Leeham News and Analysis

There's more to real news than a news release.

Pontifications: Boeing moves in China only the beginning

Sept. 28, 2015, (c) Leeham Co.:The move by Boeing to establish a 737 Completion Center in China is only one step in a series of moves to increase its footprint there.

Boeing also said it will join with China’s National Development Reform Commission to develop:

- Industrial cooperation;

- A “world-class” aviation transportation system through deliveries to China of Boeing airplanes and services;

- Technologies to reduce aviation’s environmental impact and enhance sustainability;

- Leadership and training for the next generation of leaders in China’s aviation industry;

- Continued cooperation to support the safety, efficiency and capacity of China’s air transport system

- Further cooperation in biofuels.

“Boeing and Aviation Industry Corp. of China (AVIC) will broaden their long-term collaboration to support Boeing’s commercial airplane programs,” the company announced last week in connection with the visit to Seattle by the president of China. “In a framework agreement, the companies said they intend to further advance AVIC’s manufacturing capabilities by adding major component and assembly work packages; strengthening leadership; and developing AVIC’s broad aviation infrastructure and business practices, including supply chain management.”

I believe this is only the beginning of a new push of Boeing’s expansion outside Washington State, elsewhere in the US and overseas.

Separately, last week it was also announced that a key supplier is done expanding in Washington State. Future expansion will be elsewhere.

Boeing announces big China order–but how big is it, really?

Sept. 24, 2015, (c) Leeham Co. Boeing yesterday announced a deal pegged at $38bn for 300 jets for China, timing the announcement with the State visit to Seattle of Chinese President Xi Jinping.

Orders and Commitments for Boeing Commercial Airplanes

Boeing and China Aviation Supplies Holding Company (CASC) have signed a General Terms Agreement related to the purchase of 300 airplanes. The package has a value of approximately $38 billion at list prices.

Aircraft orders and commitments include:

(240) airplanes for Chinese airlines, including (190) 737s and 50 widebody aircraft

(60) 737s for leasing companies ICBC and CDB Leasing

“Boeing airplanes have played an important role in supporting the development of China’s aviation transportation for the past 40 years,” said Li Hai, president of China Aviation Supplies Holding Company. “These additional airplanes will further help connect the people in China and around the world.”

“China is a critical international market for commercial airplanes,” said Conner. “We thank our Chinese customers for selecting fuel-efficient Boeing airplanes to meet their fleet growth and expansion.”

But the information above is remarkably vague on detail. Questions immediately arose on Wall Street over just how big this deal truly is.

Chinese 737 Completion Center makes tactical, strategic sense

Sept. 22, 2015, © Leeham Co. The expected announcement by Boeing and Chinese President Xi during

Sept. 22, 2015, © Leeham Co. The expected announcement by Boeing and Chinese President Xi during

.jpg)

President Xi of China. Photo via Google images.

his state visit to Seattle this week that Boeing will develop a Completion Center for the 737 in China is a significant event that may one day lead to an assembly line there.

Boeing’s touch labor union, the IAM 751, was predictably critical. In a post on the 751 website last week, the union said, “In a previous meeting with Renton’s 737 leadership we saw a brief presentation outlining Boeing’s perceived market conditions regarding sales of single aisle aircraft and the company’s desire to collaborate with China. We have asked the Company for details of what is intended with “collaboration” and have not received ANY information on “collaboration” or confirming or disputing the media reports. While we don’t know specifics of any such proposal, ANY shift of aerospace jobs from our bargaining unit or Washington State causes grave concern.”

Embraer CEO interview: oil prices, Brazil’s economy, China

Paulo Cesar, president and CEO of Embraer’s commercial aviation unit. Photo via Google images.

Subscription required

Introduction

Part 3

Sept. 14, 2015, © Leeham Co. It’s only been three months since the Paris Air Show and there have been some significant developments in the world that have impact on commercial aviation:

- Oil prices dropped from about $62/bbl to a low of $38 in mid-August and it’s climbed back to about $46 this week;

- China devalued the Yuan;

- The Brazilian economy has deteriorated and so has the domestic political situation; and

- Some LCC airlines in Asia are feeling the strain of growth and weakening currencies.

We talked with Paulo Cesar, president and CEO of Embraer at the Paris Air Show on some of these topics. We caught up with him Sept. 2 in Seattle, revisiting these topics and talking about more.

Airbus, Boeing YTD orders assessed (Update)

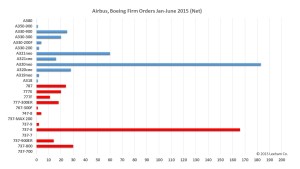

Update, July 8: In our original post, we omitted 44 Boeing 737NGs from the YTD firm orders. The charts and text have been updated to reflect this information.

July 7, 2015, © Leeham Co. Airbus pulled ahead of Boeing in firm orders through June, and both companies have a number of commitments that were announced at the Paris Air Show that aren’t included in the year-to-date tally.

Airbus leads with single-aisle orders and Boeing leads with widebody orders, but at the half-way point of the year, the contest is far from over. The leads could shift or increase, depending on how the balance of the year goes.

ISTAT Asia day two: home for the elderly

Introduction

May 12, 2015, c. Leeham Co: As you would have guessed we are talking Asian civil airliners, where planning in the region for the fast growing older generations is inadequate. This was the subject of several sessions during day two of the ISTAT Asia (International Society of Transport Aircraft Trading) conference in Singapore.

The problem is new, as up to now a newly established airline fleet in Asia has not had any numbers of older aircraft. But the expansion over the last 20 years is now producing the first transition waves of aircraft and the planning around the problems this generates is inadequate.

The result will be surprising write-downs of airline assets as aircraft being replaced cannot be transitioned out at booked residual values. The scale of the problem was highlighted by a survey of the 500 gathered ISTAT industry experts. The question posed to them was “There are 4700 aircraft coming up for replacement until 2033, has Asian airlines planned adequately for this?”:

- 49% of the delegates responded a few airlines have.

- 45% answered there are only some that do it.

- 5% of the delegates answered most airlines does it.

- 2% thought all Asian airlines have done it.

Bjorn’s Corner: China’s civil aviation, from nothing to world’s largest in 2030

Introduction

By Bjorn Fehrm

14 May 2015, C. Leeham Co: In my ISTAT Asia reports, I wrote about how China will overtake USA as largest civil aviation market in 2030. Airbus China Group chairman, Laurence Barron, and I had a chat after his ISTAT presentation where he described China’s evolution as a civil aviation market and how Airbus gradually worked itself from a late and hesitant start to today’s split of the market with Boeing.

Barron provided his slides, some of which we will use to review how China grew from virtually no civil aviation after the Chinese revolution in 1949 to the world’s largest market by 2030. We will also look at what aircraft have made up this growth and finally describe how Airbus progressed from a latecomer in 1985 to sharing the market with Boeing today.

Read more

19 Comments

Posted on May 14, 2015 by Bjorn Fehrm

Airbus, Airlines, Bjorn's Corner, Boeing, China, Douglas Aircraft Co, Leeham News and Comment, McDonnell Douglas

707, A310, Airbus, Boeing, EADS