Leeham News and Analysis

There's more to real news than a news release.

Pontifications: As customers wait for 787s, some rethink 777-300ERs

Nov. 8, 2021, © Leeham News: Boeing now has passed one year since deliveries were suspended for the 787. There were 105 787s in inventory at Sept. 30. The current build rate is 2/mo.

LNA identified 93 787s that were ordered in 2020 and 2021 that are believed to be parked, leaving 12 unaccounted for.

Among the aircraft in inventory are:

- 11 787-8s destined for American Airlines, which are owned by Boeing Capital Corp.

- 3 for BOC Aviation, which do not have identified customers.

- 9 for Chinese airlines.

- 8 for the always cranky Qatar Airways.

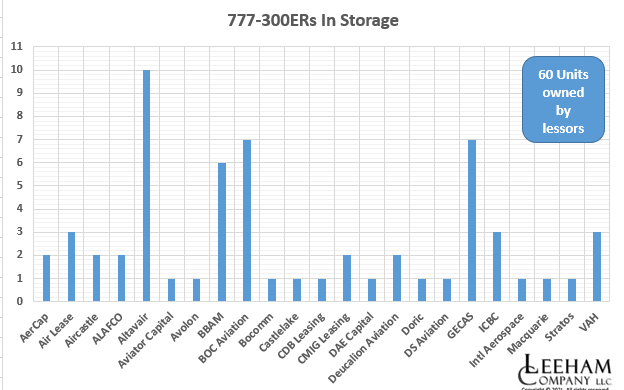

LNA understands that several customers are now looking for substitutions in the Boeing 777-300ER fleet owned by lessors. Of the 116 -300ERs in storage, 60 are owned by lessors. Nearly all are leased to airlines that put the aircraft in storage. But there are some off-lease. The latter includes seven owned by GECAS (now AerCap), which are destined for conversion to freighters via IAI Bedek.

HOTR: Boeing sees travel recovery end of 2024

By the Leeham News Team

Nov. 2, 2021, © Leeham News: Although US domestic passenger traffic seems to be booming, globally air trave l remains well below 2019 levels preceding the 2020 COVID-19 pandemic.

l remains well below 2019 levels preceding the 2020 COVID-19 pandemic.

Boeing sees domestic travel recovering in 2022. But international, widebody traffic won’t recover until the end of 2024, Boeing predicts.

In an appearance last week before the Aerospace Futures Alliance in Seattle, Janene Collins, VP of Contracts & Sourcing Supply Chain, also said Boeing expects a supply chain squeeze is likely to impact plans to increase airplane production rates.

Vaccinations, improving economies drive recovery

Collins said vaccinations and improving economies are accelerating air travel recovery. As vaccinations become more widespread and economies recover, pent-up demand is spurring traffic. However, international border restrictions and proof of vaccinations continue to inhibit travel recovery, however.

Supply chain squeeze

Collins also told the AFA conference that competition for raw materials and labor, especially in the US, is a rising concern. Shipping at US ports is backing up, with hundreds of cargo vessels anchored awaiting labor and truck drivers to unload and ship their freight.

On Boeing’s 3Q2021 earnings call the next day, CEO David Calhoun said, “We’re actively working to ensure the production system, including the supply chain, is stable prior to making decisions to further increase

the production rate. Raw materials, logistics and labor availability will also be key watch items for future rate increases.

“With economic activity picking up, labor availability within our supply chain will be the critical watch item,” Calhoun said.

Snippets from the Boeing earnings call

Other quick facts from the earnings call:

- About one-third (122) of the current 737 MAX inventory of 370 airplanes is destined for China.

- “We have to get better at delivering [737s] out of the completion center our inventoried airplanes,” Calhoun said. (Delivery of MAXes from inventory is taking about twice as long as previously expected, a knowledgeable source tells )

- Boeing will increase the production capacity of the 777F, which currently is about 1.5/mo, due to the demand for freighters. Boeing did not specify the new rate.

Boeing faces cancellations for 787s

Boeing has about 110 787s in inventory, representing the suspension of deliveries since October 2020. LNA understands that one major customer sees as many as half of these aircraft as subject to cancellation before deliveries resume. No date has been set for resumption. But, based on information LNA has obtained as affected airlines look for substitute lift, it may be well into the first quarter of 2022 before Boeing begins clearing this inventory.

Boeing, and airlines, are shopping for available 777-300ERs to provide substitute lift for the grounded 787s. Some airlines seek long-term leases, suggesting cancellations are possible. As the delivery delays pass 9-12 months, customers are able to cancel the aircraft–even if built.

Engine OEMs pushing ahead for next airplane, even as Boeing pauses

Subscription Required

By Scott Hamilton

Nov. 1, 2021, © Leeham News: David Calhoun may not be anywhere near ready to launch the Next Boeing Airplane (NBA), but the engine makers are actively researching and developing engines to hang of whatever that NBA will be.

Calhoun, the CEO of Boeing, repeatedly said the NBA will be more about reducing production costs through advanced design and production methods. For some time, Calhoun said the next engines available on the assumed timeline—to about 2030—will have only 10% better economics than today’s engines.

And 10% isn’t enough for the airlines or the commensurate reduction in emissions.

CFM/GE Aviation/Safran are developing an “open fan” engine that will reduce fuel burn and emissions by 20%. A target date for entry into service is in the 2030 decade. The open fan builds on R&D of open rotors that have been underway since the era of the Boeing 727 and McDonnell Douglas MD-80.

Pratt & Whitney sees an evolution of its Geared Turbofan engine. The GTF was under development for 20 years before an operating engine made it onto the Bombardier C Series (now the Airbus 220), the Airbus A320, and United Aircraft MC-21. The GTF also was selected for the Mitsubishi MRJ90, which launched the GTF program. However, Mitsubishi pulled the plug on the MRJ/SpaceJet program last year. PW remains committed to the GTF for future engines.

Rolls-Royce is developing the Ultra Fan and Advanced engines. GE’s Open Fan and RR’s engines adopt geared turbofan technology pioneered by PW but add new technology.

LNA takes a look at the new engines for the NBA or any other competing airplane in a series of articles.

Boeing and Airbus freighter battle

By Scott Hamilton

Oct. 28, 2021, © Leeham News: Boeing yesterday gave its clearest indication yet that it’s moving closer to launching the 777X Freighter.

In a message to employees in conjunction with its third quarter earnings release Oct. 27, CEO David Calhoun said, “We’re progressing in development across several key franchise defense programs, and on the 737-7, 737-10 and 777X development and certification efforts. We’re also evaluating the timing of a freighter version of the 777X and are beginning to lay the foundation for our next commercial airplane development program.” News reports earlier suggest Boeing may launch the XF at the Dubai Air Show.

On the earnings call, Calhoun was slightly more expansive. “Given the continued robust freighter demand and the compelling economics of the 777X, we are currently evaluating the timing of launching a freighter version of our 777X airplane.”

Single-aisle or Widebody over the Atlantic on thin routes?

Subscription Required

By Bjorn Fehrm

Introduction

October 28, 2021, © Leeham News: The headline seems like a no-brainer. On long thin routes over the Atlantic, we have learned a Boeing 757, or its replacement, the Airbus A321LR, is the right aircraft (as long as it’s within its range).

This was the situation in a pre-pandemic market where freight yields were half of today. The single-aisle has lower operating costs than the widebodies, and if the passenger stream and range fits, it was the transport to have on the route.

With the high cargo prices, does this change? We check for several Atlantic routes.

Summary

- The increased yields for air cargo challenge the mantra; a single aisle is preferred for trans-Atlantic service as long as the passenger number and range fits.

- Going forward it will be all about the cargo prices and the number of passengers to transport.

Update 1: Boeing posts small operating profits, net losses in 3Q and nine months (with CNBC comments)

Oct. 27, 2021, © Leeham News: Boeing reported small operating profits and small net losses for the third quarter and nine months.

The third quarter operating profit was $329m and $1.27bn for the nine months. Boeing lost $401m and $4.7bn for the periods in 2020.

Operating cash flow used in the third quarter declined to $262m and $4.1bn compared with $4.8bn and $14.4bn used in 2020. Additional cash was used for spending on property, plants and equipment. Boeing had $20bn in cash at Sept. 30, down slightly from June 30’s $21.3bn. Consolidated debt declined from $63.6bn at June 30 to $62.4bn at Sept. 30.

HOTR: Lessors warn Airbus

By the Leeham News team

Oct. 26, 2021, © Leeham News: Two mega-lessors warned Airbus against dramatically upping production rates of the A320 family, London’s Financial Times reported Oc t. 23.

t. 23.

“[B]old plans to speed up production are unjustified given still subdued demand from airlines after the coronavirus pandemic,” The Times wrote. Airbus notified suppliers earlier this year to study going to a production rate of 70 aircraft per month by 2025. Rates might go even higher, to 75/mo, Airbus said.

“The chief executives of Avolon and AerCap, wrote to Guillaume Faury, Airbus chief executive, in recent weeks to express their concerns that the aircraft market would not support the most aggressive increases in output rates, according to four people familiar with the situation. A surge in supply of new aircraft, potentially flooding the market, could push down the value of the lessors’ existing fleets. They make their money by renting to airlines,” the paper wrote.

Airbus sees encouraging signs of wide-body demand recovery

Subscription required

By Scott Hamilton

Oct. 25, 2021, © Leeham News: Airbus sees some “encouraging” signs wide-body demand is recovering from the global COVID-19 pandemic.

Passenger demand is nearing-pre-pandemic levels in key areas of the world where single-aisle aircraft are used. Long-haul international demand remains suppressed, however. Some don’t forecast a return to normal for up to two more years. Others forecast a recovery on key routes next year.

Christian Scherer, the chief commercial officer for Airbus, is optimistic.

“I would say that on the wide-body market, you see encouraging signs,” he said during a press gaggle at the IATA AGM Oct. 3-5 in Boston. “Maybe that has to do with the fact that the ecosystem at large is realizing that the best thing they can do in the short- and medium-term, towards that whole global objective of sustainable air transportation is to equip themselves with the most fuel-efficient and therefore eco-friendly airplanes.

“I think that against that backdrop and the opening of more international corridors sees a regained interest on the wide-body side as well. Now it’s lagging the single arch really and there is no scoop here that rates in the long-range airplanes are going to change imminently, but the general sentiment is positive on the wide-bodies as well and that’s really good.”

Air freight demand explosion: a long-term trend?

Subscription Required

By Judson Rollins

Introduction

October 18, 2021, © Leeham News: Much ink has been spilled over the surge in demand that has washed over every corner of the cargo world: air, sea, road, and rail.

Amazon Air’s first parcels being unloaded at Amazon.com’s new Cincinnati (US) sort hub. Source: Amazon.com.

Before the COVID-19 crisis, air transport was reserved primarily for items with high value and/or time sensitivity, such as laptop computers or express documents. And growing competition in the cargo market meant that average yield (revenue per ton-mile) was declining by more than 2% per year, according to past editions of Boeing’s World Air Cargo Forecast.

But now the cost of sea transport has exploded, shifting a significant chunk of cargo from ocean freighters to their airborne equivalents. This is driving some retailers to use air transport. Home Depot, an American home-improvement retailer, is resorting to air freight to bring in smaller, higher-value items like power tools that it needs to keep on the shelves at all times.

Even before COVID-19, a growing share of air freight has come from e-commerce — thereby shifting the volume-to-weight considerations relative to “traditional” freight.

Will these trends continue even beyond the COVID crisis? And what impact will it have on the market for factory-built freighters and passenger-to-freighter (P2F) conversions?

Summary

- Soaring sea freight yields mean small shipments are now more economic by air than sea.

- Volumetric capacity matters more than max gross weight.

- New freighter options will compete with a glut of conversion feedstock.

- Air freight yields will eventually revert to historical trendlines in most regions.