Leeham News and Analysis

There's more to real news than a news release.

Is Norwegian in trouble?

By Bjorn Fehrm

July 11, 2017, © Leeham Co.: In our review of Norwegian Air Shuttle (Norwegian) the 8 of February, we pointed out the company’s ambitious fleet expansion plans with a rather weak balance sheet. We followed up with a second article the 15th of February where we analyzed the risky fleet plans further.

Last week, the longtime Norwegian CFO, Frode Foss, departed. It sent shock waves through analysts and the stock tanked 8% in a day.

The departure of a CFO is many times the pre-warning of troubled times. Foss was with Norwegian for 15 years. It was not a planned departure and Foss has no successor. The post is run by the Investor Relations manager in the interim. Read more

Read more

Developing Boeing’s airplanes

June 21, 2017, © Leeham Co.: “It’s all about continuing the development strategy since thirty years” said Mike Delaney, VP of program development for Boeing. “It’s about continuing the development strategy for 30 years producing super efficient twins that support point-to-point networks.”

June 21, 2017, © Leeham Co.: “It’s all about continuing the development strategy since thirty years” said Mike Delaney, VP of program development for Boeing. “It’s about continuing the development strategy for 30 years producing super efficient twins that support point-to-point networks.”

Delaney made the remarks at the Paris Air Show about developing the 737 MAX 10 and the NMA (New Medium size Airplane).

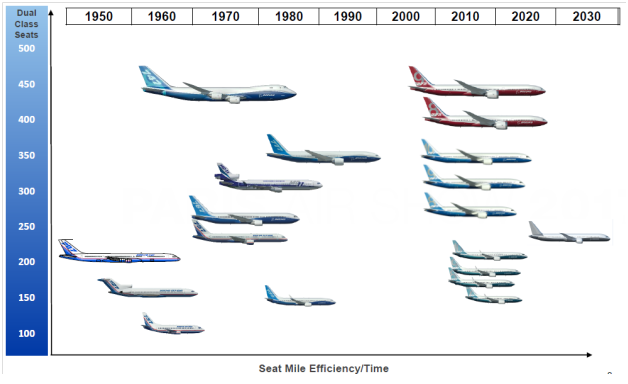

Figure 1 shows the Boeing products over the years, with the 737 MAX 10 and the NMA filling the gap between 180 and 270 two class seats (note the 748i is no longer part of the chart). The MAX 10 is in place and a tentative NMA is showing the way into the next decade. Read more

Dissecting the 737-10 numbers

Analysis

June 19, 2017, © Leeham Co.: Boeing’s launch of the 737 MAX 10 on its face was a surprisingly strong showing here at the Paris Air Show.

June 19, 2017, © Leeham Co.: Boeing’s launch of the 737 MAX 10 on its face was a surprisingly strong showing here at the Paris Air Show.

Kevin McAllister, CEO of Boeing Commercial Airplanes, and Dennis Muilenburg, CEO of The Boeing Co., announced there were 240 orders from more than 10 customers when they confirmed the show’s worst kept secret: that the launch was here.

The 240 orders were more than had been expected—and less than advertised.

MC-21 and C919 compared. Part 3.

By Bjorn Fehrm

Subscription required.

Introduction

June 15, 2017, ©. Leeham Co: We continued the comparison of Irkut’s MC-21 and COMAC’s C919 last week with an analysis of the cabins and systems. The week before, we compared project time plans, structures and aerodynamics.

Now we finish with an analysis of the economics of the aircraft.

Now we finish with an analysis of the economics of the aircraft.

Summary:

- The MC-21 is the more advanced aircraft of the two. It uses carbon composites for the wings and empennage.

- Coupled with more refined aerodynamics, the MC-21 offers a higher efficiency than the more classical C919.

MC-21 and C919 compared. Part 2.

By Bjorn Fehrm

Subscription required.

Introduction

June 08, 2017, ©. Leeham Co: We started the comparison of Irkut’s MC-21 and COMAC’s C919 last week. We compared project time plans, structures and aerodynamics.

Now we continue with the comparison of cabin capacities and systems.

Summary:

- The C919 cabin is a slightly longer copy of the Airbus A320 cabin. MC-21 sets new standards for cabins in the single aisle segment.

- Both aircraft use Western systems to ease development and improve in-service reliability.

Pratt & Whitney, rest of industry, await Boeing decision on NMA

June 1, 2017, © Leeham Co.: Pratt & Whitney, like the airlines, lessors, suppliers and competitors, awaits a decision by Boeing whether it will launch the New Midrange Aircraft for the Middle of the Market sector.

PW’s president, Bob Leduc, said the company is going through its business case studies

Bob Leduc, president of Pratt & Whitney. UTC photo.

even as it provides information to Boeing.

In an interview yesterday with Leduc and PW Commercial Engines president Chris Calio at PW’s pre-Paris Air Show media days near its West Palm Beach (FL) engine production facility, Leduc says the market size and the assumption Boeing will choose two engine makers to power the NMA are among factors that will drive the business case.

Here is a transcript of the interview on the NMA and other topics. The lead into the NMA evolved from a question about the aftermarket services PW—and Boeing—have as strategic profit-center goals.

Pontifications: Emirates profits drop 83%, MC-21 and more news last week

May 15, 2017, © Leeham Co.: It was a busy news week last week.

- Emirates Airline headlined its 29th consecutive year of profits, but downplayed an 83% decline.

- The Irkut MC-21 moved to the tarmac, an indication first flight may be coming shortly.

- Multiple media reports indicate that electronics flight ban from the Middle East may be extended in part to all of Europe.

- Boeing suspended test flights on the 737 MAX after CFM discovered some quality issues in some LEAP 1B engines.

Let’s look at these events.

How Airbus can kill the Boeing 797

Artisit concept of the Boeing 797. Rendering via Google images.

May 10, 2017, © Leeham Co.: Airbus can kill the business case for the prospective Boeing 797, the New Midrange Aircraft also known as the Middle of the Market Airplane,

- Reuter’s Tim Hepher has this story.

- CNN’s Jon Ostrower has this story.

All it has to do is move first, instead of waiting for Boeing to launch the 797, something considered likely next year.

If Airbus launched what is commonly called the A322, a larger, longer-range version of the A321neo, the new version would become a true replacement for the Boeing 757, meet economics of the smaller 797, which has a working title of the 797-6, at a much lower capital cost.

C919, the Chinese challenger

Subscription Required.

By Scott Hamilton and Bjorn Fehrm

May 01, 2017, ©. Leeham Co: The COMAC (Commercial Aircraft Corporation of China) C919 is expected to have its first flight this month, perhaps as early as this week. We review where the program stands and how it compares to its competition.

When the C919 program was launched in 2008, neither Airbus nor Boeing envisioned re-engining the A320 and 737 families. First flight was planned for 2014 and entry-into-service in 2016.

The C919 would have had economic and capital cost advantages over the A320 and 737NG. With program delays of at least four years, and maybe more, those advantages have been narrowed. Read more