Leeham News and Analysis

There's more to real news than a news release.

Leeham News and Analysis

Leeham News and Analysis

- The Boeing 767 Cross Section, Part 1 November 24, 2022

- Movie Review: Devotion November 21, 2022

- China will accelerate development of its commercial aerospace sector November 21, 2022

- Bjorn’s Corner: Sustainable Air Transport. Part 46. eVTOL comparison with helicopter November 18, 2022

- The economics of a 787-9 and A330-900 at eight or nine abreast November 16, 2022

Bombardier woes go beyond CSeries

The news last week that Bombardier reorganized its business units, laid off another 1,800 employees and saw the retirement of Guy Hachey, president and CEO of the aerospace division, was viewed by some media and observers as an indictment of the CSeries program. While it’s certainly true that delays in the program weigh heavily on BBD, the problems don’t stop with CSeries.

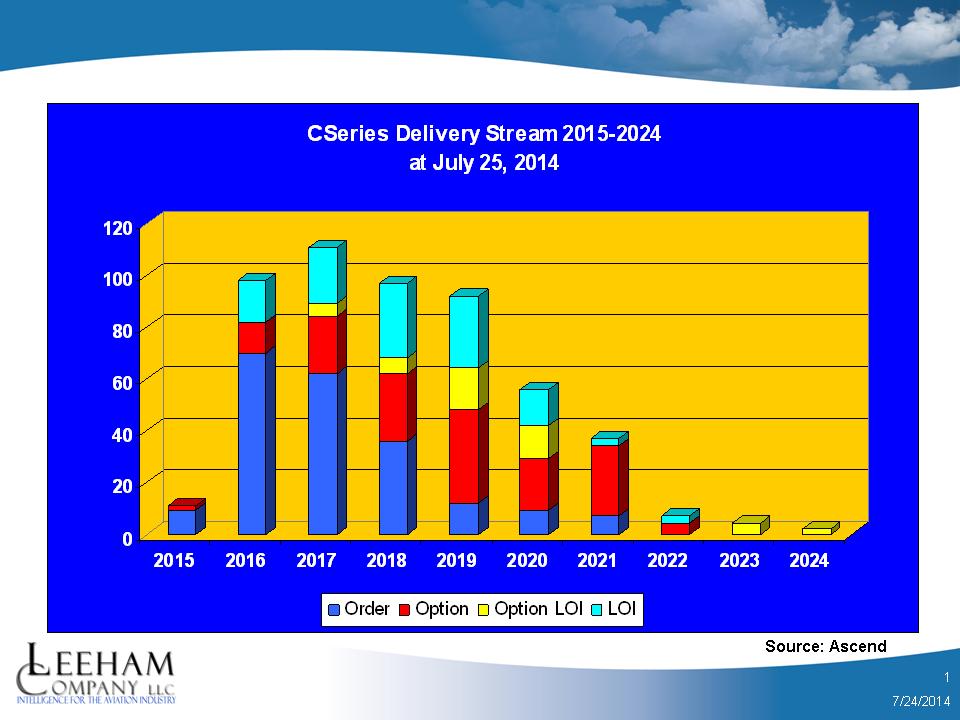

Bombardier has 203 firm orders and 310 commitments for CSeries. This delivery stream doesn’t include any potential rescheduling as a result of the grounding of the Flight Test fleet from May as a result of the engine incident.

Slow sales of the CRJ, Q400 and business jets–as well as program development issues with a new corporate jet–all combined to drag down financial performance and bleed cash. Bombardier doesn’t have the balance sheet strength of Boeing or Airbus, nor strong sales of other airplane family members, to weather the challenges of new airplane development programs.

Posted on July 28, 2014 by Scott Hamilton

Farnborough Air Show, July 17: Orders summary, reflections of the show

Orders continued to trickle in as the Farnborough Air Show winds down (there could be others not listed here).

- Airbus: Transaero, LOI for 12 A330neos and eight A330ceos; Hong Kong Aviation Capital firms up an order for 40 A320neo and 30 A321neo aircraft, announced at the Paris Air Show last year. Here is the Airbus wrap up press release.

- Boeing: Summarizes its performance at FAS with this press release; 201 orders and commitments.

Items of interest:

- Emirates Airlines says it could order 60-80 A380s if Airbus proceeds with a neo.

Overall reflections:

Posted on July 17, 2014 by Scott Hamilton

Farnborough Air Show, July 16: MRJ program analysis

After a long drought of orders or even LOIs and MOUs, the Mitsubishi MRJ program saw some life at this Farnborough Air Show.

Sales of Japan’s first commercial airplane since the propeller-era’s YS-11 stalled with orders from SkyWest Airlines, Trans States Airlines and Japan’s ANA.

But at the FAS, Mitsubishi announced an MOU with Eastern Air Lines, a US start-up carrier, for up to 40 and a much smaller order for six from Air Mandalay.

The Eastern MOU can fairly come under scrutiny if for no other reason than the company is a start-up. Little is known about its financial fund raising and the business model–to begin as a charter airline and transition to a scheduled carrier in the highly competitive US Southeast–doesn’t instill a lot of confidence. EAL, named after the old trunk carrier that went out of business in 1991, has also ordered the Boeing 737-800 after initially announcing plans to begin service with the Airbus A320.

Posted on July 15, 2014 by Scott Hamilton

Farnborough Air Show, July 15: Orders summary

Here are the orders and commitments announced today that we saw–there could be others we haven’t seen:

- Airbus: Avolon (a lessor) ordered 15 A330neos; CIT Aerospace, MOU for 16 A330-900s, five A321neos; SMBC Aviation (lessor), 110 A320neo and five A320ceo aircraft; BOC Aviation, 36 Airbus A320ceo and seven A320neo family 17 of which will be fore the A321 family; AirAsiaX, MOU 50 A330-900s.

- ATR: Air Lease Corp. purchased seven ATR-72-600s.

- Boeing: Intrepid Aviation, 6+4 777-300ERs; Air Lease Corp, six 777-300ERs, 20 737-8s; CIT Aerospace, 10 787-9s.

- Bombardier: One Q400 from Horizon Air; revealed an unidentied customer, Abu Dhabi Aviation, for two Q400s; LOI from Falcon Aviation for five Q400s.

- CFM: Air Lease Corp. ordered the LEAP-1A for 20 A320neo family aircraft.

- Embraer: Azul Air, LOI for 30+20 E-195 E2 (and becomes launch customer for this sub-type); Fuji’s Dream Airlines, 3+3 E-175s, a previously unidentified customer.

- Mitsubishi: six MRJ90s from Air Mandalay.

- Pratt & Whitney: SaudiGulf Airlines orders the V2500 to power four A320ceos; Philippine Airlines executes a previous LOI to a firm order for the GTF for 10 A320neos; BOC Aviation, V2500 for eight of the A320ceo family listed above; International Airlines Group (Vueling Airlines), V2500 for 30 A320ceo family.

- Viking Air: Air Seychelles, two Twin Otters.

Items of note:

- Airbus’ John Leahy says he expects a total of 100 A330neo orders from FAS;

- BOC Aviation endorsed the launch of the A330neo but didn’t (yet) order any.

- Boeing said its new 777X will have a cabin altitude of 6,000 ft, the same as the 787, larger windows than its 777 Classic and the A350; features borrowed from the 787 and many that go beyond the 787 passenger experience; and lower noise.

- Bombardier launched its Q400 Combi, seating 50 passengers and carrying 8,200 lbs of cargo.

- Steven Udvar-Hazy, CEO of Air Lease Corp, which has a large order book for the ATR-72-600, says, the Q400 is a good aircraft, but “much more expensive to operate” vs ATR. [However, that’s at the Q400’s high cruising speed. If it’s throttled back, the operating costs are said by BBD to be comparable.–Editor.]

Posted on July 15, 2014 by Scott Hamilton

Airbus, ATR, Boeing, Bombardier, CFM, Embraer, Mitsubishi, Pratt & Whitney

737-8, 777-300ER, 777X, A320ceo, A320NEO, A321NEO, A330-900neo, A330neo, Airbus, ATR-72, Boeing, Bombardier, CFM, GTF, LEAP-1A, Leap-1B, Mitsubishi, Mitsubishi MRJ, MRJ90, Pratt & Whitney, Pratt & Whitney GTF, Q400, Q400 Combi, Twin Otter, Viking Aircraft

Farnborough Air Show, July 15: WA State and Mitsubishi; PW GTF issue revealed, finally;

The news that Mitsubishi will stage flight testing for its new MRJ 90-seat jet program at Moses Lake (WA) is, parochially, good news. And it is exactly the type of non-industrial aerospace business that we’ve been advocating for Washington since our consulting days to the State Department of Commerce in 2010, and during our tenure as a member of the Board of Directors for the Pacific Northwest Aerospace Alliance (PNAA) for three years (2010-2013).

Washington, understandably, has been married to, and focused on, industrial aerospace. Boeing is here, of course. The supply based the supports Boeing has a huge footprint in Washington. But industrial business is highly capital-intensive, and winning this business is highly competitive.

Posted on July 15, 2014 by Scott Hamilton

Airbus, Boeing, Bombardier, CSeries, Embraer, Farnborough Air Show, Mitsubishi, Pratt & Whitney

777-9, 777X, Airbus, Beyond Boeing, Boeing, Bombardier, CSeries, Embraer, Farnborough Air Show, Gov. Christine Gregoire, Gov. Jay Inslee, GTF, Japan Air Lines, Jim McNerney, Mitsubishi, Mitsubishi MRJ, Pratt & Whitney, Pratt & Whitney GTF, Space Shuttle

Farnborough Air Show, July 14: Orders Summary

Here are orders that were announced on the first official day of the Farnborough Air Show (at least the ones we’ve seen from Seattle–feel free to add to the list if we’ve missed any):

- Airbus: from Air Lease Corp: 25 A330neos and 60 A321neos. British Airways converts 20 A320neo options to firm orders; 20 A320neos from AerCap.

- ATR: NAC places firm order for 75 ATR 42-600s.

- Boeing: Announced what had been leaked before the show–30 737-8s from Monarch Airlines, an important “flip” from incumbent Airbus; six 737 MAX 8s and four Next-Generation 737-800s from Okay Airlines; six 787-9 Dreamliners and five additional 737 MAX 9 from lessor Avolon.

- Bombardier signed LOIs with: Chinese airline Loong Air for 20 CS100s; Petra Airlines of Jordon for two CS100s and two CS300s; and it converted a previously announced LOI for Falcon Air of Abu Dhabi for two CS300s to a firm order. BBD also revealed a previously unidentified follow-on order for three CS300s from Air Baltic. This was announced at the Singapore Air Show.

- CFM International won the large engine order from American Airlines to power its A319neo/A321neo fleet. We reported June 19 that this deal would come down to commercial terms, according to American CFO Derek Kerr. Given CFM’s position on the Boeing 737-800, 737-8 and Airbus A319ceo; and GE Aviation’s presence on AA’s widebody fleet, plus whatever maintenance agreements also exist, CFM/GE was in a position to offer commercial terms that Pratt & Whitney could not when offering the GTF. Also as previously noted, CFM won the easyJet A320neo family order for 270 engines.

- Embraer: 50 “reconfirmable” and 50 options for the E-175-E2 from Trans States Airlines of the USA.

- Mitsubishi: Eastern Airlines signed an MOU for 20 firm and 20 purchase rights for this MRJ90. Parenthetically, we’re happy that Mitsubishi also announced it will test the MRJ in Moses Lake (WA).

- Pratt & Whitney won the GTF order for VivaAerobus’s 40+40 A320 fleet and the V2500 for 12 A320ceos.

Things of note:

- Airbus predicts sales of 1,000 A330neos, plans two year overlap in production of A330ceo. EIS 4Q2017.

The sniping between Airbus and Boeing continues:

- “The only way a passenger will know he’s not on a 787 is that the seats will be bigger,” says John Leahy of the A330neo vs the Boeing 787. Leahy gives good quote.

- Ray Conner, CEO of Boeing Commercial Airplanes, calls the A330 an airplane of the 1980s. (Careful, Ray: the 737 MAX and the 747-8 are airplanes of the 1960s….)

Posted on July 14, 2014 by Scott Hamilton

Farnborough Air Show preview

The Farnborough Air Show is just around the corner, and we don’t expect the event to be especially newsworthy.

Here are our expectations for the show:

Airbus

Market expectations are that Airbus will launch the A330neo at the air show, and we know John Leahy, COO of Customers, would like to do so at this event. His bosses, Fabrice Bregier and Tom Enders, have been less than encouraging that this announcement could come at the show.

Although news stories last week indicated Airbus’ board may green light the program in advance of the FAS, it was nonetheless reported that a formal public launch may not be made at the show. So what might happen? An “Authority to Offer,” or ATO, might be how Airbus proceeds. We don’t think there will be firm orders ready to go when the FAS begins July 14—although certainly Airbus could also take Boeing’s 777X approach and announce “commitments” as was done at the Dubai Air Show.

We are skeptical whether there might be any A330 Classic orders announced, as customers await the neo. We certainly expect the usual orders for the A320 Family. We expect A350 orders. We’re doubtful of A380 orders.

Posted on July 7, 2014 by Scott Hamilton

Lessors analyze market conditions in commercial aviation at ISTAT

The final presentation at ISTAT was the popular lessors’ panel, a free-wheeling discussion of commercial aviation issues. The reporting summarizes and paraphrases the comments.

The moderator is Jeff Knittel, president of CIT Aerospace.

The lessors are:

Angus Kelly, CEO of AerCap

Mark Lapidus, CEO of Amedeo

Norman Liu, CEO of GECAS

Raymond Sisson, CEO of AWAS

Steven Udvar-Hazy, CEO of Air Lease Corp

Knittle: when we were sitting here 10-15 years ago, the six lessors sitting here would largely represent the leasing industry. Now there are 20 or so in China, more elsewhere. The market is fragmentized.

Hazy: The newcomers don’t have the relationships or experience in buying in bulk even though they are capitalized but they have a long way to go.

Lapidus (a new lessor) says people are learning pretty quickly how to do business. (Amedeo is the former Doric Leasing, which finances Airbus A380s.)

Kelly: Although the names on the door have changed, the people running them really haven’t changed. New capital is coming in because there is greater return on capital than in other areas. They want to come in because they see this attraction but they want to do so on a smaller basis. The number of true global lessors hasn’t changed all that much.

Posted on March 18, 2014 by Scott Hamilton

The case for an NSA in 2025 — successor to 737-8 MAX — (continued)

Editor’s Note: Given the amount of interest in the prospect of replacements for the single-aisle airplanes, including the Boeing 757, our Guest Columnist provided a follow-up think piece.

By James Krebs

With the reengined Boeing 737 MAX and Airbus A320 neo families selling like gangbusters, it may seem premature, before one even flies, to be considering a New Small Airplane (NSA) successor to enter service beginning in 2025. But I’m convinced the NSA will come before conventional wisdom expects. The marketplace will demand them.

A combination of market forces could make a compelling case for a NSA in service in 2025.

– Continuing high fuel prices

– Increasing urgency to reduce aviation carbon emissions

– Availability of technology for 20% fuel savings vs 737-8 max and A320 neo (at same seat number) at acceptable risk

– Traffic growth calling for more seats for 2025 and beyond.

– Growing pressure from the airlines later in this decade for cleaner, more economical short haul NSA’s

– Huge global market potential for NSA families — with their performance improved through the years

– A short haul market share by 2017-18 (neo’s and MAX in service) very disappointing to Boeing.

Posted on February 25, 2014 by Scott Hamilton

Odds and Ends: LEAP vs GTF; CSeries flight testing; MRJ FAL

LEAP vs GTF: Reuters has a story looking at the intense competition between CFM and Pratt & Whitney for the market dominance of the LEAP vs Geared Turbo Fan engines.

The only airplane where there is competition is on the Airbus A320neo family; CFM is exclusive on the Boeing 737 MAX and COMAC C919 and PW is exclusive on the Bombardier CSeries, Embraer E-Jet E2 and Mitsubishi MRJ. PW shares the platform of the Irkut MC-21 with a Russian engine. PW says it has sold more than 5,000 GTFs across the platforms. CFM has sold more than 6,000 across the three models it powers.

On the A320neo family, the competition is 50-50 at this point, with a large number of customers yet to decide on an engine choice. However, 60 A320neos (120 engines) ordered by lessor GECAS never were in contested (GECAS buys exclusively from CFM) and 80 A319/320neos from Republic Airways Holdings (160 engines) were part of a financial rescue package for then-ailing Frontier Airlines.

PW’s joint venture partner, International Aero Engines, shares the A320ceo family platform with CFM. Late to the market, IAE caught up to CFM in recent years.

On platforms where they compete, the sales figures so far show a neck-and-neck competition between CFM and PW.

Update, 12:30: The link has been fixed. Update, 9:30 am PST: Flight Global has this story reporting that PW plans a Performance Improvement Package on the GTF that will further cut fuel consumption by 3%.

CSeries flight testing: Bombardier’s CSeries flight testing has been slow to this point, but it’s beginning to ramp up. Aviation Week reports that FTV 3 should be in the air by the end of this month and FTV 4 should follow in April. FTV 3 is the avionics airplane and FTV 4 focuses on GTF engine testing.

Mitsubishi MRJ: Aviation Week also reports that the Mitsubishi MRJ airplane #1 is nearing final assembly.

Posted on February 18, 2014 by Scott Hamilton

Airbus, Boeing, Bombardier, CFM, Comac, CSeries, Embraer, Irkut, Mitsubishi, Pratt & Whitney

737MAX, A320NEO, Airbus, Boeing, Bombardier, CFM, CFM International, Comac, CSeries, E-Jet E2, Embraer, Geared Turbo Fan, GTF, International Aero Engines, Irkut, LEAP, MC-21, Mitsubishi, Mitsubishi MRJ, MRJ, Pratt & Whitney

Email Subscription

Twitter Updates

My TweetsAssociations

Aviation News-Commercial

Commentaries

Companies-Defense

Resources

YouTube

Archives

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008