Leeham News and Analysis

There's more to real news than a news release.

Leeham News and Analysis

Leeham News and Analysis

- The Boeing 767 Cross Section, Part 1 November 24, 2022

- Movie Review: Devotion November 21, 2022

- China will accelerate development of its commercial aerospace sector November 21, 2022

- Bjorn’s Corner: Sustainable Air Transport. Part 46. eVTOL comparison with helicopter November 18, 2022

- The economics of a 787-9 and A330-900 at eight or nine abreast November 16, 2022

Analysis: Mitsubishi suspends development of M100, continues M90 due to COVID

By Scott Hamilton

Analysis

May 12, 2020, © Leeham News: Mitsubishi Heavy Industries (MHI) yesterday said it cut development money for the M100 SpaceJet. M100 R&D is suspended indefinitely while it continues for the M90 on half rations.

MHI will continue certification of the M90.

MHI also said it will reevaluate demand for the M100 because of COVID-19 impacts.

This immediately raised questions whether MHI may kill the M100 program.

To do so will squander MHI’s once-in-a-lifetime chance to become a real global power in commercial aviation. If this happens, “Japan Inc.” also loses a chance to be part of this.

Posted on May 12, 2020 by Scott Hamilton

Bringing back long-haul capacity with narrowbody aircraft

Subscription Required

By Vincent Valery

Introduction

May 11, 2020, © Leeham News: The timeline for a passenger traffic recovery is highly uncertain. Major OEMs and some airlines expect a return to 2019 passenger traffic levels in two years at the earliest.

Southwest Airlines doesn’t see traffic returning to 2019 for five years. IAG, parent of British Airways and several other airlines, predicts a three year recovery.

Leeham Co. predicts that it will take four to eight years before traffic returns to pre-COVID-19 levels.

However, the recovery sequence for the various markets is becoming clearer. Governments will progressively lift travel restrictions on domestic markets, followed by regional international. Long-haul international will probably be the last to return to normal.

Airlines in China started ramping up domestic capacity, though the government mandates some of this. The governments of Australia and New Zealand disclosed discussions to lift trans-Tasman travel restrictions. French President Emmanuel Macron made it clear that travel would be first allowed within the European Union before outside the old continent.

People who need to travel for business reasons will be allowed first, including for long-haul travel. That means airlines that wish to restore long-haul capacity will have to do so with a much-reduced demand. With this in mind, it might make sense to restore long-haul flights with latest generation narrowbody aircraft such as the Airbus A321(X)LR and Boeing 737 MAX.

LNA analyzes pre-COVID-19 long-haul route patterns to determine what fraction narrowbody aircraft can cover as passenger traffic recovers.

Summary

- Long-haul markets split in two;

- Missed New Mid-Range Aircraft launch opportunity;

- A large addressable market for the A321XLR;

- A321LR and 737MAX long-haul route coverage.

Posted on May 11, 2020 by Vincent Valery

Bjorn’s Corner: Can I get COVID-19 in airline cabins? Part 1.

May 8, 2020, ©. Leeham News: In our Corner series, we now dig into this important subject: Is my probability of getting infected with the COVID-19 virus higher in an airliner cabin than in other places?

We look at simulations of how the virus travels when we breathe/cough and how the virus load propagates in an airliner cabin. Then we talk about infection probabilities compared with other environments.

Posted on May 8, 2020 by Bjorn Fehrm

Better to bring capacity back with a 777X or 777-300ER? Part 2

By Bjorn Fehrm

Subscription Required

Introduction

May 7, 2020, © Leeham News: With the Covid-19 pandemic depressing passenger traffic for years to come, we started an analysis last week on the options the airlines have who wait for their Boeing 777-9. Hold on to their 777-300ER or upgrade to the newer and more efficient 777-9?

We deepen the analysis this week by comparing the economics of a 10 years old 777-300ER versus a new 777-9.

Summary:

- The 777X is best seen as a cross between a Boeing 787 and a 777-300ER. It inherits the passenger comfort features the 787 brought to the market like lower cabin altitude, higher cabin humidity, larger windows, and a smoother ride.

- If a 777-9, with it’s higher capital costs, can compete on operating cost with a used 777-300ER depends on the fuel price.

Posted on May 7, 2020 by Bjorn Fehrm

Supply chain focus: Safran’ s first 2020 quarter

By Bjorn Fehrm

May 5, 2020, ©. Leeham News: Next out in our COVID19 supply chain focus is Safran Group.

Safran, together with GE Aviation, is the largest supplier of turbofan engines to the World’s airliners. Their success in the CFM joint venture is unprecedented. The first joint engine, the CFM56 has passed 30,000 deliveries, and the follow-up, the CFM LEAP, has 16,000 orders.

At the back of this successful business, Safran has expanded to a major aeronautical supplier for propulsion, systems, and cabins.

Posted on May 5, 2020 by Bjorn Fehrm

Pontifications: Ugly, fundamental changes coming for airline industry

May 4, 2020, © Leeham News: The global airline industry is on the cusp of a fundamental restructuring that will be painful, and painfully long.

A few airlines already ceased operations.

Several others are on the brink of filing for bankruptcy—among them Lufthansa and Virgin Atlantic, brand names that aren’t normally at the top of an endangered list.

A shake-out in Europe was already underway before the COVID-19 crisis erupted. The inevitable shake-out in Asia hadn’t yet begun.

Fleet rationalization among legacy carriers will occur at rapid-fire speed. And some carriers now have the opportunity to shed unprofitable routes that were maintained for market share.

It’s going to be an ugly process, though.

Posted on May 4, 2020 by Scott Hamilton

Boeing announces voluntary layoffs in Puget Sound

By Bryan Corliss

April 28, 2020, © Leeham News: Boeing on Monday formally announced it would offer voluntary layoffs – essentially contract buyouts – to members of its Puget Sound workforce.

For most workers, the offer would give them one week’s pay for each year of service, up to a maximum of 26 weeks. Boeing would also continue paying health insurance benefits for most of the laid-off workers for three months. (The exception to this: Machinists Union members will get six months of extended health benefits under the terms of an agreement negotiated in 2016.)

Posted on April 28, 2020 by Bryan Corliss

HOTR: Product development another victim of virus crisis

By the Leeham News staff

April 28, 2020, © Leeham News: The Coronavirus not only decimates the airline industry.

It’s going to completely upend the product strategies of Airbus, Boeing and Embraer.

Boeing is most immediately affected.

Posted on April 28, 2020 by Scott Hamilton

Pontifications: What shape and how long will recovery take?

April 20, 2020, © Leeham News: There just is little good news for the aerospace industry right now.

Airbus announced it will reduce production by a third across the A-Series airliners. I don’t think this will be the last cut.

Boeing last week said it will resume production in the Seattle area of its wide-body airplanes. It’s also now preparing to restart production of the 737 MAX, clearly a piece of good news. Defense-related production for the P-8 Poseidon and the KC-46A tanker resumed last week.

But Boeing hasn’t laid out its production plans for the 7-Series airplanes. This undoubtedly will come next week. Monday is the shareholders’ annual meeting. This will be held virtually at 9am CDT. Access is via the Boeing website. The first quarterly earnings call will be held two days later, also accessible via the web. Either meeting may outline the production plans for the rest of the year.

Posted on April 20, 2020 by Scott Hamilton

Can a passenger airliner run as a freighter with today’s tariffs? Part 3.

By Bjorn Fehrm

Subscription Required

Introduction

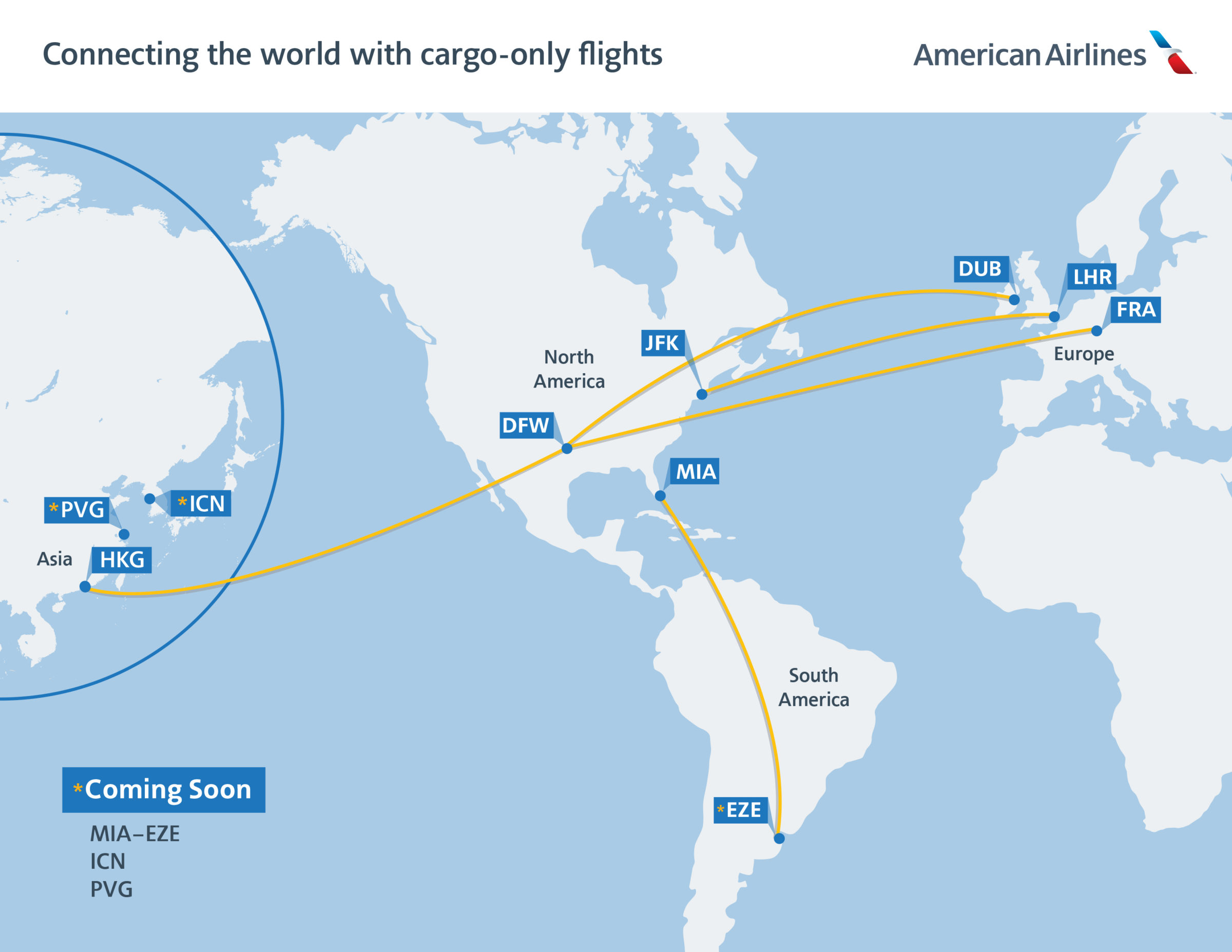

April 16, 2020, © Leeham News: In last week’s article we saw the present high air freight prices can support a belly-cargo operation with a passenger airliner when flying the hot routes from Asia to North American and Europe.

But the aircraft shall fly the return route as well, with as much belly cargo as possible. And last week’s freight prices are volatile. We dig deeper this week and look at the total equation with return flights, different levels of load factors, and price variations.

At what level is an operational belly freighter better than a grounded passenger jet?

Figure 1. American Airlines is increasing its belly cargo operation step by step since the launch on March 20. Source: American Airlines.

Summary:

- Last week we saw the belly cargo operation with passenger aircraft make sense in today’s market if we fly the prime routes, Asia to North America or Europe.

- When one includes the return trips the case is less clear cut. But it’s still sensible as long as aircraft and crews are sitting idle and can’t be used for other purposes.

Posted on April 16, 2020 by Bjorn Fehrm

Email Subscription

Twitter Updates

My TweetsAssociations

Aviation News-Commercial

Commentaries

Companies-Defense

Resources

YouTube

Archives

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008