Leeham News and Analysis

There's more to real news than a news release.

Leeham News and Analysis

Leeham News and Analysis

- The Boeing 767 Cross Section, Part 1 November 24, 2022

- Movie Review: Devotion November 21, 2022

- China will accelerate development of its commercial aerospace sector November 21, 2022

- Bjorn’s Corner: Sustainable Air Transport. Part 46. eVTOL comparison with helicopter November 18, 2022

- The economics of a 787-9 and A330-900 at eight or nine abreast November 16, 2022

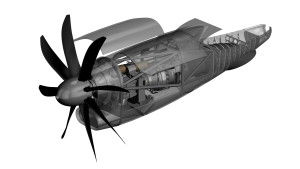

PW Canada continues next-gen turboprop development despite airplane demand uncertainty

March 24, 2016, © Leeham Co.: Pratt & Whitney Canada (PWC) continues development of the next generation turboprop engine, even as low oil prices reduce the attractiveness of turboprop airplanes.

Few believe oil prices won’t creep back up over time, once again making prop-jets attractive once again. The ancillary question is what’s next for this type airplane? An entirely new, clean-sheet design? A 90-100 seat turboprop airplane? Or retrofitting this next-gen engine on today’s turboprop airliners?

Summary

- PWC’s new engine could be fitted to a new airplane design or retrofitted to today’s Bombardier Q400 and ATR series airplanes.

- The 20-year market is small.

- The 20-year market for a 90-seat turboprop is smaller still.

- Embraer is evaluating whether to reenter the turboprop market, 15 years after the last mass-produced Brasilia rolled off the assembly line.

- GE is developing a turboprop engine and at least three countries have interest in this sector.

Posted on March 24, 2016 by Scott Hamilton

Nordic Aviation Capital completes second major acquistion

March 15, 2016: Nordic Aviation Capital yesterday announced it acquired regional aircraft lessor Jetscape Aviation Group. This is the second major acquisition since  December. Then, NAC agreed to acquire 25 ATR turboprop aircraft from Air Lease Corp., which decided to focus entirely on jets, most of which are mainline aircraft. All but a handful of the ATRs were already leased, with the remaining still in production.

December. Then, NAC agreed to acquire 25 ATR turboprop aircraft from Air Lease Corp., which decided to focus entirely on jets, most of which are mainline aircraft. All but a handful of the ATRs were already leased, with the remaining still in production.

Nordic had nearly 250 aircraft from the ATR and Bombardier Dash and Q families, plus a small number of Bombardier CRJs, Airbus A320s and Boeing 737s. The Jetscape acquisition brings Embraer EJets to the Nordic portfolio.

“The deal will see Nordic Aviation Capital expand into the regional jet arena, bringing 28 owned Embraer E-Jets, commitments for 11 E-Jets and a further 18 of the type under management into its sizeable regional aircraft portfolio,” the company said in a press release.

Posted on March 15, 2016 by Scott Hamilton

Bombardier earnings preview

Subscription required

Introduction

Feb. 16, 2016, © Leeham Co.: Bombardier’s fourth quarter and full year 2015 financial results will be reported Wednesday, and we don’t expect the situation to be pretty.

Wednesday, and we don’t expect the situation to be pretty.

Yes, officials will highlight the recent closing of the sale of 30% of the Transportation (Rail) subsidiary.

Yes, the C Series is now on a world tour and appearing at the Singapore Air Show this week.

Yes, the CS100 will enter service in the second quarter.

Yes, the CS300 should be certified, delivered and enter service before the end of this year.

But missing will be any concrete information about new orders.

Summary

- Still no C Series orders since September 2014.

- Bombardier has its hand out for more government aid.

- ATR is making a new push in China and North America, the latter a stronghold for the Q400.

Posted on February 15, 2016 by Scott Hamilton

Pontifications: Bad week for aerospace stocks

Feb. 1, 2016, © Leeham Co. Ouch.

Boeing stock tanked about 10% last Wednesday when the company surprised analysts with unexpected news and below expectations 2016 guidance.

Bombardier became a penny stock.

What the heck happened?

Posted on February 1, 2016 by Scott Hamilton

The turbo-prop conundrum: small market, high costs

ATR Turbo-prop. Photo via Google images.

Subscription Required

Introduction

ATR and Bombardier are incumbents. China has a home-market offering.

Indonesia and India want to create a product.

It’s the 60-seat and up turbo-prop market.

It’s too many companies chasing too-small a market.

Summary

- The 20-year demand for 60-99 seat turbo-props is small.

- Developing a new, clean-sheet design is costly.

- There is a solid demand for an inexpensive 19-34 seat turbo-prop—but nobody is interested.

Posted on November 23, 2015 by Scott Hamilton

Evaluating airliner performance, part 1.

By Bjorn Fehrm

Subscription required.

Introduction

Sep. 21 2015, ©. Leeham Co: Comparing and evaluating operational and economic performance of competing airliners is a complex task that requires analysis of thousands of parameters.

It’s not unknown for smaller airlines to have limited capability to undertake these difficult analyses. Accordingly, they often rely on the Original Equipment Manufacturers (OEMs) for their analysis on behalf of the potential customer.

Unfortunately, the OEM’s have little incentive to provide an unbiased view of either their products nor those of their competitors.

Thorough evaluations require quite some preparations. If these preparations are not carried out correctly, the result can be biased to the extent that the evaluation method dictates which’s the best aircraft and not the most suitability aircraft for the task. We will in a series of articles cover how aircraft evaluations are done and how evaluation pitfalls can be avoided.

Summary:

- Aircraft evaluations are made for all direct operating costs that can be linked directly to the operation of the airliner.

- The costs can be divided in Cash Operating Costs (COC), which covers the operation of the aircraft and capital costs. Combined these costs constitute the Direct Operating Costs, DOC.

- The OEMs produce data for all COC cost items, but they do that in their own way. To make the costs comparable one need to know and understand their assumptions and neutralize these through independent modeling of the costs.

- We describe what these assumptions are and how to neutralize them.

Posted on September 21, 2015 by Bjorn Fehrm

ATR selling their 1,500 ATR turboprop to Japan Airlines.

By Bjorn Fehrm

Introduction

June 15. 2015, C. Leeham Co: ATR said its turboprop product has broken a barrier that was thought impossible for regional turboprops at its Paris Air Show press briefing today. It was a company telling about being in a strong market and enjoying a market leading position. ATR sold its 1500th aircraft to Japan Airlines Commuter (JAC), the regional daughter of Japan Airlines. JAC signed for eight ATR 42 to replace the Saab 340 fleet. JAC also holds options for a further 15 aircraft. The order was the first for ATR aircraft to Japan.

ATR, which is owned 50:50 by Airbus and Finmeccanica of Italy with headquarters in Toulouse, is dominating the under 90 seat worldwide turboprop market. ATR said that it will unveil business for 46 aircraft during the air show with 35 options as it continues to dominate the world market for turboprops which seats up to 90 passengers. ATR claims it has controlled 77% of the market since 2010 to date and that its customer base during that time was 51 customers versus nearest competitor’s 24.

Posted on June 16, 2015 by Bjorn Fehrm

Paris Air Show: Qatar and others

Subscription required.

Introduction

June 1, 2015, c. Leeham Co. It could be called the Qatar Airways Air Show.

Qatar Airways plans to have five airliners on display at the Paris Air Show in two weeks: the Airbus A319, A320, A350, A380 and the Boeing 787. The carrier hasn’t  announced whether it will provide an aerial display as it has at previous air shows, but Qatar may well have more airliners there than Airbus or Boeing.

announced whether it will provide an aerial display as it has at previous air shows, but Qatar may well have more airliners there than Airbus or Boeing.

As for manufacturers other than Airbus and Boeing, we don’t expect anything of consequence from these.

Summary

- Irkut, COMAC, Mitsubishi, Sukoi and ATR are other major aircraft producers that will be at the Paris Air Show.

- Engine makers CFM International, GE Aviation, Rolls-Royce, Pratt & Whitney and Engine Alliance will also be there.

- An update on Airbus expectations.

Posted on June 1, 2015 by Scott Hamilton

Airbus, ATR, Boeing, Bombardier, CFM, Comac, Embraer, Emirates Airlines, Irkut, Mitsubishi, Paris Air Show, Pratt & Whitney, Premium, Qatar Airways, Rolls-Royce, Sukhoi

787, A319, A320, A350, A380, Airbus, ATR, Boeing, CFM, Comac, Emirates Airlines, Engine Alliance, GE Engines, Irkut, Mitsubishi, Paris Air Show, Pratt & Whitney, Qatar Airways, Rolls-Royce, Suhkoi, Tim Clark

Next Gen turboprop R&D continues at Pratt & Whitney

Subscription Required

Introduction

Maria Della Posta, SVP Sales and Marketing, Pratt & Whitney Canada

April 5, 2015, c. Leeham Co. Pratt & Whitney Canada (PWC) continues to develop the next generation turbo prop engine despite little interest from Bombardier for a replacement for its slow-selling Q400 or from Airbus, 50% owner of ATR, dominant producer of this type of aircraft.

Maria Della Posta, SVP of sales and marketing, said PWC is confident demand will prevail over the current lack of interest to see a new airplane program launched as early as 2016 or 2017–though she hedges that this could slip a year or two.

Summary

- In the meantime, PWC continues to undertake Performance Improvement Packages (PIPs) for its ubiquitous PW100 series that is now in its 38th iteration.

- Emerging market ambitions could create new opportunities for PWC to put its next engine on new entrant turbo prop producers.

- Airlines seek a new, larger turbo prop than the Q400 and ATR 72.

Posted on April 5, 2015 by Scott Hamilton

Bombardier changing the message on the Q400 to emphasize flexbility

March 19, 2015: C. Leeham Co. Bombardier’s current challenges don’t end with the CSeries. The company has seen its once-dominate positions in the regional jet and turbo prop markets decline precipitously.

The CRJ struggles in its sales against the Embraer E-Jet. The Q400’s market share of the turbo prop sector has declined to a mere 10% of the backlog vs ATR.

Still, Ross Mitchell, vice president of Business Acquisition and Commercial Aircraft for Bombardier, gave a spirited defense and upbeat outlook of both products during last week’s ISTAT conference in Phoenix. In a one-on-one interview the next day, we posed a series of questions about the CRJ and the Q400. Today’s report is about the Q400. Tomorrow’s will be about the CRJ.

Posted on March 19, 2015 by Scott Hamilton

Email Subscription

Twitter Updates

My TweetsAssociations

Aviation News-Commercial

Commentaries

Companies-Defense

Resources

YouTube

Archives

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008