Leeham News and Analysis

There's more to real news than a news release.

Leeham News and Analysis

Leeham News and Analysis

- The Boeing 767 Cross Section, Part 1 November 24, 2022

- Movie Review: Devotion November 21, 2022

- China will accelerate development of its commercial aerospace sector November 21, 2022

- Bjorn’s Corner: Sustainable Air Transport. Part 46. eVTOL comparison with helicopter November 18, 2022

- The economics of a 787-9 and A330-900 at eight or nine abreast November 16, 2022

Airbus COO faces production challenge vs bulging order book

Subscription required.

Now open to all Readers.

Introduction

June 15, 2015, Paris Air Show, c. Leeham Co. Airbus, like Boeing, is faced with an embarrassment of riches: too many  orders for the A320 and A350 production rates that have been announced. There’s pressure from the top commercial officer to hike rates, but the president and chief operating officer says not so fast.

orders for the A320 and A350 production rates that have been announced. There’s pressure from the top commercial officer to hike rates, but the president and chief operating officer says not so fast.

Tom Williams was elevated to the presidency only a few

months ago from his position as EVP-Programs, where he was in charge of production and the Airbus supply chain. Williams, a Scotsman and the first non-French or non-German to be president and COO of Airbus Commercial, ruefully observes he didn’t give up the production and supply chain duties with his new title.

Although Williams agrees with John Leahy, chief operating officer-customers, that demand indicates higher rates are needed for the A320 and A350, the demands on the supply chain for Airbus, as well as the other airframers, also demands caution.

- Summary

- Decision end of this year or early next on A380 production rates.

- A380neo launch aid reported—but it’s premature.

- No decision yet on greater than 50 A320 production rate per month.

- Pondering hike in A350 production rate beyond the 10/mo announced.

- Cabin suppliers a top concern.

Posted on June 15, 2015 by Scott Hamilton

Airbus, Boeing, Bombardier, CFM, Comac, Embraer, Irkut, Mitsubishi, Paris Air Show, Sukhoi

777X, 787, A320, A320NEO, A350, A380, Airbus, Boeing, John Leahy, Tom Enders, Tom Williams

Paris Air Show: Qatar and others

Subscription required.

Introduction

June 1, 2015, c. Leeham Co. It could be called the Qatar Airways Air Show.

Qatar Airways plans to have five airliners on display at the Paris Air Show in two weeks: the Airbus A319, A320, A350, A380 and the Boeing 787. The carrier hasn’t  announced whether it will provide an aerial display as it has at previous air shows, but Qatar may well have more airliners there than Airbus or Boeing.

announced whether it will provide an aerial display as it has at previous air shows, but Qatar may well have more airliners there than Airbus or Boeing.

As for manufacturers other than Airbus and Boeing, we don’t expect anything of consequence from these.

Summary

- Irkut, COMAC, Mitsubishi, Sukoi and ATR are other major aircraft producers that will be at the Paris Air Show.

- Engine makers CFM International, GE Aviation, Rolls-Royce, Pratt & Whitney and Engine Alliance will also be there.

- An update on Airbus expectations.

Posted on June 1, 2015 by Scott Hamilton

Airbus, ATR, Boeing, Bombardier, CFM, Comac, Embraer, Emirates Airlines, Irkut, Mitsubishi, Paris Air Show, Pratt & Whitney, Premium, Qatar Airways, Rolls-Royce, Sukhoi

787, A319, A320, A350, A380, Airbus, ATR, Boeing, CFM, Comac, Emirates Airlines, Engine Alliance, GE Engines, Irkut, Mitsubishi, Paris Air Show, Pratt & Whitney, Qatar Airways, Rolls-Royce, Suhkoi, Tim Clark

ISTAT Asia: Asian airline market update

Introduction

May 11, 2015, c. Leeham Co: We are participating this week in the ISTAT Asia conference in Singapore where IATA and different panels gave an interesting update on the Asian airline market. This is the fifth year that an ISTAT (International Society of Transport Aircraft Trading) conference is held in Asia and participation has virtually doubled from last year to 500 delegates.

IATA’s Conrad Clifford opened the event with the following overview about the Asian market for airline passenger travel:

- The IATA 20 year forecast growth for the region is 4.9 % annual growth, making it the largest world-wide passenger market by 2030.

- The domestic markets of China and India grew with 11% and 20% respectively in 1Q2015. The US market in comparison grew 3%.

- The growth in the region makes China the world-wide largest domestic passenger market by 2030, surpassing the US with India in third place.

- The highest growth markets are China, India and Indonesia. Countries like Thailand and Malaysia are struggling with low demand at present.

Posted on May 11, 2015 by Bjorn Fehrm

Airbus, Airlines, Boeing, Bombardier, China, Comac, Embraer, ISTAT, Leasing, Mitsubishi

Bombardier CS300 analysis vs A319neo, 737-7

By Bjorn Fehrm

Subscription required

Introduction

March 29, 2015, c. Leeham Co: Bombardier’s big bet in the aeronautics sector, CSeries, is well into flight testing, now more than half way toward the 2,400 hours required by Transport Canada before certification can be granted. The first aircraft to be certified will be the smaller 110 seat CS100 but the market is most interested in the larger 135 seat CS300, which has 63% of present orders and commitments, Figure 1.

Bombardier’s new CEO, Alan Bellemare, told reporters last week that the CS100 would be certified during 2015 with entry into service slipping into 2016. The CS300, which is a direct challenger to Airbus’ A319neo and Boeing’s 737-7, should follow six months after CS100. With the CS300 in flight testing and going into service next summer, we decided to have a deeper look at CS300 and its competitors.

Summary

- A319 and 737-7 are shrinks of the market’s preferred models, A320 and 737-8, and as such not the most efficient models.

- The CS300 is the series center-point and it shows. The modern design beats the Airbus and Boeing designs on most counts.

- Part of the modern concepts in CSeries is the well-conceived Pratt & Whitney PW1000G geared turbofan.

- PW’s 73 in fan version of the PW1000G for CSeries is slightly less efficient that the 81 in version for A319neo but CS300 lower weight makes sure this is more than compensated for.

Posted on March 29, 2015 by Bjorn Fehrm

Airbus, Boeing, Bombardier, CFM, China, Comac, CSeries, Embrarer, GE Aviation, International Aero Engines, Pratt & Whitney, Premium, Sukhoi, United Aircraft, YAK

737, 737 MAX, 737-7, 737NG, A319neo, A320, A320NEO, Airbus, Boeing, Bombardier, CFM, Comac, CSeries, E-195 E2, E-Jet E2, Embraer, GTF, LEAP-1A, Leap-1B, Pratt & Whitney

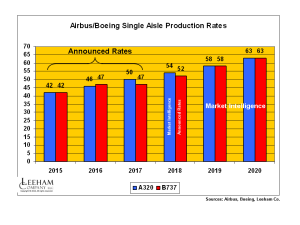

Production rates on single-aisles keep going up, up

Figure 1. Airbus and Boeing production rates for the A320 and 737 lines are going up as announced rates and rates under consideration go to lofty levels. Click on image to enlarge.

Subscription Required

Introduction

March 3, 2015: c. Leeham Co. Production rates for single aisle airplanes continue to go up for the Big Two, following the Airbus announcement last week that the A320 rates will go to 50/mo in 2017 and officials are considering going to more than 60/mo.

We’ve previously reported that Airbus already has notified the supply chain to be prepared to go to 54/mo in 2018.

Rate 50 will propel Airbus ahead of Boeing, which will briefly be ahead of Airbus when the 737 production rate goes to 47/mo next year, compared with the Airbus plan to take A320 rates to 46/mo next year. The two companies are at parity this year. (Figure 1.)

Summary

- Bombardier, COMAC and Irkut add to supply by 2020, but impact will be minimal.

- No 747-8 deliveries scheduled in 2018. We see program termination coming very soon.

- A330ceo production rate reduced, higher rate for 787 than announced.

- We see short-term Airbus advantage coming in wide-body production rates as A350 ramps up. We stick with our call that 777 Classic rates have to come down.

- We reduce A380 production rates in our estimates.

Is next airliner a single or dual aisle?

By Bjorn Fehrm

19 Feb 2015: There has been much speculation over the last weeks and months what Boeing is up to in the segment 200 to 250 seats, also know as the “757 replacement market“. The speculations over Airbus response are also vivid. One of the reasons is that apart from this segment the landscape of which civil airliners will be produced over the next 10-15 years is pretty much settled; Cseries is on final stretch of development, A320neo is flying while 737 MAX flies next year. A330neo will fly 2017 as will 787-10. A350-1000 start testing in 2016 with deliveries in 2017 and 777-9X flies 2019 with deliveries 2020.

Apart from an announcement by Russia and China that they will design a 250-280 seat widebody there is only the “757 replacement” segment which can result in a clean sheet approach from the major OEMs. Around this questions has arisen a lot of speculation about possible short and long term solutions. Having done a lot of checking of these alternatives with our proprietary model, we have learned that:

- The 757 has an attractive capacity but is around 25% less efficient than the new generation of single aisle, A321neo or 737 MAX9, on the routes they can fly.

- Airbus could stretch the A321 into something we called A321neoLR and indeed Airbus was working on it, it is now in the market as A321LR.

- While 737 MAX9 limitations prohibited a response from Boeing we compared Airbus A321neoLR to what Boeing might come up with in their clean sheet design studies NSA (New Single Aisle) and NLT (New Light Twin)

- Subsequently a 757 MAX was proposed but Boeing immediately declared that it does not work for them and we explained why.

- Based on Boeing’s statement that the market is looking for something “a little larger than a 757” we looked into a 767 MAX with 767-200 as the airframe (it would be readily available from the KC-46 program) with GEnx-2B engines (from 747-8, they would fit). Once again it does not pass the first check, efficiency would not be much better than 757.

Posted on February 19, 2015 by Bjorn Fehrm

Airbus/Boeing production rates forecast through 2020

Subscription Required.

Introduction

Feb. 3, 2015: Boeing out-delivered Airbus in 2014, for the second year in a row, as the 787 program improved in delivery rates and before the A350 made its first delivery in December.

Topping Airbus in deliveries allowed Boeing to claim it is the world’s leading ![]() commercial airplane manufacturer. By the delivery metric, Boeing is. By orders, Airbus came in first again, maintaining a decade-long lead.

commercial airplane manufacturer. By the delivery metric, Boeing is. By orders, Airbus came in first again, maintaining a decade-long lead.

The A350 ramps up its production this year even as the A330ceo rate begins to come down at the end of the year and further next year. Boeing vows to maintain the current production rate of the 777 Classic at 100/yr. The 747-8 rate is declining. And both companies are ramping up rates of the single-aisle airplanes.

The production wars continue.

Summary

- Airbus is forecast to out-produce Boeing by 2018.

- Boeing’s ramp-up of the 737 line will drive the delivery stream.

- The 737 rate may hit 63/mo by 2020.

- Airbus will likely match.

Odds and Ends: Wrapping up 2014 in the news

Dec. 31, 2014, just under the wire: 2014 is over and there was some news unrelated to the loss of AirAsia flight 8501:

Bombardier: The company received a firm order for 24 CRJ900s from an unidentified customer (we believe it is a US regional airline). The National Post of Canada also has this look at how 2015 will be a “pivotal” year for the CSeries. BBD also announced an order from mega-lessor GECAS for five Q400s and options for 10 more.

ARJ-21 certified: The Chinese government certified the COMAC ARJ-21, the 70 seat regional jet that looks like the old Douglas DC-9-10. The airplane is now supposed to go into service in April or May, only eight years late.

Boeing declares victory: The year was really over yet but Boeing declared victory over Airbus in this Dec. 29 story in The Seattle Times. Yes, Boeing will deliver more airplanes than Airbus in 2014, but will it truly end with more orders? Airbus won’t reveal its full 2014 performance until its annual press conference Jan. 13, and it’s famous for announcing a whole bunch of orders to pull the proverbial rabbit out of the hat. So we’ll wait and see then who truly has the bragging rights for the full year.

Airbus and Boeing: For all of our extremely partisan Airbus and Boeing readers, choke on this one: Airbus and Boeing have teamed up to bid on a defense contract, reports Aviation Week.

Real-time tracking: It’s possible and it’s being done. See this Washington Post article.

Posted on December 31, 2014 by Scott Hamilton

Airbus/Boeing duopoly single-aisle is safe well into 2030 decade

Subscription Required

Introduction

Dec. 28, 2014: Two challenges to the duopoly of Airbus and Boeing in the 150-220 seat single-aisle sector move forward in development in 2015, but neither is in a position to be a threat for the balance of this decade, nor even in the next.

Both challenges, the COMAC C919 from China, and the Irkut MC-21 from Russia, will for various reasons fall short of the Airbus A320/321 and Boeing 737-8/9 and plans to design the next generation new single-aisle airplane.

Summary

- The C919’s chief advantage was eliminated when Airbus and Boeing moved to reengine the A320 and 737 families.

- C919 retains pricing advantage but won’t overcome duopoly dominance.

- By the time the C919 enters service, Airbus and Boeing will have the second generation of LEAP and GTF engines available.

- The MC-21 takes into account better passenger comfort through a wider fuselage, but engines will be no better than those used on Airbus and Boeing.

- The MC-21 sales potential will be highly limited because Russia still hasn’t become a full trading partner due to political direction.

Looking ahead in 2015 in commercial aviation

Here’s a visualization of events to look for in commercial aviation in 2015.

Posted on December 26, 2014 by Scott Hamilton

Airbus, Boeing, Bombardier, CFM, China, Comac, CSeries, Embraer, GE Aviation, Mitsubishi, Paris Air Show, Pratt & Whitney, Rolls-Royce

767-2C, A320NEO, A350-1000, A350-900, A380neo, air force tanker, Airbus, Boeing, Bombardier, CFM, CSeries, E-Jet E2, Embraer, GTF, KC-46A, LEAP, MC-21, Mitsubishi, MRJ, Pratt & Whitney, Qatar Airways, Rolls-Royce, Trent XWB

Email Subscription

Twitter Updates

My TweetsAssociations

Aviation News-Commercial

Commentaries

Companies-Defense

Resources

YouTube

Archives

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008