Leeham News and Analysis

There's more to real news than a news release.

HOTR: Boeing warns of forward losses on 787, 777X programs

By the Leeham News Staff

Aug. 5, 2020, © Leeham News: In another demonstration of the negative impact of the COVID-19 crisis, Boeing warned that two flagship airplane programs could face forward losses.

Neither the 787 nor the 777X are in forward loss positions yet. A forward loss means Boeing won’t make money on the program.

Despite the 787 incurring more than $30bn in deferred costs, Boeing hasn’t taken a write down. The deferred costs have been burning off since 2015. Other programs have been subjected to forward losses, including the 747-8, VC-25 (Air Force One) and the KC-46A tanker.

But with the production reduction of the 787, down to 6/mo in 2021, Boeing now says there is a risk to a forward loss.

HOTR: NOK Air, 3 more bite the dust in COVID fall-out

By the Leeham News Staff

July 31, 2020, © Leeham News: NOK Air of Thailand is the latest carrier to filed for bankruptcy.

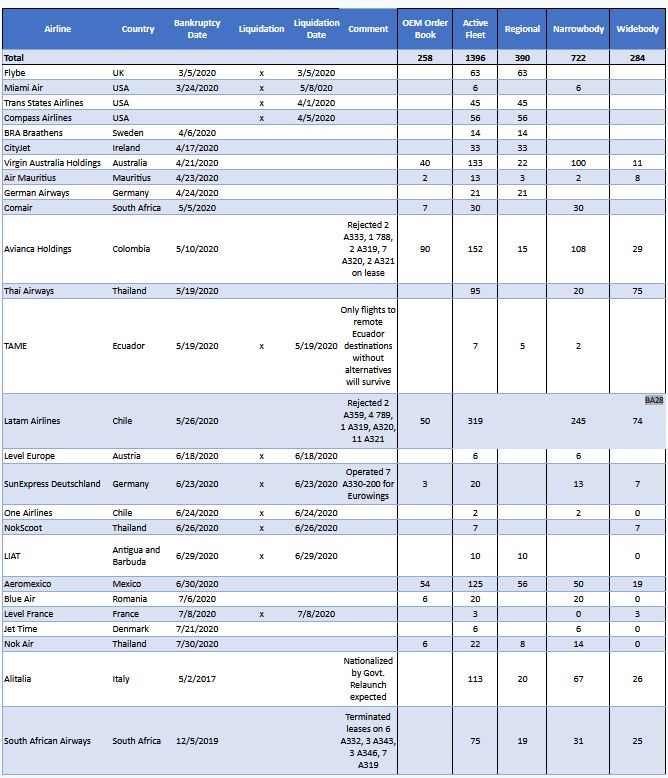

LNA’s monthly tracking of failed carriers adds NOK, Jet Time, Level and Blue Air to the list of carriers in bankruptcy since COVID collapsed the global airline industry beginning in mid-March.

HOTR: Norwegian claims $1bn+ in damages from Boeing

HOTR072120

By the Leeham News staff

July 21, 2020, © Leeham News: Norwegian Air Shuttle said June 30 it canceled orders for 92 Boeing 737 MAXes and five 787s.

The orders still appear on Boeing’s Unfilled Orders website, which is updated monthly.

In a lawsuit filed June 20 in Cook County Circuit Court (Chicago), NAS claimed breach of contract for failure to deliver the MAXes due to grounding. It claims breach of contract for failure to delivery 787s due to the long-running issues with the Rolls-Royce engines.

HOTR: American’s threat to Boeing: no MAXes without financing

By the Leeham News staff

July 14, 2020, © Leeham News: Last week’s news that American Airlines told Boeing it won’t take delivery of 17 new 737 MAX-8s unless it can get financing isn’t a surprise for those in the know.

This could be a bit of negotiating in the press.

When MAX was grounded, AA had lined up Japanese financing for its next round of deliveries. The lease rate was said to be in the vicinity of 0.52%, a number that is unconfirmed. But it was a very inexpensive lease rate. Over the course of the balance of 2019, the financing expired.

HOTR: Second hand 787-8 market to be tested

By the Leeham News Staff

July 10, 2020, (c) 2020, Leeham News: A few months ago, Qantas announced that it intended to sell three Jetstar-operated Boeing 787-8s that would become surplus once the airline received its first A321-LRs. In the aftermath of the COVID-19 outbreak, Avianca rejected one 787-8 lease and Royal Air Maroc intends to sell four of them.

Four 787-8 operators (Aeromexico, Avianca, Latam Airlines, and Thai Airways) with a total of 38 aircraft in service filed for Chapter 11 or are in administration. This represents around 11% of the 374 787-8s delivered so far.

After years of high 787-8 production rates, Boeing is reluctant to sell the type. It has less production commonality than the 787-9 and 787-10 have between them and sales margins are lower. As a result, airlines do not place many new orders for the variant because they think other aircraft are more attractive investments.

HOTR: Aircraft lease rates, values continue to plunge in virus environment

By the Leeham News Staff

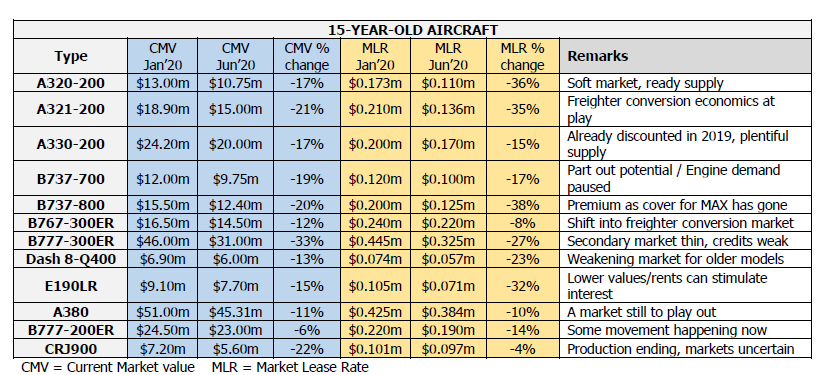

June 30, 2020, © Leeham News: Fifteen year old aircraft values and leases plunged compared with six month ago, according to the latest analysis  by Ishka.

by Ishka.

Ishka is an aircraft appraisal and consultancy.

The aircraft are assumed off lease and immediately available. Mid-life maintenance status is also assumed. Rates and values will continue to decline, Ishka believes. Aircraft on-lease have higher values and lease rates.

HOTR: Boeing still sees MAX 3Q recertification

By the Leeham News staff

June 10, 2020, © Leeham News: Despite COVID slowdowns, Boeing still expects recertification of the 737 MAX in the third quarter, say people familiar with the situation.

Whether this timetable proves out remains to be seen. But this is the schedule Boeing continues to work toward.

The two key regulators are the Federal Aviation Administration and Europe’s EASA. Other regulators are expected to follow their leads.

Concurrent recertification as conventionally thought of—recertification and everyone authorizes a return to service at the same time—isn’t realistic. After EASA recertifies the airplane, the member states’ own regulators must step up and formally do so. This may take a couple of weeks.

China’s CAAC was the first regulator to ground the airplane. It has its own process. There isn’t a reciprocity agreement with the FAA in place. (There are bilaterals, which aren’t the same thing.)

HOTR: Moving up the 777-8F?

By the Leeham News Staff

June 4, 2020, © Leeham News: A lawsuit filed by cargo specialist Volga Dnepr against Boeing claims Boeing is running out the clock on the 747-8F.

The report by The Seattle Times makes for interesting reading. Key of HOTR is the reference that Boeing plans to end 747 production within three years. This is longer than LNA believes. Regardless, the three-year timeline fits with information LNA about the 777-8F.

years. This is longer than LNA believes. Regardless, the three-year timeline fits with information LNA about the 777-8F.

LNA is told Boeing sales floated the possibility of launching the 777-8F around 2023-24. This would bring forward the launch by about two years from plans when the X program was launched in 2013.

Then, the entry into service for the 777-9 was targeted for 2019-2020. This was to be followed by the 777-8 passenger model in two years and then the 8F two years after that.

During the fallout of the MAX grounding, the 777-8 was deferred indefinitely. Now, with COVID upending demand, customers are deferring and talking about canceling 777X orders. Boeing is reducing 777 production from five to three per month. The 777-9 production will go to one per month.

The 777 Classic line is sustained by the 777-200LRF. The 777-8F concept is a couple of frames longer than the -8P but shorter than the 777-9.

Having spent more than $1bn for the advanced Composite Wing Center to build 777X wings and having produced about a dozen 777-9s so far, Boeing needs to boost the X sales prospects.

Bringing forward the -8F is the way to do so.

HOTR: Airlines, lessors cancel ~250 MAXes since January

By the Leeham News Staff

April 21, 2020, © Leeham News: Since the COVID-19 pandemic went viral beginning in January, there have been nearly 250 cancellations of the Boeing 737 MAX.

cancellations of the Boeing 737 MAX.

Some of these were related more directly to the grounding of the MAX. In fact, it could reasonably be argued that most were. COVID-19 exacerbated the problems, now that passenger demand fell by as much as 95%.

The MAX was grounded globally March 13, 2019. Purchase agreements generally allowed the customer to cancel the contract if delivery is delayed more than 12 months, provided there isn’t an “excusable delay.” Pandemics typically fall under an excusable delay. Grounding by regulators depends on the language in the specific contracts.