Leeham News and Analysis

There's more to real news than a news release.

Leeham News and Analysis

Leeham News and Analysis

- The Boeing 767 Cross Section, Part 1 November 24, 2022

- Movie Review: Devotion November 21, 2022

- China will accelerate development of its commercial aerospace sector November 21, 2022

- Bjorn’s Corner: Sustainable Air Transport. Part 46. eVTOL comparison with helicopter November 18, 2022

- The economics of a 787-9 and A330-900 at eight or nine abreast November 16, 2022

Countdown to Airbus-CSeries deal: boost needed to backlog

Subscription Required

Introduction

May 28, 2018, © Leeham News: Bombardier and Airbus may clear regulatory approvals next month, allowing for consummation of the latter’s acquisition of 50.01% of the CSeries program.

If all works, this will be well in advance of the Farnborough Air Show that begins July 15. Industry eyes will be on the FAS to see what orders might be announced by Airbus for the CSeries, which reportedly may be renamed the A210 and A230 for the CS100 and CS300 respectively.

Airbus for the CSeries, which reportedly may be renamed the A210 and A230 for the CS100 and CS300 respectively.

As May fades to June, Bombardier has beefed up its skyline quality, but there are some orders that are in doubt, including a big one for 40 airplanes.

Summary

- No sales since Dubai Air Show.

- Airbus-CSeries deal expected to close next month.

- Three questionable orders affect nearly 20% of backlog.

- Farnborough Air Show will be keen to watch for news.

Posted on May 28, 2018 by Scott Hamilton

Airbus, Bombardier, CSeries, Delta Air Lines, E-Jet, Embraer, Farnborough Air Show, Frontier Airlines, Premium, United Airlines

A210, A230, Airbus, Bombardier, CS100, CS300, CSeries, EJet, Embraer, Frontier Airlines, Gulf Air, JetBlue, Odyssey Airlines, Republic Airways, Spirit Airlines, United Airlines

Bjorn’s Corner: Aircraft stability, Part 7

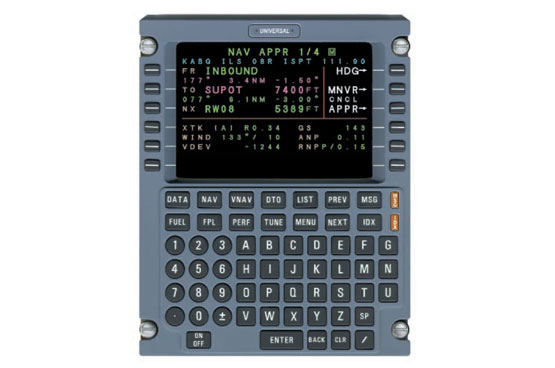

May 25, 2018, ©. Leeham News: In the last Corner we discussed the autopilots one finds in Airliners and high-end Business jets. We looked at how the autopilot was part of the larger Automatic Flight Control System (AFCS) in Bombardier’s CSeries.

To understand how such an advanced system works, we need to go through the different parts of the system and understand their role when the aircraft is flown by the autopilot. We will start with the Flight Management System (FMS) this week.

Posted on May 25, 2018 by Bjorn Fehrm

Embraer skyline has serious challenges

Subscription Required

Introduction

May 21, 2018, © Leeham News: As Boeing and Embraer continue merger discussions for the latter’s commercial airplanes unit, the EJet skyline has some serious challenges.

The only order for the E175-E2 is a conditional sale.

Lessors account for half the orders of the E195-E2 and most of the E190-E2 deals.

Lessors account for half the orders of the E195-E2 and most of the E190-E2 deals.

More than half the orders for the E190-E1 may be canceled.

The data, from the Airfinance Journal Fleet Tracker, is as of April 15 and doesn’t include options, MOUs or LOIs. The firm order from American Airlines, for 15 E175-E1s, announced after this date, has been added by LNC.

Summary

- Slow sales hamper the backlog.

- The E2 hasn’t taken off as expected.

- The E175-E1 remains the staple of the six-member family.

Read more

Bjorn’s Corner: Aircraft stability, Part 6

May 18, 2018, ©. Leeham News: In the last Corner we discussed the autopilots one finds in Turboprops and entry-level Business jets. Our example was the autopilot for the Garmin G1000 integrated flight deck.

Now we will step up to the airliner level. We will look at the autopilot and its supporting avionics for the Bombardier CSeries. This is a modern, state of the art system, and a good example of the autopilots for an Airliner or top of the line Business jet.

Posted on May 18, 2018 by Bjorn Fehrm

Bombardier refocuses the CRJ

By Bjorn Fehrm

Subscription Required

Introduction

May 10, 2018, © Leeham News: American Airlines last week ordered 30 additional regional jets. Of these, 15 were the Embraer E175. No surprise there. It’s the traveler’s favourite and the market leader among US regional jets. But American Airlines also ordered the same number of Bombardier CRJ900. Why? Isn’t it a bit dated?

There are good reasons for this order and Bombardier sees a new spring for the trusted regional. We use our performance model to understand why.

Summary:

Summary:

- The CRJ900 is still a good choice for the US Scope Clause regulated regional jet market.

- Is strong economics makes it a favourite with the airline’s bean counters.

- In addition, it has the longest cabin, enabling large First-class and Premium economy sections.

- With programmed updates, it will be competitive for years to come.

Posted on May 10, 2018 by Bjorn Fehrm

Single-aisle production on track for 1,800/yr

Subscription Required

Introduction

May 7, 2018, © Leeham News: Single aisle airliner production rates are on a track to hit 1,800 per year by 2022, a new analysis by LNC concludes.

This is for aircraft of 100 seats or more. Therefore, this includes the Bombardier CS100 and its competitors the Embraer E190/195 E1/E2 at the smallest end of the 100-240-seat single-aisle markets.

The dominating companies are, of course, Airbus and Boeing. Airbus plans to increase rates of its A320 family next year to 63/mo; Boeing is going to 57/mo for the 737. Both companies are studying increasing rates to 70/mo, a figure LNC believes can be sustained through at least 2025.

Bombardier plans to go to rate 10 for its C Series, a figure that may have been difficult to achieve before BBD sold 50.01% of the program to Airbus. The deal is expected to close before the Farnborough Air Show.

For purposes of this analysis, LNC assumes the deal goes through but for identification carves out C Series as a stand-alone airplane.

COMAC and Irkut are included in the forecast.

Summary

- A320 backlogs extend through the next decade in a greater number than Boeing’s 737.

- 737 backlogs extend through the next decade, but many operators have yet to order the MAX to fully replace retiring 737 NGs.

- Airbus acquisition of control of C Series program gives it a boost.

- Embraer is a niche player in the small end of the market—for now.

- COMAC and Irkut present little near-term threat to Airbus and Boeing.

Pontifications: Boeing case against Airbus at WTO: appeal decision due this month

May 7, 2018, © Leeham News: The World Trade Organization resumes action in the European Union appeal of an adverse ruling in the Airbus illegal subsidies case filed by the US years ago, at Boeing’s behest.

This column appears at the start of the business day in Europe, before the WTO opens its hearing today. By the time the US wakes up in New York for business, today’s hearing will be over. The WTO announced today’s hearing a week ago and initially a decision on the appeal was expected, but it may not come until later this week or next.

Based on history, the WTO will probably affirm earlier decisions that Airbus benefited from illegal subsidies and hasn’t yet cured the violations (ie, repaid the subsidies). Just how sweeping this will be is a matter of speculation.

Throughout the long-running dispute, now in its 14th year, Airbus has been on the losing end of the US complaint at least on some level. The European company has won on some issues and lost on others, but the WTO found that Airbus received subsidies from EU states that violate WTO rules.

The spin from Airbus and Boeing will be along historically predictable lines.

Posted on May 7, 2018 by Scott Hamilton

India’s Spicejet big turnaround

May 2, 2018, © Leeham News: Spicejet, the Indian low-cost airline, in its 2016-2017 Annual Report (to March 31) didn’t mince words or try to parse over its troubled history:

“Back after near shutdown. Restoring confidence. Organisational restructuring. Rising crude prices.Stiff competition. Legacy issues. We were determined to transform.”

These words are on the first page of the Annual Report.

Name another airline that is so up-front, open and candid about its past turmoil.

Posted on May 2, 2018 by Scott Hamilton

Airbus, Airlines, Boeing, Bombardier, India

737, 787, A320, Airbus, India, Indigo Airlines, Jet Aitrways, Spicejet

Airbus investment resets the clock on CSeries

Special to Leeham News

By Olivier Bonnassies

Airfinance Journal

April 17, 2018, (c) Airfinance Journal, Montreal: Aviation Week & Space Technology managing director technology Graham Warwick believe the acquisition of a 50.1% stake into Bombardier’s CSeries will give the program opportunities in many areas.

Talking at the Innovation Aerospace Forum in Montreal, Warwick says Airbus expertise in marketing, sales and support will be “immediate benefits” to the CSeries program.

Warwick recalls that Airbus is into its second iteration of the Airbus A320 program, whilst Bombardier’s CSeries is a new product.

“The CSeries is right at the beginning of its life. It clearly resets the clock for the CSeries and can even have a meaningful impact in the future,” he says.

Bombardier’s CSeries vice president program Rob Dewar says 29 CS100/300s are now in service with three customers: Air Baltic, Swiss and Korean Air.

The Canadian manufacturer continues to be pleased with the introduction into service.

Posted on April 17, 2018 by Scott Hamilton

Airlines need OEM choices: Air Canada

Special to Leeham News

By Olivier Bonnassies

Airfinance Journal

April 16, 2018, (c) Airfinance Journal, Montreal: The commercial aircraft manufacturing industry could head into a scenario with two major alliances: Airbus/Bombardier rivaling Boeing/Embraer, but for Air Canada, airlines need to have choices.

Calin Rovinescu, president of Air Canada. Photo via Google images.

“This is a terrific double-edge sword. Airlines definitively need to have choice,” said Calin Ravinescu, Air Canada president and chief executive officer at the Innovation Aerospace Forum in Montreal.

Ravinescu says the idea of a single source supply is not acceptable for maintenance prospective and from a customer service prospective.

“I am totally against any notion of single sourcing, or any component in any aircraft in any circumstances. Just like our customers, airlines expect competition is the aerospace and the aircraft space.

Posted on April 16, 2018 by Scott Hamilton

Email Subscription

Twitter Updates

My TweetsAssociations

Aviation News-Commercial

Commentaries

Companies-Defense

Resources

YouTube

Archives

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008