Leeham News and Analysis

There's more to real news than a news release.

Leeham News and Analysis

Leeham News and Analysis

- The Boeing 767 Cross Section, Part 1 November 24, 2022

- Movie Review: Devotion November 21, 2022

- China will accelerate development of its commercial aerospace sector November 21, 2022

- Bjorn’s Corner: Sustainable Air Transport. Part 46. eVTOL comparison with helicopter November 18, 2022

- The economics of a 787-9 and A330-900 at eight or nine abreast November 16, 2022

Bjorn’s Corner: Intro, LCC long range and CFM’s LEAP

March 19, 2015: This is the first version of my Corner where I will comment on the aeronautical world as I see it. It will be a mix of tech things (I am an engineer) and my view on things from my European vantage point. Enough on reason and style; lets get started.

LCC goes long range: After AirAsiaX and Norwegian, now Ryanair is going long range, according to Irish Times (or not; the latest news from Robert Wall of The Wall Street Journal is that the board has not approved a long range business plan).

Be that as it may with Ryanair, the key thing is that what happened to the majors on short haul is about to hit them on long haul as well. Short haul LCCs brought about a change in airline economics and in single aisle aircraft. The LCCs, followed by Ultra LCCs, started the trend to denser and denser configurations where the latest trends are sub 29 inch pitch slim-seats and lavatories that started at 37 inch getting slimmed to 31 inch. It has also brought about changes in galleys and emergency exits configurations, all leading to aircraft with higher and higher capacities.

Posted on March 20, 2015 by Bjorn Fehrm

Rebuilding confidence at Bombardier

Subscription Required

- This week the Malay government announced an order for 20 CSeries CS100s. for a new airline.

Introduction

March 17, 2015: c. Leeham Co. Turmoil at Bombardier, both financial and with the departure of several key personnel, caused a crisis in confidence among customers and shareholders. The stock price took a tumble and some Canadian aerospace analysts, and the few on Wall Street who also follow the stock, have become increasingly pessimistic. Leeham News and Comment published a long analysis after Ray Jones departed Bombardier Commercial Aircraft in a surprise move, the latest in a series of top-level departures at the unit. Market reaction was decidedly negative.

CEO Pierre Beaudoin stepped up February 12 to executive chairman, relinquishing the chief executive title of Bombardier to Alain Bellemare, a veteran of Pratt & Whitney whose appointment was generally well received.

Still, customers we talked with continue to be cautious. One has a wait-and-see about what Bellemare will be able to achieve, and how soon. This customer believes Bellemare has until the Paris Air Show in June to show some tangible progress.

Another customer was considerably more upbeat, viewing the appointment as a major change in the company for the better.

Canadian analysts were positive about the management changes, in part because the market has lost confidence in the Beaudoin management and in part because Bellemare and his PW experience are viewed as heavy-weight.

Ross Mitchell, vice president of Business Acquisitions and Commercial Aircraft, Bombardier. Source: Fleigerfaust.

We sat down with Ross Mitchell, vice president of Business Acquisitions and Commercial Aircraft for Bombardier, at the ISTAT conference last week in Phoenix for a wide-ranging interview. Here is Part 1.

Summary

- Bombardier needs to restore confidence in the market after all the turmoil. How will this be accomplished?

- Will Alain Bellemare have the flexibility and freedom to do what needs to be done?

- Organizational restructuring has already made some progress.

- The financings are a positive.

Posted on March 17, 2015 by Scott Hamilton

Notes #1 from ISTAT 2015

Snippets heard in the hallways of the 2015 ISTAT annual meeting in Phoenix:

- The Rolls-Royce Advance engine intended for the Airbus A380neo appears to be heavy, causing Airbus to return to Engine Alliance to discuss how the GP7200 might be improved. But at best the engine probably could only gain perhaps 5% better fuel consumption, well short of the 10% goal set by Tim Clark, president of Emirates Airline, the largest A380 customer. This means Airbus would have to find 5%, more or less, from the airframe–a challenge.

- It’s still unconfirmed but appears highly likely that Swiss Airlines will be the first operator of the Bombardier CSeries. But Jon Ostrower of The Wall Street Journal beat us to the Publish button reporting the same, along with a first half EIS of the CSeries. We’ve previously estimated a 1Q2016 EIS with a slight chance of 2Q2016.

Posted on March 9, 2015 by Scott Hamilton

Pontifications: A350 launch aid, Emirates and the A380, Bombardier and U-Turn Al

March 5, 2015: A350 Launch Aid: Boeing and the US Trade Representative got in a big twist around 2006 when Airbus said it would accept more than $1bn in launch aid from Germany for the A350. At that time, the US and European Union had recently launched the international trade complaints before the World Trade Organization (WTO), but the A350 came after the complaint was filed and the WTO refused the US request to add it to the proceedings.

Germany, in a political snit, later said it would withhold part of the launch aid because Airbus hadn’t promised the number of jobs in connection with the program to Germany that politicians wanted.

Posted on March 5, 2015 by Scott Hamilton

Airbus, Boeing, Bombardier, CSeries, GE Aviation, ISTAT, Malaysian Airlines, MH370, Rolls-Royce

747-8, 777-9, 777X, 787, A350, A380neo, Airbus, Akbar Al-Baker, Boeing, Bombardier, CS300, Emirates Airline, Engine Alliance, GE Aviation, George Hamlin, ISTAT, Malaysia Airlines, MH370, Qatar Airways, Richard Aboulafia, Rolls-Royce, U-Turn Al, World Trade Organization, WTO

Production rates on single-aisles keep going up, up

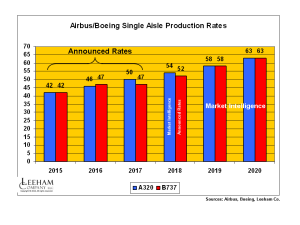

Figure 1. Airbus and Boeing production rates for the A320 and 737 lines are going up as announced rates and rates under consideration go to lofty levels. Click on image to enlarge.

Subscription Required

Introduction

March 3, 2015: c. Leeham Co. Production rates for single aisle airplanes continue to go up for the Big Two, following the Airbus announcement last week that the A320 rates will go to 50/mo in 2017 and officials are considering going to more than 60/mo.

We’ve previously reported that Airbus already has notified the supply chain to be prepared to go to 54/mo in 2018.

Rate 50 will propel Airbus ahead of Boeing, which will briefly be ahead of Airbus when the 737 production rate goes to 47/mo next year, compared with the Airbus plan to take A320 rates to 46/mo next year. The two companies are at parity this year. (Figure 1.)

Summary

- Bombardier, COMAC and Irkut add to supply by 2020, but impact will be minimal.

- No 747-8 deliveries scheduled in 2018. We see program termination coming very soon.

- A330ceo production rate reduced, higher rate for 787 than announced.

- We see short-term Airbus advantage coming in wide-body production rates as A350 ramps up. We stick with our call that 777 Classic rates have to come down.

- We reduce A380 production rates in our estimates.

Exclusive: CSeries performance better than guarantees, “favorable” to brochure; range better than advertised

March 3, 2015: c. Leeham Co. Flight test results for the Bombardier CSeries show that the economics of the airplane not only are meeting the economic and performance guarantees, they are “favorable” to the marketing brochures that have promised 15% better operating costs and 20% better fuel burn than today’s in-production Airbus A319s and Boeing 737-700s, Leeham News and Comment confirmed.

Three sources told us the CSeries flight tests were turning in better-than-guarantee results. Rob Dewer, vice president and general manager, CSeries Program, confirmed the information today in an exclusive interview.

Posted on March 3, 2015 by Scott Hamilton

CS300 first flight

The first flight of the Bombardier CS300 occurred Feb. 27, 2015. The five hour flight was in cold but clear weather, with the moon joining the event. Source: Sylvain Faust in a Special to Leeham News. Click on image to enlarge.

The first flight of the Bombardier CS300, the 149-160 version of the new generation aircraft, came off without a hitch on Feb. 27. The flight lasted five hours.

The CS300 is a direct challenge to the Airbus A319ceo/neo and Boeing 737-700/7 and comfortably outsells the A319neo and 737-7. The economics of the CS300 are substantially better than the Airbus or Boeing, according to Bombardier claims and validated by our analysis.

This CS300 is Flight Test Vehicle 7 (FTV 7) but actually precedes FTV 5 and FTV 6 into the BBD test fleet.

Posted on February 28, 2015 by Scott Hamilton

Odds and Ends: CS300 first flight delayed; PW GTF; Boeing enters MidEast fray

Baby, it’s cold out there! Bombardier delayed the first flight of its CSeries due to the cold. Click on image to enlarge. Source: Sylvain Faust.

CS300 first flight delayed: When Bombardier says it’s too cold for the CS300 first flight, you know it’s cold up in Montreal. It’s -21C at Mirabel (-6F) and partly cloudy, but that was too cold for the guests, according to our man on the scene, Sylvain Faust. Canadians know how to dress for this cold but visitors don’t. A rescheduled time hasn’t been definitively announced.

Bombardier doesn’t have an open-faced tent and outdoor heaters set up, according to Faust.

PW GTF: Flight Global has a report about Pratt & Whitney’s “new aggressiveness” in competing with CFM International in the battle of the Pure Power Geared Turbo Fan vs the LEAP-1A. These engines power the Airbus A320neo family.

Boeing enters MidEast fray: American, Delta and United airlines want Open Skies revisited in order to curb competition by the Big Three Middle Eastern carriers. Boeing, FedEx and JetBlue, have entered the fray, opposing any such action. Here is the story.

Posted on February 26, 2015 by Scott Hamilton

CS300 first flight Wednesday, direct challenge to 737-7 and A319neo

Feb. 25, 2015, c. Leeham Co. Bombardier’s direct challenge to the Big Two duopoly in the 125-149 seat sector is scheduled for its first flight Wednesday, weather and gremlins permitting.

The CS300, challenger to the A319neo and 737-7, is to take to the skies as Bombardier’s flight testing program enters the final stretch. BBD still claims it will deliver the first CS100 by the end of this year, though most analysts (and we) believe it will slip into 1Q next year.

The CS300, 135 seats in two classes and 149 in standard one class, matches the 31-inch pitch configurations of the “baby” Airbus and Boeing products.

Bombardier claims large operating economic advantages over these competitors. Our analysis shows economics probably a bit closer than Bombardier would like.

Posted on February 25, 2015 by Scott Hamilton

Order cycle may have peaked for mainline single-aisles, but smaller jet cycle booming

Feb 24, 2015: The mainline jet orders get the headlines, and the focus on the order cycle, but the smaller jets have yet to see their order cycle peak.

Goldman Sachs downgraded Boeing to a Sell this week, in part on the theory that orders for the single-aisle, mainline jets have peaked and an oversupply is developing in its competition with Airbus.

The oversupply—if it develops—will only get worse as Airbus and Boeing ramp up production. Airbus has announced plans to take A320 family production to 46/yr next year. It’s notified the supply chain to be ready to go to 54/mo in 2018.

Boeing has announced plans to go to a firm rate of 52 737s per month in 2018. It’s considering 58/mo in 2019 and 63/mo in 2020, according to supply chain sources. We expect Airbus to match.

Given the long backlogs for mainline jets, out to 2020 and even beyond, it’s natural to conclude the order cycle has peaked for the time being. At the Pacific Northwest Aerospace Alliance conference Feb. 11 in Lynnwood (WA), Boeing’s VP Marketing Randy Tinseth said the company sees the need for 4,000 more orders for the A320/737 class in the next five years. This averages 800 per year, or about 440 per year for the A320 and 360/yr for the 737 at the recent split of 55%/45% for the two airplanes. This is down dramatically from recent order history and well below the book:bill of the production rates.

If the mainline order cycle has peaked, it’s a different story for the smaller jets in the 70-130 seat sectors.

Posted on February 24, 2015 by Scott Hamilton

Airbus, Boeing, Bombardier, CSeries, Embraer, Mitsubishi, Sukhoi

Airbus, Boeing, Bombardier, CRJ, CSeries, E-Jet, Embarer, ERJ, Mitsubishi, SSJ, Sukhoi

Email Subscription

Twitter Updates

My TweetsAssociations

Aviation News-Commercial

Commentaries

Companies-Defense

Resources

YouTube

Archives

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008