Leeham News and Analysis

There's more to real news than a news release.

Pontifications: Aircraft prices, rents plunge

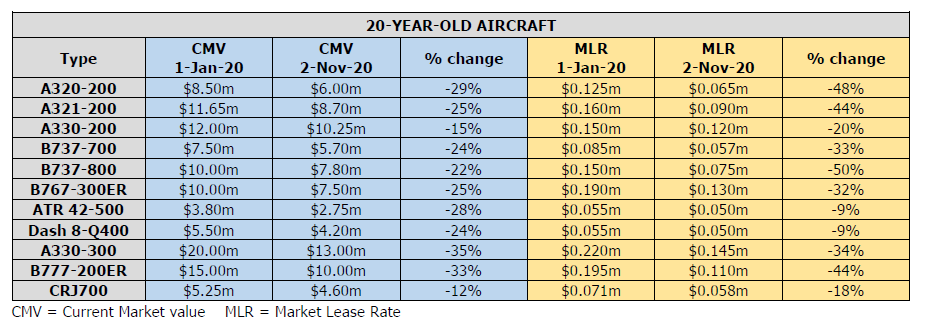

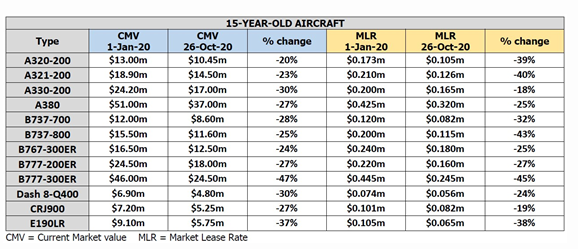

Nov. 9, 2020, © Leeham News: Aircraft prices and lease rates are plunging as the COVID-19 pandemic continues to devastate the airline and manufacturing industries.

The Australian newspaper reports that Rex Airlines will pay A$60k/mo for its ex-Virgin Australia Boeing 737-800s, rising to A$100k after 12 months. This is US$43,600 to US$72,700.

Rex is a small regional airline that is leaping to a jet operator. It committed to take 10 737s.

The article says the airplanes are more than 10 years old.

Compare the rates to the rents listed Nov. 2 by Ishka, the UK-based appraisal and consultancy firm: US$115k/mo for a 15-year-old model.

Virgin’s airplanes date from 2003 to 2018. The oldest leased airplanes date to 2004.

Virgin’s airplanes date from 2003 to 2018. The oldest leased airplanes date to 2004.

It’s not especially surprising that swamped with excess airplanes that lessors will place airplanes for whatever they can get. Lessors are under great pressure to service their own debt.

Even Ishka’s estimates for 20-year old airplanes are higher than the Rex rates.

But the real story is what new airplanes are going for. And the prices are eye-popping low.

Pontifications: Certification timing may push EIS for 777X

Nov. 2, 2020, © Leeham News: Throughout the 737 MAX investigations and recertification process, former Boeing CEO Dennis Muilenburg said there would be no delay on 777X certification.

On Boeing’s earnings call last week, Muilenburg’s successor, David Calhoun, said there could be.

“On the 777X, we continue to work with the regulators on certification work scope, including reflecting the learnings from the 737 cert process,” Calhoun said. “As with any development program, there are inherent risks that can affect schedule. And while we continue to drive toward entry into service in 2022, this timing will ultimately be influenced by certification requirements defined by the regulators.”

Boeing is certifying the 777X under the Changed Product Rule, the same process used for the MAX. Certification is being pursued as a derivative of the 777, a point of scrutiny on the MAX.

Pontifications: Earnings previews Airbus, Boeing; Watching Mitsubishi

Oct. 26, 2020, © Leeham News: It’s earnings call week for Boeing and Airbus.

And Mitsubishi Heavy Industries is said to plan an announcement “freezing” development of the SpaceJet.

Let’s preview these events.

Pontifications: Boeing’s latest forecast raises more doubt than hope

Oct. 12, 2020, © Leeham News: Every year, like clockwork, when Boeing publishes its 20-year Current Market Outlook, there is always another upward revision in forecast demand for new aircraft.

So, when the Chicago-based OEM admits that demand has taken a long-term hit, you know the situation must be dire.

Last week, Boeing belatedly published its annual CMO forecast for global commercial jet production and services. The forecast was quite a comedown as it marked a 2% fall from Boeing’s previous expectations for aircraft demand, with a whopping 10% drop for widebodies and freighters.

Airbus has withheld its 2020 Global Market Forecast while it continues to assess the impact of COVID-19. Read more

Pontifications: Boeing works on green aviation initiatives

Oct. 5, 2020, © Leeham News: Even as Boeing works its way through the final days of the 737 MAX grounding and how to survive the COVID-19 crisis, it’s working on greener aviation.

LNA already reported how Boeing views the prospects of hydrogen, hybrid and electric power. Another article discusses Boeing’s work in disinfecting airplanes to combat COVID.

Here are some other areas Boeing is working on.

Pontifications: Winter is coming

By Vincent Valery

Sept. 28, 2020, © Leeham News: The end of September marks the time when airlines in the Northern Hemisphere assess their summer season financial performance. Depending on the outcome, they adjust their capacity and evaluate their cash needs to see through the lower demand winter months.

This summer was significantly different from what airlines envisioned earlier this year. They had to re-arrange schedules on short notice to capitalize on the uptick in passenger demand after the lifting of some travel restrictions put in place during Spring.

With a resurgent COVID-19 spread in some countries and the re-establishment of movement restrictions, airlines need to, once again, adjust their plans for winter months.

Pontifications: Boeing SC makes its case for 787 production consolidation—and it favors Everett

Sept. 14, 2020, © Leeham News: Boeing’s South Carolina 787 final assembly plant has made its case whether to consolidate production in one location, or not.

The conclusion favors retaining dual assembly lines, retaining one in Everett.

This click-bait lead doesn’t mean Boeing SC management favors retaining dual assembly lines. Far from it.

Pontifications: Boeing in Washington: Here We Go Again

By Bryan Corliss

Sept. 7, 2020, © Leeham News: Stop me if you’ve heard this one: the pundits are saying Boeing is going to leave Puget Sound, leaving behind the hollow husk of a company doomed to wither and die on the vine.

Just like they did in 2003, in 2009, in 2013 and 2016.

Seattle-area political economist and author T.M. Sell, in fact, traces the company’s first threat to leave clear back to the 1920s, when company executives got into a fight with the Seattle City Council over building new roads to connect downtown with the airport we now call Boeing Field.

Boeing said it would pack up and move to southern California, if Seattle didn’t cooperate.

“Like rain in winter, this is a regular feature of the Puget Sound emotional landscape,” Sell opined back in 2009.

Pontifications: WA State frets about Boeing brain drain, but it’s already happening

Aug. 31, 2020, © Leeham News: Elected officials and others in Washington State worry about the “brain drain” as Boeing considers whether to consolidate 787 production from Everett to Charleston.

These people are asleep at the switch and have been for some time. The brain drain is already just around the corner.

Nearly half of the membership of SPEEA, the engineers and technicians union at Boeing, are 50 years or older right now.

Almost two thirds of these are within 55-64 years old. In other words, ready for retirement right now or soon to be.

Pontifications: Did Boeing telegraph its decision in February consolidating 787 production?

Aug. 24, 2020, © Leeham News: Did Boeing telegraph plans to consolidate its 787 production in Charleston last February?

That’s when Boeing announced it asked the Washington Legislature to cancel tax breaks granted in 2003 to locate what was then the only 787 production line, in Washington.

Given subsequent events in which Boeing in July said it will consider consolidating two lines into one, one must wonder if the decision is already made. There’s near unanimous conclusions by outsiders that Everett’s days producing the 787 are numbered.

When Boeing said it asked the Legislature to cancel the tax breaks, officials said it was doing so to comply with a long-ago decision by the World Trade Organization that the breaks were illegal.

The WTO has yet to agree. It’s their call, not Boeing’s whether compliance was achieved.

But what is unequivocally true is that if Boeing moved 787 production out of Washington, those 2003 tax breaks would disappear. Gary Locke, who was governor in 2003 when the Legislature approved them, told me in 2008 this was the case.