Leeham News and Analysis

There's more to real news than a news release.

The engine manufacturers worst hit by the pandemic

Subscription Required

By Bjorn Fehrm

Introduction

September 28, 2020, © Leeham News: The worldwide COVID-19 pandemic is shaking the air travel and airliner manufacturing industries like no crisis before.

More than 9/11, the oil crisis of 1973 or 2005 or the financial crisis of 2008. The problems for the airlines and the airframe OEMs are on the front pages of the world’s media.

The part of the airliner industry that is not so visible but is perhaps hardest hit, is the engine industry. Its weird business model amplifies the effects of the crisis.

Summary

- Airframe OEMs lose money on the first hundreds of aircraft produced.

- When they announce “black numbers”, it means the per aircraft losses stop. It doesn’t mean the aircraft program is positive.

- For engine OEMs, it’s worse. They never reach ‘black numbers” on engine production. Their only money makers are old engine programs that fly a lot.

A lost decade for aircraft manufacturers, suppliers

Subscription Required

Now open to all Readers

Introduction

By Judson Rollins, Bjorn Fehrm & Scott Hamilton

Sept. 21, 2020, © Leeham News: Commercial aviation is facing a lost decade due to COVID.

Yes, most forecasts target 2024-2025 as returning to 2019 passenger traffic and aircraft production levels.

However, LNA in July published its own analysis indicating full recovery may not occur until 2028. Breathless headlines notwithstanding, it will take years for vaccines to be widely available and considered safe by enough of the world’s population. Growing concern about vaccine production and distribution capacity through 2024 underscores this view. Even Southwest Airlines CEO Gary Kelly said earlier this month that business travel might not fully return for a decade.

Indeed, the 2020s may well be a lost decade for aircraft manufacturers and their supply chains.

Summary

Summary

- Debt-laden airlines will have little money to order new airplanes

- Interest in re-engined 787, A350 likely nil this decade

- Airbus, Boeing, Embraer have little interest in launching new programs

- Engine makers too financially stretched to develop new designs

- Engineering talent, knowledge will be decimated by inevitable job reductions

- OEMs must “play the long game” at a short-term cost to safeguard their futures

Sunset of the Quads, Part 4.

Subscription Required

By Bjorn Fehrm

Introduction

August 27, 2020, © Leeham News: After presenting Boeing’s and Airbus’ first 300 seater long-range widebodies, the 777-200ER and A340-300 in Part 3, we now fly them both on the route Paris to San Fransisco to understand their economics.

The A340-300 was first on the market, but when the 777-200ER arrived amid changed ETOPS rules, the four holer found the twin a difficult competitor. We use our airliner performance model to understand why.

Summary

- The A340-300 has about the same payload-range performance as the later introduced 777-200ER.

- Its economics is competitive with the 777-200ER, yet sales dried up when the 777-200ER became available. We explain why.

Pontifications: New GE Aviation CEO will face big challenges

June 1, 2020, © Leeham News: The new chief executive officer for GE Aviation (GEA) will face huge challenges when he or she succeeds David Joyce when he retires this year, say industry sources. Joyce was named CEO in 2008.

Like other sectors of commercial aviation, the COVID-19 crisis hit GEA hard.

Initially, the workforce was cut by 10% in March. This was deepened to 25% in May. Non-essential spending was cut. A hiring freeze was implemented and other cost-cutting measures were put in place.

Summary

- Demand for new airplanes tanked. The Boeing 737 MAX, powered by CFM LEAP engines, has been grounded since March 2019. No return to service is in sight. (GE is a 50% partner in CFM International, which makes the LEAP.)

- LEAP engines on the 737 and the competing Airbus A320neo family fall way short of on-wing targets. Shop visits, under warranty, add to GE’s cost basis.

- The Boeing 777-9, powered by the GE9X, is already a year late. A redesign of some critical parts of the engine was required.

- COVID also decimates the engine aftermarket business, which is core to the OEM business model.

Supply chain focus: Safran’ s first 2020 quarter

By Bjorn Fehrm

May 5, 2020, ©. Leeham News: Next out in our COVID19 supply chain focus is Safran Group.

Safran, together with GE Aviation, is the largest supplier of turbofan engines to the World’s airliners. Their success in the CFM joint venture is unprecedented. The first joint engine, the CFM56 has passed 30,000 deliveries, and the follow-up, the CFM LEAP, has 16,000 orders.

At the back of this successful business, Safran has expanded to a major aeronautical supplier for propulsion, systems, and cabins.

Engine OEMs forecast big hit to aftermarket revenue

Subscription Required

Now open to all readers.

By Scott Hamilton

May 5, 2020, © Leeham News: The COVID crisis will damage the aerospace aftermarket in ways that are only beginning to be understood.

As key companies report 1Q earnings, it’s clear that engine aftermarket revenue is going to take a major hit for years to come.

Engine companies like CFM, GE Aviation, Pratt & Whitney and Rolls-Royce, rely on aftermarket sales as the key component of their business plans.

The research and development money that goes into an engine consumes such huge amounts of cash that the OEMs don’t recoup their costs for 10-20 years. The aftermarket for parts, maintenance, repair and overhaul is where they make their profits in the meantime.

But this is seriously threatened by the virus crisis.

“The aftermarket for key programs took 4+ years to return to 2008 levels out of the Great Financial Crisis, and that was with traffic decline at a fraction of the declines today,” Bernstein Research wrote in a May 4 note to clients.

“We’re sick and tired of new technologies:” Avolon CEO

Subscription Required

Introduction

By Scott Hamilton

March 16, 2020, © Leeham News: “I can tell you from our perspective, we’re kind of sick and tired of new, new technology. It’s not proven to be the home run.”

This blunt assessment comes from the chief executive officer of the big aircraft lessor, Avolon.

Domhnal Slattery, the CEO, was giving his critique of whether Boeing should launch a new airplane once the 737 MAX crisis is over.

Boeing was on a path to decide whether to launch the New Midmarket Airplane when the MAX was grounded one year ago this month.

Airbus was waiting for Boeing to move before deciding how to respond.

Summary

- Airbus and Boeing should “stick to their knitting.”

- Focus on incremental improvements for now.

- 2030s to 2050s will be the next big advance in technologies.

Bjorn’s Corner: Why e in ePlane shall stand for environment, Part 3. Open rotor revisited.

January 3, 2020, ©. Leeham News: We continue our series why e in ePlane shall stand for environment and not electric.

Our target is to lower air transport’s environmental footprint and we can achieve this more efficiently by using established technologies. As an example, I will describe a very promising concept that has fallen out of focus due to the hype around everything hybrid and electric.

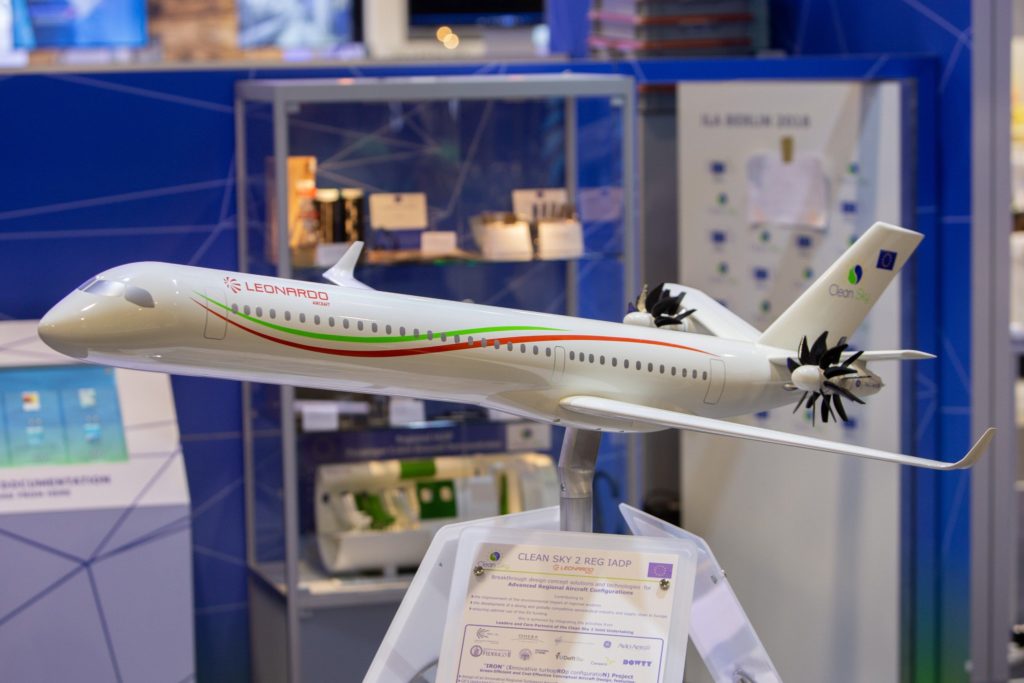

Figure 1. The Clean Sky IRON project aircraft with an Unducted Single Fan (USF) propulsion. Source: Clean Sky.

Read more

Several aircraft programs beset by engine woes

Subscription Required

By Judson Rollins

Nov. 25, 2019, © Leeham News: Nearly every manufacturer of jet engines is experiencing problems with various models, which is causing delays for several prominent Boeing and Airbus programs. The Airbus A220, A320neo, A330neo and Boeing 787, 777X are all experiencing engine-related setbacks.

Summary

- Pratt & Whitney geared turbofan (GTF) operational limitations on A220, A320neo.

- CFM LEAP said to be causing renewed A320neo delivery delays.

- Multiple new airworthiness directives on Trent 1000, 7000.

- GE9x component issues causing delays to first 777X test flight.

A380 service life struggles

Subscription Required

By Vincent Valery

Introduction

Sep. 30, 2019, © Leeham News: It hasn’t been an easy year for the Airbus A380 program since the end of production was announced in February.

Lufthansa announced in March that Airbus would buy back six A380s in 2022/2023 as part of a follow up order for 20 A350-900s. Air France intends to retire its Superjumbo fleet by 2022. Emirates retired two aircraft that were less than seven years old.

A number of factors are leading airlines to prematurely retire their A380s.

Summary

- Small MRO market increases maintenance costs;

- (Prohibitively) expensive cabin refurbishments;

- Operators struggling to operate profitably year-round;

- A lack of secondary market;

- No business case for engine PIPs.