Leeham News and Analysis

There's more to real news than a news release.

Leeham News and Analysis

Leeham News and Analysis

- The Boeing 767 Cross Section, Part 1 November 24, 2022

- Movie Review: Devotion November 21, 2022

- China will accelerate development of its commercial aerospace sector November 21, 2022

- Bjorn’s Corner: Sustainable Air Transport. Part 46. eVTOL comparison with helicopter November 18, 2022

- The economics of a 787-9 and A330-900 at eight or nine abreast November 16, 2022

Is next airliner a single or dual aisle?

By Bjorn Fehrm

19 Feb 2015: There has been much speculation over the last weeks and months what Boeing is up to in the segment 200 to 250 seats, also know as the “757 replacement market“. The speculations over Airbus response are also vivid. One of the reasons is that apart from this segment the landscape of which civil airliners will be produced over the next 10-15 years is pretty much settled; Cseries is on final stretch of development, A320neo is flying while 737 MAX flies next year. A330neo will fly 2017 as will 787-10. A350-1000 start testing in 2016 with deliveries in 2017 and 777-9X flies 2019 with deliveries 2020.

Apart from an announcement by Russia and China that they will design a 250-280 seat widebody there is only the “757 replacement” segment which can result in a clean sheet approach from the major OEMs. Around this questions has arisen a lot of speculation about possible short and long term solutions. Having done a lot of checking of these alternatives with our proprietary model, we have learned that:

- The 757 has an attractive capacity but is around 25% less efficient than the new generation of single aisle, A321neo or 737 MAX9, on the routes they can fly.

- Airbus could stretch the A321 into something we called A321neoLR and indeed Airbus was working on it, it is now in the market as A321LR.

- While 737 MAX9 limitations prohibited a response from Boeing we compared Airbus A321neoLR to what Boeing might come up with in their clean sheet design studies NSA (New Single Aisle) and NLT (New Light Twin)

- Subsequently a 757 MAX was proposed but Boeing immediately declared that it does not work for them and we explained why.

- Based on Boeing’s statement that the market is looking for something “a little larger than a 757” we looked into a 767 MAX with 767-200 as the airframe (it would be readily available from the KC-46 program) with GEnx-2B engines (from 747-8, they would fit). Once again it does not pass the first check, efficiency would not be much better than 757.

Posted on February 19, 2015 by Bjorn Fehrm

Bombardier’s crisis of confidence perhaps the biggest challenge for CSeries

Subscription Required

Introduction

Feb. 18, 2015, c. Leeham Co.: Alain Bellemare, Bombardier’s new president and chief executive officer, has his work cut out for him.

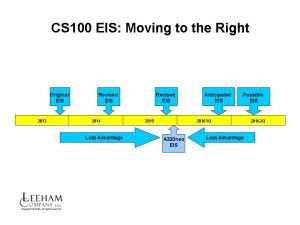

Figure 1. The CSeries was supposed to enter service in late 2013, two full years ahead of the Airbus A320neo. This market advantage has been lost with repeated delays. BBD is sticking to its public statement that EIS is now the second half of this year (most put EIS in the fourth quarter), but there is growing belief EIS will slip to the first or even the second quarter of next year–after the A320neo EIS. Source: Bombardier, Airbus, Leeham Co. Click on image to enlarge into a crisp view.

We outlined the corporate and market perception challenges ahead of him in our Feb. 13 post. Investor and media reception to the CEO leadership change was mixed. Although Bellemare’s appointment was seen as a positive, stock traded down and Bombardier took a pounding in the press (see some reaction at the bottom of this post).

He also has challenges with a changing market place, driven by two years worth of delays in the CSeries program and exacerbated by a changing global political environment.

Summary

- Bombardier faces a crisis in confidence from customers that has to be fixed.

- The CSeries has lost its entry-into-service advantage over the Airbus A320neo and has reduced its advantage over the A319neo, the Boeing 737-8/7 and Embraer E-190/195 E2 EIS due to delays.

- A changing global political environment poses additional risks to the CSeries skyline.

Posted on February 18, 2015 by Scott Hamilton

Lufthansa fleet exec praises top-level change at Bombardier

Feb. 13, 2015, c. Leeham Co.: The appointment of Alain Bellemare as president and chief executive officer of Bombardier is viewed positively by the largest and most influential customer for the slow-selling CSeries, Lufthansa Airlines Group.

Nico Buchholz, EVP Fleet Management, Lufthansa Group.

Lufthansa has a firm order for 30 CSeries and options for 30 more. The Group’s subsidiary, Swiss, is to get the firm orders. The market anticipates that the Group could eventually exercise options for its other subsidiaries.

Nico Buchholz, executive vice president for fleet management for the Group, told Leeham News and Comment today that he has worked with Bellemare as a supplier-customer for years in his previous position as an executive of Pratt & Whitney.

Posted on February 13, 2015 by Scott Hamilton

Bombardier 2014 earnings, 4Q negative cash flow at Aerospace, debt/equity plan

Feb. 12, 2015: Struggling under the strain of two years of delays for the CSeries, poor sales of the Q400 and CRJ and a disastrous LearJet program, the world’s commercial airplane maker shuffled its very top leadership and announced it would seek more than $2bn in new debt and equity as the fourth quarter negative cash flow exceeded $1bn.

Bombardier said in its press release: Read more

Posted on February 12, 2015 by Scott Hamilton

Alain Bellemare, ex-CEO of United Tech division named Bombardier CEO

Feb. 12, 2015: Alain M. Bellemare, 53, was named president and CEO at Bombardier , it was announced today ahead of the company’s 2014 earnings call. The appointment is a move to restore confidence in Bombardier, its Aerospace division and the CSeries program.

, it was announced today ahead of the company’s 2014 earnings call. The appointment is a move to restore confidence in Bombardier, its Aerospace division and the CSeries program.

Stakeholders in the CSeries program we had talked to expressed a desire for Pierre Beaudoin, who has become executive chairman, to step down.

According to Bloomberg Business, Bellemare has been consultant at United Technologies Corp. since January 31, 2015. He previously was President and CEO of UTC Propulsion & Aerospace Systems from July 26, 2012, to January 31, 2015. He also served as the president of Pratt & Whitney Canada and a number of other executive positions. Read more

Posted on February 12, 2015 by Scott Hamilton

PNAA Conference: EMB’s John Slattery: Market share from deliveries key in measuring success

Quotations are paraphrased.

Feb. 11, 2015: You can market share from sales. We don’t make revenues from sales but from deliveries, says John Slattery, chief commercial officer for Embraer. EMB dominates in deliveries, he said at the Pacific Northwest Aerospace Alliance conference today in Lynnwood (WA). Read more

Posted on February 11, 2015 by Scott Hamilton

PNAA Conference: Aboulafia–“A lot of positivity” (except for A380, 787)

- The Wall Street Journal reports that Boeing is considering restarting and re-engining the 757 in response to the Airbus A321LR.

Feb. 11, 2015: We’re at the Pacific Northwest Aerospace Alliance conference in Lynnwood (WA) north of Seattle. This is the 14th annual conference. Appearing are consultant Richard Aboulafia, Airbus, Boeing, Embraer and a number of key suppliers.

This is the first of several reports, beginning with Aboulafia, of the consulting firm Teal Group. We’ll be reporting in the format of paraphrasing his and other presenters.

Posted on February 11, 2015 by Scott Hamilton

Odds and Ends: CSeries; Mitsubishi MRJ; Air France; Saving airlines

CSeries: Bombardier provided a short update from program head Rob Dewar in advance of its 2014 earnings call Thursday. The flutter test has been completed, CS300 is moving toward joining the flight test fleet and the fleet has completed 900 hours of the 2,400 required toward certification.

- BBD today revealed the identify of the customer for 24 CRJ-900s, announced Dec. 30: it’s American Airlines.

- Luxair plans to order some Q400s to replace its Embraer E145 jets.

MRJ90: The Mitsubishi MRJ is Japan’s first commercial airliner since the YS-11 turboprop in the last century. It’s a bold project intended to break into a highly competitive market sector. Air&Space magazine of the Smithsonian Institute profiles the MRJ.

Air France: Aviation Week has a dark opinion of the future of Air France. It’s worth a read.

Saving airlines: While Aviation Week has a dim view on the future of Air France, The Wall Street Journal has a piece about how private equity saved airlines. (Subscription may be required).

Posted on February 9, 2015 by Scott Hamilton

Regional operations with the Turboprop, prop-jet or Jet

- We examined the future of turboprop airliners Jan. 5, 2015, analyzing the backlogs of Bombardier and ATR–and the ATR overwhelming dominance of the current turboprop sector. This is the second of a series looking at this sector.

By Bjorn Fehrm

Subscription required

Introduction

08 Feb 2015: Passenger traffic is growing the world over on a regional, domestic and international level. For domestic and international airlines the choice of mainline transport aircraft is clear today: there are only two vendors, Boeing and Airbus, and they produce similar products.

For regional transportation there is more choice. First of all, one can chose type![]() of aircraft, turboprop or jet. Within jet, there are several OEMs that are active. The choice in turboprop is more restricted. In practice, the choice stands between the classical turboprop with ATR and a faster type from Bombardier, the Q400 “Prop-Jet” as it is called, as its speed lands between the classical turboprop and regional jet.

of aircraft, turboprop or jet. Within jet, there are several OEMs that are active. The choice in turboprop is more restricted. In practice, the choice stands between the classical turboprop with ATR and a faster type from Bombardier, the Q400 “Prop-Jet” as it is called, as its speed lands between the classical turboprop and regional jet.

The question is, what are the real differences between them in terms of design, passenger comfort and economics and what is the right choice for a market segment? We will take a deeper look into this by analyzing the ATR72 as the classical turboprop, the Bombardier Q400 as the Prop-Jet and CRJ700 as the regional jet.

Summary:

- The ATR72-600, Bombardier Q400 and CRJ700 are all about the same size, around 70-80 seats single class or 60-70 seats dual class.

- They offer different comfort levels, and it is not all about speed.

- In developing the economics in two steps we seek the crossover points between the different types.

Posted on February 8, 2015 by Bjorn Fehrm

Single-aisle values, lease rates stable; smaller mainline jets struggle

Special to Leeham News and Comment

By Gueric Dechavanne

Collateral Verifications

Feb. 8, 2015: Apart from a few unfortunate events, the industry has been moving along quite nicely so far in 2015. Used single-aisle aircraft values and lease rates have remained somewhat stable for the most part whilst new aircraft continue to be in demand which means a competitive landscape for those looking to invest in the types. On the in-production front, Airbus A319s, A330-200s, and Boeing 737-700s continue to struggle to find homes as many operators look to their larger siblings for lift. Airbus A320s, 321s, 330-300s, A350-900, Boeing 737-800s, 777-300ERs, and 787s continue to be the aircraft of choice, which in turn has stabilized and even strengthened values and lease rates for most. We are starting to see some softening in 777 values, which we believe is due to the competitive nature of some of the Boeing campaigns to fill the order book until the 777X enters service.

Email Subscription

Twitter Updates

My TweetsAssociations

Aviation News-Commercial

Commentaries

Companies-Defense

Resources

YouTube

Archives

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008