Leeham News and Analysis

There's more to real news than a news release.

Pontifications: 8-year old A330-300 converted to freighter, reflects weak market

By Scott Hamilton

Sept. 20, 2021, © Leeham News: An 8-year-old Airbus A330-300 was converted recently from passenger to freighter configuration by EFW.

Actually, says EFW’s Wolfgang Schmid, the airplane is not quite eight. It is the youngest A333 to be converted.

I can’t remember an airplane of any type this young being converted from passenger to freighter. The market value of an eight-year-old aircraft is way too high. Operating economics are well within airline requirements at this age. Aircraft historically become conversion candidates no sooner than 15 years of age and more commonly not before 20.

Pontifications: David Joyce fills key void on Boeing’s Board

Sept. 6, 2021, © Leeham News: Last week’s election of David Joyce to the Boeing Board of Directors fills a glaring hole of talent and expertise that’s been missing from the Board for years.

Joyce, an outside director, brings commercial aviation and engineering experience to a Board that has been dominated by political, defense and financial expertise.

Following the two 737 MAX crashes in October 2018 and March 2019, the Board came under criticism—including from LNA—about the lack of technical, commercial, engineering and pilot representation. The 2018 Board had one commercial airline expert, from the executive suite: Lawrence Kellner, the former CEO of Continental Airlines. David Calhoun worked for GE for 26 years for the transportation, aircraft engines, reinsurance, lighting and other GE units. He left GE in 2006. From that point forward, Calhoun focused on finance industries. Dennis Muilenburg, an engineer, came from Boeing’s defense side.

But, as the table below illustrates, the 13-member Board was top-heavy with other disciplines.

Pontifications: Does Embraer’s turboprop design foretell what Boeing needs?

Aug. 23, 2021, © Leeham News: Could Embraer’s new turboprop design have formed the basis for the 100-150 seat Boeing single-aisle aircraft had the joint venture proceeded?

A former Boeing engineer thinks it might have.

The aft-mounted, open rotor engines and the ability to switch later to hydrogen fuel represent the kind of advances Boeing could use to restore its leadership role in commercial aviation.

Under the proposed JV, which Boeing ash-canned in April 2020, Embraer would have been responsible for development of the 100-150 seat aircraft Boeing needs to replace the 737-7 and 737-8.

Pontifications: A330ceo P2F picks up steam

Aug. 16, 2021, © Leeham News: Freighter conversions for the Airbus A330ceo are picking up steam as the inventory jumps following the COVID-19 pandemic.

There are 20 A330s that have been converted: 13 -300s and seven -200s. Package carrier DHL converted eight -300s, the most of any operator. It has contracts to convert 20 more, reports Cargo Facts.

The combined 40 P2Fs exceeds the number of A330-200Fs that was built fresh off the factory line—38.

Most observers consider the new A330-200F program a failure, although this may be a narrow view. While commercial sales were disappointing, the -200F was a companion program to the A330 Multi-Role Tanker Transport. There are so far 61 orders for the MRTT; as of last month, 48 were delivered. Looking at this as one program off the same platform, this means there were 99 orders to date.

Airbus and Lockheed Martin have joined to bid on the US Air Force contract for between 140-160 refueling tankers in the KC-Y competition that begins shortly. Boeing will offer the KC-46A, based on the 767-200ER platform. Lockheed last week announced it will rebrand the MRTT the LMXT.

Pontifications: A deeper hole for the Boeing 737 MAX market share

Aug. 9, 2021, © Leeham News: Boeing’s 737 MAX market share vs Airbus is in a deeper hole than may be generally realized.

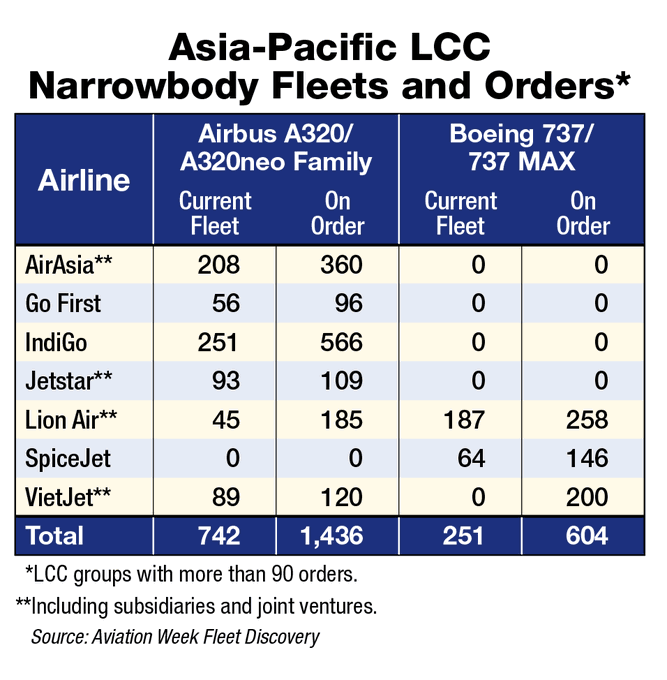

Aviation Week last week complied a list of the top seven low-cost carrier airlines in Asia with orders for 90 or more A320s or 737 family members.

The data illustrates just how deep a hole Boeing is in.

LNA created market-share pie charts based on the numbers above to better illustrate the challenge. It’s not a pretty picture for Boeing.

Pontifications: Biden’s new “Buy American” policy may hit Lockheed Martin-Airbus plans to compete in KC-Y tanker bid

Aug. 2, 2021, © Leeham News: A move by the Biden Administration may have unintended consequences in the KC-Y Bridge Tanker procurement by the US Air Force.

The Bridge Tanker is the Air Force’s second round to replace the aging Boeing KC-135 fleet. Between 140-160 airplanes will be purchased under KC-Y. The Air Force awarded a contract to Boeing in the previous KC-X procurement for 179 tankers based on the 767-200ER platform.

President Joe Biden announced last week that the US will adopt a rule under its Buy American policy that American content must be increased from 55% to 60% immediately and ultimately 75%.

If adopted, the rule appears to all but preclude an expected proposal by a partnership between Lockheed Martin and Airbus (LMA) to offer the KC-330 Multi-Role Tanker Transport (MRTT). This is based on the A330-200 platform.

Lockheed Martin did not respond to a request for comment.

Pontifications: Earnings previews for Boeing, Airbus

July 26, 2021, © Leeham News: Boeing and Airbus report second-quarter/first-half earnings on Wednesday and Thursday, respectively.

Boeing continues to have a rocky year. Although 737 MAX deliveries and production are picking up, 787 deliveries remain suspended. There are now more than 100 787s in inventory, with deliveries largely suspended since October. Production anomalies required rework and inspections combine to suspend deliveries.

The Federal Aviation Administration wants more detail about Boeing’s inspection and rework program. Even though the FAA restored on June 19 to Boeing what’s called “ticketing” authority to certify individual aircraft, the airplanes remain undelivered. The FAA continues to retain ticketing responsibility for the MAX deliveries.

Pontifications: Two re-fleeting campaign give Airbus and Boeing each an edge

July 19, 2021, © Leeham News: There are two re-fleeting campaigns coming up that are significant and in which Airbus and Boeing each have the incumbent advantage.

The successor to Alitalia, Italia Trasporti Aereo (ITA), will restructure with a single aircraft provider. Airfinance Journal reported last week that ITA will begin operations with 52 aircraft: 45 single-aisle airplanes and seven twin-aisle aircraft, drawn from the Alitalia fleet. Another 26 aircraft will be added in 2022.

Airbus is the dominant incumbent aircraft provider. There are 12 Boeing 777 Classics that were with Alitalia.

This competition should be Airbus’s to lose.

Pontifications: The reshaped commercial aviation sector

July 12, 2021, © Leeham News: With Washington State and the US open for business following nearly 18 months of COVID-pandemic shut-down, there is a lot of optimism in commercial aviation.

In the US, airline passenger traffic headcounts are matching or exceeding pre-pandemic TSA screening numbers. Airlines are placing orders with Airbus, Boeing and even Embraer in slowly increasing frequency.

The supply chain to these three OEMs looks forward to a return to previous production rates.

It’s great to see and even feel this optimism. But the recovery will nevertheless be a slow if steady incline.