Leeham News and Analysis

There's more to real news than a news release.

Leeham News and Analysis

Leeham News and Analysis

- The Boeing 767 Cross Section, Part 1 November 24, 2022

- Movie Review: Devotion November 21, 2022

- China will accelerate development of its commercial aerospace sector November 21, 2022

- Bjorn’s Corner: Sustainable Air Transport. Part 46. eVTOL comparison with helicopter November 18, 2022

- The economics of a 787-9 and A330-900 at eight or nine abreast November 16, 2022

Pontifications: Boeing NewCo exec, Slattery, faces challenges

- Our Monday paywall will appear at 6am Tuesday, PDT.

March 25, 2019, © Leeham News: Boeing last week announced the executive leadership for the joint venture with Embraer, the as-yet unnamed company that is generically called NewCo.

Separately, Embraer announced the departure at the end of next month of Embraer’s parent CEO, Paulo Cesar, a move that was expected.

Cesar was with Embraer for 22 years in various positions. We was president and CEO of EMB’s Commercial Aviation division and launched the E2 program in 2013.

Posted on March 25, 2019 by Scott Hamilton

Pontifications: Which airplanes are revolutionary or evolutionary?

Feb. 18, 2019, © Leeham News: Last week’s column about the revolutionary Boeing 747 prompted some Twitter interaction asking what other commercial airplanes might be considered “revolutionary.”

I have my views. Let’s ask readers.

There are also three polls below the jump in addition to the usual comment section. Polling is open for one week.

Posted on February 18, 2019 by Scott Hamilton

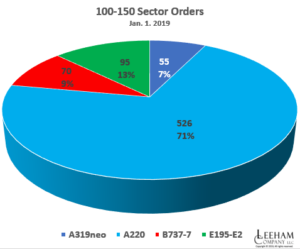

With CSeries, Airbus commands 78% of 100-150 seat sector

Subscription Required

Introduction

Feb. 11, 2019, © Leeham News: Airbus acquired 50.01% of the Bombardier CSeries program last year.

Boeing and Embraer Commercial Aviation received Brazilian government approval last month and now await a nearly-year long regulatory approval process from around the globe.

Based on the announced orders at Jan. 1, Airbus has a 78% share of the 100-150 seat sector following the combinations.

Embraer sold more airplanes in this sector than Boeing: 95 E195-E2s to 70 737-7s.

The former CSeries has 526 orders to 55 for the A319neo.

Summary

- 14% of the A220 orders are classified as “Red” in LNA’s judgment—orders that either should be removed from the backlog or, in one case, is highly questionable due to customer statements.

- Another 11% of the A220 orders are classified as “Yellow,” primarily due to region risk.

- Synergies between A220 and A320 are greater than E2 and 737.

Posted on February 11, 2019 by Scott Hamilton

PIPs planned for A220 to improve operating costs

Jan. 17, 2019, © Leeham News: Airbus is planning performance improvement packages for the A220, intended to shave operating costs off an airplane that already beat performance promises.

The PIPs, as the upgrades are known, are common among all airliners. In this case, the PIPs were under study by Bombardier long before Airbus acquired a 50.01% stake in the C Series program last year.

While financially-strapped Bombardier may have been able to find the money to execute, giant Airbus has no problem doing so.

Read more

Posted on January 17, 2019 by Scott Hamilton

Airbus new A220 is more of a match for the A320neo than Airbus says

By Bjorn Fehrm

Subscription Required

Introduction

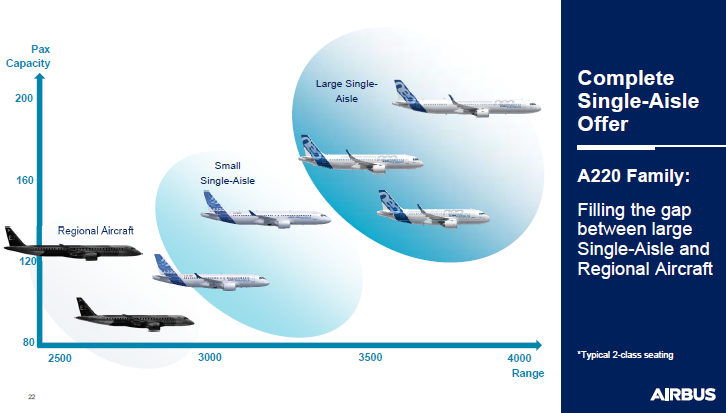

January 17, 2019, © Leeham News: It’s all about the new Airbus A220 on the North America press tour Airbus is hosting this week. Airbus got this top modern aircraft as a windfall after Boeing tried to block its sale on the US Market in 2017.

While the tour presents the A220 in the best of lights, it can’t shine brighter than Airbus’ own A320neo. The graph from the tour which positions them in capacity and range shows a clear little brother-large brother relationship. The reality, when comparing apples to apples, is another.

Figure 1. Airbus payload-range chart with the new A220-100 and -300 placed as shorter ranged than the A320neo and A321neo.

Summary:

- The ideal positioning of the A220 and A320 is when the larger models are higher in capacity and flies further. They cost more and shall, therefore, be better.

- But the comparison is not made with the same yardsticks. Use the same rules and the result is another.

- The more modern A220-300 can then give the A320neo a match both in range and fuel consumption per passenger.

Posted on January 17, 2019 by Bjorn Fehrm

Bombardier CEO “proud” at A220 FAL groundbreaking

Jan. 16, 2019, © Leeham News, Mobile (AL): Groundbreaking for the Airbus A220 final assembly line today might be viewed as a bittersweet moment for Alain Bellemare, CEO on Bombardier, designer of the C Series.

Airbus Group CEO Tom Enders at the A220 FAL groundbreaking in Mobile (AL). It’s his last one with Airbus., He retires in April. (Scott Hamilton photo.)

The program nearly bankrupted Bombardier. A sale of 50.01% of the CSLAP limited partnership to Airbus was necessary to save the program and Bombardier.

Bombardier’s share in the program was reduced to about a third after the Airbus sale. (A quasi-government Quebec pension fund owns the rest.)

But in an interview following the groundbreaking, Bellemare was almost giddy with excitement.

Read more

Posted on January 16, 2019 by Scott Hamilton

A220 wins 180 ETOPS

Jan. 14, 2019, © Leeham News: Airbus announced today that its A220 received certification ![]() for 180- minute ETOPS from the Canadian regulatory authorities.*

for 180- minute ETOPS from the Canadian regulatory authorities.*

The announcement came at the first Airbus North American Tour, a three-day event that kicked off at the Montreal, Canada, Mirabel Airport facilities created by Bombardier.

Bombardier, of course, created the C Series, which is now the A220.

Posted on January 14, 2019 by Scott Hamilton

Airbus poised to out-deliver Boeing in 2019

Subscription Required

- LNC’s Corporate and Enterprise subscribers received this Jan. 3.

Jan. 8, 2019, © Leeham News: Airbus is positioned to out-deliver Boeing this year, boosted by the addition of the Bombardier CSeries acquisition last year.

LNC projects that Airbus will deliver nearly 950 airliners this compared, compared with Boeing’s projected deliveries of about 890 jets.

These are LNC forecasts, not those of the manufacturers. Guidance for the year should come on their respective year-end earnings calls: February for Airbus and Jan. 30 for Boeing.

Posted on January 8, 2019 by Scott Hamilton

Airbus, Boeing, Bombardier, CFM, CSeries, E-Jet, Embraer, GE Aviation, Pratt & Whitney, Premium, Rolls-Royce

737, 747, 767, 777, 787, A220, A320NEO, A330neo, Airbus, Boeing, Bombardier, CFM, CSeries, EJet, Embraer, KC-46A, Pratt & Whitney, Rolls-Royce, Zodiac

2019 Outlook: ATR begins year in commanding position

Subscription Required

Introduction

Jan. 7, 2019, © Leeham News: ATR, the turboprop airliner OEM, enters 2019 in a commanding position.

Year-end 2018 order numbers for ATR and rival Bombardier aren’t in yet.

Through October, ATR held 74% of the backlog. Bombardier, buoyed by a large order for 25 Q400s from India’s SpiceJet (the 2027 deliveries in the Chart below), had 26% of the backlog.

Bombardier contracted to sell its Q400 program to Longview Capital Partners, parent of Viking Air. The Canadian company previously purchased all legacy de Havilland programs, including the Beaver, Twin Otter and aerial firefighting aircraft.

Viking restarted production of the Twin Otter and is gearing up to restart the Beaver.

Its plans for the Q400, Q300 and previous Dash 8 programs hasn’t been announced.

Summary

- Bombardier neglected the Q400.

- Small market over 20 years.

- ATR would like new program.

Posted on January 7, 2019 by Scott Hamilton

Airbus, ATR, Boeing, Bombardier, CSeries, E-Jet, Embraer, Paris Air Show, Premium

ATR, ATR 42, ATR-72, Boeing, Bombardier, Dash 8, Embraer, JADC, Longview Capital Partners, Q300, Q400, Spicejet, Viking Air

Email Subscription

Twitter Updates

My TweetsAssociations

Aviation News-Commercial

Commentaries

Companies-Defense

Resources

YouTube

Archives

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

Pontifications: The Airbus North America Tour

By Scott Hamilton

Jan. 21, 2019, © Leeham News: Last week’s Airbus North America Tour (#AirbusNATour on Twitter) was a whirlwind 2 ½ days encompassing Montreal Mirabel, Columbus (MS) and Mobile (AL).

To those who don’t follow Airbus Americas closely, the Mississippi stop might be a puzzle. I’ll come back to this to explain why an international group of media, including me, made this trek.

Let’s start with Montreal.

Read more

6 Comments

Posted on January 21, 2019 by Scott Hamilton

Airbus, Airfinance Journal, Bombardier, CSeries, Leeham News and Analysis, Leeham News and Comment, Pontifications

A220, A319, Air Canada, Airbus, Airbus helicopters, Alain Bellemare, Bombardier, C Series, Leeham News and Analysis, MRTT