Leeham News and Analysis

There's more to real news than a news release.

Focus on NMA engines: all OEMs vying for Boeing’s approval

Subscription Required

Now open to all readers.

Introduction

March 22, 2018, © Leeham Co.: As Boeing enters the final stretch whether to launch the New Midrange Aircraft (NMA, aka 797) market focus should shift to the  engines more than the airframe and even the market demand.

engines more than the airframe and even the market demand.

It all comes down to this: no engines, no plane.

Monday’s post outlined some of the issues to consider.

But there are larger implications as well.

Summary

- Market sources are tossing about various scenarios about the future GE Aviation and CFM.

- Rolls-Royce won’t have its Trent 1000 problems fixed until 2021 or 2022, at great cost.

- Pratt & Whitney won’t have its Geared Turbo Fan final PIP packages for its problems sorted out until around 2021.

- Resources—both financial and with engineering—are stretched now.

- Sequencing current engine problems, and in the case, GE’s GE9X, are a factor, in the eyes of some.

GE/CFM in “lockstep” with Boeing on NMA

March 22, 2018, © Leeham News: GE Aviation/CFM International are in “lockstep” with Boeing for development of an engine for the New Midrange Aircraft (NMA, or 797), the CEO of GE Aviation told a JP Morgan Aviation conference last week.

David Joyce acknowledged that there are technical issues and production delays for the new CFM LEAP 1A and 1B that power the Airbus A320neo and Boeing 737 MAX families respectively. Production is running up to six weeks late, but should be caught up by the end of this year, he said.

Technical issues, while affecting at least 100 engines, nevertheless are far less of an issue than those plaguing rival Pratt & Whitney’s Geared Turbo Fan.

Boeing’s NMA decision entering final stretch

By Bjorn Fehrm

Subscription Required

Introduction

March 15, 2018, © Leeham News: Boeing’s NMA or 797 is taking final form ahead of a decision to launch the program later in the year.

Jon Ostrower has published the first picture of the projected aircraft, which he acknowledges might change in its final form. Figure 1 shows the smaller of the two NMA models, the 224-seat 797-6X.

Figure 1. The first sketch of the smaller 797-6X with 224 seats. Source: JonOstrower.com

We take a closer look at the 797 in its latest definition.

Summary:

- The Boeing NMA is called the 797-6X and 797-7X when presented to airlines.

- The 797 is best compared with the 767. Cabin dimensions are close to the 767-200 for the 797-6X and to the 767-300 for the 797-7X.

- The use of a more efficient cross-section, Carbon Fibre design, higher aspect ratio wing and modern engines makes the 797 a lighter and more efficient aircraft than the 767.

Engine makers “inside the tent” on Boeing NMA, but airframer still ponders provider

March 5, 2018, © Leeham Co.: The three engine makers, CFM/GE, Pratt & Whitney and Rolls-Royce, are the only suppliers that have been brought “inside the tent” by Boeing for the New Midrange Aircraft, a company executive said today.

Launching the program is critical on the engine companies, says Randy Tinseth, VP marketing for Boeing. Boeing hasn’t decided—officially—whether it will have a

Randy Tinseth. Photo via Google images.

single-engine or dual-engine source for the aircraft because the program hasn’t been launched.

Market intelligence tells LNC that Boeing wants two engine choices. Intel also indicates all three engine OEMs view the market demand as sharply smaller than Boeing’s publicly-stated forecast of 4,000 Middle of the Market sector airplanes over the next 20 years.

Chinese and Russian Widebody takes shape. Part 4.

By Bjorn Fehrm

Subscription Required

Introduction

February 1, 2018, © Leeham Co.: In the third article about the Chinese/Russian widebody, CR929, we looked at the challenges the aircraft poses to the involved manufacturers. Now we continue with analyzing the project’s engine needs.

The CR929 is sized to use engines from the Boeing 787 project. Both GE Aviation and Rolls-Royce got Request for Proposals (RFPs) on 22 Dec. 2017. In addition, the Russian and Chinese engine industry wants to develop an engine for the project.

Summary:

- The Chinese and Russian widebody program needs engines in the 75,000lbf thrust class.

- The project’s engine specification is closely modeled after the engines available from the Boeing 787 project.

- In addition to the available 787 engines, the Chinese and Russian engine industry is trying to unite behind a joint engine proposal.

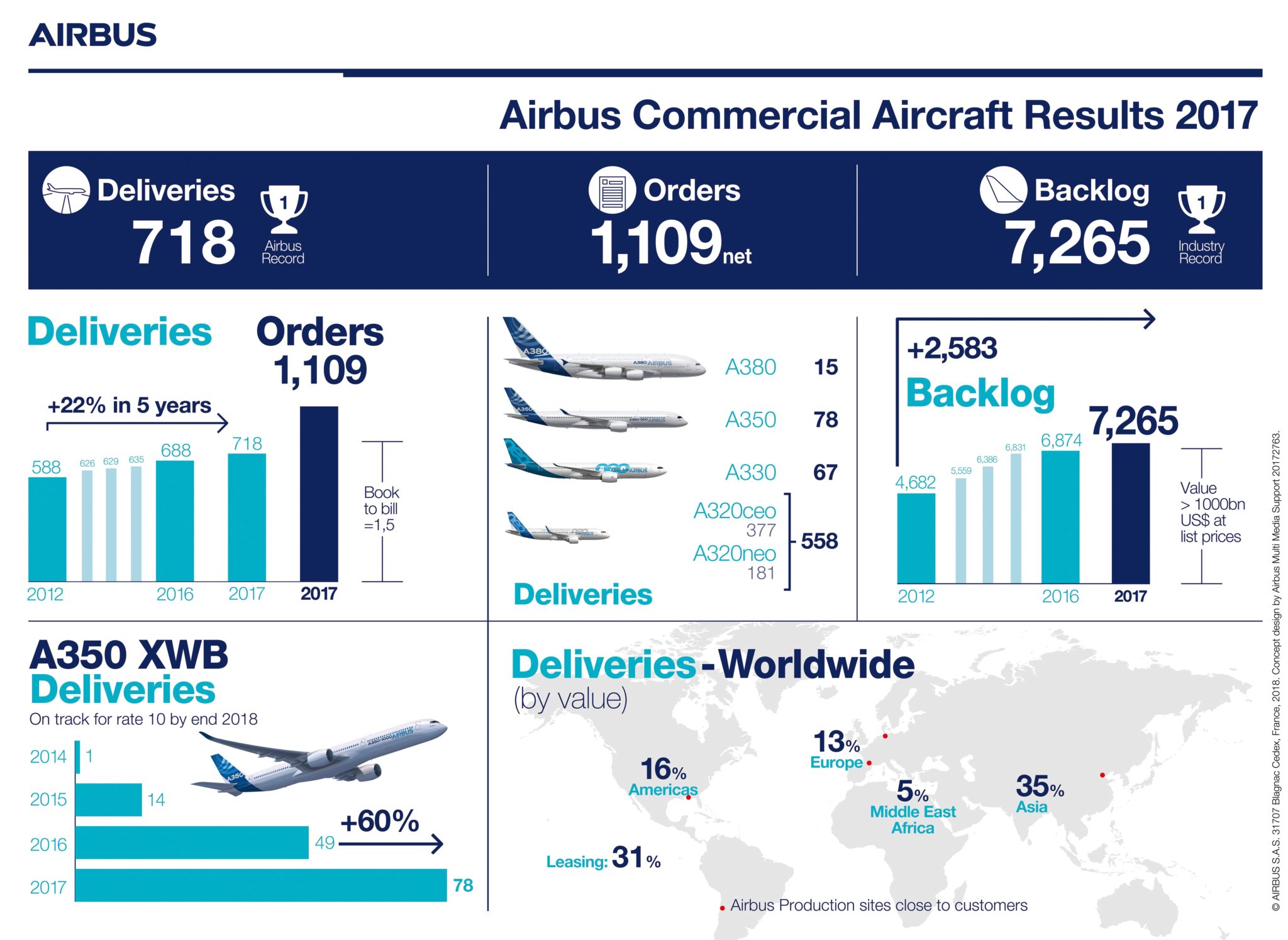

Airbus delivers record 718 aircraft amid strong sales

By Bjorn Fehrm

January 15, 2018, ©. Leeham Co: Airbus announced record 2017 airliner deliveries of 718 aircraft today. It was the 15th consecutive year of increased production, this time with 30 aircraft over 2016. Fabrice Bregier, the Chief Operating Officer of Airbus, predicted Airbus would pass Boeing in deliveries by 2020.

The company also booked its third best year in orders, with 1,109 aircraft giving a Book-to-Bill of 1.5. The backlog is at a record 7,256 aircraft (Figure 1).