Leeham News and Analysis

There's more to real news than a news release.

Leeham News and Analysis

Leeham News and Analysis

- The Boeing 767 Cross Section, Part 1 November 24, 2022

- Movie Review: Devotion November 21, 2022

- China will accelerate development of its commercial aerospace sector November 21, 2022

- Bjorn’s Corner: Sustainable Air Transport. Part 46. eVTOL comparison with helicopter November 18, 2022

- The economics of a 787-9 and A330-900 at eight or nine abreast November 16, 2022

State investment in Bombardier further mockery of WTO

Nov. 24, 2015, (c) Leeham Co. With the $1bn investment by the Province of Quebec in the Bombardier ![]() CSeries program, another example of government funding emerges in commercial aviation development.

CSeries program, another example of government funding emerges in commercial aviation development.

Setting aside whether the investment might be challenged before the World Trade Organization—and whether this makes good business sense for Quebec—the move makes a mockery of the entire concept of avoiding government support.

Posted on November 24, 2015 by Scott Hamilton

Bjorn’s Corner: Aircraft systems, the real nuts to crack

06 November 2015, ©. Leeham Co: COMAC’s C919 was rolled out in the week. We got to see a new shiny aircraft which looked ready to fly. The nicely curved fuselage and wings were immaculate, the paint was shiny and the CFM LEAP-1C engines were ready to go.

Yet many ask, when will it fly for the first time? It used to be that when the airframe was finished and the engines ran reliably it was time to fly. No longer! Today the most challenging part of an aircraft program is the integration of all the complex systems which hide under the skin. This is what kept the Bombardier CSeries on ground longer than it should and the Boeing 787 and Airbus A380 had the same flu (the latter also had to short wires).

It is the part of the aircraft which takes longest to get to work reliably. The A380 is known for its long period of nuisance warnings from the complex avionics system after entry into service and the reliability work for the 787 has to a large extent been one of software tuning of its system side.

As the system function of modern aircraft has grown more complex the whole architecture of how it was built had to be changed. Here’s how.

Posted on November 6, 2015 by Bjorn Fehrm

No fear of C919 for a generation

Nov. 4, 2015, © Leeham Co. The first COMAC C919 was rolled out of the factory over the weekend, China’s mainline entry into the fiercely competitive arena now “owned” by the Airbus-Boeing duopoly.

COMAC C919. Click on image to enlarge. Photo via Google images.

Although the two giants each has said China is the next competitor they will have to face, the Big Two have nothing to worry about for a generation to come.

Here’s why.

COMAC C919, first analysis

By Bjorn Fehrm

Subscription required.

Introduction

Nov. 04, 2015, ©. Leeham Co: COMAC rolled out China’s first modern airliner Monday. We have commented on its place in the market in a sister article. Here we will do a first analysis of its competitiveness compared to the established aircraft in the 150 to 200 seat single aisle segment.

The C919 is an aircraft which resembles another airliner which is assembled in China, the Airbus A320. Many think it is a carbon copy. While many dimensions and solutions are similar, there is enough original thinking on the aircraft to give China credit for having created their own first mainline airliner.

China is going the safe way and staying away from exotic solutions. Designing close to the most modern aircraft in this size bracket is no fault, it’s being prudent. There is no prior knowledge how to do such an aircraft in the country and the A320 is not a bad model. How good is the final result? We do a first analysis with our proprietary aircraft model and check if COMAC’s claim of 5% better aerodynamics than A320 and lower operating costs holds water.

Summary:

- The C919 has the shape of an A320neo but with more modern nose and wingtips.

- It is slightly longer than the A320 and has therefore one seat row more in the cabin.

- COMAC has sensibly stayed with a fully conventional build-up of the aircraft. It has enough on its plate to learn the ropes of getting a mainline single aisle aircraft through flight testing and certification

- The classical build and slightly larger dimension make for a heavier aircraft than A320neo. We check if its more modern wing can bring the performance past the A320neo benchmark.

Posted on November 4, 2015 by Bjorn Fehrm

Airbus, Boeing, Bombardier, CFM, Comac, CSeries, Premium

737 MAX, A320NEO, Airbus, Boeing, Bombardier, CFM, CFM LEAP-1A, CFM LEAP-1C, Comac, CSeries, Pratt & Whitney

Assessing the China market

Subscription required.

Subscription required.

Introduction

Sept. 30, 2015, (c) Leeham Co.: The Boeing deals announced last week with China put the country into the spotlight about its commercial aviation ambitions.

For many, the various deals announced by Boeing raise alarm bells. For most, that fire horse already left the fire station. The smoke has been billowing out of China (or maybe that’s smog) for a long, long time.

Summary

- Boeing announces 300 orders and commitments for China, though the company was vague about the details. We try to dissect what’s real and what’s smoke.

- Additional deals announced by Boeing are driven by China’s pay-to-play approach to business.

- Other OEMs, suppliers also have to pay-to-play.

- China’s deals with Airbus and Boeing are only two elements of a national goal for commercial aerospace.

- IP theft and technology transfer big concerns.

Chinese 737 Completion Center makes tactical, strategic sense

Sept. 22, 2015, © Leeham Co. The expected announcement by Boeing and Chinese President Xi during

Sept. 22, 2015, © Leeham Co. The expected announcement by Boeing and Chinese President Xi during

.jpg)

President Xi of China. Photo via Google images.

his state visit to Seattle this week that Boeing will develop a Completion Center for the 737 in China is a significant event that may one day lead to an assembly line there.

Boeing’s touch labor union, the IAM 751, was predictably critical. In a post on the 751 website last week, the union said, “In a previous meeting with Renton’s 737 leadership we saw a brief presentation outlining Boeing’s perceived market conditions regarding sales of single aisle aircraft and the company’s desire to collaborate with China. We have asked the Company for details of what is intended with “collaboration” and have not received ANY information on “collaboration” or confirming or disputing the media reports. While we don’t know specifics of any such proposal, ANY shift of aerospace jobs from our bargaining unit or Washington State causes grave concern.”

Posted on September 22, 2015 by Scott Hamilton

Boeing start applying “Standard Rules” to its and competitors’ aircraft.

By Bjorn Fehrm

Introduction

04 Aug 2015, © Leeham Co.: Boeing has for the last 20 years used an internal set of rules called Integrated Airplane Configuration ruleset, or IAC for short, for how it describes its own and competitors’ aircraft. These configuration rules, while comprehensive and consistently applied, have some problems, the most obvious is that they are 20 years old.

The IAC rules have filled an important role for Boeing: they have been the yard-stick how its different aircraft stack up but also how to value competitor’s aircraft. All aircraft in Boeing Commercial Airplanes (BCA) have been configured and scrutinized with IAC.

The world of civil airliners have moved on since the creation of IAC in the early 1990s and there was time for an overhaul. This has now been done, after several years of internal work the new configuration rules are ready for prime time under the name of “Boeing Standard Rules”.

The most externally visual effect is that officially published seat information and performance data for Boeing’s aircraft change. The configuration ruleset dictates how everything is measured against a standardized set of parameters for each aircraft type and use.

We talked with Boeing’s Director for Product Marketing, Jim Haas, how to decipher the changes and how aircraft stack up before and after being “Standardized”. Read more

Posted on August 5, 2015 by Bjorn Fehrm

Mitsubishi opens Seattle Engineering Center ahead of MRJ90 first flight

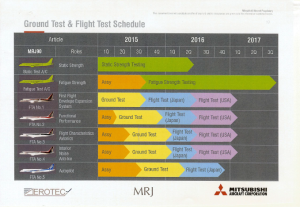

August 3, 2015, © Leeham Co.: Mitsubishi Aircraft Corp. today opened its Seattle Engineering Center jointly with local company AeroTEC in advance of the first flight of the MRJ90 in September or October. During the second quarter of next year, four of five MRJ Flight Test Vehicles will be domiciled in Moses Lake in Central Washington for the bulk of the flight testing over the following year. Entry into service is planned for 2Q2017 with launch customer All Nippon Airways.

The engineering center represents the first in Washington State for an aircraft OEM other than Boeing. Mitsubishi will assign 50 engineers from Japan to the new SEC, in South Seattle a short distance from Boeing Field. One hundred engineers will be hired locally.

AeroTEC and Mitsubishi began discussing working together only last January, said president Lee Human, who added that the seven months from January to the opening of the SEC today was remarkable for the speed in which negotiations, contracts, permits and hiring was achieved.

Posted on August 3, 2015 by Scott Hamilton

LEAP, the best of 1,000 investigated alternatives.

By Bjorn Fehrm

Subscription required.

Introduction

June 23, 2015, © Leeham Co. CFM International went through 1,000 iterations before settling on the final design for the LEAP engines that will power the Airbus A320neo, the Boeing 737 MAX and the COMAC C919.

In an interview with us at the Paris Air Show, CFM LEAP program manager Gareth Richards explained the macro process of the development of LEAP, CFM’s sequel to CFM56. This will be the largest turbofan engine program in the history of civil aviation and the follow on to the world’s most-sold turbofan, the CFM56.

Richards focused on how an engine like LEAP gets designed and what the trades are that a single aisle, short haul engine has compared to long haul engines.

LEAP is sharing the A320neo platform with Pratt & Whitney’s GTF but is sole engine on the 737 MAX and the C919. This will lead to engine production rates five years into the program of 1800 engines which is higher than the present rate of CFM56 deliveries.

Dependant on rate increases by Airbus and Boeing, this can increase beyond 2,000 engines per year after the initial ramp. It would make LEAP the largest civil turbofan program whichever way one counts: engines, installed thrust or revenue.

Summary:

- Research of optimal engine cycle was extensive, with more than 1,000 alternatives investigated before settling on the final LEAP cycle.

- The production ramp is the fastest ever, from 30 engines 2015 to 1,700 by 2019.

- While CFM does not want to ramp faster than planned, final production rate is flexible.

- The large volume of sold engines, the fast production ramp and the short-haul cycle makes for a conservative approach to performance.

- We discuss with Richards how such a program is managed and how you make sure you can deliver on promises.

Posted on July 2, 2015 by Bjorn Fehrm

Bjorn’s Corner: What Paris Air Show taught us about East and West.

25 June 2015, © Leeham Co: With a few days in the office one can look back at Paris Air Show with a bit of perspective. So what are the impressions?

It was surprising how many orders Airbus and Boeing landed. Both had played down the expectations, telling that it will be a decent show but nothing close to record. Yet both were booking orders or commitments which were better than expected going into the PAS. Read more

Posted on June 26, 2015 by Bjorn Fehrm

AirAsia, Bjorn's Corner, Boeing, Bombardier, Comac, CSeries, Farnborough Air Show, Future aircraft, GE Aviation, Irkut, Paris Air Show, Pratt & Whitney, Rolls-Royce, Sukhoi, United Aircraft, YAK

737 MAX, 787, A320NEO, A330neo, Airbus, Boeing, Bombardier, Comac, CSeries, GE, Pratt & Whitney, Rolls-Royce

Email Subscription

Twitter Updates

My TweetsAssociations

Aviation News-Commercial

Commentaries

Companies-Defense

Resources

YouTube

Archives

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008