Leeham News and Analysis

There's more to real news than a news release.

Leeham News and Analysis

Leeham News and Analysis

- The Boeing 767 Cross Section, Part 1 November 24, 2022

- Movie Review: Devotion November 21, 2022

- China will accelerate development of its commercial aerospace sector November 21, 2022

- Bjorn’s Corner: Sustainable Air Transport. Part 46. eVTOL comparison with helicopter November 18, 2022

- The economics of a 787-9 and A330-900 at eight or nine abreast November 16, 2022

Bombardier to sell Belfast wing factory, dumping key parts of profitable Aerostructures unit

May 2, 2019, © Leeham News: Bombardier today reported its first quarter earnings, which were lower than originally expected by analysts and previewed last week.

But the big news are plans to sell its Belfast, Northern Ireland, wing factory and its aerospace  facility in Morocco.

facility in Morocco.

The Belfast plant produces wings for the Airbus A220 (nee C Series). This plant and the Morocco facility were reorganized previously into an Aerostructures unit that has been profitable.

Bombardier now labels these plants as non-core to its business.

The CRJ program, which is for sale, has been put into a new Bombardier Aviation business unit that includes the business jets.

Posted on May 2, 2019 by Scott Hamilton

Bjorn’s Corner: Time to reassess the safety standards for our airliners

April 26, 2019, ©. Leeham News: In the wake of the 737 MAX crashes the standards to which Boeing and the FAA qualified and approved the 737 MAX MCAS function is questioned.

FAA has called the world’s aviation regulators to a meeting on the 23rd of May to discuss how the revised MCAS function will be approved. But it’s time to discuss more than how the updated MCAS shall pass.

Posted on April 26, 2019 by Bjorn Fehrm

Pontifications: Collins Aerospace resolved to compete for aftermarket services

April 22, 2019, © Leeham News: Moves by Airbus, Boeing and Embraer to increase their shares of aftermarket services are viewed by their own suppliers with a mix of trepidation or resolve, depending on who they are.

For Collins Aerospace, it’s resolve.

It’s also about become more efficient with advanced manufacturing of its parts supplied to the aerospace industry. This reduces costs, lead times and takes advantage of Collins’ own engineers and designs for value-added services to its customers.

I spoke with two officials from Collins at the Aviation Week MRO Americas conference in Atlanta April 9-11.

Posted on April 22, 2019 by Scott Hamilton

Delta Tech Ops 5-year goal to double revenues

#MROAM

April 9, 2019, © Leeham News: Delta Air Lines has the third largest third-party MRO company in North America and aggressively seeks to grow, in sharp contrast to its competitors.

While American and United airlines have limited their own maintenance, repair and overhaul, let alone seek third party business, Delta Tech Ops is a business unit and profit center. Delta CEO Ed Bastian said today that Tech Ops will achieve $1bn in revenues this year and has a goal of $2bn within five years.

Bastian was the lead-off speaker at the Aviation Week MRO Americas conference in Atlanta this week.

Posted on April 9, 2019 by Scott Hamilton

Airbus, Boeing, Bombardier, CFM, CSeries, Delta Air Lines, ET302, Ethiopian Airlines, JT610, Lion Air, Middle of the Market, MOM, New Midmarket Aircraft, NMA, Pratt & Whitney, Rolls-Royce

737 MAX, 737-10, 787, A220, A321NEO, A330neo, Airbus, Aviation Week MRO Americas, Boeing, Bombardier, C Series, Delta Air Lines, Ed Bastian, ET302, Ethiopian Airlines, JT610, Lion Air, New Midmarket Airplane, NMA, Rolls-Royce, Trent

Green aircraft builder may need infusion of greenbacks

Subscription Required

By Bryan Corliss

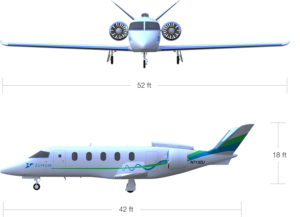

April 4, 2019, © Leeham News: While one Western Washington electric aircraft company is charging forward with battery-powered flight, another may be encountering headwinds.

Zunum, which has announced plans to put a hybrid-electric-powered aircraft into the air before the year’s end, may need a cash infusion if it’s to stick to that time line.

Unlike MagniX – which announced March 26 a deal with Vancouver’s Harbour Air to start putting electric motors into the airline’s existing fleet of seaplanes – Bothell-based Zunum is pursuing a clean-sheet aircraft design.

Summary

- Electric plane builder Zunum plans to fly hybrid test aircraft this year.

- The company says it plans to announce a manufacturing site — or maybe an airframing partner — in 2020.

- Reports say the company needs more investor cash to avoid schedule slips.

Read more

Posted on April 4, 2019 by Bryan Corliss

Pontifications: Boeing NewCo exec, Slattery, faces challenges

- Our Monday paywall will appear at 6am Tuesday, PDT.

March 25, 2019, © Leeham News: Boeing last week announced the executive leadership for the joint venture with Embraer, the as-yet unnamed company that is generically called NewCo.

Separately, Embraer announced the departure at the end of next month of Embraer’s parent CEO, Paulo Cesar, a move that was expected.

Cesar was with Embraer for 22 years in various positions. We was president and CEO of EMB’s Commercial Aviation division and launched the E2 program in 2013.

Posted on March 25, 2019 by Scott Hamilton

Cutting A220 costs is an ‘ongoing exercise’ for Airbus

Subscription required

Introduction

March 14, 2019, © Leeham News: Airbus’ effort to slash supply costs for A220 production is “an ongoing exercise at this point,” Joe Marcheschi, Airbus’ head of procurement in North America, told LNA in an interview last month.

“There are no specific, let’s say, achievements yet,” he said. “We are working closely with our supply chain.”

It takes time to squeeze cost out of the supply chain, he said. “We only took over July 1. That’s when we got full knowledge of the existing contracts.”

In January, Philippe Balducchi, head of the Airbus-led venture overseeing production, told journalists that the aerospace giant aims to realize “significant double-digit” percentage cost reduction. He indicated that most of the savings likely would come from the supply chain, according to news reports.

“Look, the airplane is absolutely fantastic—it just costs a lot of money,” Marcheschi said. “Now, we have to find a way to reduce the cost.”

Summary

- Airbus is working to slash supply chain costs on A220 program, but no announcements yet.

- The European plane maker wants to offer commercial MRO services in North America.

Posted on March 14, 2019 by Scott Hamilton

Pontifications: Delays, design creep, cost overruns–nope, it’s not an airplane program

March 11, 2019, © Leeham News: It’s late. There have been creeping delays. There’s been design creep. There were unknown unknowns. It’s way over budget.

No, it’s not a new airplane program, though the parallels are quite apparent.

It’s our new house.

After a three year process, including changing builders, going through the city twice, hitting expensive unknowns and facing rising costs, today is finally, finally, moving day.

It’s been a horrible experience I wouldn’t wish on anyone.

This will sound familiar to Airbus, Boeing, Bombardier, Mitsubishi, Rolls-Royce, Pratt & Whitney and, to a lesser extent, GE and CFM. Only Embraer can say it finished on time and on budget.

Posted on March 11, 2019 by Scott Hamilton

Pontifications: Which airplanes are revolutionary or evolutionary?

Feb. 18, 2019, © Leeham News: Last week’s column about the revolutionary Boeing 747 prompted some Twitter interaction asking what other commercial airplanes might be considered “revolutionary.”

I have my views. Let’s ask readers.

There are also three polls below the jump in addition to the usual comment section. Polling is open for one week.

Posted on February 18, 2019 by Scott Hamilton

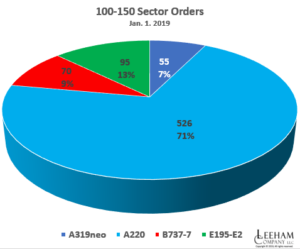

With CSeries, Airbus commands 78% of 100-150 seat sector

Subscription Required

Introduction

Feb. 11, 2019, © Leeham News: Airbus acquired 50.01% of the Bombardier CSeries program last year.

Boeing and Embraer Commercial Aviation received Brazilian government approval last month and now await a nearly-year long regulatory approval process from around the globe.

Based on the announced orders at Jan. 1, Airbus has a 78% share of the 100-150 seat sector following the combinations.

Embraer sold more airplanes in this sector than Boeing: 95 E195-E2s to 70 737-7s.

The former CSeries has 526 orders to 55 for the A319neo.

Summary

- 14% of the A220 orders are classified as “Red” in LNA’s judgment—orders that either should be removed from the backlog or, in one case, is highly questionable due to customer statements.

- Another 11% of the A220 orders are classified as “Yellow,” primarily due to region risk.

- Synergies between A220 and A320 are greater than E2 and 737.

Posted on February 11, 2019 by Scott Hamilton

Email Subscription

Twitter Updates

My TweetsAssociations

Aviation News-Commercial

Commentaries

Companies-Defense

Resources

YouTube

Archives

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008