Leeham News and Analysis

There's more to real news than a news release.

Leeham News and Analysis

Leeham News and Analysis

- The Boeing 767 Cross Section, Part 1 November 24, 2022

- Movie Review: Devotion November 21, 2022

- China will accelerate development of its commercial aerospace sector November 21, 2022

- Bjorn’s Corner: Sustainable Air Transport. Part 46. eVTOL comparison with helicopter November 18, 2022

- The economics of a 787-9 and A330-900 at eight or nine abreast November 16, 2022

Embraer’s challenges

Subscription Required

By Vincent Valery

Introduction

Jan. 13, 2020, © Leeham News: It is no exaggeration to say that 2020 is a pivotal year for Embraer. Whether the tie-up with Boeing materializes will determine its future.

As crunch time approaches for the creation of Boeing Brasil, LNA thought it relevant to study the company’s financial records since 1999. This is another in a series of financial analysis of leading aerospace companies and airlines.

From humble beginnings, the company achieved a dominant position in the regional market with the E-Jet family. After a slump in defense and security business revenues in the early 2000s, the company undertook significant programs. It also entered the business jet market to diversify its revenue streams.

So far, E2 E-Jet sales have been tepid. After years of significant development spending, the Commercial aircraft division is just above red ink, the Defense and Security division isn’t profitable and the Business jets are not adding anything to the bottom line.

Regardless of whether the tie-up with Boeing materializes, Embraer will have to take major strategic decisions, especially in the Commercial Aviation division.

Summary

- From government project to world-class OEM;

- Profitability challenges;

- (Not so) diversified revenue sources;

- Plans with Boeing;

- And without it.

Posted on January 13, 2020 by Vincent Valery

Bombardier, E-Jet, Embraer, Premium

Bombardier, CRJ, E-Jet, E-Jet E2, E175, E175 E2, Emrbaer, ERJ, KC-390, WTO dispute

Pontifications: Airbus almost certain to be hurt by MAX crisis

Jan. 6, 2020, © Leeham News: This may be the year that Airbus is hit with the negative consequences of the Boeing 737 MAX crisis.

Most observers see Airbus benefitting with greater A320 family sales while the MAX remains grounded.

In LNA’s 2020 Outlook last week, we pointed out that the long-running trade war between the US and European Union could be coming to a head this year. Airbus and the EU are waiting for the World Trade Organization’s authorization to impose tariffs on US products. This decision is expected in May or June. Boeing is expected to be the first target. The Trump Administration last year imposed a 10% tariff on Airbus aircraft.

The MAX crisis could ratchet up tariffs on Airbus aircraft.

Posted on January 6, 2020 by Scott Hamilton

2020 Outlook for Airbus, Boeing, et al

Subscription required

Introduction

By the Leeham News team.

Jan. 2, 2020, © Leeham News: This will be a pivotal year for Boeing.

It will be a year of challenges for Airbus.

Embraer Commercial Aviation should disappear.

Mitsubishi Heavy Industries faces final decisions for the SpaceJet.

Overhanging international trade is the US presidential election.

These are just some of the headlines to look for in 2020.

Leeham News and Analysis provides its annual outlook as the new year, and the new decade, begins.

Posted on January 2, 2020 by Scott Hamilton

Airbus, ATR, Boeing, Comac, de Havilland Canada, Embraer, Irkut, Mitsubishi, Premium, Sukhoi

737 MAX, 747-8, 767, 777, 787, A220, A320NEO, A330neo, A350, A380, A400M, ARJ21, ATR 42, ATR-72, AVIC, C919, CRJ, DHC 8-400, E-Jet E2, Embraer turboprop, FSA, Future Small Airplane, KC-390, M90, MC-21, New Mid-Market Airplane, NMA, Q400, SpaceJet, SSJ100

Pontifications: There was other news in 2019 besides MAX. Really.

Dec. 23, 2019, © Leeham News: The Boeing 737 MAX crisis clearly dominated the news this year.

It’s felt like the aviation stories have been all-MAX, all-the-time.

Believe it or not, there was aviation news other than the MAX.

Posted on December 23, 2019 by Scott Hamilton

Can the DHC 8-400 compete with a CRJ550 for the 50 seat Scope Clause market?

By Bjorn Fehrm

Subscription Required

Introduction

November 14, 2019, © Leeham News: The US mainline airlines have large fleets of 50-seater regional jets that are getting old. The present Scope Clause limits on the number of aircraft with seating over 50 seats stop the mainlines from replacing these aircraft with larger aircraft. So there is a real need for an efficient 50 seater regional aircraft for the US market.

As there are no 50 seater jets in production, United is converting its 70 seater CRJ700s to 50 seaters to fill the gap and calls them the CRJ550. This is where de Havilland Canada sees a change for an adapted DHC 8-400 turboprop. It’s more efficient than a CRJ550 while offering the same comfort, says de Havilland. We check if this is correct and what chances a DHC 8-“550” have in this market.

- The US Scope Clauses allow the three mainlines to have more 1,000 50 seater jets, yet no new ones are available to replace the more than 600 in the market.

- The in-production DHC 8-400 would be an alternative when looking at cabin size and dimensions.

Posted on November 14, 2019 by Bjorn Fehrm

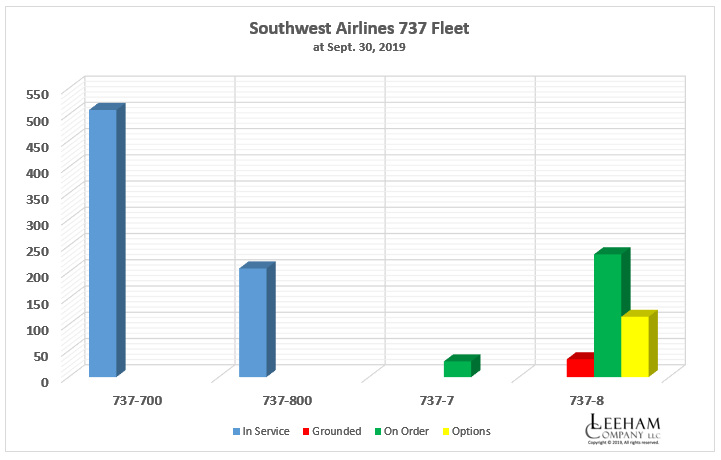

Pontifications: Southwest to evaluate splitting airplane supplier next year

Oct. 28, 2019, © Leeham News: Gary Kelly, the chairman of Southwest Airlines, told CNBC Thursday that next year, the company will review whether to source airplanes from another manufacturer besides Boeing.

This, of course, means Airbus.

The prolonged grounding of the Boeing 737 MAX is the reason. Southwest says the grounding already has cost nearly $500m in lost revenues.

Kelly said the analysis won’t be for “smaller” airplanes, but he didn’t specify to CNBC what this means.

Southwest has 500 Boeing 737-700s seating 143 passengers at 30-31 inch pitch.

The Airbus A220-300 seats 145 at 32 inches in the Air Baltic one-class configuration.

The Embraer E195-E2 seats 146 passengers, but in a 28-inch pitch. At Southwest’s preferred 31-32 inch pitch, the E-Jet seats 132 passengers.

Since the context was the 737-8 MAX, did Kelly mean, not smaller than the -8? This isn’t known.

Posted on October 28, 2019 by Scott Hamilton

Europe’s Regional airlines meet in Antibes, Cotes d’Azur.

By Bjorn Fehrm

October 9, 2018, ©. Leeham News, Antibes France: The European Airlines Association, ERA, gathered 44 of its 51 member airlines in Antibes France, today for the first day of its 2019 General Assembly meeting.

LNA participated in the event for the first time and we found an impressive gathering of airline and airport representatives, aircraft OEMs and support businesses discussing the challenges facing the European regional air transport market.

Posted on October 9, 2019 by Bjorn Fehrm

Embraer’s E195-E2 or Airbus A220-300 under 150 seats? Part 3

By Bjorn Fehrm

Subscription required.

Introduction

October 3, 2019, ©. Leeham News: We have the last two weeks analyzed what aircraft to choose for the segment 120 to 150 seats, comparing Embraer’s E195-E2 with Airbus’ A220-300.

The first week we looked at fundamental data and last week we compared the drag data and by it the fuel consumption of the aircraft. Now, we analyze the other operational costs for the aircraft.

Summary:

- The fuel costs between the E195-E2 and A220-300 are close.

- We now analyze the other operational costs; Crew, Maintenance and Airway/Airport costs to see how these differ.

Posted on October 3, 2019 by Bjorn Fehrm

Pontifications: Safety changes good for Boeing, the industry

Sept. 30, 2019, © Leeham News: Boeing’s announcement last week that it’s establish a permanent Board level safety committee, realigning some functions and creating new lines of reporting is a good and necessary step.

It’s not only good and necessary for the 737 MAX return to service, it’s good and necessary for Boeing and for the industry.

It’s also just a first step in restoring confidence in the MAX and the Boeing brands.

Posted on September 30, 2019 by Scott Hamilton

Bjorn’s Corner: Fly by steel or electrical wire, Part 10

September 27, 2019, ©. Leeham News: In our series about classical flight controls (“fly by steel wire”) and Fly-By-Wire (FBW or “fly by electrical wire”) we started a discussion about the need for stability augmentation systems last week and how these are implemented.

We handled yaw augmentation and began the discussion on pitch augmentation. Now we dig deeper into the trickier form of pitch augmentation, the one needed because of regions of lower stability in pitch at higher Angles of Attack (AoA).

Posted on September 27, 2019 by Bjorn Fehrm

Email Subscription

Twitter Updates

My TweetsAssociations

Aviation News-Commercial

Commentaries

Companies-Defense

Resources

YouTube

Archives

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008