Leeham News and Analysis

There's more to real news than a news release.

Boeing’s Calhoun completes first year as CEO

By the Leeham News Team

Jan. 13, 2021, © Leeham News: Today marks the first anniversary of David Calhoun becoming CEO of The Boeing Co.

Calhoun’s first year faced challenges unprecedented in Boeing’s history. There was the 737 MAX crisis. Sales of the 777X were stagnant. The balance sheet was stressed.

And then COVID exploded, all but destroying commercial passenger demand and with it, ability by airlines to take delivery of new airplanes.

Boeing’s balance sheet went further upside down. Production and quality control problems with the 787 emerged.

Finally, Calhoun was afflicted with a case of foot-in-mouth disease. This contrasted with his calm, well-received initial public face during the waning days of then-CEO Dennis Muilenburg’s stilted public persona.

Boeing to pay $2.5bn to settle criminal charges stemming from 737 MAX crisis

Jan. 7, 2021, © Leeham News: Boeing today agreed to pay $2.5bn to settle criminal charges with the US Department of Justice over the 737 MAX investigation.

The settlement comes in the form of a Deferred Prosecution Agreement (DPA).

In a filing with the Securities and Exchange Commission, Boeing synopsized the agreement:

In a filing with the Securities and Exchange Commission, Boeing synopsized the agreement:

The DPA contemplates that the Company will: (1) make payments totaling $2,513.6 million, which consist of (a) a $243.6 million criminal monetary penalty; (b) $500 million in additional compensation to the heirs and/or beneficiaries of those who died in the Lion Air Flight 610 and Ethiopian Airlines Flight 302 accidents; and (c) $1.77 billion to the Company’s airline customers for harm incurred as a result of the grounding of the 737 MAX, offset in part by payments already made and the remainder satisfied through payments to be made prior to the termination of the DPA; (2) review its compliance program for implementation of continuous improvement efforts; and (3) implement enhanced compliance reporting and internal controls mechanisms. Under the terms of the DPA, the criminal information will be dismissed after three years, provided that the Company fully complies with its obligations under the DPA. Of the payments described above, $1.77 billion has been included in amounts reserved in prior quarters for 737 MAX customer considerations. The Company expects to incur earnings charges equal to the remaining $743.6 million in the fourth quarter of 2020.

However, Dominic Gates of the Seattle Times points out that “Only $243.6 million, less than 10%, is a fine for the criminal conduct. And Boeing must pay an additional $500 million compensation to the MAX crash victim families. However, 70% of the $2.5 billion cited is compensation to airline customers that Boeing has already agreed to pay.”

Outlook 2021: Boeing needs boring, Airbus looks for recovery

Subscription Required

By Scott Hamilton and Vincent Valery

Introduction

Jan. 5, 2021, © Leeham News: What’s in store for Airbus and Boeing this year?

Boeing needs a boring year.

Airbus is clearly better positioned than Boeing.

Airbus is clearly better positioned than Boeing.

Twenty-twenty one is a year of recovery for Boeing. It must dig out from a very deep hole.

Airbus reported that it hit cash break-even in the third quarter. But the company is not out of the woods yet.

Everything depends on something largely out of their control: how quickly the airline industry recovers from the COVID pandemic.

Summary

- Boeing hopes to deliver about half of the 450 stored MAXes this year.

- Low-rate production inches up for the 737.

- Widebody sales dried up for Airbus and Boeing.

HOTR: Alaska Air still have A320neos on order; working with Airbus on best path forward

Dec. 29, 2020, © Leeham News: Stories and headlines shouted that this month’s Boeing order by Alaska Airlines adding 23 orders and 15 options to an existing agreement meant the death knell for the Airbus fleet.

Alaska indeed announced that all the A319s and A320s inherited from its acquisition of Virgin America will leave the fleet by 2024. But 10 Airbus A321neos remain at least through their lease terms in 2029.

The airline now has 68 Boeing 737 MAX 9s on order and 52 on option.

This is exactly as LNA suggested several times: rotate out the smaller Airbuses as leases expire and keep the larger A321neos.

COVID-19 accelerated the retirement of the smaller Airbus family members by a couple of years. But it never made sense to keep them in lieu of the 737-9 once Alaska committed to this plane several years ago.

But what of the old Virgin America order for 30 A320neos? These are still on the books.

Boeing should build 757 replacement in Washington

Commentary

Dec. 22, 2020, © Leeham News: If you get a chance over the next few weeks – in between binge-watching The Queen’s Gambit, putting up the 79 extra feet of Christmas lights you ordered this year and figuring out how to buy surprise Christmas gifts for your spouse when you have a joint Amazon account – you should take 90 minutes to watch this video from our friends at the International Association of Machinists District Lodge 751.

The Machinists on Dec. 8 hosted (on Zoom, of course) a high-level panel discussion about the state of the aerospace industry and Washington state’s role in it, featuring a whole bunch of Brand-Name People Who are Smarter Than Me(c).

They shared their insights for those of us coffee-drinkers who are trying to read the tea leaves to divine what Boeing’s next moves should be as it tries to get back on its feet – and what the implications are for its home state.

The takeaway:

The problems for Boeing are obvious, and the solutions are pretty clear – but doing the smart thing would require a major cultural shift from an executive team that’s locked into a 1990s vision of how business gets done.

- Boeing needs a 757 replacement this decade

- It should get built in Washington state

- There are concrete – and audacious – steps for the state to take

- Can GE alum Calhoun change Boeing’s GE culture?

Senate report reveals FAA retaliation, hostile culture

Subscription Required

By Scott Hamilton

Introduction

Dec. 21, 2020, © Leeham News: The US Senate Commerce, Science and Transportation Committee Friday issued a damning report taking Boeing and the Federal Aviation Administration to task.

A 20-month investigation began in the wake of the two Boeing 737 MAX crashes in October 2018 and March 2019.

The report concluded Boeing inappropriately coached the FAA pilots during recertification simulator training to test fixes to the now-infamous MCAS system.

Details were widely reported last week.

More troubling is the larger picture painted by the Committee of an FAA for years ignoring several US airlines’ safety violations and attempts by FAA inspectors to enforce safety regulations.

Whistleblowers were subject to retaliation, Committee investigators found. The FAA and its parent agency, the Department of Transportation, refused to make FAA employees available for interviews and stonewalled when documents were requested.

The bigger picture of an agency that protects airlines more than the public raises questions of a culture that favors cozy relationships with airlines. Media reports focused on the Boeing-FAA relationship and not the larger issues.

Summary

- Restoring confidence in FAA certification with other regulators.

- US Congress crafts FAA reform bill.

- 777X is next up

- The full report is here: CST FAA Aviation Safety Oversight Report

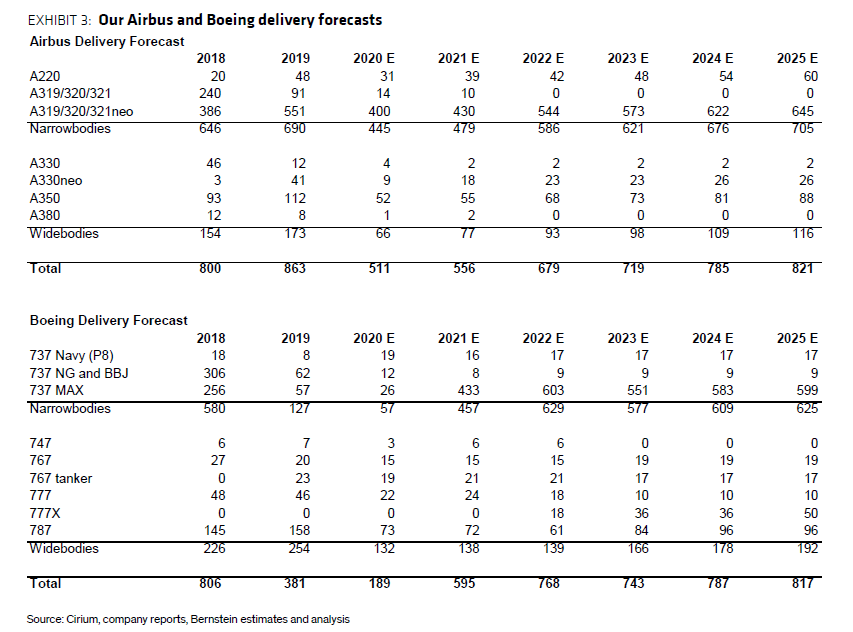

HOTR: Narrowbody delivery recovery in 2025

By the Leeham News Team

Dec. 15, 2020, © Leeham News: “We do not expect Airbus or Boeing to get back to planned narrowbody deliveries (adjust for MAX grounding) before 2025, with widebody deliveries taking much longer.”

That’s the view of Bernstein Research in a note published Dec. 14. It is a pessimistic view that belies the hopes of others in the industry.

Boeing officials said they hope to deliver about half the ~450 stored MAXes in 2021. Most of the remaining stored aircraft will deliver in 2022. There will be some spillover into 2023, Boeing said.

On this basis, Bernstein’s forecast suggests Boeing will deliver about 208 new-production MAXes in 2021. This computes to a production rate of 17/mo. The current rate is 6/mo, according to a Wall Street analyst. A rate break to 10/mo is expected soon.

In 2022, the Bernstein data suggests Boeing will deliver about 378 new-production MAXes. This is a production rate of about 31/mo. Boeing said it hopes to be at rate 31 in “early 2022.”

Pontifications: Don’t lose sight of the future, says top Boeing exec

Dec. 7, 2020, © Leeham News: “It’s really important that we stay in tune with the market dynamics, making the adjustments we need to do and not lose sight of the future. Which is absolutely we are not doing.”

Greg Smith, the of Enterprise Operations and chief financial officer for The Boeing Co., added, “We haven’t lost sight of the importance of making investments that are critical to the future of the business. So, when we think about future product strategy, we’re continuing to reprioritize and streamline our R&D investments to CapEx.

“When we were in pursuit around the NMA, we asked the team to step back and reassess the commercial development strategy and determine what family of aircraft to be needed for the future. And that team continues to work and they’re building off the work that we did on NMA.”

Smith made the remarks at last Friday’s Credit Suisse annual conference.