Leeham News and Analysis

There's more to real news than a news release.

Leeham News and Analysis

Leeham News and Analysis

- The Boeing 767 Cross Section, Part 1 November 24, 2022

- Movie Review: Devotion November 21, 2022

- China will accelerate development of its commercial aerospace sector November 21, 2022

- Bjorn’s Corner: Sustainable Air Transport. Part 46. eVTOL comparison with helicopter November 18, 2022

- The economics of a 787-9 and A330-900 at eight or nine abreast November 16, 2022

ISTAT Asia: Asian airline market update

Introduction

May 11, 2015, c. Leeham Co: We are participating this week in the ISTAT Asia conference in Singapore where IATA and different panels gave an interesting update on the Asian airline market. This is the fifth year that an ISTAT (International Society of Transport Aircraft Trading) conference is held in Asia and participation has virtually doubled from last year to 500 delegates.

IATA’s Conrad Clifford opened the event with the following overview about the Asian market for airline passenger travel:

- The IATA 20 year forecast growth for the region is 4.9 % annual growth, making it the largest world-wide passenger market by 2030.

- The domestic markets of China and India grew with 11% and 20% respectively in 1Q2015. The US market in comparison grew 3%.

- The growth in the region makes China the world-wide largest domestic passenger market by 2030, surpassing the US with India in third place.

- The highest growth markets are China, India and Indonesia. Countries like Thailand and Malaysia are struggling with low demand at present.

Posted on May 11, 2015 by Bjorn Fehrm

Airbus, Airlines, Boeing, Bombardier, China, Comac, Embraer, ISTAT, Leasing, Mitsubishi

Bombardier CS300 analysis vs A319neo, 737-7

By Bjorn Fehrm

Subscription required

Introduction

March 29, 2015, c. Leeham Co: Bombardier’s big bet in the aeronautics sector, CSeries, is well into flight testing, now more than half way toward the 2,400 hours required by Transport Canada before certification can be granted. The first aircraft to be certified will be the smaller 110 seat CS100 but the market is most interested in the larger 135 seat CS300, which has 63% of present orders and commitments, Figure 1.

Bombardier’s new CEO, Alan Bellemare, told reporters last week that the CS100 would be certified during 2015 with entry into service slipping into 2016. The CS300, which is a direct challenger to Airbus’ A319neo and Boeing’s 737-7, should follow six months after CS100. With the CS300 in flight testing and going into service next summer, we decided to have a deeper look at CS300 and its competitors.

Summary

- A319 and 737-7 are shrinks of the market’s preferred models, A320 and 737-8, and as such not the most efficient models.

- The CS300 is the series center-point and it shows. The modern design beats the Airbus and Boeing designs on most counts.

- Part of the modern concepts in CSeries is the well-conceived Pratt & Whitney PW1000G geared turbofan.

- PW’s 73 in fan version of the PW1000G for CSeries is slightly less efficient that the 81 in version for A319neo but CS300 lower weight makes sure this is more than compensated for.

Posted on March 29, 2015 by Bjorn Fehrm

Airbus, Boeing, Bombardier, CFM, China, Comac, CSeries, Embrarer, GE Aviation, International Aero Engines, Pratt & Whitney, Premium, Sukhoi, United Aircraft, YAK

737, 737 MAX, 737-7, 737NG, A319neo, A320, A320NEO, Airbus, Boeing, Bombardier, CFM, Comac, CSeries, E-195 E2, E-Jet E2, Embraer, GTF, LEAP-1A, Leap-1B, Pratt & Whitney

Airbus Group 2014, analysis after press conference

By Bjorn Fehrm

Munich 27 Feb. 2015: The team from Airbus Group that met the press in Munich today consisted of Tom Enders, Airbus Group Chief Executive Officer, Harald Wilhelm, Airbus Group Chief Financial Officer and Marwan Lahoud, Head of Airbus Group strategy and M&A.

It was a team in good spirits that met around 150 on-site journalists from mainly Europe, with both Tom Enders and Harald Wilhelm clearly at ease with the groups improving results and giving Marwan Lahoud compliments for his restructuring work in the groups remaining problem areas.

Before we go into the areas with work in progress, lets focus on why these gentlemen felt at ease with presenting the state of Airbus Group after its first year operating under the new name. Read more

Posted on February 27, 2015 by Bjorn Fehrm

Bombardier’s crisis of confidence perhaps the biggest challenge for CSeries

Subscription Required

Introduction

Feb. 18, 2015, c. Leeham Co.: Alain Bellemare, Bombardier’s new president and chief executive officer, has his work cut out for him.

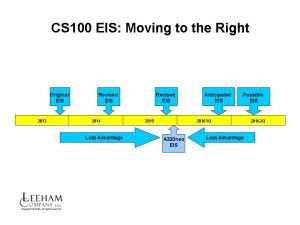

Figure 1. The CSeries was supposed to enter service in late 2013, two full years ahead of the Airbus A320neo. This market advantage has been lost with repeated delays. BBD is sticking to its public statement that EIS is now the second half of this year (most put EIS in the fourth quarter), but there is growing belief EIS will slip to the first or even the second quarter of next year–after the A320neo EIS. Source: Bombardier, Airbus, Leeham Co. Click on image to enlarge into a crisp view.

We outlined the corporate and market perception challenges ahead of him in our Feb. 13 post. Investor and media reception to the CEO leadership change was mixed. Although Bellemare’s appointment was seen as a positive, stock traded down and Bombardier took a pounding in the press (see some reaction at the bottom of this post).

He also has challenges with a changing market place, driven by two years worth of delays in the CSeries program and exacerbated by a changing global political environment.

Summary

- Bombardier faces a crisis in confidence from customers that has to be fixed.

- The CSeries has lost its entry-into-service advantage over the Airbus A320neo and has reduced its advantage over the A319neo, the Boeing 737-8/7 and Embraer E-190/195 E2 EIS due to delays.

- A changing global political environment poses additional risks to the CSeries skyline.

Posted on February 18, 2015 by Scott Hamilton

Turboprops’ future is OK but not great as ATR corners market

Subscription Required

Introduction

Jan. 5, 2015: Conventional wisdom suggests that turboprops are making a bit of a comeback because these remain far more efficient for routes up to 400 miles than jets, particularly at high fuel prices.

Even though oil prices have plunged to a seven year low, few expect that long-term prices will remain at today’s levels. While fuel between $50-$60bbl breathes new life into aging regional jets, there remains efforts in several corners to develop a new generation of turboprops.

- Summary

ATR wants to launch a new, 90-100 seat turboprop. - Bombardier launched a high-density, 86, seat version of its Q400 but appears cool to a new design.

- China offers its indigenously built turboprop.

- India and Indonesia are exploring a new design.

- Pratt & Whitney, GE, others are developing the next generation engine.

Posted on January 5, 2015 by Scott Hamilton

Looking ahead in 2015 in commercial aviation

Here’s a visualization of events to look for in commercial aviation in 2015.

Posted on December 26, 2014 by Scott Hamilton

Airbus, Boeing, Bombardier, CFM, China, Comac, CSeries, Embraer, GE Aviation, Mitsubishi, Paris Air Show, Pratt & Whitney, Rolls-Royce

767-2C, A320NEO, A350-1000, A350-900, A380neo, air force tanker, Airbus, Boeing, Bombardier, CFM, CSeries, E-Jet E2, Embraer, GTF, KC-46A, LEAP, MC-21, Mitsubishi, MRJ, Pratt & Whitney, Qatar Airways, Rolls-Royce, Trent XWB

World’s dud airliners

While we’re in the slow-news Holidays, we thought we’d have some irreverent fun. There have been many attempts at building airliners. There are the obvious successes but there have been many, many failures. Starting with the end of World War II, we’ve collected the following for our nominees for duds–sales or technological failures. We invite readers to make their own nominations. If you have photos, add them to your Comments.

This list is in no particular order. Next week we’ll construct a poll to see how the airplanes rank. Read more

Posted on December 23, 2014 by Scott Hamilton

Airbus, Airlines, American Airlines, Boeing, China, Comac, Douglas Aircraft Co

707, 727, 880, 990, Airbus, Airlift, American Airlines, ARJ21, AVIC, BEA, BOAC, Boeing, Braniff Airlines, Bristol, Britannia, British European Airlines, Budd, Canadair, CL-44, Comac, Comet, Constoga, Convair, Dassualt, DC-4 M2, DC-8, de Havilland, Electra, Flying Tiger, Fokker-VFW, Fokker-VFW 614, Howard Hughes, Lockheed, Lockheed Electra, Loftleider, Martin, Martin 202, Martin 303, Martin 404, Mercure, Seaboard World, Stratocruiser, Trident, TWA, United Airlines

Zhuhai airshow: Airbus gains A320 MOU while regional A330 needs explaining

The Zhuhai airshow has not brought the expected slew of announcements from Western aircraft manufacturers. Boeing announced an order for 80 737 MAX Monday but this was characteristically from a leasing company across the Chinese see, SBMC Capital of Tokio.

Airbus on the other hand has not been able to move the much talked about A330 regional to order yet, despite announcing it in China last year and enticing with an announcement for a Chinese completion center for the aircraft before the show. Flightglobal reports that the A330 regional needs further explaining, Chinese carriers seems hesitant to buy what Boeing pitches as “obsolete technology” in a weight variant that only could fly local missions.

Airbus China president Eric Chen explains that the 200t variant is not constrained to Chinese mainland and can fly any missions that its range would allow. He also points out that the weight variant is just that, a de-papered weight version that can be upped to whatever take off weight the customer wishes at a later date by paperwork changes (and perhaps some additional galley equipment). As for technology level, an aircraft shall be valued for its contribution to a carriers business says Chen, not by which years it says on its airworthiness certificate.

The smaller A320 did not disappoint reports Aviation Week, Airbus CEO Fabrice Bregier could announce a Memorandum Of Understanding (MOU) for 100 A320 from state affiliated China Aircraft Leasing whereof 74 would be A320neo. The order, once confirmed, can help Chinese carriers with the aircraft demand for the 2016-2020 economic planning period. Chinese carriers have been slow to place the necessary early OEM orders for the period (needed due to the large backlogs), the lessor sees it can back-fill that demand when the carriers comes around to needing the aircraft.

Airbus also has explaining to do in other corners of the world, Emirates intend to start second round talks around A350 in the next months according to Reuters. The first round of 70 aircraft was cancelled after Emirates did not understand a specification change that Airbus undertook without consulting Emirates. This time Emirates will see the aircraft flying with neighbor Qatar Airways before agreeing to any specifications according to Emirates CEO Tim Clark.

Posted on November 13, 2014 by Bjorn Fehrm

Zhuhai Airshow: China’s aircraft industry is gaining speed

The 10th Chinese airshow at Zhuhai opened today. It was a day with fewer announcements than expected from the usual suspects (Airbus, Boeing…) but the Chinese industry did not disappoint. China is now showing more and more of its coming might as a player on the aeronautics arena.

The most prominent displays at this show were on the military side, where China has two stealth aircraft projects flying (the large Chengdu canard J-20 and the smaller Shenyang J-31) while their canard Chengdu J-10 was flying the display circuits overhead (Figure 1).

Figure 1. Chinas latest fighter developments; the J-31 and J-20 stealth fighters and the canard J-10. Source: China internet.

All aircraft are of latest structural and aerodynamic design if not in engines and systems. This is a big difference to previous shows where the Russian Sukhoi and MIG aircraft and their local copies did the flying display until 2008. Since then everything has changed and now China and USA are the only countries in the world with two different stealth designs flying. USA has one in operation (F-22) and one close to (F-35) whereas China still has many years to go until they have their new aircraft operational. But it is significant that the old aeronautical behemoths Europe and Russia have none respective one (PAK-50) stealth fighter in flight test.

Email Subscription

Twitter Updates

My TweetsAssociations

Aviation News-Commercial

Commentaries

Companies-Defense

Resources

YouTube

Archives

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

Part 3: Boeing 757 replacement: 757 and Airbus A321neoLR versus clean sheet designs.

Subscription required.

By Bjorn Fehrm

Part 3 of 3

Introduction

In Part 2 of our three-part 757 Replacement analysis, we took a close look at Airbus’ new 97 tonne take-off weight A321neo, revealed in a world exclusive by Leeham News and Comment October 21. We analyzed the A321neoLR’s capabilities and limitations when compared to Boeing 757-200W and we saw that it could do the international flights that the 757-200 does with about 25% better efficiency. In this final Part 3, we will now compare the 757 and A321neoLR against what can be Boeing’s reaction, a clean sheet New Single Aisle, NSA, or New Light Twin Aisle, (NLT). First the conclusions from Part 2:

Leeham News and Comment October 21. We analyzed the A321neoLR’s capabilities and limitations when compared to Boeing 757-200W and we saw that it could do the international flights that the 757-200 does with about 25% better efficiency. In this final Part 3, we will now compare the 757 and A321neoLR against what can be Boeing’s reaction, a clean sheet New Single Aisle, NSA, or New Light Twin Aisle, (NLT). First the conclusions from Part 2:

Summary

For Part 3 we can summarize:

Figure 1. Fuselage cross sections of our models of NSA and NLT. Source: Leeham Co.

Read more

5 Comments

Posted on October 28, 2014 by Bjorn Fehrm

Airbus, Airlines, Boeing, CFM, China, Comac, CSeries, Embraer, GE Aviation, Irkut, Leeham Co., Leeham News and Comment, Pratt & Whitney, Premium, Rolls-Royce, Uncategorized

737, 737 MAX, A320, A320NEO, Airbus, Boeing, Bombardier, CFM, Comac, CSeries, Embraer, GTF, Pratt & Whitney, Rolls-Royce