Leeham News and Analysis

There's more to real news than a news release.

Embraer delivers 90 EJets, finishes 2018 with 368 backlog

Feb. 11, 2019, © Leeham News: Embraer delivered 90 EJets last year, comprised of 67 E175 E1s, 13 E190-E1s, five E195-E1s, one E170 and four  E190-E2s.

E190-E2s.

It finished the year with a book:bill of 2.3:1 and a backlog of 368 airliners.

Airbus holds 56% share of backlogs vs Boeing

Jan. 11, 2019, © Leeham News: Airbus trailed Boeing in net orders in 2018 but it still holds a commanding lead in backlog market share.

With the companies reporting their year-end tallies, Airbus has a 56% share of the backlog to Boeing’s 44%.

Airbus carries the day with narrowbody backlog. Its share is 58% to Boeing’s 42%.

Boeing wins the widebody backlog, 53% to 47%, driven by a broader product line, including strong 777F and KC-46A/767-300ERF backlogs.

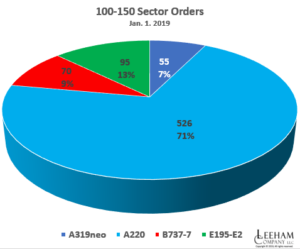

When the emerging narrowbody airplane programs of China and Russia, and Embraer’s sole entry into the 100-150 seat sector (based on two-class seating), Boeing’s narrowbody share of the backlog drops from 42% to 40%.

Charts are below. Data is based on firm orders only.

Brazil OKs Boeing, Embraer JV

Breaking News: Boeing just announced the Brazilian government approved the proposed “strategic partnership” between Boeing and Embraer.

The deal now begins to make the rounds among global governments for anti-trust approvals.

Officials hope the transaction will gain all approvals by the fourth quarter this year.

The press release is below the jump.