Leeham News and Analysis

There's more to real news than a news release.

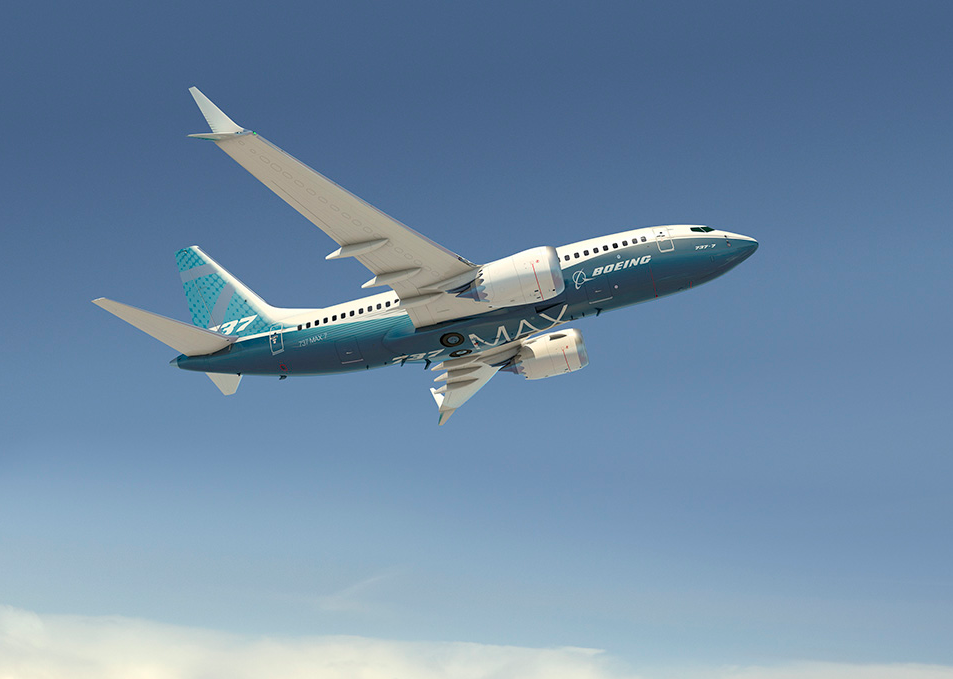

Boeing: Our 737 MAX product range will come to market as planned despite changes

By Bjorn Fehrm

July 13, 2016, ©. Leeham Co, Farnborough Air Show: Mike Delaney, Boeing’s Vice president and General manager for Aircraft development in the Commercial Airplane division, promises unchanged delivery times despite late changes to the company’s 737 MAX line-up.

Delaney went through the changes for the MAX program as part of a larger presentation, outlining the status for all ongoing aircraft developments within Boeing at the ongoing Farnborough Air Show.

AirAsia: More and more congestion for Asian airports

By Bjorn Fehrm

July 13, 2016, ©. Leeham Co, Farnborough Air Show: AirAsia Group Chief Executive Tony Fernandes said yesterday that increased congestion the group has seen for several of the airports AirAsia operates to in the Asian market motivated an order for 100 Airbus A321neos.

“We are slot constrained on several of our destinations and when we can’t get any more slots from an airport, it’s better to take-off with the 50 more passengers that an A321neo offers rather than the 180 seat our standard A320 have,” said Fernandes.

“The congestion has grown to the point where it will no longer be optimal for AirAsia to only operate with our standard-size aircraft, our fleet of 200 A320ceos with 180 seats, which will be gradually replaced in coming years by our order for 304 A320neos with the same seating,” Fernandes said. Read more

Boeing MAX program progresses well

Our coverage of the Farnborough Air Show begins today with an interview with Keith Leverkuhn, VP and GM of the Boeing 737 program. There will be a combination of paywall and freewall posts.

Our coverage of the Farnborough Air Show begins today with an interview with Keith Leverkuhn, VP and GM of the Boeing 737 program. There will be a combination of paywall and freewall posts.

Subscription Required

Introduction

July 10, 2016, © Leeham Co.: Farnborough Air Show: The Boeing 737 MAX flight test

Keith Leverkuhn, VP and GM of the Boeing 737 program. AIN Online photo via Google Images.

program is going well, with the company looking for ways to add improvements to the airplane even before it enters service next year.

Improvements, which include airplane and engine components, are intended to provide dispatch reliability close to the 99.98% of the 737 NG and extend on-wing time for the reliable CFM56 engine that has powered the 737 since introduction of the 737-300 in 1984, says Keith Leverkuhn, VP and GM of the 737 program.

Summary

- Many of the major tests are completed.

- Boeing, CFM see opportunities to insert components into the LEAP-1B during flight testing to extend on-wing time from entry-into-service.

- MAX 7X (or “7.5”) can be done within the “confines” of the current MAX program.

- A larger MAX isn’t ready to go yet.

Mid-Market airplane comes before A320, 737 replacement: Pratt & Whitney exec

Subscription Required

Introduction

June 16, 2016, © Leeham Co.: A middle of the market airplane will come before a replacement for the Airbus A320 and Boeing 737, predicts Alan Epstein, vice

Alan Epstein, VP technology and environment, Pratt & Whitney.

president of technology and the environment for Pratt & Whitney.

“The challenge to the business of the narrow-bodies is the A320s and the 737s are so learned-out that Boeing and Airbus are so efficient at building those airplanes, that their inherent cost is so low, it’s extremely difficult to move into that market,” Epstein said. “Because the learning curve, you need incredibly deep pockets and you’re going to be negative for a long time.

“I think that also applies to Airbus and Boeing,” Epstein said, referring to the prospect of a new single-aisle aircraft.

Summary

- New single aisle airplane would be a “white elephant” for 10 years.

- Engines need to be at least 10% more efficient than today’s GTF and LEAP for a new single-aisle aircraft.

- Middle-Market airplane likely to come first.

Airbus aircraft programs in review

By Bjorn Fehrm in Hamburg

Introduction

May 31, 2016, ©. Leeham Co: Airbus went through a complete review of all their aircraft programs as part of their yearly briefing for media in Hamburg today. A lot was said regarding the status for the different programs by Airbus CEO Farbice Bregier, its COO customers John Leahy and Executive VP Strategy and Marketing Kiran Rao.

The briefing was given against a backdrop of weak orders and deliveries for the first five months of the year. Both Bregier and Leahy said, “This is to be expected, it’s not sustainable that we have Book-to-Bill ratios (orders vs. deliveries) of over 1.5 or even close to two for many consecutive years. We have a backlog of 6,700 aircraft that customers expect us to deliver and they have little appetite to order new aircraft when they can earliest get them by 2021 at the earliest.

“We are now in a period of focus on deliveries and we can expect and be happy with a book to bill ratio of around one for the coming years. The extraordinary backlog also justifies our decision to increase production to 60 units per month for our A320 single aisle program.”

Here follows what was said for each of the programs.

How good is a MAX 7X and why would it replace the original? Part 4

By Bjorn Fehrm

Subscription required

Introduction

May 23, 2016, ©. Leeham Co:In Part 1 to Part 3 of this article series,we looked into the reasons behind that Boeing is considering changing the 737-7 MAX into a slightly larger 737-7X.

When an aircraft gets larger, its operating costs increase, everything else being equal. At the same time, it can take more passengers. This will increase the aircraft’s revenue generating capability, assuming the network can generate the traffic level needed.

To understand the difference in revenue capability for the 7 and 7X we will now develop their Direct Operating Cost (DOC) and compare these with the revenue generation capability of the aircraft. This gives the margin capability and one can establish where the cross over point would be between 737-7 and 7X with respect to margin for the airline.

Summary

- We develop the Direct Operating Costs (DOC) for the 737-7 and -7X.

- We also develop the revenue streams of the aircraft over typical missions.

- When compared, the margin of the aircraft will result and it will be possible to define the extra passenger count needed for the 7X to deliver the same margin as the presently defined 7 MAX.

- We then can establish the revenue upside potential for a 737-7X over the 7.

How good is a MAX 7X and why would it replace the original? Part 3

By Bjorn Fehrm

Subscription required

Introduction

May 16, 2016, ©. Leeham Co: In Part 1 and Part 2 of the article series we have described the rational for Boeing to change the definition of the 737-7 MAX into something that has the working name of 737-7X. This is a 737-7 variant that is based on a shortened 737-8.

In the previous articles we defined a probable size for such a cut down 737-8. The size is determined by economical criteria where the second most dominant cost in an airlines operation, the crewing cost, is the sizing criteria. These costs have a step increase if the aircraft’s seating go beyond 150 seats.

We sized the 737-7X cabin size (and therefore fuselage length) to avoid such cost increases. In this article, we will compare the resulting main data for a 7X to the original 7 and compare their fuel efficiencies.

Summary

- A 737-7X will be a larger and heavier aircraft than the original MAX 7.

- As such it will consume more fuel per mission; its aircraft fuel mile costs will be higher.

- The key comparison for an airline is the fuel consumption per seat mile for its missions. It would be vital that this is lower for a 7X than the presently defined 7.

- We check if this is the case with our proprietary performance model.

How good is a MAX 7X and why would it replace the original? Part 2

By Bjorn Fehrm

Subscription required

Introduction

May 16, 2016, ©. Leeham Co:In Part 1 we described the driving forces behind Boeing’s investigations into changing the definition of the 737 MAX 7.

There are good reasons to make the -7 model larger. The passenger market is moving the average size of the cabins upwards by about 2-3 seats per year. Boeing therefore made the middle model, the -800 and later the MAX 8 larger than the 737-400. It went from 146 seats in two classes to 162 seats.

But the -700 and therefore the MAX 7 stayed the same size as the predecessor, the -300 at 126 seats. As described in our last article, this is not an ideal size. You don’t amortize the cost of the aircraft’s crew over an optimal number of passengers at normal loadfactors and you have a smaller number of very specific 737-7 in your fleet. We now discuss what would be a more competitive definition for a 737 MAX 7.

Summary

- The 737-700 and MAX 7, as presently defined, is sized at 126 seats two class.

- A more competitive sizing would be closer to 150 seats in order to maximize the utilization of the regulatory mandated aircraft crew resources.

- The exact sizing will depend on how many seats the dominant customer, Southwest Airlines, wants to have in its one class economy seating, which uses a generous seat pitch of 31-32 inches.

Airbus Group 1Q 2016 results: Slow start to the year, guidance maintained.

By Bjorn Fehrm

28 April 2016, ©. Leeham Co: Airbus Group has had a slow start to 2016. Deliveries of A320neo, A350 and A400M are slowed by problems with engine and cabin suppliers. Only 127 aircraft were delivered out of a total guidance of 670 deliveries for 2016, a mere 18%. Group 1Q 2016 (1Q 2015) revenue were €12.2b (€12.1b) with EBIT of €501m (€651m), down 23% year on year.

28 April 2016, ©. Leeham Co: Airbus Group has had a slow start to 2016. Deliveries of A320neo, A350 and A400M are slowed by problems with engine and cabin suppliers. Only 127 aircraft were delivered out of a total guidance of 670 deliveries for 2016, a mere 18%. Group 1Q 2016 (1Q 2015) revenue were €12.2b (€12.1b) with EBIT of €501m (€651m), down 23% year on year.

The group expects to recover the shortfall in deliveries during the year and to reach guidance levels for revenue and EBIT, except for the troublesome A400M. This time it’s a engine gearbox item which is the culprit. Airbus CFO, Harald Wilhelm, gave a clear warning during the quarterly conference call: the A400M program “risks a significant charge” during the year.

The financial results for the divisions for the quarter were:

- The commercial aircraft division delivered 125 (134) aircraft with revenues €8,668m (€8,565m) and EBIT €407m (€569m).

- Airbus Helicopters delivered 56 (62) helicopters with revenues €1,158m (€1,285m) and EBIT €33m (€52m).

- Airbus Defence and Space revenues were €2,534m (€2,603m) with EBIT €109m (€90m).

Details of the Airbus Group 1Q 2016 results are below.