Leeham News and Analysis

There's more to real news than a news release.

Pontifications: David Joyce fills key void on Boeing’s Board

Sept. 6, 2021, © Leeham News: Last week’s election of David Joyce to the Boeing Board of Directors fills a glaring hole of talent and expertise that’s been missing from the Board for years.

Joyce, an outside director, brings commercial aviation and engineering experience to a Board that has been dominated by political, defense and financial expertise.

Following the two 737 MAX crashes in October 2018 and March 2019, the Board came under criticism—including from LNA—about the lack of technical, commercial, engineering and pilot representation. The 2018 Board had one commercial airline expert, from the executive suite: Lawrence Kellner, the former CEO of Continental Airlines. David Calhoun worked for GE for 26 years for the transportation, aircraft engines, reinsurance, lighting and other GE units. He left GE in 2006. From that point forward, Calhoun focused on finance industries. Dennis Muilenburg, an engineer, came from Boeing’s defense side.

But, as the table below illustrates, the 13-member Board was top-heavy with other disciplines.

Pontifications: Does Embraer’s turboprop design foretell what Boeing needs?

Aug. 23, 2021, © Leeham News: Could Embraer’s new turboprop design have formed the basis for the 100-150 seat Boeing single-aisle aircraft had the joint venture proceeded?

A former Boeing engineer thinks it might have.

The aft-mounted, open rotor engines and the ability to switch later to hydrogen fuel represent the kind of advances Boeing could use to restore its leadership role in commercial aviation.

Under the proposed JV, which Boeing ash-canned in April 2020, Embraer would have been responsible for development of the 100-150 seat aircraft Boeing needs to replace the 737-7 and 737-8.

Pontifications: A deeper hole for the Boeing 737 MAX market share

Aug. 9, 2021, © Leeham News: Boeing’s 737 MAX market share vs Airbus is in a deeper hole than may be generally realized.

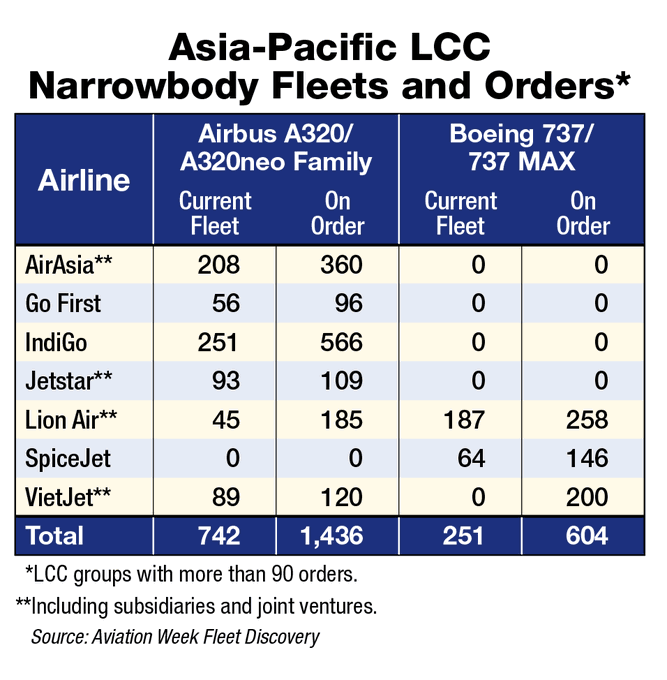

Aviation Week last week complied a list of the top seven low-cost carrier airlines in Asia with orders for 90 or more A320s or 737 family members.

The data illustrates just how deep a hole Boeing is in.

LNA created market-share pie charts based on the numbers above to better illustrate the challenge. It’s not a pretty picture for Boeing.

Pontifications: The reshaped commercial aviation sector

July 12, 2021, © Leeham News: With Washington State and the US open for business following nearly 18 months of COVID-pandemic shut-down, there is a lot of optimism in commercial aviation.

In the US, airline passenger traffic headcounts are matching or exceeding pre-pandemic TSA screening numbers. Airlines are placing orders with Airbus, Boeing and even Embraer in slowly increasing frequency.

The supply chain to these three OEMs looks forward to a return to previous production rates.

It’s great to see and even feel this optimism. But the recovery will nevertheless be a slow if steady incline.

China distorts progress in Boeing 737 MAX return to service

Subscription Required

By Scott Hamilton

Introduction

June 28, 2021, © Leeham News: There are now 265 Boeing 737 MAXes in airline service, according to data reviewed by LNA.

There are 263 MAXes in storage that appear to be previously delivered airplanes. This number is artificially inflated by the 95 MAXes that are grounded in China. China’s regulator hasn’t recertified the MAX, a move widely considered political due to the long-running trade war between the US and China initiated by the Trump Administration.

When the MAX was grounded in March 2019, there were 387 in service. The math indicates 147 MAXes were delivered from inventory or new production since the airplane was recertified by the Federal Aviation Administration in November 2020 and other regulators shortly afterward.

There were 400 MAXes in inventory at the end of the first quarter, down from 425 at the end of the year. Boeing resumed production in the single digits. Boeing does not reveal its rate, but it is believed to be about 10-14/mo going to 16/mo in the third quarter.

In contrast, there are 106 A320neos and 38 A321neos in storage as of last Friday.

Why the MAX isn’t back – yet

Subscription Required

By Judson Rollins

Introduction

April 29, 2021, © Leeham News: Much virtual ink has been spilled in recent weeks over an apparent surge in demand for Boeing’s 737 MAX, as a slow drip-drip-drip of cancellations finally reversed into net new orders.

The Boeing team must be grateful to see a shift toward positive headlines for its single-aisle family. Longtime 737 customers provided badly needed votes of confidence with top-ups to their previous orders.

However, such momentum has been slowed by a continuing wave of cancellations. Boeing logged just 12 net orders in February and 40 in March. More cancellations are due to be announced; Turkish Airlines recently said it would cancel or convert to options 50 of its previous MAX orders, and ch-aviation says a single unidentified customer cancelled another 45 in March. Aeromexico swapped MAX orders for other MAX orders, saving $2bn in the process – a revenue hit for Boeing down the line.

The total backlog, net of orders in doubt under ASC 606, is down from a high of 4,708 to just 3,240 as of this week. This is enough to support average production of just 30 airplanes per month through 2029. Boeing CEO David Calhoun said on yesterday’s earnings call that he remains confident the MAX demand will recover from this point forward.

Summary

- New orders are mostly from large existing MAX customers, and likely include mitigation discounts for delivery delays.

- Boeing has 400 undelivered aircraft in storage, some of which were due for delivery to now-defunct airlines.

- Pricing trends are quite negative, depriving Boeing of badly-needed free cash flow.

Did Airbus miss opportunities with Alaska, Southwest?

Subscription Required

By Scott Hamilton

Introduction

March 22, 2021, © Leeham News: Airbus lost an order from Alaska Airlines, which means the carrier will essentially revert to an all-Boeing fleet.

Alaska Airlines ordered more Boeing 737 MAXes instead of Airbus A321neos. Southwest Airlines appears ready to order the 737-7 MAX instead of Airbus A220-300s. Were these real opportunities? Photo by Boeing.

And despite the apparent high-profile loss of a potential order from Boeing loyalist Southwest Airlines, Airbus is holding its ground in the USA.

Did Airbus miss opportunities to gain ground?

It all depends on how you look at it.

Summary

- Alaska Airlines chose to eliminate the Airbus A319s and A320s inherited with the 2016 acquisition of Virgin America. It’s not going to retain the orders for A320neos. And it passed on ordering more A321neos when it recently placed a follow-on order for Boeing 737-9s.

- It looks all but sure Southwest Airlines will pass on ordering the Airbus A220-300 for its sub-150-seat fleet requirement. Boeing looks poised to win a big order from Southwest for the slow-selling 737-7 MAX.

- Neither outcome, however, was unexpected.

Suppliers remain hunkered down as pandemic recovery may stall

Subscription Required

By Scott Hamilton

Introduction

March 8, 2021, © Leeham News: Aerospace suppliers continue to struggle even as passenger airlines begin to gingerly place new aircraft orders and  Boeing resumes production of the 737 MAX.

Boeing resumes production of the 737 MAX.

Airbus continues to produce the A320, A330 and A350 at lower production rates than the pre-pandemic era. Boeing is at low-rate production for the 737 MAX, after a 20-month grounding. The 777 is down to 2/mo and the 787 goes to 5/mo this month. At least two aerospace analysts on Wall Street think the 787 rate could come down further.

Airbus and Boeing each received a handful of orders so far this year.

But suppliers continue to struggle.

Summary

- Airbus, Boeing continue to extend payments.

- Smaller suppliers seek bankruptcies.

- Larger suppliers remain in “hunker down” mode.

The 737 MAX – A Tragedy 60 years in the Making

This is the first in a series. Special to Leeham News.

By Peter W. Lemme

Twitter satcom_guru

Part 1: Min to the Max

- The Customer is Always Right

- Heredity

- Boeing 757 Misses the Mark

- Where were you when the 737 hit the fan

- Idiot Lights

- Finding a Way

- Equivalent Safety – Flying Qualities

Feb. 2, 2021, © Leeham News: The Boeing 707 entered service in 1958. 60 years later, a Boeing 737 MAX, the model’s fourth generation, crashed into the sea with all lives tragically lost. After, the 737 entered service in 1968, every subsequent 737 model was carefully crafted with the minimum changes necessary to deliver performance and reliability improvements. Differences were discouraged in order to reduce pilot training requirements, holding dear to visible family traits pioneered by the 707.

Figure 1. The Boeing 737 MAX became Boeing’s most controversial commercial aircraft. Its development was 60 years in the making. Source: Boeing.

Changes that jeopardized an amended Federal Aviation Administration Type Certificate were culled. A new type certificate is a costly and lengthy process, with considerable risk.

The 757 should have saved Boeing from endless 737 generations, but the will of the customer changed its trajectory from the start, in the end leaving no mark at all.

The 737-100 was a marvel by fitting the engine tight under the wing, and every generation since has marveled at how to fit the latest engine under the wing.

Every swept wing air transport suffers growing pains, working out issues with flying qualities.

The 737 seems to have diverged from the other Boeing airplanes progressively. Should the 737 MAX’s now-infamous Maneuvering Augmentation Characteristics System (MCAS) implementation have been applied to the stabilizer? Did Boeing have a better choice?

Flying qualities approved “to the letter”, quantitatively, are balanced by qualitative measures, with latitude in judging acceptable performance.