Leeham News and Analysis

There's more to real news than a news release.

Embraer’s E195-E2 or Airbus A220-300 under 150 seats? Part 2

By Bjorn Fehrm

Subscription required

Introduction

September 26, 2019, ©. Leeham News: We started an analysis of what aircraft to choose for the segment 120 to 150 seats last week, where we compared Embraer’s E195-E2 with Airbus A220-300.

We began by comparing the fundamentals: their size, their engines, physical data and how these would compare in a normalized way. Now we continue by looking at the drag characteristics of the airframes and what this means for their fuel consumption.

Summary:

- Any difference in fuel consumption between the E195-E2 and the A220-300 will be done to the optimization of the airframes, as they share the same engine.

- The drag picture for the E195-E2 versus the A220-300 is a mixed bag. One is better on normalized friction drag (drag due to size) the other on induced drag (drag due to weight).

The Struggling European Regional Airlines

- This is the third in a series of articles on the struggling low cost and leisure carriers in Europe.

Subscription Required

By Vincent Valery

Introduction

Sep. 23, 2019, © Leeham News: Numerous European regional airlines are struggling financially.

FlyBe was sold earlier this year for a symbolic amount to Connect Airways. The new airlines’ shareholders are Stobart Air, Virgin Atlantic and Cyrus Capital Partners.

UK regional carrier flybmi ceased operations earlier this year. Air France announced a 15% cut in domestic capacity at regional subsidiary Hop! after years of steep losses.

In spite of their struggles, European regional airlines represent a significant market for aircraft OEMs. The Airbus A220, Embraer E2 and turboprop programs count on new European airline orders to bolster their order book.

Summary

- A fragmented industry;

- Another prevailing business models than in the USA;

- Influence of geography and public transportation;

- Dearth of latest generation aircraft orders;

- External factors threatening the industry.

Embraer’s E195-E2 or Airbus’ A220-300 for the 120 to 150 seat segment?

By Bjorn Fehrm

Subscription required

Introduction

September 19, 2019, ©. Leeham News: What aircraft to choose for the segment 120 to 150 seats, Embraer’s E195-E2 or Airbus A220-300? After discussions with Airbus’ Rob Dewar at the Paris Airshow, Head of A220 Engineering and Product Support, and a visit to Embraer last week for the E195-E2’s first customer delivery, we have collected some unique insights.

We also had the opportunity to talk to David Neeleman of Azul, Moxy and TAP Portugal when at Embraer, the only owner/operator which has bought both aircraft; E195-E2 for Azul and A220-300 for his Moxy project.

Summary:

- We start with a detailed comparison of the aircraft in this first article.

- While serving the same passenger capacity segment, they are surprisingly different in their design approach and, therefore, in their characteristics.

Milestone for Embraer with the E195-E2

Sept. 18, 2019, © Leeham News: Embraer passed a milestone last week with the delivery of the first E195-E2, to Azul Airlines of Brazil.

The airplane is the largest Embraer has designed. It’s bigger than the KC-390 tanker-transport. It’s longer than the Boeing 737-8 but shorter than the Boeing 737-9. It carries 146 passengers in high density configuration.

The marketing head for Embraer’s US offices says the E195-E2 will be the sales leader while the CEO of Embraer Commercial Aviation, John Slattery, said it will account for a third of program sales.

Either way, LNA’s Bjorn Fehrm was on site for the delivery and tomorrow will begin a series of articles analyzing the design of the E195-E2 and its economics compared with its nearest competitor, the Airbus A220.

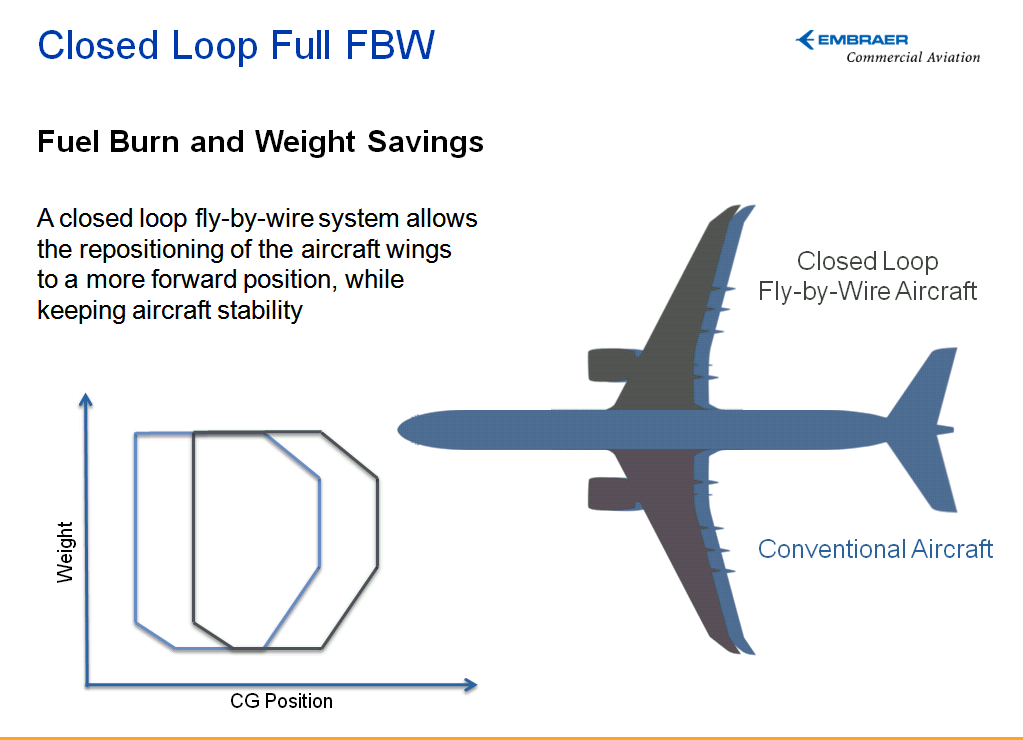

Bjorn’s Corner: Fly by steel or electrical wire, Part 8

September 13, 2019, ©. Leeham News: In our series about classical flight controls (“fly by steel wire”) and Fly-By-Wire (FBW or “fly by electrical wire”) we discussed the flight control laws of Boeing’s 777/787 and Airbus’ A220 last week.

Now we continue with Embraer’s fourth-generation FBW, the one for the E-Jet E2 series.

Embraer delivers first E195-E2, expects E175-E2 entry into service 2021.

By Bjorn Fehrm

Sept. 12, 2019, ©. Leeham News, Sao Jose dos Campos, Brazil: Embraer celebrated the first delivery of its to-date largest aircraft, the 132 seat E195-E2, to Brazil’s Azul Airlines at a press event at its Sao Jose dos Campos headquarters today.

At the conference, the Commercial Aircraft CEO, John Slattery. also stated the smallest member of the E2 family, the E175-E2, will fly before the end of the year and he expects it fly revenue flights for its first customer before end 2021.

A321 accounts for 50%+ of future deliveries; few production gaps

Subscription Required

Introduction

Sept. 12, 2019, © Leeham News: More than half the Airbus A320 family scheduled for delivery over the next four years will be the A321neo, according to an analysis performed by LNA.

Airbus is sold out through 2024 the current production rate of 60/mo or 720 per year.

The production rate increases to 63/mo next year, although LNA doesn’t have a precise time when this occurs.

A variable is also whether a full 12 months of production is calculated, or only 11 ½ months to allow for the summer vacation shutdown.

Either way, the production gaps appear manageable through 2024.

Summary

- Previous Airbus forecasts A321 would account for half of production were viewed skeptically.

- A321 long-term future depends on Boeing’s decision over the New Midmarket Airplane.

Pontifications: Catching up on Odds and Ends-Alaska’s Airbus fleet, first E195-E2 delivery, Boeing’s MAX rebranding question

- Take our Boeing 737 MAX rebranding poll at the end of this post.

Sept. 2, 2019, © Leeham News: It’s time to catch up on Odds and Ends.

Alaska Airlines

In its second quarter earnings call and 10Q Securities and Exchange Filing, Alaska Airlines said it was returning one Airbus A319 and two A320s off lease this year and next.

These airplanes are from its Virgin America acquisition, which introduced the Airbus family into the all-Boeing Alaska mainline operations.

Alaska officials have said several times they are evaluating whether to phase out all Airbuses and return to an all-Boeing fleet, or keep the Airbuses and operate a mixed fleet indefinitely.

I wondered if this was the start of the phase out.

“We are planning to return 1 A319 this year and 2 A320s next year at normal lease expiration,” Brandon Pederson, EVP and CFO of the company, wrote LNA. “This is not part of a broader fleet decision, nor a phase out of the smaller Airbus aircraft. Leases on the remaining 50 A319/A320 aircraft in the fleet have varying maturities through 2025.”