Leeham News and Analysis

There's more to real news than a news release.

Leeham News and Analysis

Leeham News and Analysis

- The Boeing 767 Cross Section, Part 1 November 24, 2022

- Movie Review: Devotion November 21, 2022

- China will accelerate development of its commercial aerospace sector November 21, 2022

- Bjorn’s Corner: Sustainable Air Transport. Part 46. eVTOL comparison with helicopter November 18, 2022

- The economics of a 787-9 and A330-900 at eight or nine abreast November 16, 2022

Bombardier reports lower 2Q2015 income

July 30, 2015: Bombardier reported lower net income on slightly higher revenues for the second quarter.

The press release is here. The earnings call presentation is here. Bombardier-Q2-2015-Presentation-20150730-en

“Overall, the second quarter was in line with plan in terms of revenues, EBIT and deliveries, and our liquidity stands at $4.4 billion,” said Alain Bellemare, President  and Chief Executive Officer. “After five months on the job, I have a better understanding of our challenges and opportunities. We are taking specific action, including the launch of our Bombardier transformation plan, a disciplined approach to cash management, and the strengthening of our leadership team to reshape the company and ensure our long-term success.”

and Chief Executive Officer. “After five months on the job, I have a better understanding of our challenges and opportunities. We are taking specific action, including the launch of our Bombardier transformation plan, a disciplined approach to cash management, and the strengthening of our leadership team to reshape the company and ensure our long-term success.”

Bombardier said it completed 2,000 of the 2,400 hours required for certification of the C Series, which will be delivered during the first half of 2016 to launch operator Swiss International.

During the earnings call, Bellemare outlined more details of the Transformation Plan designed to turn BBD around from its financial strains.

Posted on July 30, 2015 by Scott Hamilton

Boeing 777X heading towards design freeze a bit heavier than planned.

By Bjorn Fehrm

Subscription required

Introduction

July 12, 2015, © Leeham Co. As we reported from Boeing’s Paris Air Show briefing, Boeing’s 777X project is progressing to a design freeze later in 2015. At the briefing everything was presented as being on track with no changes of key data. There have been signs that this in not fully the case. The 777X program is suffering the same disease that hits other aircraft programs, weight gain flu.

To understand it better, we compiled the many indications that points to weight increase and ran them through our proprietary model to understand why and see what it means for the aircraft’s performance.

Summary:

- Weight increase is an evil that all aircraft programs battle with. Our analysis shows that 777X is no different.

- Engine thrust is one of the areas which will be increased to mitigate increased weight. We give the latest status of GE9X thrust development, now beyond 105,000 lb.

- A number of airframe changes have been made. We analyze their consequences and make predictions for future maximum weight increases.

Posted on July 13, 2015 by Bjorn Fehrm

Mid-Year pause: warning signs for Airbus and Boeing?

Subscription required.

Introduction

July 9, 2015, © Leeham Co. At the half way point of 2015, there are a number of signs emerging that require some interpretation. Some are signs of caution. Others are Go Slow.

Summary

- China’s economy is taking a sudden dip. The cargo market is taking a dive.

- Aircraft orders are off substantially YOY for the first half. Has the order bubble finally popped?

- Bombardier didn’t get any CSeries orders at the Paris Air Show. Is the program in trouble (still)?

- Boeing still leads Airbus in wide-body orders; will Airbus fall short by year-end?

Airbus, Boeing YTD orders assessed (Update)

Update, July 8: In our original post, we omitted 44 Boeing 737NGs from the YTD firm orders. The charts and text have been updated to reflect this information.

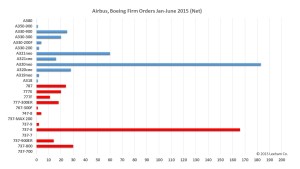

July 7, 2015, © Leeham Co. Airbus pulled ahead of Boeing in firm orders through June, and both companies have a number of commitments that were announced at the Paris Air Show that aren’t included in the year-to-date tally.

Airbus leads with single-aisle orders and Boeing leads with widebody orders, but at the half-way point of the year, the contest is far from over. The leads could shift or increase, depending on how the balance of the year goes.

Posted on July 7, 2015 by Scott Hamilton

CSeries performance improvement demystified

By Bjorn Fehrm

Subscription required

Introduction

July 6, 2015, © Leeham Co. Bombardier presented a slew of new data for their CSeries aircraft during Paris Air Show. Listening to Bombardier (BBD) officials it sounded like there was only positive news: increased range, better fuel economy, better field performance and lower per seat costs.

We have commented on the released information in two articles when at the Paris Air Show, “Bombardier makes it official: CSeries exceeds advertised numbers” and “CSeries range even better than Bombardier revealed.” We now follow up these articles with an analysis of the furnished figures to reveal how these improved performance figures were achieved.

Aircraft programs use sophisticated modeling tools to understand what performance a finished aircraft will have. A 10% range increase with standard payload from 2,950nm to 3,300nm does not come from any miscalculations with such tools. Nor does it come from claimed lower fuel consumption due to lower airframe drag alone.

There are other contributing factors. Using our proprietary model to identify the factors, we explain how BBD has achieved the claimed higher performance.

Summary:

- We analyze where the range increase come from and how it affects other performance parameters

- We also analyze where the improved per seat costs of the CSeries comes from. Lower aircraft costs or other factors?

- Finally we look at the promised future performance improvements and discuss where these are to find and if they are plausible.

Posted on July 6, 2015 by Bjorn Fehrm

Pontifications: Passenger experience and the WOW factor

June 29, 2015, © Leeham Co. Back on June 1, I wrote in this column I had yet to experience traveling on the Airbus A380, which entered service in 2007. The A380 doesn’t serve Seattle, where I live, and I really didn’t have a desire to add hours and a connection to my travels just to fly the A380 if I could go non-stop. Note that this is precisely the argument advanced by Boeing, but this is a coincidence. I have yet to fly on the Boeing 787, either, and it does fly into Seattle from Asia.

A reader Tweeted to me his incredulity that in all these years I hadn’t flown the A380. I replied, All in good time. I knew when I wrote that I would be returning from the Paris Air Show on an A380 via Los Angeles. The time had come for me to experience the airplane. (Interestingly, Dominic Gates of The Seattle Times, unbeknownst to either of us, wrote he’s doing the same thing via New York on Air France. I would be flying Air France. Friends warned me that the passenger experience on Air France, however, was hardly what the A380 is all about.

They weren’t kidding.

I had been on the test A380 during static displays before, but never in a passenger-configured model. At the PAS, Qatar Airways had its own little air show, displaying more airliners than any OEM: the A319, A320, A350 and A380 plus the 787. The A350 and A380 were open to the press. As with anyone in the industry, I had long-heard of how the Middle Eastern airlines went over the top on outfitting their cabins, but I wasn’t remotely prepared for the Qatar A380. Walking on board, into the first class section, was a jaw-dropping “wow” moment.

Posted on June 29, 2015 by Scott Hamilton

Airbus, Airlines, American Airlines, Boeing, Delta Air Lines, Paris Air Show, Pontifications, Qatar Airways, United Airlines

737, 747-8, A319, A320, A350, A380, Air France, Airbus, Akbar Al-Baker, American Airlines, BE Aerospace, Boeing, Boeing Sky Interior, Delta Air Lines, Lufthansa Airlines, Paris Air Show, Qatar Airways, Recaro, United Airlines

Bjorn’s Corner: What Paris Air Show taught us about East and West.

25 June 2015, © Leeham Co: With a few days in the office one can look back at Paris Air Show with a bit of perspective. So what are the impressions?

It was surprising how many orders Airbus and Boeing landed. Both had played down the expectations, telling that it will be a decent show but nothing close to record. Yet both were booking orders or commitments which were better than expected going into the PAS. Read more

Posted on June 26, 2015 by Bjorn Fehrm

AirAsia, Bjorn's Corner, Boeing, Bombardier, Comac, CSeries, Farnborough Air Show, Future aircraft, GE Aviation, Irkut, Paris Air Show, Pratt & Whitney, Rolls-Royce, Sukhoi, United Aircraft, YAK

737 MAX, 787, A320NEO, A330neo, Airbus, Boeing, Bombardier, Comac, CSeries, GE, Pratt & Whitney, Rolls-Royce

Volga deal for 747-8Fs not as solid as assumed by some; production rate reduction likely

June 23, 2015, © Leeham Co. The Memorandum for Understanding for expansion of the Boeing 747-8F fleet of Volga-Dnepr announced at the Paris Air Show is somewhat less than met the eye at the time.

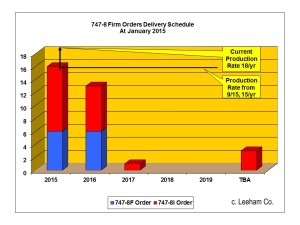

Despite a few orders subsequent to this chart’s creation in January 2015, the 747-8 production gap is insurmountable. The Paris Air Show announcement of Volga-Dnepr fleet “expansion” by 20 747-8Fs is more about options than firm orders, according to market intelligence, which does nothing to fill the gap unless exercised. The expansion is over seven years, which also fails to fill the gap at current production rates. Click on image to enlarge.

Although Boeing said the 20 airplanes will be added through a mix of direct purchases and leases over seven years, it didn’t indicate how many firm orders, options and leases were involved nor the delivery timeline. Market Intelligence indicates perhaps two of the 20 are white tails, aircraft that were built without customers. If correct, this won’t add to the backlog or production stream. Neither would options, unless exercised. Market Intelligence also indicates that firm orders are in the mid-single digits, which if correct is a far cry from what Boeing needs to fill the production gap

Some media and aerospace analysts concluded this deal meant 20 firm orders equal to a year-and-a-half worth of work for the struggling 747-8 production line, but Boeing said the fleet “expansion” is streaming the deliveries over seven years. If evenly spread, adds up to three aircraft in the production stream if all were new orders and not white tails, and options were converted to orders. Even this interpretation fails to fill the production gap.

A Boeing spokesperson said, “We are in discussion with Volga-Dnepr Group and will provide details when ready. There is nothing else we can add here.”

Accordingly, we expect Boeing to announce a reduction in the 747-8 production rate sooner than later. The current rate is 18/yr, declining to 16/yr from September. Boeing previously said it can still make money at 12/yr, so we expect the rate to be reduced to at least this level. However, as the chart shows, the current firm order backlog doesn’t support even this reduced rate.

The USAF indicated it wants to receive the first of two replacements for Air Force One in 2018.

What raised questions over the solidity of the Volga announcement was the way Boeing worded the press release last week at the PAS. All other press releases were specific about orders and options, except the Volga release, which contained highly unusual wording, a departure from Boeing’s standard boiler-plate. Excerpts of these releases are below the page break. We made inquiries in the market, and the results are outlined above.

Posted on June 23, 2015 by Scott Hamilton

Embraer CEO talks about risks

Subscription Required

Introduction

Embraer CEO Paulo Cesar Silva. Photo: AINOnline via Google Images.

June 22, 2015, Paris Air Show, © Leeham Co. Embraer has emerged as the#3 commercial aircraft producer over the years, behind Airbus and Boeing and overtaking Bombardier, by approaching risks carefully and conservatively. No other decision in recent years reflects this approach than what to do when events outside its control forced officials to decide what to do about the future of the E-Jet.

Bombardier launched the CSeries with a new design and a new engine. The larger of two models, the CS300, was a direct challenge to Airbus and Boeing and their smallest aircraft. Airbus responded with the New Engine Option family, forcing Boeing to react with the re-engined 737, the MAX.

With the smallest CSeries, the CS100, a competitor to the largest EJets, the E190 and E195, Embarer had to do something. The question was what.

Embraer could launch an entirely new, larger aircraft, following the Bombardier example. It could do a “simple” re-engine of the EJet. Or it could do something else.

Officials chose to stay away from confronting Airbus and Boeing with a CS-300-sized EJet. Instead, they drew the line at 133 seats in highest density, adding 12 seats to the E-195. The Pratt & Whitney GTF was chosen to power a fundamentally new airplane, one with new wings, new systems, aerodynamic upgrades and other improvements.

We met with CEO Paulo Cesar de Souza e Silva at the Paris Air Show to talk about EMB’s approach to global risk factors.

Summary

- Oil prices, over-ordering and over-expansion by airlines factor into Embraer’s market assessments.

- Airline focus on market share rather than profitability is bad decision-making.

- Asia is Embraer’s best opportunities today.

Posted on June 22, 2015 by Scott Hamilton

Pontifications: Final thoughts of the Paris Air Show

- Our interview during the Paris Air Show with Tom Williams, president and COO of Airbus Commercial, is now open to all Readers. Williams discussions production, supply chain issues, launch aid for the potential A380neo and more.

June 22, 2015, c. Leeham Co. The Paris Air Show was largely as expected, with a few small surprises. Boeing did better than expected via-a-vis Airbus, actually leading slightly in firm orders and tied in orders-and-options going into Thursday. This is virtually never the case, particularly at the Paris Air Show, Airbus’ “home” turf. At the same time, some Wall Street analysts noted the firm orders fell below expectations. I’m not especially concerned about whether an announcement was firm or a commitment, because the latter typically firm up, if not within the current calendar year then usually in the next. Note, for example, Boeing announced the launch of the 777X program at the 2013 Dubai Air Show was some 200 commitments, or thereabouts, but the orders didn’t firm until 2014. Airbus announced a commitment for 250 A320s from Indigo in 2014 and it will likely be firmed up this year.

Posted on June 22, 2015 by Scott Hamilton

Airbus, Airlines, Boeing, Dubai Air Show, Emirates Airlines, Farnborough Air Show, GE Aviation, MOM, Paris Air Show, Pontifications, Qatar Airways, Rolls-Royce

747-8F, 757, 757 replacement, 767-200ER, 777 Classic, 777F, 777X, 787-10, A300, A350-900, Airbus, Boeing, Dubai Air Show, Emirates Airline, EVA Airlines, Farnborough Air Show, IATA, John Leahy, Middle of the Market, MOM, Paris Air Show, Qatar Airways, Seattle Times, Tim Clark

Email Subscription

Twitter Updates

My TweetsAssociations

Aviation News-Commercial

Commentaries

Companies-Defense

Resources

YouTube

Archives

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008