Leeham News and Analysis

There's more to real news than a news release.

- Dubai Air Show: 777X, flight demos.

- Emirates seeks larger A350, 777 after big Dubai order

- Bjorn’s Corner: Faster aircraft development. Part 17. Critical Design Review, CDR.

- NTSB issues preliminary report of UPS crash with dramatic moment engine leaves airplane

- The state of alternative propulsion aircraft? Part 2.

Does an Airbus A220-500 need a new wing and engines?

Subscription required

By Bjorn Fehrm

May 1, 2025, © Leeham News: For years, the debate has been going on about when Airbus will complement the A220-100 and -300 with a longer, higher-capacity A220-500.

In fact, the Bombardier team that designed the A220 as the CS300 already foresaw the prospect of a longer -500. The latest discussions have been around how much to stretch and whether a new wing and stronger engines are needed if the A220-500 replaces the A320neo in the Airbus lineup.

We use the Leeham Aircraft Performance and Cost Model (APCM) to examine the design data for the A220-100 and -300 and determine whether a stretched -500 would benefit from a new wing and stronger engines (which would then be the CFM LEAP-1Bs used on the Boeing 737 MAX).

Summary:

- The A220 started life as the CSeries, designed to compete with Embraer’s E-Jet E2.

- It has since added range through increased Maximum Takeoff Weights to enter the single aisle segment range-wise.

- A stretched A220 would expand the present A220 series upwards and potentially replace the A320neo for Airbus.

- We start by comparing the A220 to the E2, then we move on to examining whether an A220-500 can successfully replace the A320neo.

Posted on May 1, 2025 by Bjorn Fehrm

Embraer gears for growth

Subscription required

By Bjorn Fehrm

June 1, 2023, © Leeham News: We attended a briefing on Embraer’s strategy for the years ahead last week. The company has regrouped after the failed Joint Venture with Boeing in 2020 and the tough COVID years.

The focus has been on streamlining operations after the carve-out of the Commercial Aviation division was reversed. The reintegration was followed by efficiency projects in all divisions to lower costs, free capital, and pay down debt.

Only from a strengthened economic base can Embraer go for growth in the years ahead.

Summary:

- Embraer has turned corners in Finance, Executive jets, and Defense with the KC-390.

- Now, the E-Jets shall follow, with sales of E2s picking up over the last six months.

Posted on June 1, 2023 by Bjorn Fehrm

Outlook 2023: Turboprops: Embraer and De Havilland look to future, leaving market to ATR

Embraer’s TPNG turboprop concept. A decision whether to launch the program has been delayed. Credit: Embraer.

Subscription Required

By Bryan Corliss

Jan. 9, 2023, © Leeham News: Turboprops should be having a moment, given all the concern about how the aviation industry is contributing to climate change. Want to cut your fuel burn by 45%? Just retire your fleet of 70-seat regional jets and replace them with turboprops.

Yet even with concerns over the environmental (and monetary) costs of operating regional jets, there hasn’t been a big move toward turboprops. In December, Embraer announced it was putting the development of a 70-to-90-seat turboprop on hold. The reason: Suppliers can’t provide it with components (meaning engines) that will provide enough of a performance increase to make a new plane worthwhile.

Meanwhile, the orphaned De Havilland Dash-8 – now owned by a rebranded De Havilland Aircraft Canada – has been out of production since mid-2021.

That leaves the Franco-Italian consortium of ATR as the only OEM likely to deliver any turboprops to airlines in 2023, 2024 – maybe even beyond.

That could change by the end of the decade, however. Embraer is working on a hybrid-electric aircraft that could be ready as soon as 2030 in 19- and 30-seat versions. And a rebranded De Havilland Canada is taking steps to restart production of the Dash-8 at a new factory site in Alberta.

Summary

- Embraer focuses Energia on two models

- ATR working to certify STOL version of ATR42

- Can Dash-8 come back with new company, factory, workforce?

Read more

Posted on January 9, 2023 by Bryan Corliss

Regional Aircraft production

Subscription Required

By Vincent Valery

Introduction

Nov. 22, 2021, © Leeham News: Last week, LNA looked at Airbus and Boeing’s planned twin-aisle production rates. We now turn our attention to production rates in the regional aircraft market.

The production of the Mitsubishi Heavy Industry-owned CRJ ceased earlier this year, while De Havilland of Canada’s Q400 will also end soon. Few expect production on the latter program to restart.

MHI also halted the development of its MRJ/SpaceJet, with a program restart unlikely at this point. These exits mean that ATR and Embraer will be the only major regional OEMs outside China and Russia.

ATR announced plans to raise its combined ATR42 and ATR72 production to 50 aircraft annually. LNA will investigate whether the turboprop’s order book justifies such an increase.

LNA will separately analyze the Embraer E175 and E-Jet E2 production. Since the E-Jet E2 Embraer program competes with Airbus’ A220, we will also look at production plans on the latter.

Summary

- An optimistic ATR production plan;

- Comparing E175 and E Jet-E2 production;

- Steady A220 production plans;

- Orders at risk;

- Other OEMs.

Outlook 2021: Turboprops challenged

Subscription Required

By Judson Rollins & Bjorn Fehrm

Introduction

Jan. 11, 2021, © Leeham News: COVID-19 may ultimately prove to be a net positive for turboprop manufacturers. Near-term orders will be pinched just as for jets, but a long-term loss of business travel and the resulting impact to airline yields will make turboprops’ superior unit costs appealing for shorter missions.

Turboprop engines create their thrust with a very high bypass ratio. The result is 30% better fuel economy than a jet. But it also means 30% lower speed. This limits turboprops to stage lengths to about half that of jets.

The market-dominating ATR and De Havilland Canada (DHC) turboprops use this base efficiency to compete against newer regional jets despite having designs which are 20 years older.

Summary

- Turboprops have attractive economics, making them a larger part of the market post-COVID.

- ATR-72, DHC-8-400 turboprops are old designs.

- The only new turboprops come from Russia (Ilyushin I-114) and China (Xian MA700), limiting their market reach.

- Embraer is keen to enter the market with a new clean-sheet design.

- Continued dominance by ATR, DHC depends on whether Embraer goes ahead.

Posted on January 11, 2021 by Bjorn Fehrm

Pontifications: Assessing the impact of COVID-19: today’s take

April 6, 2020, © Leeham News: It’s going to be quite a while before there is a clear understanding how coronavirus will change commercial aviation.

LNA already touched on impacts to Airbus, Boeing and Embraer. None of it is good. For Boeing, burdened with the additional stress of the 737 MAX, is in the worst position. Even when the MAX is recertified, there won’t be many—or any—customers in a position to take delivery of the airplane.

Bearing in mind that what’s true today will change in a day, or even an hour, let’s take a rundown of where things seem to stand now.

Posted on April 6, 2020 by Scott Hamilton

Embraer presents 3Q2019 results.

By Bjorn Fehrm

November 12, 2019, ©. Leeham Co: Embraer announced its 3Q2019 results today. The company delivered a report which disappointed analysts regarding revenue, earnings and free cash flow. Commercial deliveries were 17 jets (15 in 2Q2018) but only two of these were of the E2 generation. Total E2 deliveries now stand at eight jets after 18 months of deliveries, a very low figure.

The Joint Venture with Boeing is now delayed as the European Union says it sees a risk for diminished competition in the Airliner market. Embraer will close the carve-out of the Commercial Aircraft division and its services at the end of the year while waiting for final approvals.

Posted on November 12, 2019 by Bjorn Fehrm

Embraer’s E195-E2 or Airbus A220-300 under 150 seats? Part 4

By Bjorn Fehrm

Subscription required

Introduction

October 10, 2019, ©. Leeham News: We have over the last weeks analyzed what aircraft to choose for the segment 120 to 150 seats, comparing Embraer’s E195-E2 with Airbus A220-300.

After looking at fundamental data, drag data and fuel consumption and other costs for the aircraft, it’s now time to summarize the series by looking at what route networks the aircraft are suitable for.

Summary:

- The E195-E2 and A220-300 address the segment market segment under 150 seats.

- They have similarities but also differences.

- These differences have made an early adopter operate both types over different types of networks.

Posted on October 10, 2019 by Bjorn Fehrm

Bjorn’s Corner: Fly by steel or electrical wire, Part 7.

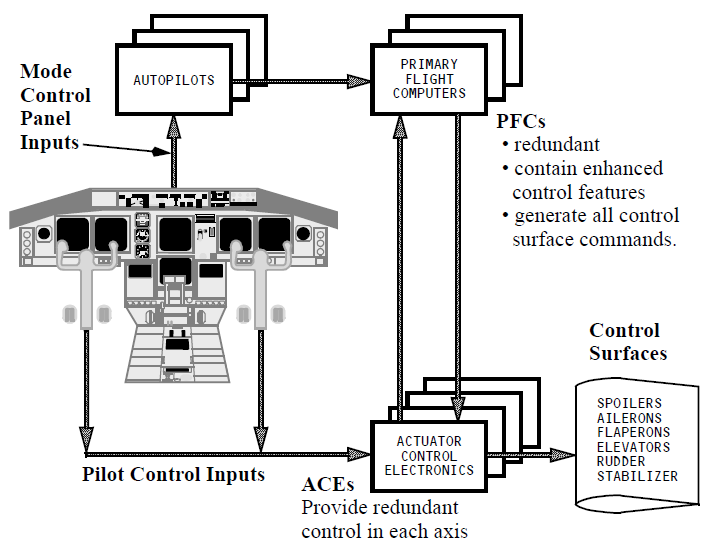

September 6, 2019, ©. Leeham News: In our series about classical flight controls (“fly by steel wire”) and Fly-By-Wire (FBW or “fly by electrical wire”) we discussed the flight control laws which are implemented with classical flight controls compared with the Embraer E-Jet and Airbus A320 FBW systems last week.

Now we describe alternative FBW approaches, analyzing Boeing’s 777/787 system and Airbus’ A220 system.

Posted on September 6, 2019 by Bjorn Fehrm

2018 deliveries: Airbus leads Single Aisle, Boeing Widebody and Freighters

By Bjorn Fehrm

Jan. 10, 2019, © Leeham News: Boeing and Airbus came within six aircraft in their 2018 deliveries, 806 versus 800. For orders, Boeing was the leader, with 893 net orders versus Airbus 747.

Looking at Orders and Deliveries for the different segments there are some interesting trends.

Posted on January 10, 2019 by Bjorn Fehrm