Leeham News and Analysis

There's more to real news than a news release.

Leeham News and Analysis

Leeham News and Analysis

- The Boeing 767 Cross Section, Part 1 November 24, 2022

- Movie Review: Devotion November 21, 2022

- China will accelerate development of its commercial aerospace sector November 21, 2022

- Bjorn’s Corner: Sustainable Air Transport. Part 46. eVTOL comparison with helicopter November 18, 2022

- The economics of a 787-9 and A330-900 at eight or nine abreast November 16, 2022

Pontifications: The Bottom Line isn’t always about The Bottom Line

June 6, 2016, © Leeham Co.: Sweetheart deals to win strategic aircraft orders are nothing new in commercial aviation.

John Leahy, COO-Customers for Airbus, last week poked Bombardier for its order from Delta Air Lines. Citing a reported airplane sales price of $22m, which Leahy estimated cost BBD $7m per airplane, Airbus’ chief salesman—known for his barbs and quips—said if BBD sold more C Series faster, the company would go out of business quicker.

Set aside for the moment the numbers he cited as unknown quantities. LNC has different figures we’ve reported and in two posts on my column at Forbes, here and here, there are other aspects to the Delta deal that affect economics.

It’s undisputed that BBD took a US$500m charge against the Delta, Air Canada and AirBaltic deals. The second Forbes post explains why. It’s all about the learning curve. Airbus and Boeing know about this: the first A350s are being chalked up to big losses and the 787 has $29bn in production costs. But it’s not to their benefit to acknowledge this when criticizing the C Series deals.

All this is neither here nor there, however. Airbus, Boeing and McDonnell Douglas all have (had) done deals that don’t seem to make commercial sense when key, strategic transactions were necessary.

Posted on June 6, 2016 by Scott Hamilton

Airbus, Boeing, Bombardier, CSeries, Delta Air Lines, Douglas Aircraft Co, Lockheed Martin, Pontifications

737-600, 767, A300-600R, A300B4, A310, Air Canada, Air France, AirBaltic, Airbus, American Airlines, Boeing, Bombardier, CSeries, DC-3, DC-5, DC-9 Super 80, Delta Air Lines, Eastern Airlines, John Leahy, Lockheed, Lufthansa Airlines, MD-80, MD-95, Pan Am, Pan American, SAS

Pontifications: The crystal ball

May 30, 2016, © Leeham Co.: We at Leeham Co. and Leeham News and Comment take some risk when we make analyses, forecasts, projections and predictions. These often put us out on a limb, open us to criticism and even ridicule and as often as not really pisses off those companies that are the target of such predictions.

Some recent events and news stories caught my eye that validated something I predicted eleven years ago.

First, the set up.

Posted on May 30, 2016 by Scott Hamilton

Airbus, Boeing, Bombardier, CSeries, Delta Air Lines, E-Jet, Embraer, Pontifications, United Airlines

717, 737-10, 737-7, 737-7.5, 737-700, 737-7X, 737-8, 747-400, 747-8, 777, 777 Classic, 777X, A320, A350, Airbus, Boeing, CS300, Delta Air Lines, E190, Embraer, John Leahy, MAX 10, MAX 200, MAX 7.5, MAX 8, Midway Airport, Moody's, Ray Conner, Tom Wiliams, United Airlines

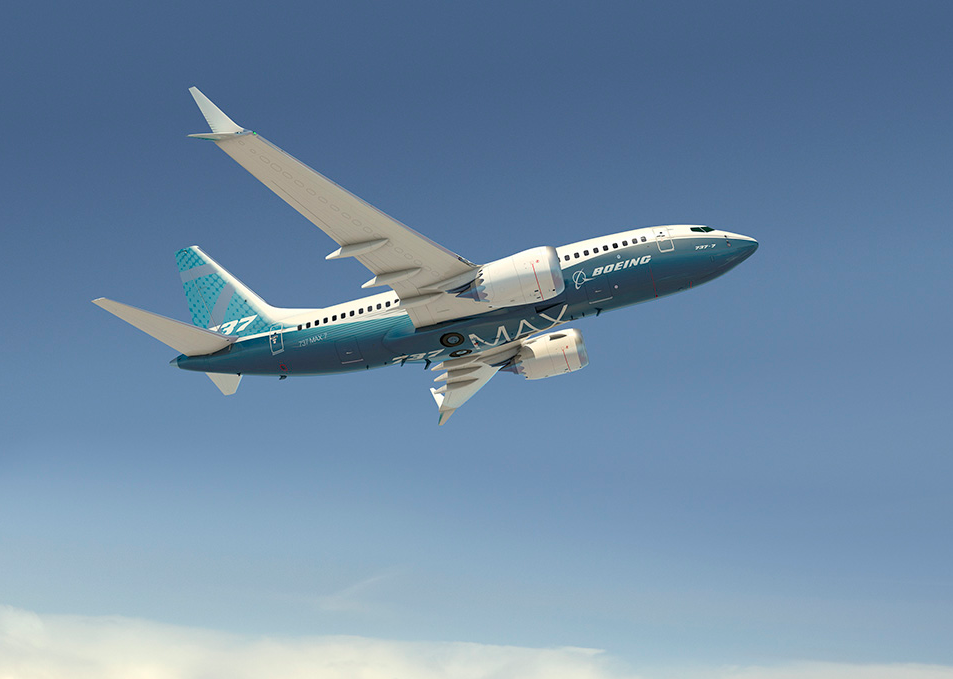

How good is a MAX 7X and why would it replace the original?

By Bjorn Fehrm

Subscription required

Introduction

May 9, 2016, © Leeham Co: Boeing is considering changing the 737 MAX 7 in a rather drastic way. The present model would be hitting the market as the last of the MAX models in 2019. It hasn’t been selling well. In fact, there are only two legacy airlines and a start-up that have ordered the MAX 7.

Right now, there are just 60 orders for an aircraft series which has garnered 3,100 orders in total.

Sources have long told LNC that Boeing doesn’t really want to build the MAX 7. But Southwest Airlines needs the airplane for short-runway airports like Chicago Midway and Burbank (CA) and has resisted suggestions to up-gauge. The other airline that has ordered the MAX 7 is WestJet, which has thin markets in Canada that don’t justify a MAX 8. And there is a third customer, a start-up in Canada that has yet to begin operations.

With the C Series gaining momentum, the cancellation of the MAX 7 now seems off the table. Instead, Boeing is thinking about making it better, the MAX 7X project. What is it, and why would it be better than the original MAX 7? We use our aircraft model to answer the questions.

Summary

- The 737-700, and therefore MAX 7, was defined a continuation of the 737-300 at 126 passengers in a domestic two class configuration.

- Bombardier is offering 135 seats in a similar, but more comfortable, CS300 cabin with an aircraft which is lighter and more economical than the MAX 7.

- The already meager order book for the MAX 7 is therefore getting more pressure from a resurging C Series line.

- Boeing is now attempting to convince its customers that a larger MAX 7, based on MAX 8, would be a better aircraft for the customers (and for Boeing). We reveal why.

Posted on May 9, 2016 by Bjorn Fehrm

Embraer 1Q2016 results: Strong start to the year

By Bjorn Fehrm

3 May 2016, ©. Leeham Co: Embraer has made a good start to 2016. Group revenue for 1Q2016 was $1,309m compared to $1,056m 1Q2015, up 24% year on year. EBIT was $86m compared with $80m a year ago, giving a margin of 7.5%.

The major increase in revenue was for the Business jet side which delivered 23 aircraft compared to 11 1Q2015. Commercial aircraft increased with one aircraft to 21 deliveries.

Embraer’s commercial aircraft best seller, the E175 being delivered to United Express. Source: Embraer.

The commercial aircraft side sold 23 E175-E2 in the quarter giving a Book-to-Bill of 1.1. Sales for the Business Jets side was not publicized. Group order backlog was $21.9b compared to $20.4b for 1Q2015. The balance sheet is strong with $1,854m in cash and total debt of $2,389m.

The group’s only problem area is domestic state demand. Its KC-390 military transport program has stopped once for lack of Government payments and it risks being caught again in the problems of the Brazilian state economy.

Here the details of the financial results for the divisions and their aircraft programs. Read more

Posted on May 3, 2016 by Bjorn Fehrm

Pontifications: Big sigh of relief at Bombardier

May 2, 2016, © Leeham Co.: To say that the order from Delta Air Lines last Thursday for 75+50 CS100s with conversion rights to the CS300s was welcome news for Bombardier is an understatement.

Bombardier has a superb airplane in the C Series. The passenger seats are the most comfortable coach seats of any manufacturers, better than the Airbus A320 and way more comfortable than the Boeing 737. With apologies to Embraer, the C Series is even marginally better than the Embraer E-Jet, which is very good. Read more

Posted on May 2, 2016 by Scott Hamilton

Bombardier’s onerous $500m loss demystified

By Bjorn Fehrm

Subscription required

Introduction

May 2, 2016, © Leeham Co: Bombardier announced a game-changing order from Delta Air Lines for its C Series program last week. In the midst of the celebration and well wishing came the news that this order, one to Air Canada and seven firmed up options to airBaltic, would result in a charge of $500m next quarter.

One analyst wrote in the wake of the Delta deal that “I understand that to get Delta and Air Canada you need to give attractive pricing, but that it would cost Bombardier $500m is a bit stiff.”

The comment shows that at least this analyst had no idea about the realities of aircraft programs financials. The announced onerous loss is nothing special; it is business as usual.

Summary

- Bombardier’s accounting is according to International Financial Reporting Standards (IFRS) rules. These say that one must announce the results of a contract on the company’s financials at the time of contract closure.

- Consequently, BBD informed in the 1Q2016 report that: “In conjunction with the closing of these firm purchase agreements, we expect to record an onerous contract provision of approximately $500 million as a special item in the second quarter of 2016.“

- Note that it says “provision” and not loss. Further, the provision will have no effect on 2016 profits or cash flow. This is a non-cash charge.

- In fact, the $500m provision is nothing special; it’s part of business as usual. We explain why.

Posted on May 2, 2016 by Bjorn Fehrm

Bjorn’s Corner: C Series flight controls

29April 2016, ©. Leeham Co: With the order by Delta Air Lines, the Bombardier C Series has taken the step up to be a viable alternative to Airbus’ and Boeing’s single aisle 130-150 seat aircraft.

In my description of airliners’ flight control and Flight Management Systems (FMS), I have focused on the established mainline single aisle players. Time to change that; C Series has arrived and will stay in the mainline segment.

Why 130 seats as a limit? Because below 130 seats there are a number of additional players (Embraer, Sukhoi, Mitsubishi…) and we can’t describe them all right now.

Now to how Bombardier has implemented the flight controls, autopilot and FMS for the C Series. In fact, we will look at how they have made the C Series cockpit, Figure 1.

I haven’t flown the C Series yet (working on it!) but I have been able to glean quite a bit over time and spent quite some time in the cockpit with the Bombardier test pilots at the Paris Air Show.

So here is a shot at describing the C Series control philosophies and capabilities and how they mimic/differ from Airbus and Boeing.

Posted on April 29, 2016 by Bjorn Fehrm

Bombardier: Our turnaround plan is gaining traction

Alain Bellemare, CEO of Bombardier. CTV photo via Google images.

April 28, 2016: “Our turnaround plan is gaining traction,” said Alain Bellemare, BBD CEO, to lead off the first quarter earnings report for Bombardier.

“This is a big win for Bombardier,” he said. “This is a strong endorsement for the C Series.” He said BBD is finalizing the agreement with Air Canada for 45 firm orders and 30 options for the CS300. “We significantly improved the quality of the backlog list.

“Looking ahead, we are seeing increased customer interest in C Series,” Bellemare said.

The Air Canada, Air Baltic and Delta orders will result in a 2Q2016 charge of $500m, or nearly $4m per aircraft, BBD announced in its press release. This means the aircraft were sold at a loss, but the gain of these blue chip customers were needed. This is about the learning curve and unit accounting (see below).

Delta deliveries begin in 2018.

Belleman said the C Series will be the largest driver of future growth for BBD.

The CRJ and Q400 saw soft orders in the first quarter. Bellemare sees a stronger second quarter. He vowed increased attention by management this year.

Posted on April 28, 2016 by Scott Hamilton

Bombardier wins breakthrough C Series order, from Delta

April 28, 2016, (c) Leeham Co.: At long last, after years of disappointment for that big, breakthrough order, Bombardier finally got it: a huge deal from a blue chip

Delta Air Lines ordered 75 CS100s and optioned 50 more. This is the breakthrough order Bombardier has been waiting years to receive. Source: Delta Air Lines.

airline, and one from North America: a firm order for 75 C30S100s and options for 50 more from Delta Air Lines.

Delta has conversion rights to the CS300. Bombardier now has more than 300 firm orders, although many of these are iffy, and commitments for up to 500 more.

This is the order that observers, analysts and aviation geeks have been waiting for during much of the development and production of the C Series.

The announcement came concurrently with highlights of BBD’s first quarter results.

Posted on April 28, 2016 by Scott Hamilton

Email Subscription

Twitter Updates

My TweetsAssociations

Aviation News-Commercial

Commentaries

Companies-Defense

Resources

YouTube

Archives

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

737-7X, 737-10 studies illustrate Boeing weakness in single-aisle market

Subscription RequiredIntroduction

The Wall Street Journal revealed last week that Boeing is planning the airplane, which is larger than the current 737-7 but smaller than the 737-8. Jon Ostrower, the reporter, dubbed the plane the 737-7.5. Internally, it’s called the 737-7X.

Summary

Read more

Leave a Comment

Posted on April 27, 2016 by Scott Hamilton

Airbus, Boeing, Bombardier, CSeries, Delta Air Lines, Leeham News and Comment, United Airlines

737-10, 737-200, 737-300, 737-500, 737-600, 737-7, 737-7.5, 737-700, 737-7X, 737-8, 737-800, 737-9, 737-900, 737-900ER, 757, 767-200ER, 767-300ER, 787-8, A318, A319, A319ceo, A319neo, A320, A320NEO, A321, A321NEO, A330-200, A330-300, Airbus, Boeing, Bombardier, C Series, CS300, Delta Air Lines, Dennis Muilenburg, Jon Ostrower, Randy Tinseth, Ray Conner, Southwest Airlines, United Airlines, Wall Street Journal, WestJet