Leeham News and Analysis

There's more to real news than a news release.

Zhuhai Airshow: China’s aircraft industry is gaining speed

The 10th Chinese airshow at Zhuhai opened today. It was a day with fewer announcements than expected from the usual suspects (Airbus, Boeing…) but the Chinese industry did not disappoint. China is now showing more and more of its coming might as a player on the aeronautics arena.

The most prominent displays at this show were on the military side, where China has two stealth aircraft projects flying (the large Chengdu canard J-20 and the smaller Shenyang J-31) while their canard Chengdu J-10 was flying the display circuits overhead (Figure 1).

Figure 1. Chinas latest fighter developments; the J-31 and J-20 stealth fighters and the canard J-10. Source: China internet.

All aircraft are of latest structural and aerodynamic design if not in engines and systems. This is a big difference to previous shows where the Russian Sukhoi and MIG aircraft and their local copies did the flying display until 2008. Since then everything has changed and now China and USA are the only countries in the world with two different stealth designs flying. USA has one in operation (F-22) and one close to (F-35) whereas China still has many years to go until they have their new aircraft operational. But it is significant that the old aeronautical behemoths Europe and Russia have none respective one (PAK-50) stealth fighter in flight test.

Boeing considers single, twin aisle, co-development 757/767 style for next new airplane

Subscription required.

Now open to all Readers.

Introduction

Boeing is looking at a number of scenarios for its New Airplane Study (NAS) that would replace the 757 and 737, have ranges from 4,000nm-5,000nm, and carry as few passengers as 130 or as many as 240.

To cover this broad range of demands could require reverting back to the 1980s when Boeing simultaneously developed two airplanes serving very different missions, the 757 and 767, that shared cockpits and some other common elements.

To cover this broad range of demands could require reverting back to the 1980s when Boeing simultaneously developed two airplanes serving very different missions, the 757 and 767, that shared cockpits and some other common elements.

Boeing faces some hard decisions in the coming years, as Airbus outflanks Boeing in the single-aisle sector with the A320neo family and its latest offering, the A321neoLR. Our analysis and sales figures show the 737 MAX falling further and further behind in market share as MAX 9 lags vis-à-vis the A321neo.

We spoke with Kourosh Hadi, director of product development at Boeing, during a break at a conference last week organized by the British American Business Council-Pacific Northwest, and covered this and a number of other topics.

Summary

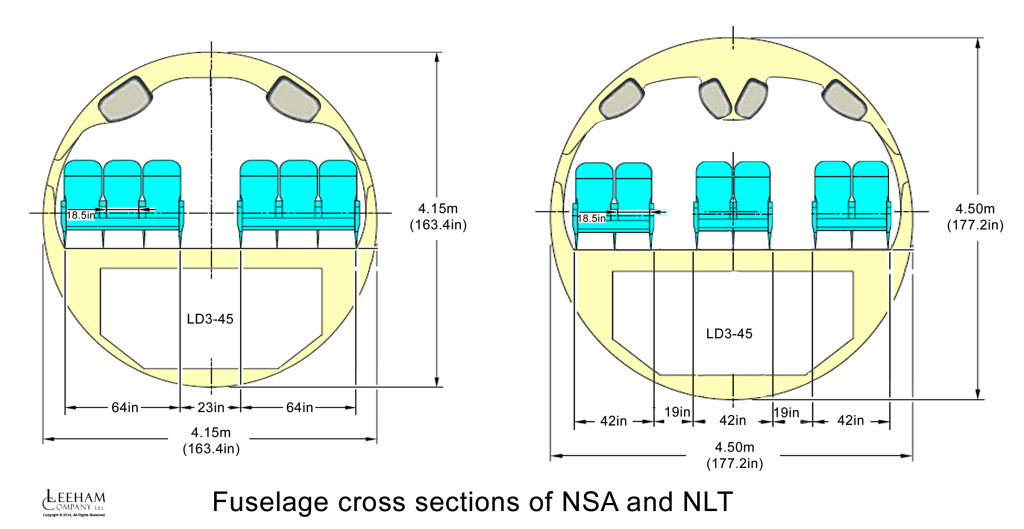

- Boeing is studying a New Light Twin (NLT) and New Single Aisle (NSA) to replace the 757 and 737 airplanes.

- The tipping point between an efficient NSA and the NLT is around the passenger size of the 757-200.

- Boeing is evaluating materials, including metals and composites, for the NAS and the manufacturing process, which will also be a determining factor in the materials for the new airplane.

- Engine advances for the 777X’s GE9X are beyond the GEnx and CFM LEAP of today and could help drive the next new small engine technology.

- Although having a miniscule portion of the 100-150 seat market, Boeing today plans to continue participation in at least the 130 or 150 seat sector even as airplane size moves up every year.

Part 2: Boeing 757: Airbus A321neoLR as a replacement on long and thin routes

Subscription required.

By Bjorn Fehrm

Part 2 of 3

Introduction

In Part 2 of our three-part 757 Replacement analysis, we take a close look at Airbus’ new 97 tonnes take off weight A321neo, revealed by Leeham News and Comment October 21. We call the 97t airplane the A321neoLR (Long Range); Airbus has yet to name the aircraft, which it began showing to airlines last week.

We analyze the A321neoLR’s capabilities and limitations when compared to the aircraft it intends to replace, the Boeing 757-200W. We have chosen to do so using a real airline configuration as opposed to an OEM’s typical seating layout. By comparing the 757-200W and the A321neoLR over the route structure that United Airlines is using the 757 today, we can better see the characteristics of the A321neoLR and what operational consequences the differences between the types would mean for the airlines. Before we start, a short recap of Part 1 about the 757 and its replacement candidates. Here is what we found:

We analyze the A321neoLR’s capabilities and limitations when compared to the aircraft it intends to replace, the Boeing 757-200W. We have chosen to do so using a real airline configuration as opposed to an OEM’s typical seating layout. By comparing the 757-200W and the A321neoLR over the route structure that United Airlines is using the 757 today, we can better see the characteristics of the A321neoLR and what operational consequences the differences between the types would mean for the airlines. Before we start, a short recap of Part 1 about the 757 and its replacement candidates. Here is what we found:

- the seating capacity of the A321 is within 10 seats of the 757-200 in a standard configuration; the 737 MAX9 is trailing with about 20 fewer seats.

- the myth about the strong engines of the 757 is just that, a myth.

- the good field performance of the 757 is coming from its wing more than any advantage on the engine side

- the A321neo and 737 MAX9 were hindered in their capability to replace the 757 for long and thin international routes by characteristics that can be changed. For the A321neo, this may be accomplished with rather modest changes to Max Take Off Weight (MTOW) and tankage. For the 737 MAX9, more elaborate changes to the wing and engines are required, both hard to do.

Figure 1. Boeing 757-200 of British Airways which launched the 757 together with Eastern Airlines 1983. Source: Wikimedia.

Summary, Part 2

- We will now look in detail on the changes Airbus is doing on the A321neoLR, what each change brings and any restrictions that remain.

- We will also detail why we think it will be harder for Boeing to match the A321neoLR with a 737 MAX9 development.

- We detail prime, present 757W long-thin routes.

- We present 757W international, A321neoLR and 737 MAX9 “long range” configurations.

- We provide economic comparisons such as Payload-Range charts and Fuel consumption per trip and per seat diagrams.

In the final Part 3, will look at Boeing’s alternative to an A321neoLR, a clean sheet New Single Aisle (NSA) and a prospective Small Twin Aisle (STA) design and how much such an approach would surpass the A321neoLR on medium and long haul networks and when it could be available.

Part 1–Boeing 757: An analysis of facts and myths

Subscription required.

By Bjorn Fehrm

Part 1 of 3

Introduction

The Boeing 757 was developed in the late 1970s as a replacement for Boeing’s popular 727 mid-range single aisle aircraft. Starting from the smaller 727, it ultimately grew to 180 to 230 seat capacity and US transcontinental range. With initial orders from Eastern Airlines and British Airways, the aircraft nonetheless had poor sales through most of the 1980s, picking up with a surge of orders in 1988-1990 when major deals were announced from American, Delta and United airlines.

Following the 1991 Persian Gulf War and recession, orders plunged until the mid-decade with a respectable resurgence. After 9/11, sales dried up and Boeing terminated the program.

Summary

- The 757 program had slow sales in its first decade, robust sales for a few years then declining sales through most of the 1990s.

- Sales were respectable in the late 1990s but dried up after 9/11.

- Boeing efforts to boost sales with the 757-300 were a failure–only 55 were sold. 757F sales were a moderate success.

- The 757-200 had strong engines for its time (especially the Rolls Royce equipped models), we dissect if this is still true.

- With the 757 being the only narrow-body with trans-Atlantic range, what is missing from today’s Airbus A321 and Boeing 737 MAX9 to make the cut? What can be done with small changes will be answered in part 2.

- How will a future clean sheet NSA perform compared to these three? How much of a game-changer will a clean sheet design be if it enters service 2025? We look at the answers in part 3.

Boeing 737 MAX 8 as a long and thin aircraft and how it fares in general versus Airbus A320neo.

Subscription required.

By Bjorn Fehrm

Introduction

Over the last weeks we have looked at Boeing’s 757 replacement possibilities on its long and thin network niche, including a ground breaking launch interview for the A321neoLR with Airbus Head of Strategy and Marketing, Kiran Rao. In the series we have seen that the A321neo has the potential to replace the 757-200 on long and thin international routes. Boeing’s equivalent single aisle entry, 737 MAX 9, has problems to extend its range over 3,600nm. It is too limited in the weight increase necessary to cover the longer range.

Marketing, Kiran Rao. In the series we have seen that the A321neo has the potential to replace the 757-200 on long and thin international routes. Boeing’s equivalent single aisle entry, 737 MAX 9, has problems to extend its range over 3,600nm. It is too limited in the weight increase necessary to cover the longer range.

Many have asked how the less- restricted Boeing 737 MAX 8 would fare, suitably equipped with the necessary extra tanks. This is the subject of this week’s sequel on the theme long and thin. At the same time we look at Airbus entry in this segment, the A320neo, to see how it stacks up to the 737 MAX 8, both in their normal 1,000 to 2,000nm operation and then also in a long and thin scenario.

Let’s first summarize what we found so far in our four articles around the Boeing 757 and its alternatives:

Summary

Figure 1. Boeing 737 MAX 8 overlaid with Airbus A320neo. Source: Leeham Co.

Read more

4 Comments

Posted on November 9, 2014 by Bjorn Fehrm

Airbus, Airlines, Boeing, CFM, GE Aviation, Leeham Co., Leeham News and Comment, Pratt & Whitney, Premium, Rolls-Royce

737, 737 MAX, 737NG, A320, A320NEO, Airbus, Boeing, CFM, Pratt & Whitney, Rolls-Royce