Leeham News and Analysis

There's more to real news than a news release.

Leeham News and Analysis

Leeham News and Analysis

- The Boeing 767 Cross Section, Part 1 November 24, 2022

- Movie Review: Devotion November 21, 2022

- China will accelerate development of its commercial aerospace sector November 21, 2022

- Bjorn’s Corner: Sustainable Air Transport. Part 46. eVTOL comparison with helicopter November 18, 2022

- The economics of a 787-9 and A330-900 at eight or nine abreast November 16, 2022

Pontification: A320 production challenges may extend to 2022/23

- Update of Boeing 737 NG Pickle Fork cracking issues.

Dec. 2, 2019, © Leeham News: Airbus sees struggles for A320 production continuing throughout next year, into 2021 and spilling into 2022/23 as the Air Space cabin is introduced on the A321XLR.

Executives also see lower margins than the target 15% for the A350 and losses on the A220 continuing into the middle of the next decade.

Even so, profit targets are expected to be met and officials still want to ramp up production rates on the A320.

This mixed picture was presented by Airbus CFO Dominik Asam during series of investors meetings last month in Asia, arranged by Citi Research’s London office.

In a research note issued Nov. 22, Citi summarized the three days of meetings with investors in Australia, New Zealand and Tokyo.

Posted on December 2, 2019 by Scott Hamilton

Can the DHC 8-400 compete with a CRJ550 for the 50 seat Scope Clause market?

By Bjorn Fehrm

Subscription Required

Introduction

November 14, 2019, © Leeham News: The US mainline airlines have large fleets of 50-seater regional jets that are getting old. The present Scope Clause limits on the number of aircraft with seating over 50 seats stop the mainlines from replacing these aircraft with larger aircraft. So there is a real need for an efficient 50 seater regional aircraft for the US market.

As there are no 50 seater jets in production, United is converting its 70 seater CRJ700s to 50 seaters to fill the gap and calls them the CRJ550. This is where de Havilland Canada sees a change for an adapted DHC 8-400 turboprop. It’s more efficient than a CRJ550 while offering the same comfort, says de Havilland. We check if this is correct and what chances a DHC 8-“550” have in this market.

- The US Scope Clauses allow the three mainlines to have more 1,000 50 seater jets, yet no new ones are available to replace the more than 600 in the market.

- The in-production DHC 8-400 would be an alternative when looking at cabin size and dimensions.

Posted on November 14, 2019 by Bjorn Fehrm

Europe’s Regional airlines meet in Antibes, Cotes d’Azur.

By Bjorn Fehrm

October 9, 2018, ©. Leeham News, Antibes France: The European Airlines Association, ERA, gathered 44 of its 51 member airlines in Antibes France, today for the first day of its 2019 General Assembly meeting.

LNA participated in the event for the first time and we found an impressive gathering of airline and airport representatives, aircraft OEMs and support businesses discussing the challenges facing the European regional air transport market.

Posted on October 9, 2019 by Bjorn Fehrm

de Havilland Canada vows to revitalize Q400

Sept. 6, 2019, © Leeham News: Nashville—The new de Havilland Canada (DHC) vowed yesterday to revitalize the former Bombardier Dash 8-400 (Q400), the program DHC acquired effective June 1.

Bombardier is selling off and exiting the commercial aviation sector after a series of  management miscalculations, cost overruns and thee new airplane programs in commercial and business aviation nearly bankrupted the company.

management miscalculations, cost overruns and thee new airplane programs in commercial and business aviation nearly bankrupted the company.

The Q400 was the first complete airplane program to go. The CRJ program sale is next. A majority interest in the C Series jetliner occurred in 2018.

DHC is a subsidiary of Canada’s Longview Aviation. Another subsidiary, Viking Air, acquired all previous Bombardier-de Havilland programs from the Dash 1 through Dash 7 and CL-Series aerial fire-fighting water bombers.

Posted on September 6, 2019 by Scott Hamilton

E195-E2 will lead E-Jet sales, predicts N. American sales exec

Sept. 6, 2019, © Leeham Co., Nashville– Embraer is seeing interest from North American airlines in the E195-E2 despite a requirement that this would have to be operated by US mainline pilots or carriers without restrictions under some labor contract Scope Clauses, a top marketing official said yesterday.

Charlie Hills, VP of Sales and Marketing and based at the company’s US headquarters in Ft. Lauderdale, declined to name names of these airlines expressing interest in the E195-E2.

The remarks were made at the annual Regional Airlines Assoc. conference in Nashville.

But it is known that low-cost carriers Spirit Air, Frontier Airlines and even Southwest Airlines have looked at the airplane. None of these has a Scope Clause in labor contracts.

Legacy carrier United Airlines also has reviewed the airplane, but its level of interest is hard to gauge. It’s restricted by Scope by size, weight, seat count and the number of airplanes it can fly through its regional partners, so the E2 would have to fly mainline. Pilot wages would be a make-or-break issue.

The first E195-E2 will be delivered Sept. 12 to Brazil’s Azul Airlines.

Posted on September 6, 2019 by Scott Hamilton

Bjorn’s Corner: Fly by steel or electrical wire, Part 7.

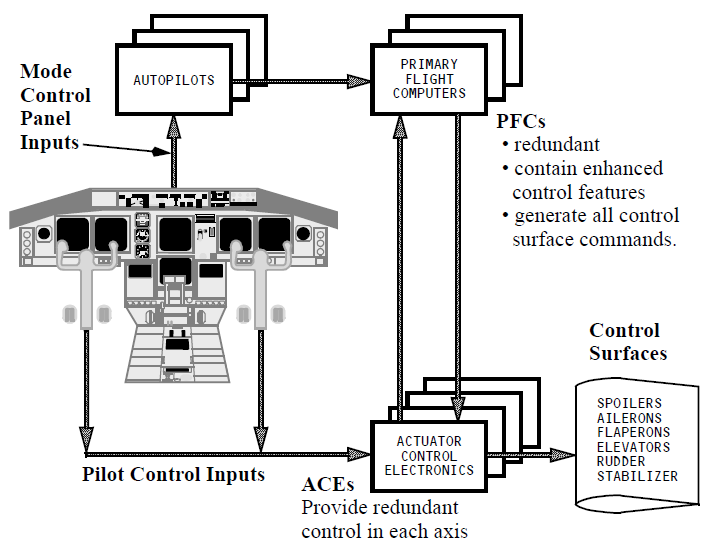

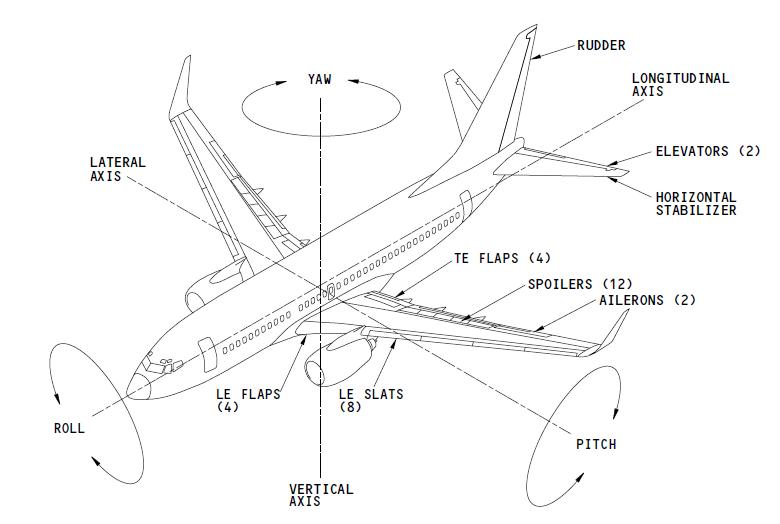

September 6, 2019, ©. Leeham News: In our series about classical flight controls (“fly by steel wire”) and Fly-By-Wire (FBW or “fly by electrical wire”) we discussed the flight control laws which are implemented with classical flight controls compared with the Embraer E-Jet and Airbus A320 FBW systems last week.

Now we describe alternative FBW approaches, analyzing Boeing’s 777/787 system and Airbus’ A220 system.

Posted on September 6, 2019 by Bjorn Fehrm

Mitsubishi lands MOU for up to 100 SpaceJets from USA’s Mesa Air

Sept. 5, 2019, © Leeham News: Nashville—Mitsubishi Aircraft Corp (MITAC) won a large commitment for up to 100 of its new M100 SpaceJet from US regional carrier Mesa Airlines.

The Memorandum of Understanding was announced today at the Regional Airline Assn. annual US conference. The MOU is for 50 firm orders and purchase rights for 50 more. Mesa is a new MITAC customer. Deliveries begin in 2024. Entry into service is planned for 2023.

The M100 is compliant with the US pilot contract Scope Clauses, which (among other things) limit the weight of the airplane and seating configuration.

A Letter of Intent for 15 M100s was announced at the Paris Air Show. This customer has yet to be identified.

Read more

Posted on September 5, 2019 by Scott Hamilton

Pontifications: Embraer sees E175-E2 orders this year outside US

Aug. 26, 2019, © Leeham News: My column July 22 entitled Embraer counts on Boeing heft for E2 sales boost raised a few hackles in Sao Jose dos Campos, headquarters of Embraer.

It wasn’t meant to. Rather, slow sales of the E-Jet E2 this year caught the attention of more than a few in the market, so I thought putting some perspective on the issue was worthwhile.

After all, sales of the Bombardier C Series were slow between the announcement of selling 50.01% of the program and consummation of the deal nearly a year later.

Such is the case with E2 sales pending consummation of the Boeing-Embraer joint venture, which has a target date of closing by year end, I wrote.

Posted on August 26, 2019 by Scott Hamilton

Will the A220 drive the trans-Atlantic fragmentation to smaller jets? Part 2.

By Bjorn Fehrm

Introduction

August 15, 2019, ©. Leeham News: Airbus is increasing the Gross Weight of its A220 variants by 5,000lb from 2H2020. It is to increase the already long range of the aircraft according to Airbus.

We looked at the typical trans-Atlantic routes this longer-range capability enabled last week. Now we explore further route areas and compare the A220 economics to the Boeing 737-8 and Airbus A321LR.

Summary:

- Last week we saw the A220 could open trans-Atlantic routes from West Europe to East Canada and North-East US.

- This week we explore further alternatives and explore the economics of the A220 as an aircraft for long and thin routes.

Posted on August 15, 2019 by Bjorn Fehrm

Bjorn’s Corner: Fly by steel or electrical wire, Part 3

August 9, 2019, ©. Leeham News: In our series about classical flight controls (“fly by steel wire”) and Fly-By-Wire (FBW or “fly by electrical wire”), we this week turn to the actual Flight control system after covering the infrastructure needs last week. We could see the FBW required a higher redundancy Hydraulic and Electrical infrastructure. Why we will come to.

Now we look at the control principles for classical control systems like the Boeing 737 system and FBW system like the Airbus A320 system.

Posted on August 9, 2019 by Bjorn Fehrm

Email Subscription

Twitter Updates

My TweetsAssociations

Aviation News-Commercial

Commentaries

Companies-Defense

Resources

YouTube

Archives

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008