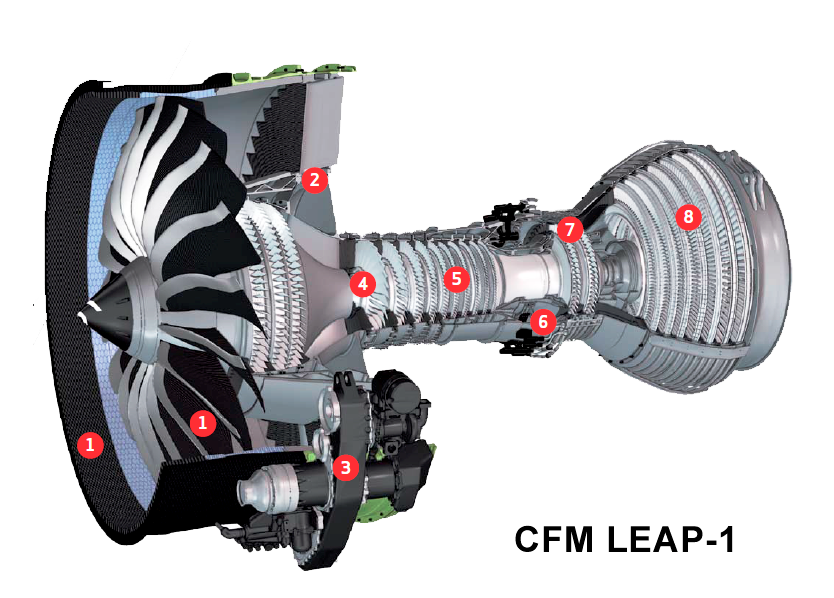

David Joyce acknowledged that there are technical issues and production delays for the new CFM LEAP 1A and 1B that power the Airbus A320neo and Boeing 737 MAX families respectively. Production is running up to six weeks late, but should be caught up by the end of this year, he said.

Technical issues, while affecting at least 100 engines, nevertheless are far less of an issue than those plaguing rival Pratt & Whitney’s Geared Turbo Fan.

Boeing’s NMA decision entering final stretch

By Bjorn Fehrm

Subscription Required

Introduction

March 15, 2018, © Leeham News: Boeing’s NMA or 797 is taking final form ahead of a decision to launch the program later in the year.

Jon Ostrower has published the first picture of the projected aircraft, which he acknowledges might change in its final form. Figure 1 shows the smaller of the two NMA models, the 224-seat 797-6X.

Figure 1. The first sketch of the smaller 797-6X with 224 seats. Source: JonOstrower.com

We take a closer look at the 797 in its latest definition.

Summary:

- The Boeing NMA is called the 797-6X and 797-7X when presented to airlines.

- The 797 is best compared with the 767. Cabin dimensions are close to the 767-200 for the 797-6X and to the 767-300 for the 797-7X.

- The use of a more efficient cross-section, Carbon Fibre design, higher aspect ratio wing and modern engines makes the 797 a lighter and more efficient aircraft than the 767.

Pratt & Whitney’s Indian trouble

By Bjorn Fehrm

March 14, 2018, ©. Leeham Co: India’s Directorate General of Civil Aviation (DGCA) grounded Airbus A320neos equipped with Pratt & Whitney GTF engines with faulty compressor seals Monday.

Affected are eight A320neos of Indigo airlines and three A320neos of GoAir. The Indian groundings are unusual as they go beyond the directives of EASA and FAA for the problem.

Airbus, Boeing respond differently to engine problems

March 14, 2018, © Leeham Co.: Airbus and Boeing have engine issues on in-service airplanes, but customers point to very different responses to getting their  grounded airplanes back in the air.

grounded airplanes back in the air.

Airbus’ problems with A320neos powered by Pratt & Whitney Geared Turbo Fan engines have been making headlines almost since introduction in late 2016.

Less well publicized, but nevertheless by now well-known within the industry, has been Boeing’s 787 powered by Rolls-Royce Trent 1000 engines.